Produced Water Treatment Market Report Scope & Overview:

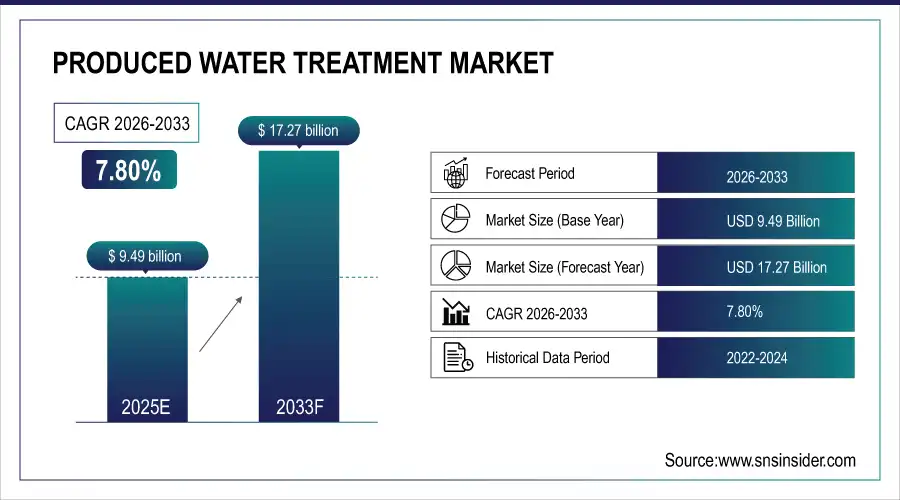

The Produced Water Treatment Market Size is valued at USD 9.49 Billion in 2025E and is projected to reach USD 17.27 Billion by 2033, growing at a CAGR of 7.80% during the forecast period 2026–2033.

The Produced Water Treatment Market analysis report offers a comprehensive overview of emerging technologies, treatment methods and regulatory compliance. Increasing oil & gas production, water scarcity concerns and environmental regulations are expected to drive demand for efficient produced water management during the forecast period.

Produced water treatment capacity is estimated at 25 billion barrels annually in 2025, driven by rising oil & gas production and increasing demand for water reuse and regulatory compliance.

Market Size and Forecast:

-

Market Size in 2025: USD 9.49 Billion

-

Market Size by 2033: USD 17.27 Billion

-

CAGR: 7.80% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Produced Water Treatment Market - Request Free Sample Report

Produced Water Treatment Market Trends:

-

Growing oil & gas production and offshore drilling activities are driving demand for advanced produced water treatment solutions.

-

Increasing regulatory pressure on wastewater discharge is expanding the adoption of efficient treatment technologies.

-

Rising water scarcity and the need for industrial reuse are encouraging investment in water recycling and reuse systems.

-

Technological advancements such as membrane filtration and biological treatment are enhancing treatment efficiency and market appeal.

-

Expansion in on-site and off-site treatment services is enabling wider market penetration across regions.

-

Sustainability initiatives and eco-friendly operations are trending, with companies focusing on reducing environmental impact of produced water disposal.

U.S. Produced Water Treatment Market Insights:

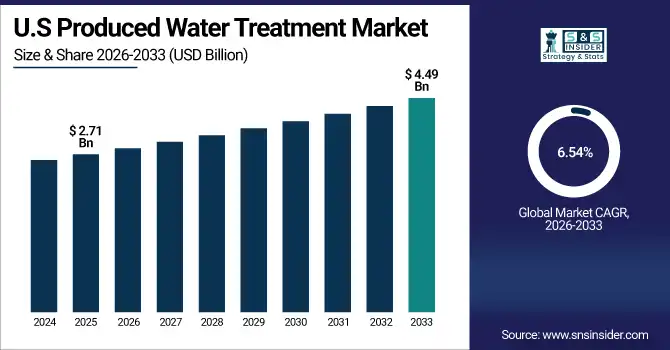

The U.S. Produced Water Treatment Market is projected to grow from USD 2.71 Billion in 2025E to USD 4.49 Billion by 2033, at a CAGR of 6.54%. Growth is driven by expanding oil & gas operations, stricter environmental regulations and increasing adoption of water reuse and advanced treatment technologies.

Produced Water Treatment Market Growth Drivers:

-

Stringent environmental regulations and rising water reuse mandates across oil & gas operations driving produced water treatment market growth.

Stringent environmental regulations and rising water reuse mandates are major drivers of the Produced Water Treatment Market Growth. Governments and regulatory bodies increasingly enforce strict discharge standards to reduce environmental contamination from oil & gas operations. Operators are compelled to invest in advanced treatment technologies to meet compliance, minimize freshwater consumption and enable reuse for industrial and agricultural purposes. This regulatory push, combined with sustainability goals and water scarcity concerns, is reshaping operational strategies and accelerating adoption of efficient produced water treatment solutions.

