Cigarette Vending Machine Market Report Scope & Overview:

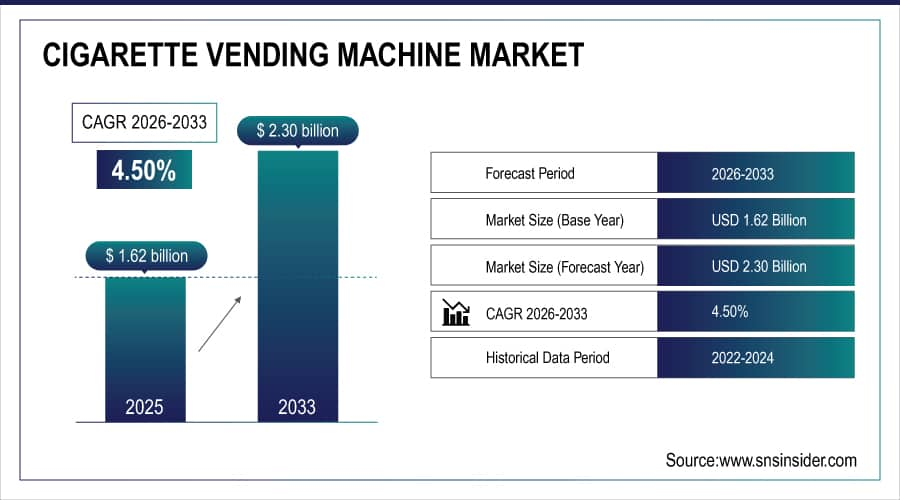

The Cigarette Vending Machine Market Size is valued at USD 1.62 Billion in 2025E and is projected to reach USD 2.30 Billion by 2033, growing at a CAGR of 4.50% during the forecast period 2026–2033.

The Cigarette Vending Machine Market analysis report offering after essential breakdown of market synopsis, use volume and scope that gives esteem, revenue and development rate history. Increasing consumer preference toward convenience, regulatory evolution and continued modernization of retail distribution will continue to support growth in the market.

Cigarette Vending Machine installations reached 185,000 units in 2025, driven by rising automation demand and growing adoption of cashless payment systems.

Market Size and Forecast:

-

Market Size in 2025: USD 1.62 Billion

-

Market Size by 2033: USD 2.30 Billion

-

CAGR: 4.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Cigarette Vending Machine Market - Request Free Sample Report

Cigarette Vending Machine Market Trends:

-

AI-based smart sensors are improving machine performance, safety, and user experience.

-

Vending machines are changing with the times, and by incorporating cashless payments and mobile payments, consumers benefit from greater convenience.

-

As a bar, club or hotel with small space you will prefer compact, customised machine designs.

-

Regulatory and age compliance become technology differentiators shortcut instead.

-

New environmentally responsible and energy efficient models have evolved based on conservative sustainability goals.

-

The push into entertainment and hospitality locations is raising the brand’s profile and its sales.

U.S. Cigarette Vending Machine Market Insights:

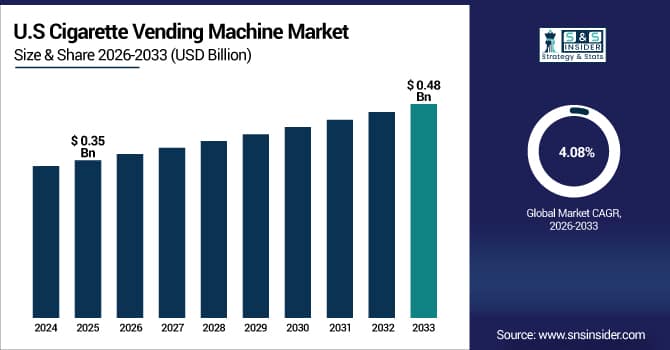

The U.S. Cigarette Vending Machine Market is projected to grow from USD 0.35 Billion in 2025E to USD 0.48 Billion by 2033, at a CAGR of 4.08%. Growth will be spurred by continued growth in the adoption of automated retail concepts, increasing demand for noncash transactions and updated vending equipment within entertainment and hospitality establishments.

Cigarette Vending Machine Market Growth Drivers:

-

Rising adoption of automated retail solutions and cashless technologies driving demand for modern cigarette vending machines.

The rising adoption of automated retail solutions and cashless technologies is a key driver of the Cigarette Vending Machine Market growth. Modern vending machines providing digital payment solutions are being adopted across hotels, casinos and restaurants as convenience becomes a key demand driver for consumers in the industry. These advances provide greater operational efficiency, lower maintenance costs and the security of adhering to regulation, and are key reasons why unattended vending is increasingly becoming the preferred retail model. This technology change is reshaping cigarette sales and a smoker's experience.

