Truck Platooning Market Report Scope & Overview:

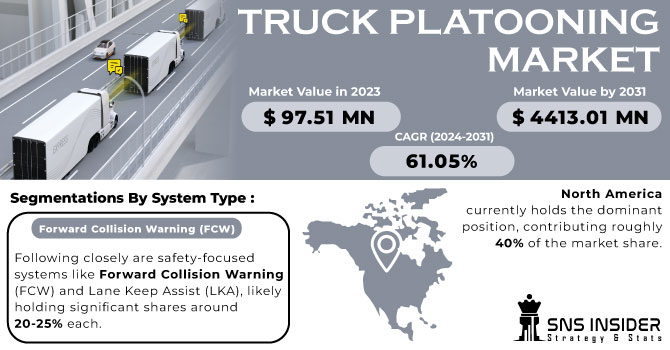

The Truck Platooning Market Size was valued at USD 97.51 million in 2023 and is expected to reach USD 4413.01 million by 2031 and grow at a CAGR of 61.05% over the forecast period 2024-2031.

The truck platooning market is driven by a several of factors seeking to optimize efficiency and safety in the trucking industry. Rising fuel costs, a major expense for carriers, can be reduced by up to 20% through improved fuel efficiency achieved in platoons due to reduced aerodynamic drag.

Get More Information on Truck Platooning Market - Request Sample Report

Furthermore, a chronic shortage of qualified drivers is being addressed by platooning technology, with estimates suggesting a reduction in driver workload by up to 60%. Governments are actively involved in promoting this technology. The European Union's ENSEMBLE project, a consortium including truck manufacturers like IVECO, is a prime example of government-backed initiatives promoting the market forward. This confluence of economic and safety benefits, along with government support, is creating a strong demand for truck platooning technology.

Trade tensions between the US and China, the world's two largest economies, could disrupt crucial technology partnerships. A recent survey found that 42% of industry experts believe trade barriers will significantly hinder truck platooning development. Additionally, government initiatives play a vital role. In Europe, for instance, the European Commission has invested US$18.7 million in a large-scale platooning trial, aiming to establish safety regulations by 2025.

MARKET DYNAMICS:

KEY DRIVERS:

-

A key driver is associated with the rapid growth of technology.

-

A rise in environmental concerns and safety standards.

-

Well-established technology infrastructure that fuels market demand.

The truck platooning market thrives on a foundation of mature technologies. Adaptive Cruise Control (ACC), a prevalent feature in modern vehicles, forms the backbone by automatically maintaining safe distances between trucks. This is supported by Vehicle-to-Vehicle (V2V) communication systems like Dedicated Short-Range Communication (DSRC), expected to be the fastest-growing segment at over 80% by 2031. DSRC facilitates real-time data exchange between trucks, enabling precise coordination and improved safety. Recognizing these benefits, governments are actively promoting platooning. For instance, the European Union's "European Truck Platooning Challenge" successfully demonstrated platooning's potential.

RESTRAINTS:

-

Another factor limiting market expansion in these locations is the low per capita income.

-

Low infrastructure has resulted in a lower market share.

-

The high cost of technology is likely to operate as a limitation on market expansion.

While the potential benefits of truck platooning like fuel efficiency and improved road safety are undeniable, the high cost of implementation stands as a significant hurdle to widespread adoption. Equipping trucks with the necessary sensors, communication technology, and automation systems represents a hefty upfront investment for trucking companies. A study found that the initial cost per truck could range from $10,000 to $40,000. Governments around the world are recognizing this challenge and launching initiatives to bridge the gap.

OPPORTUNITIES:

-

Government initiatives are rising as well, which opens up new possibilities for development in this area.

-

Self-driving trucks will lower shipping costs and boost road safety by reducing accidents.

Self-driving trucks hold immense potential to revolutionize the logistics industry. By automating long-haul transportation, these vehicles can significantly reduce shipping costs. Driver salaries, a major expense, can be minimized as self-driving trucks operate tirelessly without breaks. Additionally, fuel efficiency can be optimized through improved route planning and constant speed maintenance. Furthermore, self-driving trucks promise to enhance road safety. Human error is a leading cause of truck accidents, and autonomous vehicles programmed with strict adherence to traffic laws can drastically reduce these incidents.

