Automotive Solar Sunroof Market Key Insights:

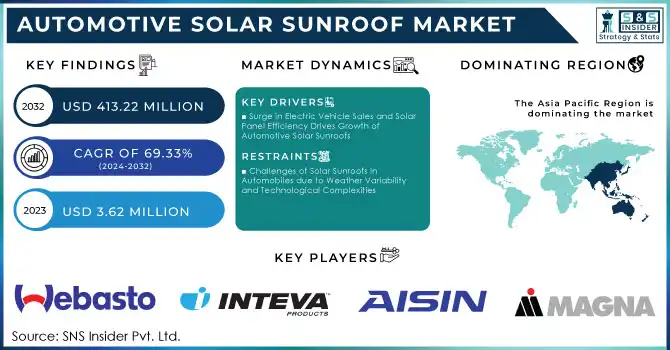

The Automotive Solar Sunroof Market size was valued at USD 3.62 million in 2023 & is expected to reach USD 413.22 Mn by 2032, with a growing at CAGR of 69.33% over the forecast period of 2024-2032.

Get More Information on Automotive Solar Sunroof Market - Request Sample Report

The automotive solar sunroof market is on an uptrend because of the increasing search for sustainable energy alternatives in the automotive business. Solar sunroofs expand vehicle efficiency through renewable energy that powers auxiliary systems or extends the range for battery electric vehicles (BEVs). The growing deployment of EVs and hybrid vehicles on roads, reinforced by supportive government incentives and vehicle emission regulations, is driving the in-vehicle solar technologies market. Improvements in solar panel efficiency, such as the use of monocrystalline and thin-film solar glass, have also enhanced the feasibility of these systems for different classes of vehicles including passenger cars and light commercial vehicles. Monocrystalline solar panels are expected to provide 23% of energy needs, and the design for models such as Toyota's Prius can generate as much as 2.5 kWh/day.

Electric vehicle (EV) stock worldwide is expected to grow more than 40% per year from 2023 to 2024, and China manufactures more than 30% of all the world’s vehicles. BMW and Mercedes-Benz are among other leading automakers incorporating solar technology into their products, and the latter has a goal of 30% of its EV lineup being equipped with solar roofs by 2025. By 2024, the thin-film solar technology is predicted to hold about 20% of the market share.

Growth Of The Automotive Exterior Lighting Market

Growth of the automotive exterior lighting market is the increasing consumer preference for premium features in vehicles, mainly in the North America, Europe, and Asia-Pacific regions. While sunroofs are certainly comfortable, solar-powered sunroofs can additionally conserve energy, which is greatly preferred by modern consumers with an eye for eco-friendly and technologically innovative cars. This is followed by solar technologies that integrate seamlessly into vehicles in functionality as well as appearance, as is increasingly found in the automotive industry, and innovations in smart energy management systems will continue driving the market. All of these factors combined make solar sunroofs a significant element of the sustainable transformation of the global automotive market. Expected 7% range extension for electric vehicles (EVs) equipped with solar panels by 2024. The global EV stock is expected to increase by 43% in 2023, with China providing the dominant share, accounting for over 30% of overall vehicle output. By the end of 2023, more than 200,000 vehicles around the world featured Webasto's solar roof system, and production is set to double in 2024.

Automotive Solar Sunroof Market Dynamic

KEY DRIVERS:

-

Surge in Electric Vehicle Sales and Solar Panel Efficiency Drives Growth of Automotive Solar Sunroofs

The automotive solar sunroof market is also witnessing significant growth owing to the increasing need for sustainable energy-based solutions in the automotive sector. Solar sunroofs improve vehicle economics by producing renewable energy to run auxiliary systems or fuel electric vehicles (EVs). The rising demand for electric vehicles (EV) and hybrid vehicles, backed by positive government initiatives and environmental regulations relating to emissions, has created enormous opportunities for the incorporation of solar technologies into cars. Moreover, improved solar panel efficiency with examples like monocrystalline and thin-film solar glass has made such systems more suitable for various vehicles, from passenger cars to light commercial vehicles.

By 2024, more than 70 countries around the world will have implemented one form of incentives or another encouraging the purchase of electric vehicles (EVs) or renewable energy technologies, accelerating the adoption of solar vehicles. Solar panels built into vehicle roofs can produce a peak of up to 2.5 kWh of energy per day, which is 5% of the additional range for electric vehicles. At the same time, global EV sales are expected to hit 17 million units in 2024, up 44% from 2023.

