Home Decor Market Report Scope & Overview:

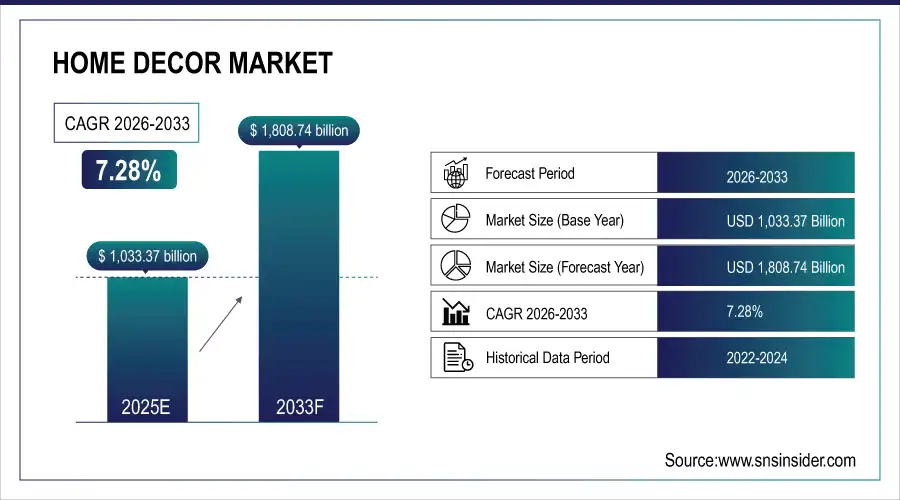

The Home Decor Market size is valued at USD 1,033.37 Billion in 2025E and is projected to reach USD 1,808.74 Billion by 2033, growing at a CAGR of 7.28% during the forecast period 2026–2033.

The Home Decor Market analysis report provides a detailed overview of design trends, product innovations, and material adoption. Growing consumer focus on aesthetic living spaces, rising disposable income, and increasing demand for customized and premium decor solutions are expected to drive market growth during the forecast period.

The Home Decor Market is expected to see over 3,500 new interior design projects by 2026, driven by rising urbanization and growing demand for personalized home furnishings.

Market Size and Forecast:

-

Market Size in 2025: USD 1,033.37 Billion

-

Market Size by 2033: USD 1,808.74 Billion

-

CAGR: 7.28% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Home Decor Market - Request Free Sample Report

Home Decor Market Trends:

-

Rising consumer preference for personalized and bespoke interiors is driving demand for premium home decor products.

-

Increasing urbanization and residential construction projects are expanding opportunities for furniture, lighting, and wall decor.

-

Growth in e-commerce and online design platforms is accelerating the adoption of home decor solutions.

-

Advancements in sustainable and smart materials are improving product durability, functionality, and eco-friendliness.

-

Collaborations with interior designers and lifestyle brands are facilitating innovative, trend-focused decor offerings.

-

Integration of AR/VR tools and digital visualization is enhancing the shopping and design experience for consumers.

U.S. Home Decor Market Insights:

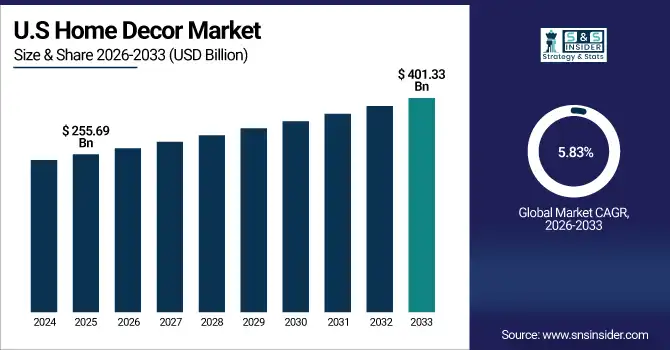

The U.S. Home Decor Market is projected to grow from USD 255.69 Billion in 2025E to USD 401.33 Billion by 2033, at a CAGR of 5.83%. Growth is driven by rising disposable incomes, urban residential development, increasing adoption of premium and customized interiors, and strong e-commerce and design service adoption.

Home Decor Market Growth Drivers:

-

Rising consumer demand for personalized and premium interiors driving rapid Home Decor market growth.

Rising consumer demand for personalized and premium interiors is a key driver of Home Decor Market growth. Homeowners and commercial clients are increasingly seeking bespoke furniture, lighting, and decor solutions to enhance aesthetics and functionality. Growth in urban residential and commercial projects, coupled with the adoption of sustainable and smart materials, is accelerating product innovation. Additionally, collaborations with designers and digital tools such as AR/VR for visualization are further fueling market expansion and consumer engagement.

