Electric Truck Market Report Scope & Overview

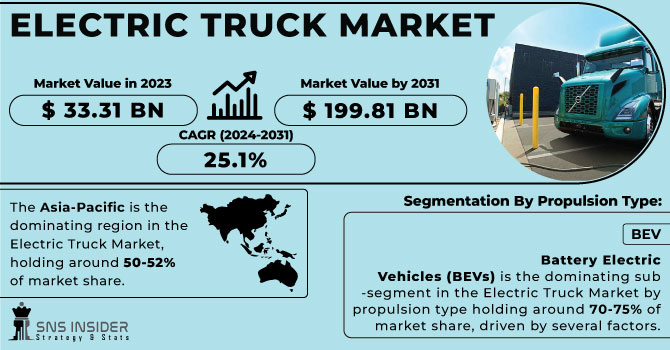

The Electric Truck Market Size was valued at USD 33.31 billion in 2023 and is expected to reach USD 199.81 billion by 2031 and grow at a CAGR of 25.1% over the forecast period 2024-2031.

The increasing environmental regulations aimed at reducing greenhouse gas emissions are pushing companies and governments to adopt cleaner transportation solutions. The European Union has set a target to reduce CO2 emissions from new trucks by 30% by 2030.

Get More Information on Electric Truck Market - Request Sample Report

This incentivizes companies to develop and sell electric trucks to comply with regulations. Electric trucks produce zero tailpipe emissions, making them a more sustainable option compared to traditional diesel models. Battery packs are becoming more powerful and affordable, allowing electric trucks to travel greater distances on a single charge. For instance, Tesla's Semi truck boasts a range of over 500 miles, making it a viable option for long-haul deliveries. Thus, the charging infrastructure is expanding rapidly, addressing concerns about fear of running out of power before reaching a charging station.

Many countries offer subsidies and tax breaks for purchasing electric vehicles, including trucks. These makes electric trucks more cost-competitive with their diesel counterparts, accelerating their adoption. Thus, the upfront cost of electric trucks is still higher than diesel trucks, though the gap is narrowing. The charging times can be longer than refuelling with diesel, which can be a drawback for some applications.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advancements in battery technology are offering electric trucks greater range on a single charge, reducing range anxiety.

Researchers are constantly innovating, developing batteries with higher energy density. This essentially means they can pack more power into the same sized battery pack. Electric trucks can now travel significantly further on a single charge. Thus, some manufacturers are boasting ranges exceeding 500 miles (800 km), which puts them in line with traditional diesel trucks for many typical delivery routes. This substantial increase in range directly addresses range anxiety, making electric trucks a more practical and attractive option for fleet operators and businesses. Battery technology is also evolving to enable faster charging times, which can further improve operational efficiency and reduce downtime for electric trucks. Thus, battery advancements are playing a critical role in paving the way for wider adoption of electric trucks and a cleaner transportation future.

-

Growing demand for electric trucks in logistics and other industries is creating a larger market for these vehicles.

-

Stricter government regulations on emissions are forcing manufacturers to develop cleaner electric trucks.

RESTRAINTS:

-

The relatively new technology of electric trucks raises concerns about long-term battery life and potential maintenance costs.

-

Limited charging infrastructure, especially for long-distance routes, makes electric trucks impractical for some applications.

Trucks may not be able to travel far enough on a single charge to reach the next available station, forcing them to take detours or wait for charging, both of which disrupt schedules and impact productivity. Thus, finding charging stations specifically designed for electric trucks, particularly along less populated stretches of highway, can be a challenge. This limited infrastructure creates a range anxiety loop. While advancements are being made to expand charging networks, the current state can make electric trucks impractical for certain applications, especially long-distance routes that rely on efficient travel times. Even when stations are available, charging times for electric trucks are typically much longer compared to refuelling a diesel truck. This can lead to extended downtime and disrupt delivery schedules.

OPPORTUNITIES:

-

Increasing consumer demand for sustainable products and services creates a market advantage for companies utilizing electric trucks.

-

Technological advancements in autonomous driving have the potential to optimize electric truck routes and improve efficiency.