-

Consumer Demand For Enhanced Automotive Technologies Is Another Key Factor Fueling The Vehicle Access Control Market

Solar-powered sunroofs, combining seamless convenience with energy efficiency, are highly preferred today with people opting for more eco-friendly and high-tech vehicles. The transition to lightweight, integrated designs for solar panels, along with existing innovations in smart energy management systems in the automotive industry can help drive market growth. All these factors collectively make solar sunroofs an essential part of the green transformation that the automotive industry has to go through on a global scale. more than 50% of SUVs made in China have sunroofs, and this trend is accelerating in luxury segments. Over 60% of the automotive sunroofs were sold to premium and luxury vehicle markets, owing to their high consumer offer on advanced features in premium vehicles. Electric Vehicles (EVs) sunroofs are becoming an increasingly popular feature, adding realistic and sustainable 50-100 watts an hour (gain particularly in mid- to high-end models). Lightweight solar panels in sunroofs have further cut up to 15% of the weight of vehicles. In 2024, glass solar sunroofs are likely to become an important component of the energy-generating aspect of electric vehicles in sunny parts of the world.

RESTRAIN:

-

Challenges of Solar Sunroofs in Automobiles due to Weather Variability and Technological Complexities

The automotive solar sunroof is a locally developed technology for producing electric energy in automobiles but faces restraints, which include limited energy efficiency, intensive weather, and a wide range of energy consumption depending on geographical locations where sunlight does not shine consistently high throughout the day on specific areas for long duration. Solar panels, particularly those that are incorporated into vehicles, rely on a steady source of sunlight to produce electricity. The utility of these systems is especially limited since the energy output drops significantly in areas with frequent cloud cover, rain, or snow. For high latitudes and weather variable countries and regions solar performance is particularly pronounced as a challenge. Technological hurdles such as incorporating solar roofs into existing vehicle designs are also a barrier. High control systems are needed to ensure smooth energy management between solar panels, batteries, and vehicle electronics over time However, this complexity could lead to reliability issues, especially sustaining a reliable output power without impairing other functions in the vehicle. Incorporating solar technology into multiple vehicle types especially larger ones, such as buses or heavy-duty trucks involves extensive design changes, resulting in more engineering headaches.

Automotive Solar Sunroof Market Segment Analysis

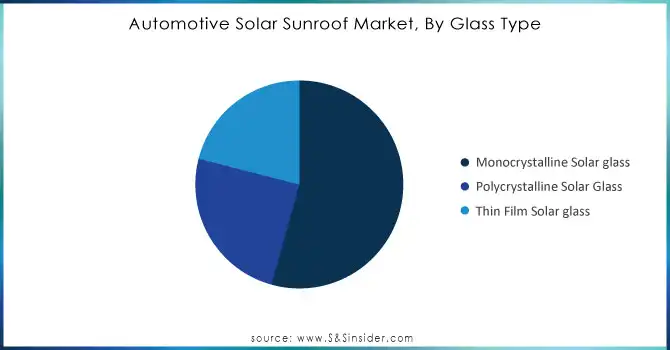

BY GLASS TYPE

The Monocrystalline solar glass segment accounted for the largest market share in 2023, holding 54.34% of the market share thanks to its high efficiency and longevity. With a capacity to convert sunlight to electricity at a very high rate, monocrystalline panels are well suited for automotive applications where the amount of energy used is important. It's particularly suited to electric and hybrid vehicles, maximizing the amount of energy generated in available roof space. Its durability and performance in different environmental conditions lead to a longer lifespan making it a favoured choice for the premium as well as mid-range automobiles. The above reasons combined with increasing consumer demand for high-performance, sustainable automotive solutions further strengthen its position in the market.

The thin-film segment is expected to exhibit the highest CAGR throughout the forecast years (2024 to 2032) as its cost efficiency and lightweight, flexible nature make it seamless to use, giving it versatility. Thin-film technology is versatile enough to be incorporated into almost any design, including complex, curved, or irregularly shaped vehicle roofs. By being lighter, it minimizes the load on vehicles, which in turn helps to increase fossil fuel and energy efficiency essential for electric and hybrid vehicles. In addition, its adoption is also driven by more efficiency in thin film and the push of a low-cost solar solution in emerging markets. Such attributes are being aligned as there is a rising necessity for innovative, energy-efficient, and cost-competitive solar technologies, thereby, leading to the thin-film glass primary growth segment in the upcoming years.

