Racing Bike Market Report Scope & Overview:

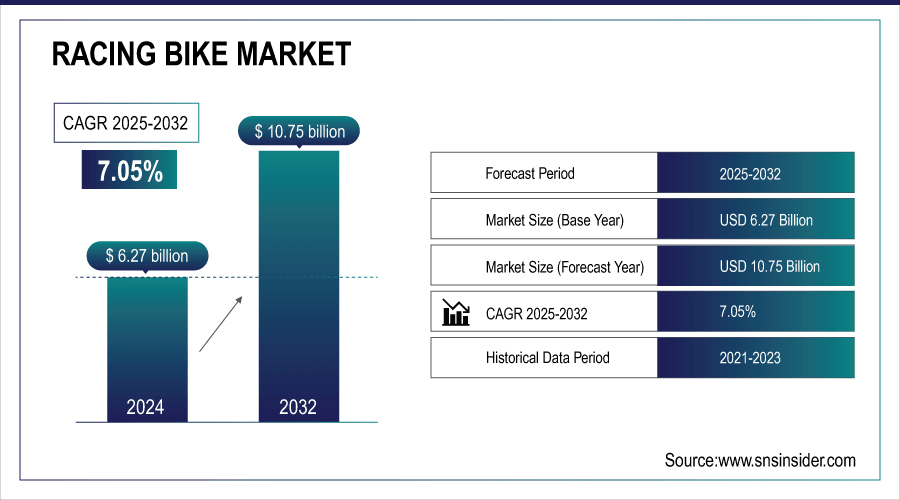

Racing Bike Market was valued at USD 6.27 billion in 2024 and is expected to reach USD 10.75 billion by 2032, growing at a CAGR of 7.05% from 2025-2032.

The Racing Bike Market is growing due to rising health consciousness and fitness awareness among consumers, increasing participation in professional and recreational cycling, and the growing popularity of competitive cycling events globally. Additionally, technological advancements in lightweight materials, aerodynamics, and electric-assisted racing bikes are enhancing performance and rider experience. Expanding online retail channels and social media influence further drive demand, making racing bikes more accessible and desirable worldwide.

To Get More Information On Racing Bike Market - Request Free Sample Report

Racing Bike Market Trends

-

Rising popularity of motorsports and recreational biking is driving racing bike demand.

-

Advances in lightweight materials, aerodynamics, and high-performance engines are enhancing speed and handling.

-

Growing interest in electric and hybrid racing bikes is shaping market trends.

-

Expansion of racing events, competitions, and biking clubs is boosting consumer engagement.

-

Increasing focus on safety features, such as advanced braking and suspension systems, is improving rider confidence.

-

E-commerce and specialty dealerships are expanding accessibility to high-performance bikes.

-

Collaborations between manufacturers, sponsors, and motorsport organizations are accelerating innovation and brand visibility.

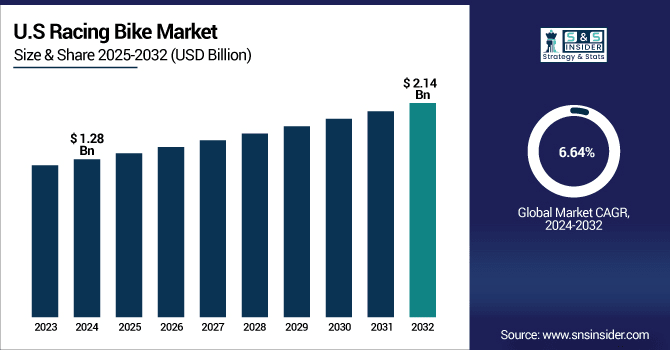

U.S. Racing Bike Market was valued at USD 1.28 billion in 2024 and is expected to reach USD 2.14 billion by 2032, growing at a CAGR of 6.64% from 2025-2032.

The U.S. Racing Bike Market is growing due to increasing fitness awareness, rising participation in cycling events, and demand for advanced, lightweight bikes. Technological innovations, e-commerce expansion, and the popularity of recreational and competitive cycling also drive market growth.

Racing Bike Market Growth Drivers:

-

Rapid technological advancements in racing bike materials, aerodynamics, and smart features enhance performance and attract growing demand across global cycling markets.