CHALLENGES:

-

Uncertainties surrounding long-term battery life and potential maintenance costs for electric trucks raise concerns for some businesses.

KEY MARKET SEGMENTS:

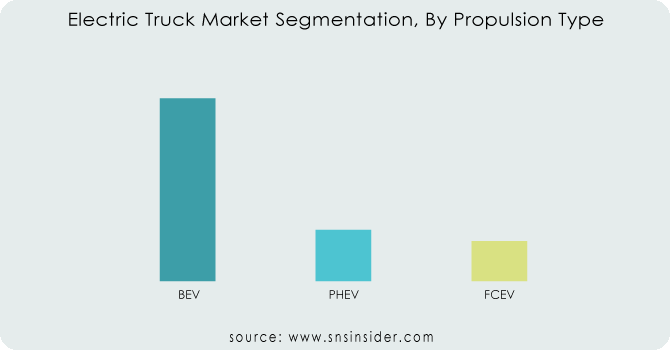

By Propulsion Type

-

BEV

-

PHEV

-

FCEV

Battery Electric Vehicles (BEVs) is the dominating sub-segment in the Electric Truck Market by propulsion type holding around 70-75% of market share, driven by several factors. The BEV technology is the most mature compared to PHEVs and FCEVs. This translates to a wider range of BEV truck models readily available from various manufacturers. Secondly, BEVs offer greater efficiency as they solely rely on electricity, leading to lower operating costs for companies compared to traditional diesel trucks. Additionally, advancements in battery technology are steadily increasing the range of BEVs, addressing a major concern for potential buyers. Finally, government regulations and incentives often focus heavily on promoting zero-emission vehicles, further propelling BEV adoption.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Type

-

Light-duty Trucks

-

Medium-duty Trucks

-

Heavy-duty Trucks

Medium-duty Trucks is the dominating sub-segment in the Electric Truck Market by vehicle type holding around 50-55% of market share. This can be attributed to several factors. Firstly, medium-duty trucks are typically used for regional and short-haul deliveries, perfectly aligning with the current range capabilities of most electric trucks. Secondly, these trucks operate on predictable routes, making it easier for companies to establish dedicated charging infrastructure at depots or hubs. Additionally, the total cost of ownership (TCO) for electric medium-duty trucks becomes more favourable compared to heavier classes due to factors like lower battery pack size and weight. Finally, government regulations and subsidies often target medium-duty trucks as a stepping stone for wider electric truck adoption.

By End User

-

Last Mile Delivery

-

Long Haul Transportation

-

Refuse Services

-

Field Services

-

Distribution services

Last-Mile Delivery is the dominating sub-segment in the Electric Truck Market by end-user. This dominance is primarily driven by the suitability of electric trucks for urban environments. With shorter routes and readily available charging opportunities at depots or hubs, range anxiety becomes less of a concern for last-mile delivery operations. Additionally, the focus on sustainability and environmental regulations in urban areas incentivizes companies to adopt cleaner electric vehicles. Furthermore, the stop-and-go nature of last-mile delivery can benefit from electric trucks' regenerative braking capabilities, potentially leading to increased energy efficiency and lower operating costs. Finally, the availability of government grants and subsidies specifically targeting last-mile delivery electrification further fuels segment growth.

By Range

-

Up to 200 Miles

-

Above 200 Miles

Above 200 Miles is the dominating sub-segment in the Electric Truck Market by range due to the wider availability of such trucks, the market is shifting towards vehicles with a range exceeding 200 miles. This is due to the increasing focus on overcoming range anxiety, particularly for applications beyond last-mile delivery. As battery technology advances and offers greater range capabilities, we can expect the "Above 200 Miles" segment to become increasingly dominant. This will unlock the potential for electric trucks in long-haul transportation and other applications that require extended travel distances. The development of faster charging infrastructure will further support the growth of this segment, paving the way for a more versatile and practical electric truck market.