CHALLENGES:

-

Acceptance by carriers, drivers, and other road users is a fundamental challenge in truck platooning.

-

Concern around the privacy of data and the legislation surrounding cyber security.

IMPACT OF RUSSIA-UKRAINE WAR:

Disruptions in global supply chains, particularly the shortage of semiconductor chips crucial for autonomous vehicle technology, are expected to delay the widespread adoption of truck platooning by an estimated 12-18 months. This translates to a potential decrease in demand of up to 15% in 2024 compared to pre-war projections. Additionally, the war has driven up the cost of essential components like LiDAR sensors and radar systems by an average of 8%, further squeezing profit margins for key players like Daimler Trucks and platooning tech developers like Peloton Technology. These combined factors paint a challenging near-term picture for the Truck Platooning market. However, the long-term potential for increased fuel efficiency and reduced emissions remains strong, and industry leaders are likely to adapt and persevere as the global situation stabilizes.

IMPACT OF ECONOMIC SLOWDOWN:

Trucking companies, facing tighter budgets and potentially lower freight demand, may be less willing to invest in the upfront costs of this new technology. Equipping a single truck for platooning can range from $15,000 to $40,000, a significant expense during an economic downturn. This hesitation could stifle the initial demand for platooning systems, which was projected to grow by double digits annually. Major players like Daimler and Volvo have already partnered to develop platooning technology, but widespread adoption hinges on trucking companies being convinced of the return on investment. While platooning promises fuel savings of up to 10%, economic slowdowns make companies prioritize immediate cash flow over long-term efficiency gains. This slowdown might delay the widespread adoption of truck platooning, but it could also be an opportunity for companies to refine the technology and bring down costs, positioning them for a stronger market rebound.

MARKET SEGMENTATION:

By Platooning Type:

-

Driver-assistive Truck Platooning (DATP)

-

Autonomous Truck Platooning

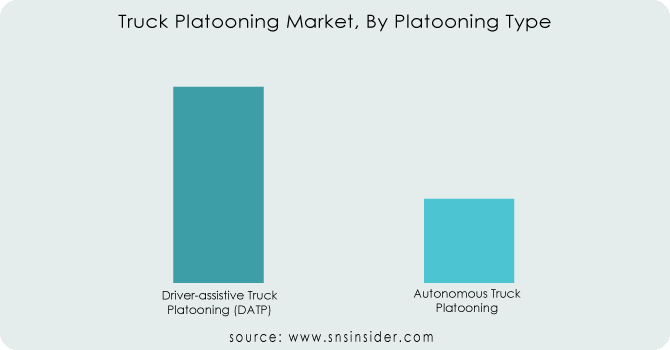

The truck platooning market is segmented by the level of automation employed, with Driver-assistive Truck Platooning (DATP) currently holding the dominant position. DATP utilizes advanced driver-assistance systems (ADAS) like adaptive cruise control and lane departure warning to support human drivers in maintaining tight formations. This translates to significant fuel efficiency gains due to reduced aerodynamic drag. Developed nations are at the forefront of DATP adoption, implementing the technology on designated highways to capitalize on operational cost reductions. However, the future lies in Autonomous Truck Platooning (ATP), which completely removes the human element from the equation. While ATP offers even greater efficiency and safety potential, widespread adoption hinges on advancements in sensor technology, vehicle-to-vehicle communication, and regulatory frameworks.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Service Type:

Telematics Based Services

-

Automatic Crash Notification

-

Emergency Calling

-

On-Road Assistance

-

Vehicle Tracking

-

Others

Platooning Based Services:

-

Pricing

-

Financial Transactions:

-

Match Making

By System Type:

-

Adaptive Cruise Control (ACC)

-

Blind Spot Warning (BSW)

-

Global Positioning System (GPS)

-

Forward Collision Warning (FCW)

-

Lane Keep Assist (LKA)