Continuous innovation in materials and technology is transforming the racing bike industry. Carbon fiber frames, advanced gear systems, and integrated aerodynamic designs deliver lighter, faster, and more efficient bikes. Manufacturers are integrating smart features like electronic shifting, GPS tracking, and performance analytics to appeal to professional and amateur riders alike. These enhancements not only improve riding experience but also justify premium pricing, boosting profitability for producers. The appeal of high-tech bikes in competitive sports and among enthusiasts fosters higher adoption. Innovation-driven upgrades thus remain a core driver, directly fueling the expansion of the global racing bike market.

-

In June 2025, Giant launched a new aerospace-grade carbon fiber TCR bicycle priced 20–30% higher than its predecessor, yet orders have tripled due to a 10% weight reduction and advanced frame construction.

-

Similarly, in mid-2025, Canyon introduced the Endurace:ONfly, an ultra-light e-road bike under 10 kg with carbon frames (including a top-tier SUB-10 variant), a 200 W integrated drive system, and an optional range-extender battery, positioning it as the lightest in its class.

Racing Bike Market Restraints:

-

Limited cycling infrastructure and safety concerns in many regions reduce willingness to invest in racing bikes for daily or competitive use.

Lack of safe cycling lanes, inadequate urban planning, and high traffic risks hinder the adoption of racing bikes in many regions. Riders often feel unsafe sharing congested roads with motor vehicles, discouraging regular use. Poor maintenance of cycling tracks or their absence in rural and suburban areas also limits accessibility. Safety concerns extend to professional training, as athletes require protected environments for performance practice. Without adequate government investment in infrastructure and cycling safety regulations, potential buyers hesitate to invest in expensive racing bikes. This lack of supportive ecosystems becomes a key restraint, restricting the market’s broader growth potential.

Racing Bike Market Opportunities:

-

Increasing youth participation in cycling sports and lifestyle activities unlocks opportunities for premium racing bikes in global markets.

Young consumers are driving lifestyle trends by embracing cycling as both a sport and a recreational pursuit. With growing interest in adventure activities, road races, and triathlons, demand for high-performance racing bikes has expanded across urban youth populations. Fitness-driven social media communities and influencer culture further amplify this interest, encouraging aspirational purchases of premium bikes. Educational institutions and sports organizations are also promoting cycling competitions, creating pathways for long-term adoption. As younger demographics represent a sizable consumer base with growing incomes, their enthusiasm provides strong opportunities, positioning youth-driven cycling culture as a catalyst for global racing bike market growth.

Racing Bike Market Segment Highlights

-

By Bike Type, Road Racing Bikes dominated with ~42% share in 2024; Gravel Racing Bikes fastest growing (CAGR).

-

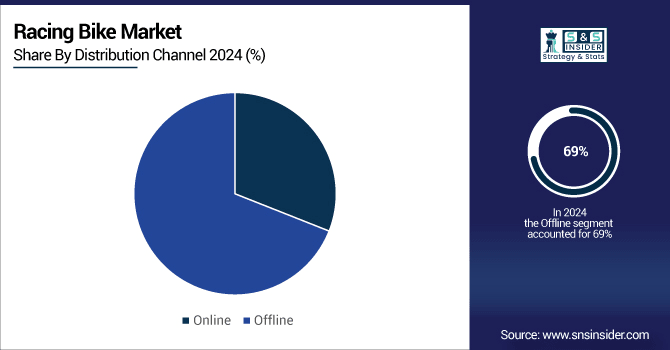

By Distribution Channel, Offline dominated with ~69% share in 2024; Online fastest growing (CAGR).

-

By Rider Type, Recreational Riders dominated with ~38% share in 2024; Triathletes fastest growing (CAGR).

-

By Frame Material, Carbon Fiber dominated with ~51% share in 2024; Carbon Fiber fastest growing (CAGR).

Racing Bike Market Segment Analysis

By Distribution Channel, Offline sales led in 2024, whereas Online sales are projected to grow fastest due to convenience and wider product variety.