Produced water treatment demand rose 7.5% in 2025, driven by stricter environmental regulations and expanding water reuse mandates in oil & gas operations.

Produced Water Treatment Market Restraints:

-

High capital investment and operational costs of advanced treatment systems limiting adoption across small and mid-sized operators.

High capital investment and operational costs represent a major restraint for the Produced Water Treatment Market. Advanced treatment technologies such as membrane filtration, chemical dosing and thermal systems require substantial upfront infrastructure spending and ongoing maintenance expenses. Smaller and mid-sized oil & gas operators often face budget constraints, limiting technology adoption. Additionally, high energy consumption, skilled labor requirements and fluctuating oil prices further impact return on investment, slowing deployment of sophisticated produced water treatment solutions across cost-sensitive regions.

Produced Water Treatment Market Opportunities:

-

Growing focus on produced water reuse for industrial, agricultural and hydraulic fracturing applications creating significant market expansion opportunities.

Growing focus on produced water reuse presents a major opportunity for the Produced Water Treatment Market. Increasing water scarcity and rising industrial water demand are pushing operators to treat and reuse produced water for applications such as hydraulic fracturing, cooling and irrigation. Advancements in treatment technologies are improving water quality and cost efficiency. This shift toward circular water management reduces freshwater dependency, enhances regulatory compliance and opens new revenue streams, supporting long-term market expansion across oil-producing regions.

Produced water reuse represented around 35% of treated volumes in 2025, driven by water scarcity and growing industrial and fracking demand.

Produced Water Treatment Market Segmentation Analysis:

-

By Treatment Technology, Physical Treatment held the largest market share of 34.75% in 2025, while Membrane Filtration is expected to grow at the fastest CAGR of 9.42% during 2026–2033.

-

By Source Type, Onshore Oil & Gas accounted for the highest market share of 46.38% in 2025, while Shale Oil & Gas is projected to expand at the fastest CAGR of 8.57% over the forecast period.

-

By Application, Re-Injection dominated with a 41.26% share in 2025, while Industrial Reuse is anticipated to record the fastest CAGR of 9.11% through 2026–2033.

-

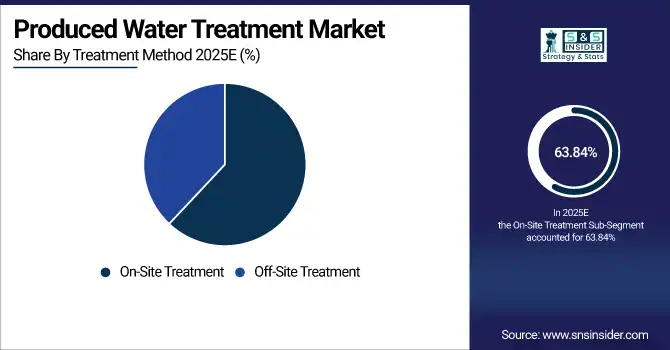

By Treatment Method, On-Site Treatment held the largest share of 63.84% in 2025, while Off-Site Treatment is expected to grow at the fastest CAGR of 8.39% during 2026–2033.

-

By End-Use Industry, Oil & Gas accounted for the largest share of 58.47% in 2025, while Municipal & Industrial is forecasted to register the fastest CAGR of 8.96% during 2026–2033.

By Treatment Technology, Physical Treatment Dominates While Membrane Filtration Grows Rapidly:

Physical Treatment segment dominated the market due to its cost-effectiveness, operational simplicity and widespread use in primary separation processes such as oil-water separation and flotation. These systems are extensively deployed across onshore and offshore facilities for bulk contaminant removal. In 2025, physical treatment technologies processed more than 9 billion barrels of produced water.

Membrane Filtration is the fastest growing segment, driven by its ability to achieve high-quality water suitable for reuse. It efficiently removes contaminants, enabling safe industrial and agricultural water reuse. In 2025, membrane-based systems were deployed in over 2,800 large-scale treatment installations.

By Source Type, Onshore Oil & Gas Dominates While Shale Oil & Gas Expands Rapidly:

Onshore Oil & Gas segment dominated the market due to the large volume of mature oilfields and continuous production activities generating significant produced water volumes. These operations rely heavily on treatment solutions to manage daily water output efficiently. In 2025, onshore operations generated more than 18 billion barrels of produced water.

Shale Oil & Gas is the fastest growing segment, fueled by rising unconventional drilling and hydraulic fracturing activities. It generates significant produced water, increasing demand for advanced treatment solutions. In 2025, shale plays accounted for over 6.5 billion barrels of treated produced water, highlighting rapid infrastructure expansion.