Cigarette vending machine sales grew 5.1% in 2025, driven by rising automation and cashless payment adoption across hospitality venues.

Cigarette Vending Machine Market Restraints:

-

Stringent tobacco regulations, age-restriction laws, and declining smoking rates are limiting large-scale adoption of cigarette vending machines.

Stringent tobacco regulations, age-restriction laws, and declining smoking rates are key restraints for the Cigarette Vending Machine Market. Manufactures are up against a bevy of regulations when it comes to e-cigs too with tough government rules for cigarette advertising and placement in vending machines, along with age verification. These will drive up costs and limit placement in public domains. Increased demand for smoke-free living and other nicotine options also continue to suppress multiple market growth, making it difficult for both new entrants and existing vending operators to grow brand presence.

Cigarette Vending Machine Market Opportunities:

-

Smart vending and digital payments create opportunities to modernize cigarette distribution and engagement.

Smart vending and digital payments present a major opportunity for the Cigarette Vending Machine Market. Progress in IoT, AI and contactless payment systems provide smooth transactions, instant inventory control or user verification. These solutions enable consumer convenience, operational efficiency and compliance. By using one of these connected vending platforms, cigarette sales can be modernized and brand engagement increased, capitalising on the growth of automated retail to ensure that businesses remain competitive in a rapidly changing digital and regulated marketplace.

Smart and digital cigarette vending machines accounted for 32% of new installations in 2025, driven by IoT connectivity and cashless payment adoption.

Cigarette Vending Machine Market Segmentation Analysis:

-

By Type, Fully Automatic held the largest market share of 58.37% in 2025, while Semi-Automatic is expected to grow at the fastest CAGR of 5.42% during 2026–2033.

-

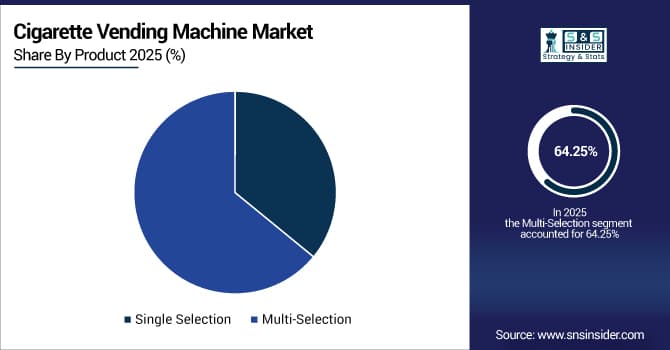

By Product, Multi-Selection accounted for the highest market share of 64.25% in 2025, while it is also projected to expand at the fastest CAGR of 4.96% during the forecast period.

-

By Payment Mode, Cashless dominated with a 47.63% share in 2025, while Mobile Payment is anticipated to record the fastest CAGR of 6.18% through 2026–2033.

-

By Installation Site, Bars & Pubs held the largest share of 31.54% in 2025, while Hotels are forecasted to register the fastest CAGR of 5.77% during 2026–2033.

-

By Distribution Channel, Direct Sales accounted for the largest share of 62.89% in 2025, while Indirect Sales are expected to grow at the fastest CAGR of 4.63% during the forecast period.

By Type, Fully Automatic Dominates While Semi-Automatic Expands Rapidly:

Fully Automatic segment dominated the market in 2025 owing to its convenience, operational efficiency and it supports advanced features such as remote monitoring & digital payments. These pneumatic machines require less hands-on involvement and are well suited for commercial locations with high volume traffic. Semi-Automatic is the fastest growing segment, from small and mid-sized businesses implementing low-cost vending options that are fully automated and affordably priced. In 2025, semi-automatic machines numbered around 68,000 units.

By Product, Multi-Selection Dominates and Expands Steadily:

Multi-Selection segment dominated the market in 2025, due to growing consumer preference for machines that allow them to choose from various cigarette brands and flavors. The factor behind the success of this section is convenience and user control which increases vending machine sales volume. Multi-Selection is also the fastest growing segment since they allow you to implement high-end payment systems and promo capabilities. In 2025, multi-selection vending machines accounted for 120,000 active installations.

By Payment Mode, Cashless Dominates While Mobile Payment Expands Rapidly:

Cashless segment dominated the market in 2025, as there was an increasing need for digital and contactless transactions. These devices save time, make payments more secure and cut down on theft and servicing related to cash. Mobile Payment is the fastest growing segment, as smartphone adoption and use of digital wallets increase. The adoption of NFC-enabled vending machines is accelerating, with 70,000 machines supporting mobile transactions by 2025 across hospitality and entertainment venues.

