Automotive Diagnostic Tool Market Report Scope & Overview:

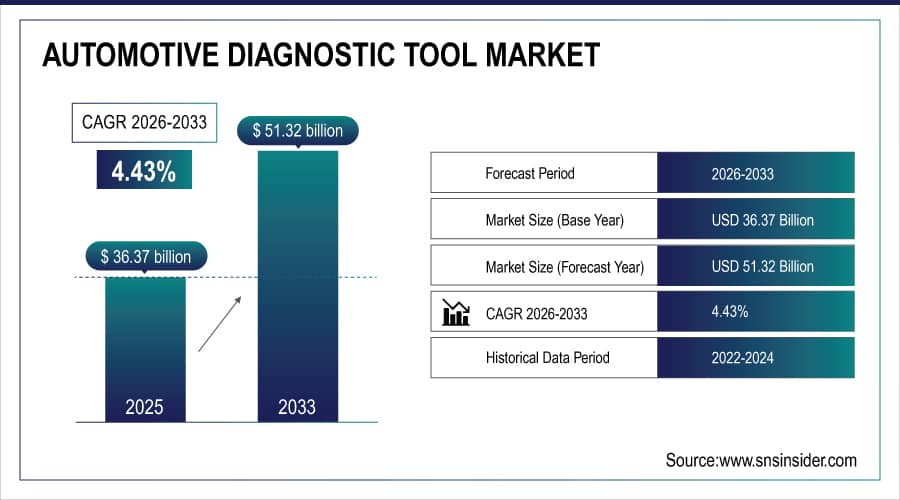

The Automotive Diagnostic Tool Market Size is valued at USD 36.37 Billion in 2025E and is projected to reach USD 51.32 Billion by 2033, growing at a CAGR of 4.43% during the forecast period 2026–2033.

Automotive Diagnostic Tool Market analysis report provides comprehensive insights into market trends, tool types, and end-user adoption. Increasing vehicle complexity, rising demand for efficient maintenance, and growth of automotive workshops and DIY users are expected to drive market expansion during the forecast period.

Automotive diagnostic tool shipments reached 42 million units in 2025, driven by rising vehicle complexity and workshop demand.

Market Size and Forecast:

-

Market Size in 2025: USD 36.37 Billion

-

Market Size by 2033: USD 51.32 Billion

-

CAGR: 4.43% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Automotive Diagnostic Tool Market - Request Free Sample Report

Automotive Diagnostic Tool Market Trends:

-

Rising vehicle complexity and emission regulations are accelerating demand for advanced diagnostic tools.

-

Integration of IoT and cloud-based solutions is transforming vehicle maintenance and real-time monitoring.

-

Increasing adoption of DIY vehicle diagnostics is expanding the consumer base beyond workshops.

-

Collaborations between tool manufacturers and automotive OEMs are enhancing product capabilities and reach.

-

Growth of e-commerce and online automotive tool platforms is reshaping distribution channels.

-

AI-powered predictive diagnostics and automated fault detection are redefining vehicle servicing efficiency.

U.S. Automotive Diagnostic Tool Market Insights:

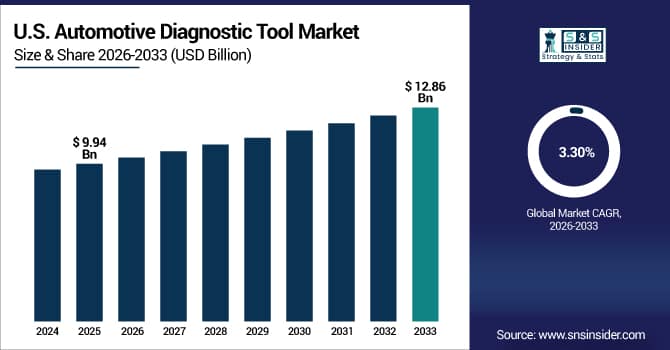

The U.S. Automotive Diagnostic Tool Market is projected to grow from USD 9.94 Billion in 2025E to USD 12.86 Billion by 2033, at a CAGR of 3.30%. Growth is driven by rising vehicle complexity, stringent emission regulations, strong workshop demand, and increasing adoption of advanced AI- and IoT-enabled diagnostic solutions.

Automotive Diagnostic Tool Market Growth Drivers:

-

Increasing vehicle complexity and stringent emission regulations, boosting demand for advanced automotive diagnostic tools.