By Application, Re-Injection Dominates While Industrial Reuse Accelerates:

Re-Injection segment dominated the market as it remains the most widely adopted method for pressure maintenance and disposal in oilfields. It is preferred due to regulatory acceptance and lower surface disposal risks. In 2025, re-injection applications managed 15 billion barrels of treated produced water.

Industrial Reuse is the fastest growing segment, driven by water scarcity and rising demand from power generation and manufacturing sectors. It supports sustainability goals while reducing freshwater dependency in industrial operations. In 2025, reused produced water supplied nearly 1.9 billion barrels to industrial operations.

By Treatment Method, On-Site Treatment Dominates While Off-Site Treatment Grows Strongly:

On-site Treatment segment dominated the market due to reduced transportation costs, immediate compliance with discharge standards and operational control at production facilities. Most oil & gas operators prefer integrated on-site systems for continuous treatment. In 2025, over 70,000 active on-site produced water treatment units were operational.

Off-site Treatment is the fastest growing segment, supported by centralized facilities and third-party service providers. It offers scalable solutions and cost efficiency for large water volumes. In 2025, off-site treatment centers handled more than 4 billion barrels of produced water, reflecting growing outsourcing trends.

By End-Use Industry, Oil & Gas Dominates While Municipal & Industrial Use Expands Rapidly:

Oil & Gas segment dominated the market as the primary generator of produced water across upstream operations. Continuous drilling, aging wells and enhanced recovery techniques sustain high treatment demand. In 2025, oil & gas operators treated over 22 billion barrels of produced water.

Municipal & Industrial is the fastest growing segment, driven by reuse initiatives and alternative water sourcing strategies. It helps cities and industries conserve freshwater and meet regulatory requirements. In 2025, municipal and industrial users consumed 1.6 billion barrels of treated produced water for non-potable applications.

Produced Water Treatment Market Regional Analysis:

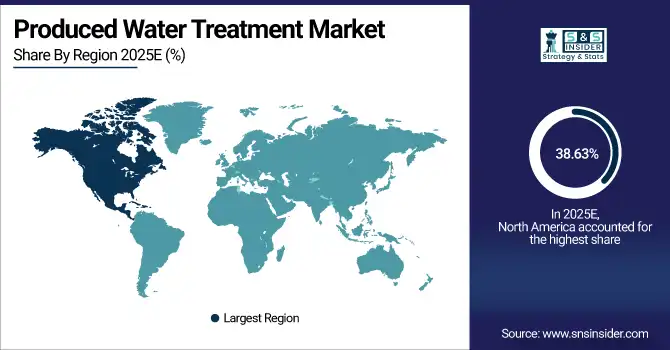

North America Produced Water Treatment Market Insights:

North America dominated the Produced Water Treatment Market, holding a 38.63% share in 2025. The region’s mature oil & gas infrastructure, extensive onshore and offshore operations and stringent environmental regulations are driving consistent demand for advanced treatment solutions. High volumes of produced water generation, combined with growing emphasis on water reuse and sustainability initiatives, are fostering investment in physical, chemical and membrane-based treatment technologies. North America remains a key hub for innovation, infrastructure expansion and market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Produced Water Treatment Market Insights:

The U.S. Produced Water Treatment Market is driven by growing oil & gas production, strict environmental regulations and rising focus on water reuse. Increasing adoption of advanced treatment technologies, including physical, chemical and membrane systems, combined with centralized and on-site solutions, is fueling the country’s dominance in the North American produced water treatment landscape.

Asia-Pacific Produced Water Treatment Market Insights:

The Asia-Pacific Produced Water Treatment Market is the fastest-growing, projected to expand at a CAGR of 9.95% during 2026–2033. Rapid growth in unconventional oil & gas production, hydraulic fracturing and increasing water scarcity are driving demand across China, India, Australia and Southeast Asia. The adoption of advanced treatment technologies, government policies promoting water reuse and investments in sustainable water management solutions are accelerating market expansion. Asia-Pacific is emerging as a key hub for innovation and infrastructure development in produced water treatment.

China Produced Water Treatment Market Insights:

China’s Produced Water Treatment Market is driven by rapid growth in oil & gas production, increasing hydraulic fracturing activities and rising water scarcity. Expansion of advanced treatment technologies, government initiatives promoting water reuse and investments in sustainable water management solutions position China as one of the fastest-growing contributors in the Asia-Pacific produced water treatment market.

Europe Produced Water Treatment Market Insights:

The Europe Produced Water Treatment Market is growing due to stringent environmental regulations, rising focus on water reuse and increasing oil & gas production across the region. Germany, the UK, France and Norway are leading contributors, driven by investments in advanced treatment technologies, centralized and on-site facilities and sustainability initiatives. Growing industrial and municipal reuse applications further strengthen Europe’s position as a key growth market in produced water treatment.