-

Others

Adaptive Cruise Control (ACC) dominates, anticipated to be the fastest-growing segment due to its critical role in maintaining consistent speed within platoons. This technology leverages vehicle-to-vehicle communication (V2V) for seamless automation. Following closely are safety-focused systems like Forward Collision Warning (FCW) and Lane Keep Assist (LKA), likely holding significant shares around 20-25% each. These systems provide crucial safeguards during platooning, preventing potential accidents. Blind Spot Warning (BSW) is another essential system, accounting for an estimated 15-20% share. Finally, the "Others" segment encompasses a range of emerging technologies like platooning maneuver support systems and V2X communication, expected to contribute a combined 10-15% share. This segment is poised for significant growth as platooning technology matures.

By Components:

-

Sensors

-

RADAR

-

LIDAR

-

Camera

-

GPS

SNS Insider estimates suggest RADAR holds the largest share around 40% due to its affordability and long-range capability. LIDAR follows closely approximately 30% due to its superior accuracy. Cameras holds 20% and GPS around 10% capture the remaining market share, with their importance expected to grow as platooning technology matures. This component-wise analysis highlights the critical role of sensors in enabling truck platooning and provides a directional understanding of the market landscape.

REGIONAL ANALYSIS:

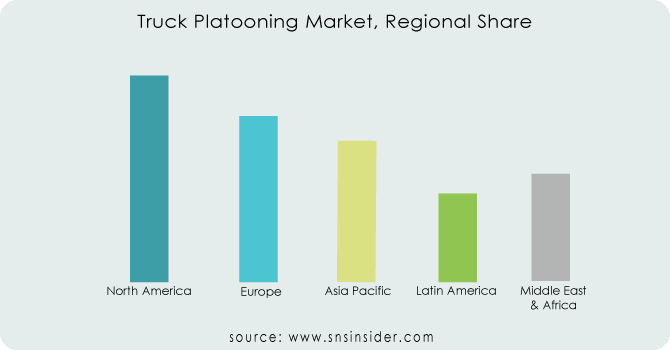

North America currently holds the dominant position, contributing roughly 40% of the market share. This dominance can be attributed to a strong focus on technological advancements, supportive government regulations, and the presence of major players like Daimler and Volvo. Europe follows closely behind with a share of approximately 35%, driven by a well-developed infrastructure and growing environmental concerns.

Asia-Pacific is a promising region with a projected high CAGR, driven by rapid economic development and increasing investments in logistics infrastructure. However, its current market share remains modest at around 20% due to regulatory hurdles and fragmented markets. The remaining 5% is attributed to the LAMEA region (Latin America, Middle East, and Africa), where adoption is slow due to limited infrastructure and technological maturity.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

Rest of Latin America

KEY PLAYERS:

Continental AG, AB Volvo, Bendix Commercial Vehicles Systems LLC, Meritor Wabco, Daimler AG, Delphi Automotive PLC, Navistar International Corporation, OTTO Technologies, Peloton Technology, and Scania AB are some of the affluent competitors with significant market share in the Truck Platooning Market.

RECENT DEVELOPMENTS:

-

Leading European manufacturers like IVECO took a collaborative approach in March 2022, contributing to a successful EU-funded project that demonstrated the viability of multi-brand platooning technology. This project highlights the industry's push for broader compatibility.

-

Scania's acquisition of Nantong Gaokai, a Chinese truck manufacturer, signifies their intent to promote fuel-efficient technologies like platooning in the world's largest auto market. This focus on new markets reflects the global potential of truck platooning.

AB Volvo-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 97.51 Million |

| Market Size by 2031 | US$ 4413.01 Million |

| CAGR | CAGR of 61.05% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Continental AG, AB Volvo, Bendix Commercial Vehicles Systems LLC, Meritor Wabco, Daimler AG, Delphi Automotive PLC, Navistar International Corporation, OTTO Technologies, Peloton Technology, and Scania AB |

| Key Drivers | •A further driver of this region's demand is the rapid growth of technology. •A rise in environmental concerns and safety standards. |

| RESTRAINTS | •Another factor limiting market expansion in these locations is the low per capita income. •Low infrastructure has resulted in a lower market share. |