Increasing vehicle complexity and stricter emission regulations are key drivers of the Automotive Diagnostic Tool Market Growth. The growing adoption of advanced vehicles with sophisticated electronics has amplified the need for precise diagnostics. Rising demand from workshops, fleet operators, and DIY users, combined with expanding digital and connected solutions, is enabling faster, more efficient vehicle maintenance. Manufacturers are leveraging these trends with innovative tools to enhance performance and market reach.

Automotive diagnostic tool shipments grew 5.2% in 2025, driven by rising vehicle complexity and stricter emission regulations.

Automotive Diagnostic Tool Market Restraints:

-

High tool costs and limited skilled technicians are restricting widespread adoption and consistent market growth.

High costs of advanced diagnostic tools and limited availability of skilled technicians pose significant restraints on the Automotive Diagnostic Tool Market. Premium pricing restricts adoption among small workshops, fleet operators, and DIY users, while the technical expertise required for accurate diagnostics limits broader usage. Inconsistent after-sales support and lack of standardized training further hinder reliability and efficiency. Together, these challenges slow market growth, forcing manufacturers to balance sophisticated tool features with affordability and accessibility for wider adoption.

Automotive Diagnostic Tool Market Opportunities:

-

Rising adoption of connected vehicles and AI-powered diagnostics presents opportunities for smarter, predictive automotive maintenance solutions.

Rising adoption of connected vehicles and AI-powered diagnostics presents significant growth opportunities for the Automotive Diagnostic Tool Market. Vehicle owners and workshops increasingly demand predictive maintenance, real-time monitoring, and intelligent fault detection. Meanwhile, cloud-based platforms, IoT integration, and user-friendly diagnostic interfaces are enhancing efficiency and accessibility. Tool manufacturers focusing on smart, connected solutions can capture market share by delivering innovative, data-driven services that meet evolving automotive maintenance needs.

AI-powered diagnostic tools accounted for 32% of new deployments in 2025, driven by predictive maintenance demand.

Automotive Diagnostic Tool Market Segmentation Analysis:

-

By Tool Type, OBD-II Scanners held the largest market share of 38.72% in 2025, while Engine Analyzers are expected to grow at the fastest CAGR of 6.37% during 2026–2033.

-

By Vehicle Type, Passenger Cars accounted for the highest market share of 52.63% in 2025, while Two-Wheelers are projected to expand at the fastest CAGR of 6.21% during the forecast period.

-

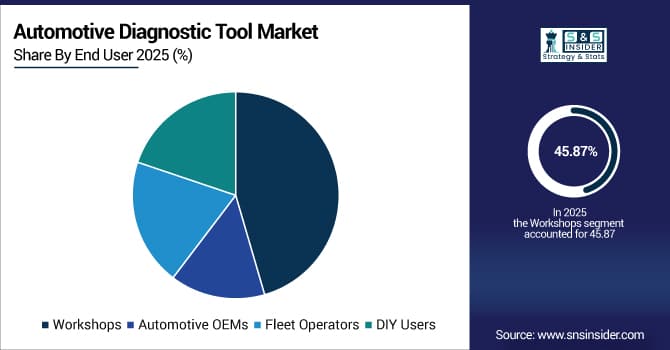

By End User, Workshops held the largest share of 45.87% in 2025, while DIY Users are expected to grow at the fastest CAGR of 6.45% through 2026–2033.

-

By Distribution Channel, Offline Retail dominated with 48.19% market share in 2025, while Online Retail is anticipated to record the fastest CAGR of 6.12% during 2026–2033.

By Tool Type, OBD-II Scanners Dominate While Engine Analyzers Expand Rapidly:

OBD-II Scanners segment dominated the market due to their widespread compatibility with most vehicles and affordability, making them a staple for workshops and DIY users. Their reliability and ease of use have solidified their position as the preferred choice for routine diagnostics. Engine Analyzers are the fastest-growing segment, driven by demand for predictive maintenance and advanced fault detection in modern vehicles. In 2025, 12 million AI-powered engine diagnostics tools were deployed globally, reflecting rapid adoption.

By Vehicle Type, Passenger Cars Dominate While Two-Wheelers Expand Rapidly:

Passenger Cars dominated the market owing to their sheer volume on roads and the growing need for regular maintenance and diagnostics. Workshops and OEMs primarily focus on car diagnostics, supporting steady tool adoption. Two-Wheelers are the fastest-growing segment as emerging markets experience rising motorbike ownership, and urban commuters increasingly rely on cost-efficient mobility. In 2025, 8.5 million diagnostic tools for two-wheelers were utilized, highlighting strong growth potential in this segment.