By Installation Site, Bars & Pubs Dominate While Hotels Expand Rapidly:

Bars & Pubs segment dominated the market in 2025 as they tend to attract large number of consumers, purchase is convenience driven and vending units are well established. These areas continue to serve as major points for cigarette vending machine sales. Hotels are the fastest growing segment, as tourism recovers and properties look at vending for guest convenience. Technological upgrades and compact machine designs have encouraged installations in hotel lounges and lobbies, with 40,000 units installed globally in 2025.

By Distribution Channel, Direct Sales Dominate While Indirect Sales Expand Rapidly:

Direct Sales segment dominated the market in 2025, however, where manufacturers and operators entered into long-term agreements with venue owners directly to facilitate installation and maintenance. This platform offers more cost control and rapid service support. Indirect Sales is the fastest growing segment, where third party distributors or franchisees are expanding their distribution in smaller locations. Growth in vending equipment resellers and partnerships enabled indirect sales to distribute 35,000 units globally in 2025.

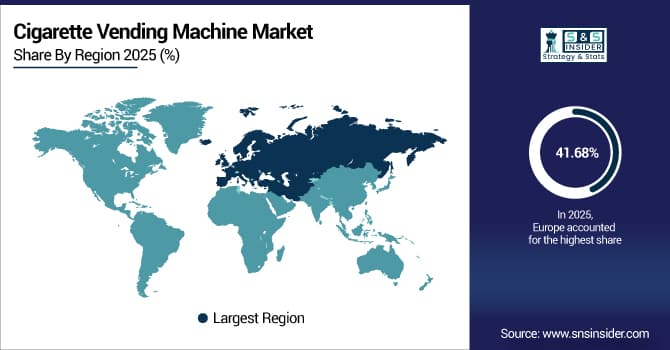

Cigarette Vending Machine Market Regional Analysis:

Europe Cigarette Vending Machine Market Insights:

The Europe Cigarette Vending Machine Market dominated the landscape with a 41.68% share in 2025, supported by increasing usage of automated retail and cashless vending machines respectively. Countries such as Germany, United Kingdom, France and Italy top adoption on the back of hospitality infrastructure proliferation, regulatory compliance while modernizing tobacco retail networks. Increasing investment in smart vending technologies and age verification tools are continuing to give Europe an upper hand as the most developed market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Germany Cigarette Vending Machine Market Insights:

Germany is the largest market in Europe for cigarette vending machines, driven by high automation penetration and strict regulation. The country's large scale penetration of hospitality and nightlife outlets, accompanied by rapid deployment of age-verification and cashless pay solutions complete the picture of Germany as a leader in "new-world" compliant cigarette retail distribution.

Asia-Pacific Cigarette Vending Machine Market Insights:

The Asia-Pacific Cigarette Vending Machine Market is the fastest-growing region, projected to expand at a CAGR of 6.03% during 2026–2033. The growth is attributed to the rapid urbanization and rising penetration of automated retail solutions and the hospitality sector in China, Japan, South Korea and India. Increasing adoption of digital payments, intelligent vending solutions and enabling infrastructure investments make Asia-Pacific the most innovative and promising market for Cigarette Vending Machine.

China Cigarette Vending Machine Insights:

China’s Cigarette Vending Machine Market is driven by rapid urbanization, expanding hospitality sectors, and strong adoption of digital and cashless payment systems. Increasing investments in smart vending technology and government initiatives supporting automated retail position China as a key growth contributor in the Asia-Pacific cigarette vending machine industry.

North America Cigarette Vending Machine Market Insights:

The North America Cigarette Vending Machine Market is characterized by widespread technological adoption, strong infrastructure and early integration of automated retail solutions. Growth is driven by growing demand for contactless transactions, retail networks modernization and the popularity of vending across entertainment and hospitality industries in the U.S. & Canada. Progressive product development, growing emphasis on security solutions and cutting-edge payment technologies are some of the other key factors that continue to underpin North America’s dominant position in next gen cigarette vending.

U.S. Cigarette Vending Machine Market Insights:

The U.S. Cigarette Vending Machine Market is driven by rapid automation, advanced digital payment adoption, and strong presence of leading vending manufacturers. Rising deployments in bars, clubs and airports are just one indication of changing customer habits. Ongoing developments of smart vending, IoT inclusions and age-verification systems continue to solidify the U.S. as an innovation leader in automated cigarette retail.

Latin America Cigarette Vending Machine Market Insights:

The Latin America Market for Cigarette Vending Machines is developing steadily, thanks to the growing urban infrastructure, advancing adoption of automated retail and upgrading payment systems in Brazil, Mexico and Argentina. Growing investment in the hospitality industry and easing regulations are encouraging installation, favoring market penetration and modernisation of cigarette vending platforms across the region.