Offline segment dominated the Racing Bike Market due to the personalized purchasing experience, availability of professional guidance, test rides, and immediate product access. Established cycling stores, strong dealer networks, and consumer trust in in-person services contributed to higher sales and revenue generation in 2024.

Online segment is expected to grow at the fastest rate from 2025-2032 owing to convenience, wider product variety, competitive pricing, and increasing digital adoption. Enhanced e-commerce platforms, seamless delivery services, and growing social media influence on cycling trends are driving more consumers to purchase racing bikes online.

By Racing Bike, Road racing bikes dominated in 2024, while Gravel racing bikes are expected to grow fastest from 2025-2032.

Road racing bikes dominated the Racing Bike Market due to their lightweight design, aerodynamic efficiency, and suitability for professional and competitive cycling. High demand from performance-focused cyclists, widespread availability through specialized stores, and continuous technological advancements in materials and components contributed to their leading revenue generation in 2024.

Gravel racing bikes are expected to grow at the fastest rate from 2025-2032 because of their versatility across varied terrains, increasing popularity among adventure cyclists, and rising interest in off-road and endurance cycling. Innovations in durability, comfort, and performance enhancements are driving adoption, making them a preferred choice for emerging cycling enthusiasts.

By End Use, Recreational riders dominated in 2024, while Triathletes are expected to grow fastest from 2025-2032.

Recreational riders dominated the Racing Bike Market because of the high number of casual cyclists seeking fitness, leisure, and weekend sports activities. Strong demand for versatile, easy-to-ride bikes, coupled with rising health awareness and participation in local cycling events, contributed to higher revenue generation in 2024.

Triathletes segment is expected to grow at the fastest rate from 2025-2032 due to rising participation in triathlon events, increasing need for specialized high-performance bikes, and continuous innovations in aerodynamics, lightweight frames, and endurance-focused components catering to competitive multisport athletes.

By Material, Carbon Fiber led in 2024 and is expected to grow fastest, driven by demand for lightweight, high-performance bikes.

The Carbon Fiber segment dominated the Racing Bike Market in 2024 due to its superior strength-to-weight ratio, high durability, and enhanced performance benefits, making it the preferred choice for professional and competitive cyclists. It is expected to grow at the fastest rate from 2025-2032 as demand rises for lightweight, high-performance bikes, coupled with ongoing technological advancements, increasing adoption in racing events, and growing consumer preference for premium cycling equipment.

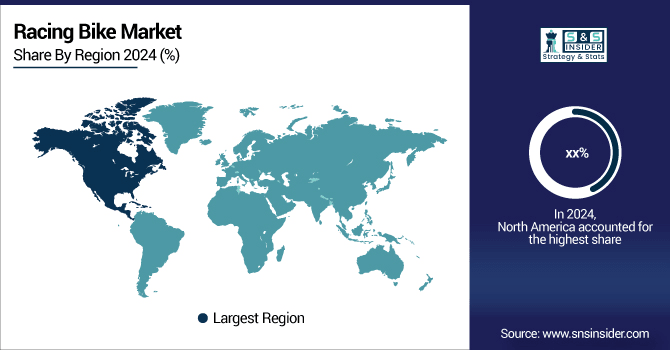

Racing Bike Market Regional Analysis

North America Racing Bike Market Insights

North America held a significant share in the Racing Bike Market in 2024 due to growing fitness and health awareness, increasing participation in recreational and competitive cycling, and strong presence of premium bike brands. Well-developed cycling infrastructure, government initiatives promoting sustainable transport, and rising demand for high-performance and technologically advanced racing bikes contributed to steady market growth and higher revenue generation across the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Racing Bike Market Insights

Asia Pacific is expected to grow at the fastest rate from 2025-2032 due to increasing urbanization, rising health and fitness awareness, growing disposable incomes, and expanding cycling communities. Rapid adoption of advanced materials and technologies, coupled with the rising popularity of competitive and recreational cycling events, is driving strong demand for high-performance racing bikes across emerging markets in the region.

Europe Racing Bike Market Insights

Europe dominated the Racing Bike Market in 2024 with the highest revenue share of about 35% due to its well-established cycling culture, high participation in professional and recreational cycling events, and strong presence of leading bike manufacturers. Advanced infrastructure, widespread awareness of fitness and sustainability, and consumer preference for premium, technologically advanced racing bikes contributed to higher sales and revenue generation across the region.