By End User, Workshops Dominate While DIY Users Expand Rapidly:

Workshops segment dominated the market as professional technicians rely on automotive diagnostic tools for efficient vehicle servicing, maintenance, and troubleshooting. Their volume orders and repeat purchases support steady market revenue. DIY Users are the fastest-growing segment, driven by rising consumer awareness, availability of user-friendly tools, and digital guides enabling self-diagnosis. In 2025, 4.2 million DIY users adopted diagnostic tools globally, reflecting increased interest in home-based vehicle maintenance and customization.

By Distribution Channel, Offline Retail Dominates While Online Retail Expands Rapidly:

Offline Retail dominated the market due to the established network of automotive tool distributors, physical dealerships and service centers where buyers can directly inspect tools. This traditional channel continues to capture high sales volumes, especially in regions with limited e-commerce penetration. Online Retail is the fastest-growing segment, boosted by e-commerce platforms, easy shipping, and wider product visibility. In 2025, 3.1 million diagnostic tools were sold through online channels, showcasing a shift toward digital purchasing.

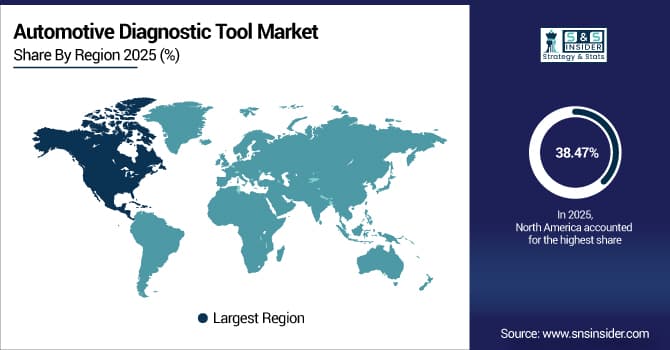

Automotive Diagnostic Tool Market Regional Analysis:

North America Automotive Diagnostic Tool Market Insights:

The North America Automotive Diagnostic Tool Market is dominated with a 38.47% market share, driven by advanced vehicle adoption and stringent emission regulations in the U.S. and Canada. High demand from workshops and fleet operators, coupled with widespread use of professional diagnostic tools, reinforces its dominance. Integration of AI-powered and IoT-enabled solutions, along with strong aftermarket support and training programs, is further strengthening North America’s leading position in the market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Automotive Diagnostic Tool Market Insights:

The U.S. Automotive Diagnostic Tool Market is strongly driven by advanced vehicle adoption, growing workshop networks, and emphasis on preventive maintenance. Increasing integration of AI-powered diagnostics, IoT-enabled tools, and user-friendly interfaces is reshaping service efficiency, while collaborations between manufacturers and OEMs, along with digital sales channels, are enhancing market reach and innovation.

Asia-Pacific Automotive Diagnostic Tool Market Insights:

The Asia-Pacific Automotive Diagnostic Tool Market is the fastest-growing region, projected to expand at a CAGR of 5.60% during 2026–2033. Growth is driven by rising vehicle production, increasing two-wheeler and passenger car ownership, and expanding automotive workshops across China, India, Japan, and South Korea. Rapid adoption of AI-powered diagnostics, connected vehicle solutions, and e-commerce platforms, along with growing demand for preventive maintenance, is accelerating market growth in the region.

China Automotive Diagnostic Tool Market Insights:

The China Automotive Diagnostic Tool Market is driven by rising vehicle ownership, expanding automotive workshops and increasing adoption of advanced diagnostics. Growing presence of domestic and international tool manufacturers, combined with digital sales channels, AI-powered solutions, and connected vehicle technologies, is accelerating market growth, making China a key contributor in Asia-Pacific.

Europe Automotive Diagnostic Tool Market Insights:

The Europe Automotive Diagnostic Tool Market held a strong market presence in 2025, driven by advanced vehicle technology adoption and stringent emission regulations. Countries such as Germany, France, and the UK lead the trend for precision diagnostics and workshop innovation. Rising demand for AI-powered and connected diagnostic tools, skilled technicians, and robust aftermarket support is driving market growth across the region, cementing Europe’s role as a key hub for automotive maintenance solutions.

Germany Automotive Diagnostic Tool Market Insights:

Germany is a key market in Europe’s Automotive Diagnostic Tool sector, with a strong automotive manufacturing base and advanced workshop networks. Growth is driven by high vehicle complexity, adoption of AI-powered and connected diagnostics, strict emission standards, and increasing digital sales channels. Innovation and skilled technician availability reinforce Germany’s leadership in the market.

Latin America Automotive Diagnostic Tool Market Insights:

The Latin America Automotive Diagnostic Tool Market is growing due to rising vehicle ownership and expanding workshop networks in Brazil, Mexico, and Argentina. Adoption of advanced diagnostics, connected vehicle solutions, and AI-powered tools is increasing. E-commerce platforms, training initiatives, and partnerships with manufacturers are further driving regional market growth.