Middle East and Africa Cigarette Vending Machine Market Insights:

The Middle East & Africa Cigarette Vending Machine Market is expanding with improving retail infrastructure, growing tourism, and increasing adoption of automated vending solutions. Investments in digital payment systems and modernization across Saudi Arabia, the UAE, and South Africa are enhancing accessibility, driving demand, and supporting regional growth in automated cigarette distribution.

Cigarette Vending Machine Market Competitive Landscape:

Fuji Electric Co., Ltd., headquartered in Japan, is a leader in vending machine technology and automation systems. They are currently one of the largest players in the Cigarette Vending Machine Market owing to their years of extensive know-how in delivering energy-efficient, robust and tech-savvy vending solutions. Concentrating on IoT-integration, smart Payment systems and user-friendly interfaces, Fuji Electric is expanding its reach. Through product innovation, precision engineering and advanced technology, the brand consistently sets new standards for reliability, adaptability and energy efficiency.

-

In March 2025, Fuji Electric Co., Ltd. launched a hydrogen-powered smart vending machine with IoT connectivity, smart payments, and accessibility features. The machine reduces environmental impact, improves efficiency, and reinforces Fuji Electric’s leadership in advanced vending technologies.

Azkoyen Group, based in Spain, is a leading player in the cigarette vending machine market. Its market supremacy is based on its broad product portfolio, design innovation and a firm focus on automation and advanced payment technologies. Azkoyen focuses on customer-specific solutions, reliable manufacturing and the possibility of customization of the machines in order to suit all the varied needs around the world. Strategic vending network deployments and ongoing adoption of smart vending solutions strengthen its leadership in the marketplace.

-

In April 2025, Azkoyen Group introduced the “Step” cigarette vending machine with touchscreen, multi-brand selection, LED lighting, and enhanced security. With 75% lower energy consumption, it serves bars, hotels, and restaurants, strengthening Azkoyen’s market position.

Sanden Holdings Corporation, headquartered in Japan, is a prominent manufacturer of vending systems known for innovation, efficiency, and eco-friendly technology. The company is one of the outstanding players in the Cigarette Vending Machine market who ensures all-round performance, energy efficient and low operating costs. With the integration of digital payment solutions, data driven maintenance and eco-friendly materials, Sanden reinforces this leading position in technology. The company’s heavy emphasis on R&D and strategic partnerships lead toward incessant innovations, making it a top player in the immensely competitive market.

-

In January 2025, Sanden Holdings Corporation launched upgraded smart vending machines with IoT analytics, digital payments, and eco-mode savings. Designed for high-traffic venues, they enhance convenience, reduce energy use, and reinforce Sanden’s leadership in innovative vending solutions.

Cigarette Vending Machine Market Key Players:

Some of the Cigarette Vending Machine Market Companies are:

-

Fuji Electric Co., Ltd.

-

Azkoyen Group

-

Sanden Holdings Corporation

-

N&W Global Vending S.p.A.

-

Sielaff GmbH & Co. KG

-

Royal Vendors, Inc.

-

Crane Merchandising Systems (Crane Co.)

-

Jofemar Corporation

-

Bianchi Vending Group S.p.A.

-

Selecta Group

-

Fastcorp Vending LLC

-

Westomatic Vending Services Ltd.

-

FAS International S.p.A.

-

HARTING System

-

Hangzhou Joegoo Technology Co., Ltd.

-

Slim Line Designs

-

Digital Media Vending International LLC

-

E Team International (Adimac SRL)

-

GM Global Solutions

-

Advanced Cigarette Vending Machine

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.62 Billion |

| Market Size by 2033 | USD 2.30 Billion |

| CAGR | CAGR of 4.50% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Manual, Semi-Automatic, Fully Automatic) • By Product (Single Selection, Multi-Selection) • By Payment Mode (Cash, Cashless, Smart Card, Mobile Payment) • By Installation Site (Bars & Pubs, Nightclubs, Hotels, Restaurants, Airports, Shopping Malls, Others) • By Distribution Channel (Direct Sales, Indirect Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Fuji Electric Co., Ltd., Azkoyen Group, Sanden Holdings Corporation, N&W Global Vending S.p.A., Sielaff GmbH & Co. KG, Royal Vendors, Inc., Crane Merchandising Systems (Crane Co.), Jofemar Corporation, Bianchi Vending Group S.p.A., Selecta Group, Fastcorp Vending LLC, Westomatic Vending Services Ltd., FAS International S.p.A., HARTING System, Hangzhou Joegoo Technology Co., Ltd., Slim Line Designs, Digital Media Vending International LLC, E Team International (Adimac SRL), GM Global Solutions, Advanced Cigarette Vending Machine |