Germany Produced Water Treatment Market Insights:

Germany is a key Produced Water Treatment market, driven by stringent environmental regulations, growing oil & gas production and focus on water reuse. Adoption of advanced treatment technologies, centralized and on-site solutions and sustainability initiatives, combined with industrial and municipal reuse projects, strengthens Germany’s leadership in the European produced water treatment market.

Latin America Produced Water Treatment Market Insights:

The Latin America Produced Water Treatment Market is expected to grow with expanding oil & gas production, rising hydraulic fracturing activities and increasing water scarcity in Brazil, Mexico and Argentina. Adoption of advanced treatment technologies, focus on water reuse and sustainable management practices are driving regional market growth.

Middle East and Africa Produced Water Treatment Market Insights:

The Middle East & Africa Produced Water Treatment Market continues to expand with increasing oil & gas activities, rising water scarcity and stringent environmental regulations. Expansion of advanced treatment technologies, focus on water reuse and growing demand from Saudi Arabia, UAE and South Africa are key factors driving regional market growth.

Produced Water Treatment Market Competitive Landscape:

Veolia Environnement S.A. is a leader in water, waste and energy services, with a strong focus on industrial and environmental water treatment solutions. Through its Veolia Water Technologies division, the company delivers advanced produced water treatment systems, including membrane, chemical and biological processes, tailored for oil & gas and industrial sectors. Veolia’s extensive footprint, sustainability strategy and partnerships with national oil companies position it as a dominant force in delivering high‑performance, regulatory‑compliant water management and reuse solutions.

- In March 2025, Veolia launched the ToroJet nutshell filter system for oil & gas produced water polishing, enhancing efficiency, reliability and ease of maintenance. The system supports reuse, reinjection or safe discharge, meeting stringent environmental standards.

Schlumberger Limited, operating as SLB, is the world’s largest oilfield services provider, offering comprehensive technology and integrated solutions across exploration, drilling, production and reservoir management. Its water and fluid management expertise plays a key role in produced water treatment, particularly within hydraulic fracturing and well production operations. By embedding water management into broader oilfield services and leveraging digital tools and engineering solutions, Schlumberger supports operational efficiency and environmental compliance, making it a critical and influential player in produced water treatment markets.

- In June 2025, Schlumberger expanded its water management portfolio by integrating WaterSure technologies, strengthening its produced water treatment and reuse solutions for oilfield operations, boosting environmental compliance and operational performance.

Halliburton Company is a major American oilfield services corporation known for its expansive portfolio spanning drilling, completion and production chemicals. Within produced water treatment, Halliburton integrates specialty chemicals, engineered solutions and mobile treatment systems to address water quality, reuse and disposal challenges at well sites. Its close alignment with fracking and stimulation activities enables scalable water management across diverse reservoirs. Halliburton’s operations, technological investments and tailored water solutions reinforce its strong market position in supporting efficient and compliant oil & gas water treatment.

- In September 2025, Halliburton Labs introduced Espiku’s modular produced water recycling technology, accelerating adoption of advanced reuse systems. This innovation supports sustainable water management, improves resource efficiency and provides scalable treatment solutions for major U.S. and international oil & gas basins.

Produced Water Treatment Market Key Players:

Some of the Produced Water Treatment Market Companies are:

- Veolia Environnement S.A.

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- SUEZ Water Technologies & Solutions

- Siemens AG / Siemens Energy

- Xylem Inc.

- Aquatech International LLC

- Genesis Water Technologies

- Ecosphere Technologies

- Aker Solutions

- CETCO Energy Services

- Ovivo Inc.

- Frames Group

- ProSep

- DPS Global

- Exterran

- Thermax Limited

- Pentair plc

- Weatherford International plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.49 Billion |

| Market Size by 2033 | USD 17.27 Billion |

| CAGR | CAGR of 7.80% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment Technology (Physical Treatment, Chemical Treatment, Biological Treatment, Membrane Filtration, Others) • By Source Type (Onshore Oil & Gas, Offshore Oil & Gas, Shale Oil & Gas, Coalbed Methane, Others) • By Application (Re-Injection, Discharge to Surface Water, Industrial Reuse, Agricultural Use, Others) • By Treatment Method (On-Site Treatment, Off-Site Treatment) • By End-Use Industry (Oil & Gas, Power Generation, Petrochemicals, Municipal & Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Veolia Environnement S.A., Schlumberger Limited, Halliburton Company, Baker Hughes Company, SUEZ Water Technologies & Solutions, Siemens AG / Siemens Energy, Xylem Inc., Aquatech International LLC, Genesis Water Technologies, Ecosphere Technologies, Aker Solutions, CETCO Energy Services, Ovivo Inc., Frames Group, ProSep, DPS Global, Exterran, Thermax Limited, Pentair plc, Weatherford International plc |