Middle East and Africa Automotive Diagnostic Tool Market Insights:

The Middle East & Africa Automotive Diagnostic Tool Market is growing with rising vehicle ownership, expanding workshops, and increasing adoption of advanced diagnostics. Investments in retail and e-commerce, coupled with modernization in Saudi Arabia, UAE, and South Africa, are driving demand. AI-powered tools and connected vehicle solutions further support market growth.

Automotive Diagnostic Tool Market Competitive Landscape:

Robert Bosch GmbH, founded in Stuttgart in 1886, is a leader in automotive technology and mobility solutions. The company dominates the automotive diagnostic tool market due to its expertise in sensors, software, and connected vehicle systems, supplying advanced diagnostic modules to most major automakers. Bosch’s substantial R&D investments, innovative diagnostic solutions, and service network reinforce its reputation. Its commitment to reliability, precision, and cutting-edge technology ensures sustained leadership in diagnostics.

-

In August 2025, Bosch released software version 6.11 for its ADS X diagnostic scan‑tool series, adding first‑time model‑year 2026 vehicle coverage, roughly 5,000 new special tests and 450 system applications, plus expanded ADAS calibration capabilities and secure gateway access for major OEM brands.

Snap‑on Incorporated, established in Milwaukee in 1920, specializes in high-quality automotive tools and diagnostic equipment for professional technicians. The company dominates the market through its extensive product portfolio, mobile-service van network, and workshop-focused diagnostic solutions, combining hardware and software for efficiency. Snap‑on’s emphasis on reliability, customer support, and continuous innovation strengthens its market position. By catering to professional users and service chains, Snap‑on maintains a strong presence and trusted brand reputation in diagnostics.

-

In January 2025, Snap‑on launched the Diagnostic Thermal Imager+ which uses infrared imagery (4,800 temperature zones up to 840 °F) to help technicians detect heat‑related vehicle faults (brakes, wiring, belts). The product integrates with Wi‑Fi and cloud upload to streamline diagnostics.

Continental AG, headquartered in Hanover, Germany, and founded in 1871, is one of the world’s leading automotive suppliers. The company dominates the automotive diagnostic tool market by leveraging its expertise in integrated electronics, chassis, and vehicle safety systems. Continental’s deep knowledge of vehicle systems, manufacturing capabilities, and innovative diagnostic solutions enable it to supply advanced tools to automakers and service centers. Its strong engineering base and international reach reinforce its leadership and market influence in diagnostics.

-

In March 2025, Continental launched an AI-Based Requirements Engineering tool in collaboration with Microsoft Azure and NTT DATA, reducing analysis effort by 80% and significantly accelerating the development of advanced vehicle diagnostics and integrated system modules for automotive applications.

Automotive Diagnostic Tool Market Key Players:

Some of the Automotive Diagnostic Tool Market Companies are:

-

Robert Bosch GmbH

-

Snap‑on Incorporated

-

Continental AG

-

Denso Corporation

-

Delphi Technologies

-

Autel Intelligent Technology Corp., Ltd.

-

Actia Group

-

SPX Corporation

-

Softing AG

-

Launch Tech Co., Ltd.

-

AVL List GmbH

-

Hella KGaA Hueck & Co.

-

Horiba, Ltd.

-

Fluke Corporation

-

DG Technologies

-

KPIT Technologies Ltd.

-

Foxwell Technology Co., Ltd.

-

Hella Gutmann Solutions

-

Innova Electronics Corporation

-

OTC Tools

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 36.37 Billion |

| Market Size by 2033 | USD 51.32 Billion |

| CAGR | CAGR of 4.43% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tool Type (OBD-II Scanners, Engine Analyzers, Battery Testers, Emission Testers, TPMS Tools, Others) • By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Others) • By End User (Workshops, Automotive OEMs, Fleet Operators, DIY Users) • By Distribution Channel (Offline Retail, Online Retail, Specialty Stores, Automotive Dealerships, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, Snap-on Incorporated, Continental AG, Denso Corporation, Delphi Technologies, Autel Intelligent Technology Corp., Ltd., Actia Group, SPX Corporation, Softing AG, Launch Tech Co., Ltd., AVL List GmbH, Hella KGaA Hueck & Co., Horiba, Ltd., Fluke Corporation, DG Technologies, KPIT Technologies Ltd., Foxwell Technology Co., Ltd., Hella Gutmann Solutions, Innova Electronics Corporation, OTC Tools |