Automotive Pressure Plates Market Report Scope & Overview:

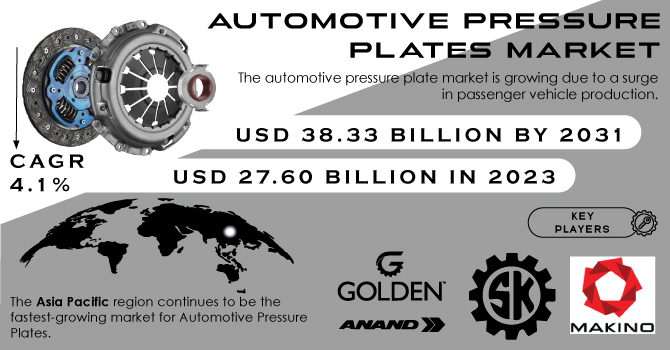

The Automotive Pressure Plates Market Size was valued at USD 27.60 billion in 2023 and is expected to reach USD 38.33 billion by 2031 and grow at a CAGR of 4.1% over the forecast period 2024-2031.

The automotive pressure plate market is growing due to a surge in passenger vehicle production. Since every manual transmission car needs a pressure plate, rising vehicle output directly translates to market growth. Furthermore, advancements in car manufacturing, driven by consumer demand for comfort and performance, are expected to positively impact the market. The development of innovative clutch systems like the Dual Clutch Transmission (DCT), fueled by the need for fuel-efficient vehicles, presents another optimistic factor. However, the pre-existing global car fleet is a significant source of future pressure plate sales. Routine maintenance and breakdowns will necessitate replacements, driving up demand throughout the forecast period. The affordability of manual clutches compared to automatics is expected to further drive the automotive pressure plate market in the coming years.

Get More Information on Automotive Pressure Plates Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising car production and innovative technology are driving demand for new vehicles.

The surge in car sales creates a direct need for more automotive parts, including pressure plates. This trend is amplified by the growing demand for high-performance vehicles with strong acceleration and traction. As a result, the pressure plate market is expected to move by the overall rise in car demand.

-

Widening landscape of the automobile market

RESTRAINTS:

-

Automatic transmissions and electric vehicles may dampen demand for pressure plates.

The growing popularity of automatic transmissions and electric vehicles threatens to decrease demand for pressure plates. Traditional transmissions rely on pressure plates to function, but automatics often utilize different mechanisms. Electric vehicles, on the other hand, forgo transmissions entirely due to their distinct electric motors. This shift in automotive technology could lead to a decline in the need for pressure plates.

OPPORTUNITIES:

-

Rising vehicle production and manual transmission affordability are fueling the market.

-

Growth in high-performance car demand creates opportunities for innovative pressure plate designs.

CHALLENGES:

-

The popularity of electric vehicles with different drivetrains could limit future sales.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war disrupts the automotive pressure plate market. Disrupted supply chains due to the conflict could make it harder to obtain raw materials and components, potentially hindering production and inflating costs. A weaker global economy might also lead to fewer people buying new cars, reducing demand for new pressure plates. The aftermarket segment, focused on repairs and replacements for existing vehicles, might see some resilience. As older cars require maintenance, pressure plate replacements could maintain steady demand despite the economic slowdown.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the automotive pressure plate market. Weaker consumer spending might lead to fewer new car purchases, directly reducing demand for pressure plates needed in original equipment (OEM) manufacturing. This could lead to production slowdowns or even temporary shutdowns for pressure plate manufacturers. However, the impact might not be uniform across the market. The aftermarket segment, which caters to repairs and replacements for existing vehicles, could show some resilience. Even during an economic downturn, car owners are likely to prioritize maintaining their existing vehicles.

KEY MARKET SEGMENTS:

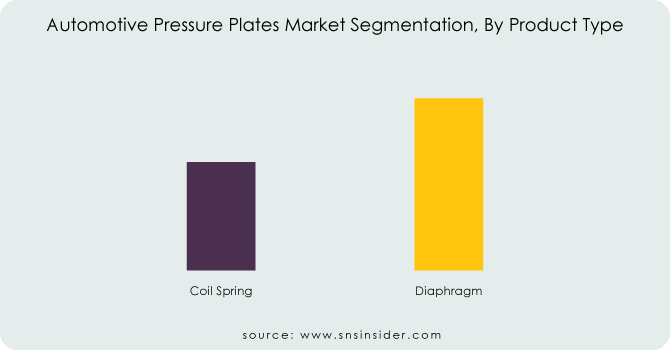

By Product Type:

-

Coil Spring

-

Diaphragm

Diaphragm dominates the Automotive Pressure Plates Market by product with 75% of market share. Diaphragm pressure plates are lighter, offer smoother gear changes, and have a higher clamping force compared to coil spring types. These features make them ideal for modern vehicles, particularly passenger cars with manual transmissions.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

Passenger Cars dominates the Automotive Pressure Plates Market by vehicle type, with 60% of market share due to the higher volume of passenger car production globally compared to light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). The widespread use of manual transmissions in passenger cars further contributes to this dominance.

By Clutch Type:

-

Single plate friction

-

Multiple frictions

-

Cone clutch

Single Plate Friction dominates the Automotive Pressure Plates Market by clutch type with 80% of market share as this is the most common type of clutch used in passenger cars and light commercial vehicles. It utilizes a single pressure plate to clamp the clutch disc against the flywheel. This simplicity and affordability make single plate friction clutches dominant in these vehicle segments.

REGIONAL ANALYSES

-

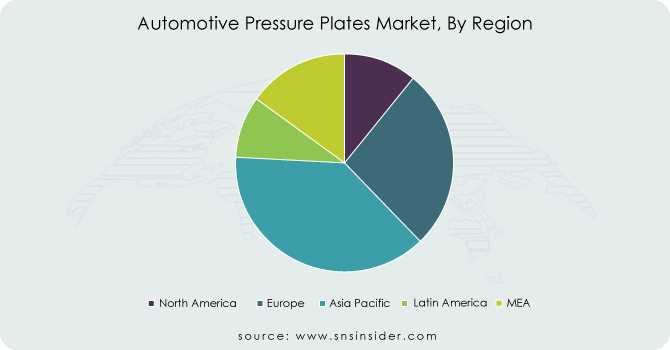

The Asia Pacific is the dominating region in the Automotive Pressure Plate Market. This dominance is likely due to the significant growth in the automotive sector in this region, particularly in countries like China and India.

-

Europe is the second highest region in the Automotive Pressure Plate Market. The presence of established automotive manufacturers and a focus on technological advancements contribute to this region's strong market position.

-

The Asia Pacific region continues to be the fastest-growing market for Automotive Pressure Plates. This is primarily driven by the factors mentioned earlier, like the growing automotive industry and rising car ownership in developing countries.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players are California Custom Clutch Corporation (US), GOLDEN Precision Products Private Limited (India), S. K. Auto Industries (India), Makino Auto Industries Private Limited (India), Raicam Clutch Ltd (Italy), SASSONE SRL (Italy), ANAND Group (India), MACAS Automotive (India), Apls Automotive Industries Private Limited (India), Hebei Tengda Auto Parts Co., Ltd. (China), Setco Automotive Ltd (India), and RSM Autokast Ltd. (India) are other key players.

GOLDEN Precision Products Private Limited (India)-Company Financial Analysis

RECENT DEVELOPMENTS:

In Dec. 2023 - Machine tool giant Makino India further solidified its commitment to India with a new "Turnkey and Engineering Factory" in Coimbatore. This expansion signifies their focus on bringing advanced manufacturing solutions and strengthening their presence in the Indian market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 27.60 Billion |

| Market Size by 2031 | US$ 38.33 Billion |

| CAGR | CAGR of 4.1 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Coil Spring, Diaphragm) • by Vehicle Type (Passenger cars, LCV, HCV) • by Clutch Type (Single plate friction, Multiple frictions, Cone clutch) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | California Custom Clutch Corporation (US), GOLDEN Precision Products Private Limited (India), S. K. Auto Industries (India), Makino Auto Industries Private Limited (India), Raicam Clutch Ltd (Italy), SASSONE SRL (Italy), ANAND Group (India), MACAS Automotive (India), Apls Automotive Industries Private Limited (India), Hebei Tengda Auto Parts Co., Ltd. (China), Setco Automotive Ltd (India), and RSM Autokast Ltd. (India) |

| Key Drivers | • Rising car production and innovative technology are driving demand for new vehicles. • Widening landscape of the automobile market |

| RESTRAINTS | • Automatic transmissions and electric vehicles may dampen demand for pressure plates. |