Middle East & Africa and Latin America Racing Bike Market Insights

The Middle East & Africa Racing Bike Market in 2024 benefited from rising fitness awareness, growing urbanization, and increasing interest in recreational and competitive cycling. Expanding retail networks, adoption of advanced racing bikes, and government initiatives promoting sports and outdoor activities supported market growth.

Latin America’s Racing Bike Market in 2024 grew due to increasing health consciousness, expanding cycling communities, and rising demand for performance and premium bikes, coupled with improving infrastructure and greater participation in cycling events across the region.

Racing Bike Market Competitive Landscape:

Specialized Bicycle Components

Specialized Bicycle Components is a prominent player in the Racing Bike Market, recognized for its high-performance racing and road bikes. The company emphasizes innovation, incorporating advanced materials, aerodynamic designs, and cutting-edge technologies to enhance speed, comfort, and rider experience. With a strong global presence, extensive retail network, and focus on professional and recreational cyclists, Specialized continues to drive market growth and maintain leadership in premium racing bike segments.

-

Specialized (2025) — At the Tour de France Femmes, Specialized delivered swift custom-painted yellow Tarmac SL8 bikes to classification leaders like Kim Le Court-Pienaar enabled by pre-painted backups and overnight logistics.

Cervélo

Cervélo is a leading brand in the Racing Bike Market, renowned for high-performance road and triathlon bikes designed for speed, aerodynamics, and endurance. The company focuses on lightweight carbon frames, innovative engineering, and precision components to enhance rider performance. With a strong presence in competitive cycling events and professional teams, Cervélo continues to expand its global market share while maintaining a reputation for premium, performance-driven bicycles.

-

Cervélo (2025) — Released the updated S5, with aerodynamic refinements yielding a 6.3-watt gain. Includes new handlebar-stem, aerodynamics, and wider geometry optimized for performance riders.

-

Cervélo (2024) — Unveiled the P5 Superbike with enhanced aerodynamics, a one-piece front end, improved armrest comfort, and wider tire compatibility—solidifying its position in elite time-trial design.

-

Cervélo (2024) — Launched the updated P-Series triathlon bike with in-frame “trap door” storage, minimal aerodynamic drag, and six frame sizes for superior fit and customization.

-

Cervélo (2023) — Debuted the 2024 Aspero gravel bike, featuring a threaded bottom bracket, cleaner cable routing, UDH hanger, improved comfort, faster ride, and a Trail Mixer geometry adjuster.

Key Players

Some of the Racing Bike Market Companies

-

Trek Bicycle Corporation

-

Specialized Bicycle Components

-

Giant Manufacturing Co. Ltd.

-

Cannondale Bicycle Corporation

-

Bianchi

-

Scott Sports

-

Shimano Inc.

-

Merida Industry Co., Ltd.

-

Felt Bicycles

-

Pinarello

-

Colnago

-

Cervélo Cycles

-

BMC Switzerland

-

Focus Bikes

-

Ridley Bikes

-

Look Cycle International

-

Wilier Triestina

-

Vitus

-

Fuji Bikes

-

Campagnolo

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.27 Billion |

| Market Size by 2032 | USD 10.75 Billion |

| CAGR | CAGR of 7.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Racing Bike(Road racing bikes, Time trial bikes, Track racing bikes, Cyclocross bikes, Gravel racing bikes) • By Material(Carbon fiber, Aluminum, Titanium, Steel) • By End Use(Professional racers, Recreational riders, Triathletes, Fitness enthusiasts) • By Distribution Channel(Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Trek Bicycle Corporation, Specialized Bicycle Components, Giant Manufacturing Co. Ltd., Cannondale Bicycle Corporation, Bianchi, Scott Sports, Shimano Inc., Merida Industry Co., Ltd., Felt Bicycles, Pinarello, Colnago, Cervélo Cycles, BMC Switzerland, Focus Bikes, Ridley Bikes, Look Cycle International, Wilier Triestina, Vitus, Fuji Bikes, Campagnolo |