Need Any Customization Research On Automotive Solar Sunroof Market - Inquiry Now

BY FITMENT TYPE

In 2023, the Sliding Sunroof held high demand, contributing 61.2% market share, and is anticipated to exhibit the highest CAGR from 2024 to 2032. This leadership is due to its better features and consumer attraction towards convenience. While sliding sunroofs offer improved ventilating and a luxury open-air driving experience, more consumers are opting for premium equipment on modern vehicles. Passenger vehicles are primarily driven by aesthetics and comfort and provide a sizable share to these systems. The rapid growth of sliding sunroofs, however, is expected owing to developments in technological means such as better sealant and noise reduction technologies that optimize the driving experience. Meanwhile, their compatibility with solar integration makes the technology a perfect fit for electric and hybrid vehicles. The growing penetration in the emerging markets, due to the rising disposable income and inclination towards advanced automotive features, also adds to the growth impetus.

BY OPERATION

In 2023, the Automatic Sunroof held the largest revenue share of 65% and is expected to register the highest CAGR during the forecast period (2024–2032). Its dominance stems from consumers increasingly seeking greater convenience and automation in cars. Automatic sunroofs make it easier for users to control ventilation and light without much input for it makes the driving experience more enjoyable, and so, they are often accompanied by many smart features like rain sensors, voice control, etc. That is apparent as they make them very popular among the premium and mid-segment vehicles and hence garner a larger market share. Growing pollution areas and rising demand for a breathable atmosphere will fuel the automatic sunroofs market over the forecast timeline, which in turn will lead to systematic technological development in terms of smart energy management systems and integration with solar panels in electric and hybrid vehicles. Moreover, the rise of connected and autonomous vehicles, which is a whole new technology field in itself based on automation, adds to it even more. Adoption is also rapidly gaining pace across emerging markets, where disposable incomes are increasing and interest in sophisticated automotive features is rising too.

BY VEHICLE TYPE

The market was led by the Passenger Vehicle segment which accounted for 64% of the share in 2023 and is projected to exhibit the highest CAGR from 2024 to 2032. Factors like the rising usage of EVs, as well as growing customer demand for high-performance features in cars, such as solar sunroofs, continue to contribute to this growth. Increased demand for sustainable, green transport needs force manufacturers to incorporate solar in passenger cars, improving energy efficiency and increasing the distance electric models can travel. Automotive design and technology evolution play a significant role in the rapid growth of the automotive solar sunroof market in terms of the passenger vehicles segment. The consumer is gradually looking for a car equipped with luxury and utility features, and the solar sunroofs fit into the comfort, operational cost saving, and minimal charging infrastructure needed in a car. With the automotive industry undergoing a massive transition towards sustainable solutions and elements that facilitate energy independence, the passenger vehicle type segment of the global automotive fuel cell market is likely to dominate the market growth in the ensuing years.

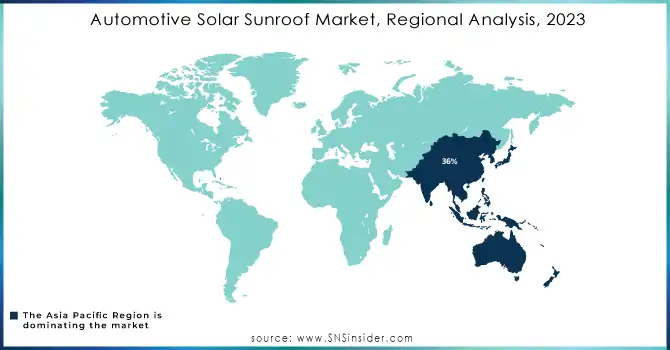

Automotive Solar Sunroof Market Regional Overview

The Asia Pacific accounted for 36% of the total share in 2023 and is anticipated to expand at the highest CAGR during the forecast period (2024 - 2032). Growth in the region is aided by government initiatives that support the adoption of electric vehicles (EVs) and clean technologies, in addition to automotive manufacturing hubs observed in several nations such as China, Japan, and South Korea. The expanding reach of solar automotive technology well, features Asia Pacific amongst the most profitable markets, primarily owing to the increased emphasis on emission reduction and energy efficiency. This demand is aided by rapid urbanization and increased disposable incomes in countries like India and China.

As an example, Toyota has incorporated solar-powered roofs on their electric vehicle lines such as the Toyota Prius Prime which was targeted for Japan and China. Mahindra & Mahindra: One of the largest automakers in India has also been using solar roof panels in a few of its solar automotive variants to boost energy efficiency and range.