The Home Decor Market is projected to grow over 10% by 2026, driven by rising demand for personalized interiors and premium furnishings.

Home Decor Market Restraints:

-

High product costs, supply chain complexities, and fluctuating raw material prices are restraining Home Decor market growth.

High product costs, supply chain complexities, and fluctuating raw material prices pose significant restraints for the Home Decor Market. Premium materials, skilled craftsmanship, and advanced manufacturing processes increase production expenses. Delays in sourcing quality raw materials or logistical disruptions can impact timely delivery of products. Additionally, rising costs may limit adoption among price-sensitive consumers and small businesses. These factors restrict market scalability and slow overall growth, despite increasing demand for personalized, stylish, and sustainable home decor solutions.

Home Decor Market Opportunities:

-

Growing adoption of smart and sustainable home decor solutions presents significant opportunities for Home Decor market growth.

Growing adoption of smart and sustainable home decor solutions represents a significant opportunity for the Home Decor Market. Increasing consumer preference for energy-efficient, eco-friendly, and tech-integrated furniture and decor is encouraging manufacturers to innovate and diversify product offerings. Integration of smart lighting, furniture, and home automation systems enhances functionality and convenience. Rising awareness of sustainability and environmentally responsible products further supports market expansion, creating new avenues for growth, adoption, and competitive differentiation.

Smart and sustainable home decor solutions are expected to account for over 22% of Home Decor sales by 2026, driven by rising consumer demand for eco-friendly and tech-integrated interiors.

Home Decor Market Segmentation Analysis:

-

By Product Type, Furniture held the largest market share of 38.25% in 2025, while Lighting is expected to grow at the fastest CAGR of 9.14% during 2026–2033.

-

By Style, Modern dominated with a 34.62% share in 2025, while Eclectic is projected to expand at the fastest CAGR of 9.67% during the forecast period.

-

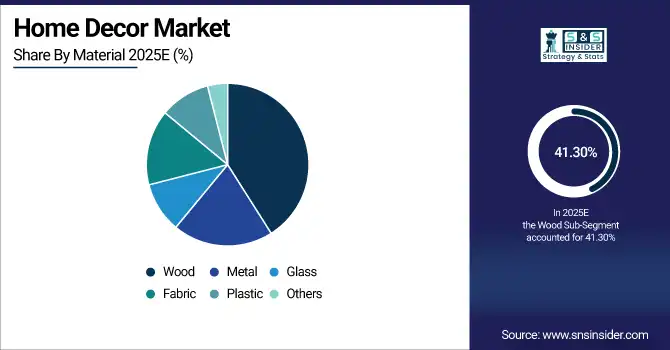

By Material, Wood accounted for the highest market share of 41.30% in 2025, while Metal is anticipated to record the fastest CAGR of 8.72% through 2026–2033.

-

By Application, Residential held the largest share of 50.18% in 2025, while Hospitality is expected to grow at the fastest CAGR of 9.21% during 2026–2033.

-

By Distribution Channel, E-Commerce accounted for the largest share of 29.40% in 2025, while Specialty Stores are forecasted to register the fastest CAGR of 9.33% during 2026–2033.

-

By End-Use, Homeowners dominated with a 55.35% share in 2025, while Interior Designers are expected to witness the fastest CAGR of 9.05% during the forecast period.

By Product Type, Furniture Dominates While Lighting Grows Rapidly:

Furniture segment dominated the market due to its extensive adoption in residential and commercial spaces. In 2025, over 2,800 large-scale housing and commercial projects incorporated customized furniture solutions, establishing dominance. Growing consumer preference for premium and multifunctional furniture further strengthened market position.

Lighting is the fastest-growing segment, driven by rising demand for designer, energy-efficient, and smart lighting systems. By 2025, more than 1,150 premium lighting installations and smart home integrations were recorded, highlighting rapid adoption and expanding opportunities for innovative lighting products.

By Style, Modern Dominates While Eclectic Grows Rapidly:

Modern segment dominated the market, as urban homeowners and commercial developers favored clean lines, minimalist designs, and functional aesthetics. In 2025, over 2,400 residential and commercial projects opted for modern interiors, reinforcing dominance.

Eclectic is the fastest-growing segment, driven by increasing consumer preference for personalized and unique decor combining multiple styles. By 2025, more than 900 eclectic-themed interior projects were initiated, signaling a significant shift toward diverse and customizable home styling solutions.

By Material, Wood Dominates While Metal Grows Rapidly:

Wood segment dominated the market due to their versatility, durability, and premium appeal. In 2025, over 3,000 large-scale furniture and decor projects incorporated wooden elements, establishing market dominance, while consumer preference for sustainable and eco-friendly materials further strengthened growth potential.