By Battery Capacity

-

< 50 kWh

-

50-250 kWh

-

Above 250 kWh

By GVWR

-

Up to 10,000 lbs

-

10,001-26,000 lbs

-

Above 26,001 lbs

By Level of Automation

-

Semi-autonomous Trucks

-

Autonomous Trucks

By Battery Type

-

Lithium-nickel-manganese-cobalt Oxide

-

Lithium-iron-phosphate

-

Others

REGIONAL ANALYSES

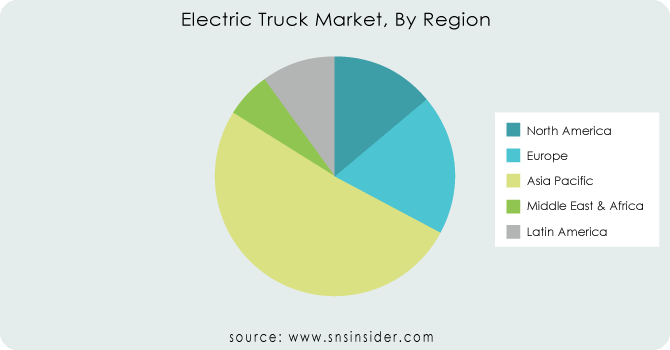

The Asia-Pacific is the dominating region in the Electric Truck Market, holding around 50-52% of market share. This dominance stems from government support in China and other countries, offering subsidies and infrastructure development to boost electric vehicle adoption. The rapid industrialization and urbanization in the region create a surging demand for cleaner transportation solutions, particularly in densely populated areas.

Europe is the second highest region in this market, driven by stringent emission regulations that push manufacturers towards cleaner technologies like electric trucks. A strong focus on sustainability further fuels European adoption, with many countries setting ambitious environmental goals. The existing network of charging infrastructure, particularly for passenger EVs, can be leveraged for electric trucks, easing concerns about range and practicality.

North America is the fastest-growing region due to rising environmental awareness and significant investments in building charging infrastructure. Technological advancements by major North American manufacturers like Tesla and Ford are also propelling the region's rapid growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are AB Volvo; BYD Auto Co. Ltd; Daimler AG; Foton Motor Inc.; Dongfeng Motor Corporation; FAW Group Co., Ltd.; Isuzu Motors Ltd; Navistar International Corp. (U.S.), Paccar Inc. (U.S.), Scania; Tevva Motors Limited, Tesla Inc (U.S.), Daimler AG (Germany), Tata Motors (India), Scania AB (Sweden), Workhorse (U.S.), Hino Motors Ltd. (Japan) and other key players.

Daimler AG-Company Financial Analysis

RECENT DEVELOPMENT

-

In May 2023 - Freightliner is launching two electric trucks: the eM2 for deliveries, available to order now with production starting this fall, and an innovative eM2 for vocational use. This second truck will gather real-world data from customer experiences.

-

In April 2023 - Daimler Truck launched Rizon, a new electric truck brand targeting the U.S. market. Rizon will focus on Class 4 and 5 medium-duty trucks equipped with lithium iron phosphate batteries. Production begins in Q3 2023 with distribution handled exclusively by Velocity Vehicle Group. The trucks will boast a range of 75 to 160 miles, catering to various delivery needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.31 Billion |

| Market Size by 2031 | US$ 199.81 Billion |

| CAGR | CAGR of 25.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Propulsion (Battery-Electric Truck, Hybrid Electric Truck, Plug-in Hybrid Electric Truck, Fuel Cell Electric Truck) • by Range (0-150 Miles, 151-300 Miles, above 300 Miles) • by Vehicle Type (Light-duty Truck, Medium-duty Truck, Heavy-duty Truck) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AB Volvo; BYD Auto Co. Ltd; Daimler AG; Foton Motor Inc.; Dongfeng Motor Corporation; FAW Group Co., Ltd.; Isuzu Motors Ltd; Navistar, Inc.; PACCAR Inc.; Scania; Tevva Motors Limited |

| Key Drivers | • The substitution of electric vehicles with diesel-powered commercial vehicles. • Electric truck use is expected to rise as a result of government efforts to encourage their use. |

| RESTRAINTS | • The electric truck market is hindered by a lack of charging infrastructure. • These vehicles make use of more expensive materials and more sophisticated manufacturing techniques. |