In addition, Chinese BYD and SAIC Motor have been looking into solar power applications in vehicles to minimize the carbon footprint while enhancing vehicle performance for the green-conscious Chinese market. This coupled with the high governmental incentives in the respective countries (China and India) keeps the regional market for automotive solar sunroofs at the top-notch and in a prosperous growth bound.

Key Players in Automotive Solar Sunroof Market

Some of the major players in the Automotive Solar Sunroof Market are:

-

Webasto Group (Solar Roof for Electric Vehicles, Roof Sensor Module)

-

Inteva Products LLC (Panoramic Sunroof, Solar Glass Roof)

-

Yachiyo Industry Co., Ltd. (Panoramic Roof, Solar Roof)

-

Inalfa Roof Systems Group B.V. (Tilt & Slide Roof, Solar Glass Roof)

-

AISIN SEIKI Co., Ltd. (Multi-Panel Sunroof, Solar Roof)

-

CIE Automotive (Sunroof Modules, Solar Panels)

-

Magna International Inc. (Glass Roof, Panoramic Sunroof)

-

Mitsuba Corporation (Solar Roof System, Panoramic Roof)

-

Johnan America Inc. (Automotive Roof Systems, Solar Roof Panels)

-

Signature Automotive Products (Sunroofs, Electric Vehicle Roof Systems)

-

Bos GmbH & Co. KG (Electric Sunroof, Solar Roof)

-

Automotive Sunroof Company (ASC, Inc.) (Pop-up Sunroof, Solar Roof)

-

Yachiyo Industry Co., Ltd. (Tilting Sunroof, Solar Panoramic Roof)

-

Mitsubishi Chemical (Glass Solar Panels, Sunroof Integration)

-

Panasonic Corporation (Solar Roof Panels, Smart Roof)

-

Toyota Boshoku Corporation (Electric Sunroof, Solar Roof)

-

Trinseo S.A. (Automotive Roof Components, Solar Sunroof Glass)

-

Solaris Technologies (Solar Roofs for EVs, Transparent Solar Panel Roofs)

-

Ficosa International (Roof Systems, Solar Glass Solutions)

-

Delphi Technologies (Power Sunroof Systems, Solar-Powered Roofs)

Some of the Raw Material Suppliers for Automotive Solar Sunroof Companies:

-

Saint-Gobain

-

DuPont

-

3M

-

BASF

-

SABIC

-

AGC Inc.

-

Corning Inc.

-

Nippon Sheet Glass Co.

-

Solvay

-

Hexcel Corporation

RECENT TRENDS

-

In September 2024, Webasto introduced a new solar sunroof system that is 40% lighter and generates 350 kWh annually. This innovation boosts energy efficiency in electric vehicles, supporting sustainability goals.

-

In June 2024, Minda Corporation partnered with Taiwan’s HSIN Chong Machinery Works Co to establish a joint venture for locally producing sunroofs for passenger vehicles. This collaboration aims to strengthen the production and supply of automotive sunroofs in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.62 Million |

| Market Size by 2032 | USD 413.22 Million |

| CAGR | CAGR of 69.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Glass Type (Monocrystalline Solar glass, Polycrystalline Solar Glass, Thin Film Solar glass) • By Fitment Type (Fixed sunroof, sliding sunroof) • By Operation (Manually Operated, Automatic) • By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Heavy Duty Trucks, Buses and Coaches) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Webasto Group, Inteva Products LLC, Yachiyo Industry Co., Ltd., Inalfa Roof Systems Group B.V., AISIN SEIKI Co., Ltd., CIE Automotive, Magna International Inc., Mitsuba Corporation, Johnan America Inc., Signature Automotive Products, Bos GmbH & Co. KG, Automotive Sunroof Company (ASC, Inc.), Mitsubishi Chemical, Panasonic Corporation, Toyota Boshoku Corporation, Trinseo S.A., Solaris Technologies, Ficosa International, Delphi Technologies. |

| Key Drivers | • Surge in Electric Vehicle Sales and Solar Panel Efficiency Drives Growth of Automotive Solar Sunroofs • Rising Demand for Solar Sunroofs in Vehicles with Eco-friendly Technologies and Lightweight Solar Panels |

| Restraints | • Challenges of Solar Sunroofs in Automobiles due to Weather Variability and Technological Complexities |