Metal is the fastest-growing segment, driven by demand for industrial-style interiors, modern furniture, and decorative accessories. By 2025, more than 1,050 commercial and residential metal decor projects were implemented, reflecting rapid adoption of sleek, contemporary, and long-lasting metallic products.

By Application, Residential Dominates While Hospitality Grows Rapidly:

Residential segment dominated the market as homeowners increasingly invested in furniture, decor, and smart interiors to enhance living spaces. In 2025, over 3,500 residential projects adopted premium and customized decor solutions, supporting market dominance.

Hospitality is the fastest-growing segment, fueled by hotel and resort upgrades and boutique interiors. By 2025, more than 1,100 hospitality projects implemented modern and themed decor solutions, highlighting rapid expansion in service-oriented spaces seeking memorable guest experiences.

By Distribution Channel, E-Commerce Dominates While Specialty Stores Grow Rapidly:

E-Commerce segment dominated the market due to convenience, wide product selection, and increasing digital adoption. In 2025, over 2,600 online transactions involved premium and customized home decor products, reinforcing dominance, while rising mobile shopping and social media influence further boosted market penetration.

Specialty Stores are the fastest-growing segment, driven by curated product experiences, personalized consultations, and designer collaborations. By 2025, more than 950 specialty store launches and expansions were recorded, indicating strong consumer interest in tailored shopping experiences and expert-guided interior solutions.

By End-Use, Homeowners Dominate While Interior Designers Grow Rapidly:

Homeowners segment dominated the market, investing heavily in furniture, textiles, and decorative accessories to enhance personal living spaces. In 2025, over 3,700 residential buyers purchased premium or customized decor products, reflecting market dominance. Rising disposable incomes and lifestyle aspirations further fueled segment growth.

Interior Designers is the fastest-growing segment, driven by rising demand for professional design services and curated interiors. By 2025, more than 1,050 design projects were commissioned, highlighting rapid adoption and the increasing influence of professional designers in shaping home and commercial decor trends.

Home Decor Market Regional Analysis:

North America Home Decor Market Insights:

North America dominated the Home Decor Market, holding a 32.45% market share, driven by rising disposable incomes, urban residential growth, and strong consumer demand for premium and customized interiors. The U.S. leads regional growth, supported by advanced e-commerce platforms, innovative design services, and high adoption of smart and sustainable decor solutions. Increasing investments in home improvement, collaborations with interior designers, and rising awareness of lifestyle and aesthetics further strengthen North America’s position as a key hub for home decor products and trends.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Home Decor Market Insights:

The U.S. Home Decor Market is driven by rising design awareness, demand for personalized and sustainable interiors, and premium product adoption. Advanced e-commerce, access to interior designers, and smart home integration support growth. Urban residential expansion and strong consumer spending reinforce the U.S. market’s dominant position in North America.

Asia-Pacific Home Decor Market Insights:

The Asia-Pacific Home Decor Market is the fastest-growing region, projected to expand at a CAGR of 8.80% during the forecast period. Growth is driven by rapid urbanization, rising disposable incomes, and increasing demand for premium and customized interiors across China, India, Japan, South Korea, and Australia. Expansion of e-commerce, adoption of smart and sustainable home solutions, and growing awareness of lifestyle and aesthetics position Asia-Pacific as a key growth engine for the Home Decor Market.

China Home Decor Market Insights:

China’s Home Decor Market is driven by rapid urbanization, rising disposable incomes, and growing demand for premium and customized interiors. Expansion of e-commerce platforms, adoption of smart and sustainable home solutions, and increasing design awareness position China as a major growth contributor within the Asia-Pacific Home Decor Market.

Europe Home Decor Market Insights:

The Europe Home Decor Market is driven by high consumer design awareness, strong purchasing power, and demand for premium and sustainable interiors. Countries such as Germany, France, the UK, and Italy are major contributors, supported by advanced retail infrastructure, skilled design professionals, and well-established e-commerce platforms. Rising adoption of smart home solutions, customization trends, and eco-friendly materials, coupled with growing investment in lifestyle and home improvement, reinforces Europe’s role as a key regional market for home decor.

Germany Home Decor Market Insights:

Germany is a key Home Decor market, supported by advanced retail infrastructure, skilled design professionals, and high consumer purchasing power. Strong demand for premium, sustainable, and customized interiors, adoption of smart home solutions, and well-established e-commerce and specialty store networks reinforce Germany’s position as a leading contributor within the European Home Decor landscape.

Latin America Home Decor Market Insights:

The Latin America Home Decor Market is witnessing steady growth driven by rising urbanization, increasing disposable incomes, and growing demand for premium and customized interiors. Countries such as Brazil, Mexico, and Argentina are key contributors, supported by expanding retail infrastructure, e-commerce adoption, and increasing awareness of smart and sustainable home decor solutions.

Middle East and Africa Home Decor Market Insights:

The Middle East & Africa Home Decor Market is expanding due to rising urbanization, increasing disposable incomes, and growing demand for premium and customized interiors. Countries such as Saudi Arabia, the UAE, and South Africa are key contributors, supported by expanding retail networks, e-commerce adoption, and rising awareness of smart and sustainable home decor solutions.

Home Decor Market Competitive Landscape:

IKEA is a leader in home furnishings, headquartered in Sweden, known for its affordable, functional, and stylish furniture and home decor solutions. The company dominates the Home Decor market through extensive retail presence, cost-effective supply chain management, and innovative flat-pack designs. Its focus on sustainability, customizable interiors, and wide product variety strengthens consumer loyalty. Strategic expansion into e-commerce and smart home solutions further reinforces IKEA’s market leadership, making it a trusted brand for residential and commercial home decor.

-

In April 2025, IKEA launched the STOCKHOLM 2025 collection, featuring 96 new furniture, textile, lighting, and accessory designs. This extensive launch reinforces IKEA’s design leadership, commitment to affordability, sustainability, and strengthens its appeal across both residential and commercial markets

Wayfair, headquartered in the U.S., is a leading online retailer specializing in furniture, home decor, and interior solutions. The company dominates the Home Decor market through a vast product assortment, user-friendly e-commerce platforms, and data-driven personalization. Wayfair’s focus on fast delivery, competitive pricing, and partnerships with suppliers enhances customer accessibility and satisfaction. Strategic investments in technology, AR/VR visualization, and logistics optimization strengthen its market presence, positioning Wayfair as a key driver of online home decor growth.

-

In November 2025, Wayfair introduced a broad range of new furniture and home decor products, including accent chairs, sofas, dining tables, and TV stands. This launch enhances functional design, aesthetic appeal, and strengthens Wayfair’s position as a leading online home decor marketplace.

Bed Bath & Beyond is a major U.S.-based home goods retailer offering a wide range of furniture, decor, textiles, and kitchen products. The company dominates the Home Decor market through a strong brick-and-mortar and e-commerce presence, diverse product portfolio, and strategic supplier partnerships. Its focus on seasonal trends, premium and customized offerings, and customer loyalty programs drives consistent market demand. Expansion into digital platforms and personalized interior solutions further reinforces Bed Bath & Beyond’s influence and leadership in the North American home decor landscape.

-

In August 2025, Bed Bath & Beyond relaunched its Home brand with a new flagship store in Nashville, showcasing modern home decor assortments, interior solutions, and strategically revitalizing its brick-and-mortar presence to complement ongoing e-commerce growth initiatives.

Home Decor Market Key Players:

Some of the Home Decor Market Companies are:

-

IKEA

-

Wayfair

-

Bed Bath & Beyond

-

The Home Depot

-

Target

-

Amazon

-

Ashley Furniture Industries

-

West Elm

-

Lowe’s

-

Pottery Barn

-

Ethan Allen Interiors

-

Mohawk Industries

-

Sherwin‑Williams

-

Benjamin Moore & Co.

-

Kimball International

-

Hanssem Corporation

-

Suofeiya Home Collection

-

Springs Window Fashions

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1,033.37 Billion |

| Market Size by 2033 | USD 1,808.74 Billion |

| CAGR | CAGR of 7.28% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Furniture, Lighting, Wall Art & Decor, Textiles, Home Accessories, Others) • By Style (Modern, Contemporary, Traditional, Rustic, Eclectic, Others) • By Material (Wood, Metal, Glass, Fabric, Plastic, Others) • By Application (Residential, Commercial, Hospitality, Healthcare, Others) • By Distribution Channel (E-Commerce, Specialty Stores, Supermarkets/Hypermarkets, Department Stores, Direct Sales, Others) • By End-Use (Homeowners, Interior Designers, Architects, Hotels & Resorts, Offices, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IKEA, Wayfair, Bed Bath & Beyond, Ashley Furniture Industries, Williams-Sonoma, Herman Miller, La-Z-Boy, HNI Corporation, Steelcase, Kimball International, Haverty Furniture Companies, Ethan Allen Interiors, Restoration Hardware (RH), Inter IKEA Group, Dunelm Group, Home Depot, Lowe’s Companies, Crate & Barrel, West Elm, At Home Group |