Automotive Ultrasonic Sensors Market Report Scope & Overview:

Get More Information on Automotive Radiator Fan Market - Request Sample Report

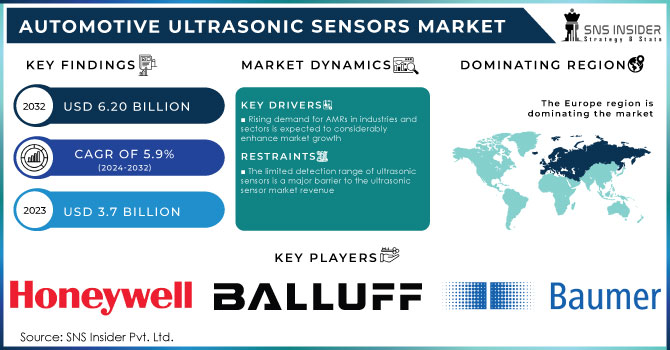

The Automotive Ultrasonic Sensors Market Size was valued at USD 3.7 billion in 2023 and is expected to reach USD 6.20 billion by 2032 and grow at a CAGR of 5.9% over the forecast period 2024-2032.

An ultrasonic sensor uses ultrasonic sound waves to determine the distance between a target object and a transducer to send and receive ultrasonic pulses and monitor time lapses between transmission and reception. The growing use of ultrasonic sensors for item detection, distance measurement, and pallet detection, among other things, across numerous industries and sectors is propelling the market forward. Furthermore, because these sensors may be used to address a wide range of needs in the food and beverage industry, their popularity has skyrocketed in recent years.

Ultrasonic sensors produce shorter wavelengths than electromagnetic sensors because they use higher frequencies. This translates to improved picture processing resolution. As a result, these technologies are becoming more widely used in medical applications like radiography. These technologies are also utilized in autonomous mobile robots (AMRs) to detect obstacles and determine the distance between the vehicle and the nearest one. Ultrasonic sensors detect the distance to a nearby obstacle and assist in avoiding a collision.

The market for automotive ultrasonic sensors is gaining momentum, based on the increasing adoption of advanced driver assistance systems and the trend for autonomous vehicles. Demand for these sensors is expected to grow at a healthy 6% annual growth rate, primarily as a result of tough government regulations calling for safety features such as blind spot detection and parking assistance. Along with this, increasing electric vehicle adoption and requirements for accurate battery monitoring systems are adding to the growth of the ultrasonic sensors market. In addition to that, advancements in sensor technology in the form of development of smaller, more energy-efficient, and wider-angle sensors are broadening their application areas in the automotive sector, thereby positively impacting its growth trajectory.

Siemens will deploy ACUSON Sequoia in Sept 2020. It aids in the resolution of ultrasonic imaging industrial difficulties. The use of a Deep Abdominal Transducer, provides new updates on contrast-enhanced ultrasonography (DAX). It has a 40cm penetration range. It allows for higher-resolution photography at deeper depths while maintaining real-time performance.

Automotive Ultrasonic Sensors Market Dynamics:

KEY DRIVERS:

-

Rising demand for AMRs in industries and sectors is expected to considerably enhance market growth

-

Ultrasonic sensors are increasingly being used in a variety of sectors, which is propelling the market forward

-

The use of ultrasonic sensors grows in the food and beverage industry

The implementation of ultrasonic sensors has increased rapidly and is particularly adopted in the food and beverage industries; its applications can be seen from ingredient handling and processing up to quality control and packaging. These sensors use high-frequency sound waves to know the measurement of distance, level, or flow rates, with a wide range of advantages compared to traditional methods. Ultrasonic sensors have commonly been used in filling lines because of their capability of accurately measuring and dispensing liquids, ensuring constant product volumes and minimizing waste while making the process more efficient. More importantly, these sensors play a very important role in reporting inventories of raw materials and stock that can be used as products, which facilitates just-in-time production and proper supply chain management.

For their part, ultrasonic sensors are also incorporated into quality control systems to detect defects in food products, such as cracks, or the presence of any object that can affect consumer safety and brand reputation. They also contribute significantly to energy efficiency by optimizing processes such as pasteurization and sterilization, hence leading to cost benefits and reducing adverse effects on the environment.

RESTRAINTS:

-

The market's expansion could be hampered by a limited detecting range

-

The limited detection range of ultrasonic sensors is a major barrier to the ultrasonic sensor market revenue

-

The market's expansion is limited by the availability of replacement sensors

OPPORTUNITIES:

-

The business is predicted to benefit from increased demand from the healthcare sector for a variety of applications

-

Surveillance drones are becoming more popular

-

The market is likely to benefit from a rise in the use of ultrasonic sensors in smart applications

CHALLENGES:

-

Limitations in detecting range could stifle industry expansion

-

Ultrasonic sensors may be physically too deep for installation in the bumper due to the existence of the crash protection bar

The chief restraint to the growth of the market for automotive ultrasonic sensors is the lower range. This includes an average range of 10 meters. At such distances, particularly under the highway driving environment or parking within vast spaces, severe limitations occur in the sensor's abilities to detect and avoid other objects. Therefore, the market grows in only 25% of the vehicles that have ultrasonic sensors mounted. This implies that for the elimination of this threat and improved market penetration, there is a call for investment research and development to enhance the detection range by at least 50%. This technological milestone will enable ultrasonic sensors to work effectively under diverse driving conditions, thereby increasing consumer confidence and driving adoption in the market.

Automotive Ultrasonic Sensors Market Segmentation:

By Type:

Based on the type segment, the global market has been divided into Level Measurement, Distance Measurement, Obstacle Detection, and Others. Due to the rising use of these systems in car accident-avoidance systems, the obstacle detection sector accounted for over 10% of the market share in 2020. Because of the growing need for level sensors for continuous level monitoring, the level measurement segment is expected to grow at a promising CAGR.

By Technology:

The global market has been divided into Retro-reflective Sensor, Through-beam Sensor, and Others based on the technology segment. In 2020, the retro-reflective sector accounted for 40% of the market. This is due to the benefits afforded by these sensors to identify transparent objects with high accuracy. Retro-reflective sensors are very easy to use because they have a simple optical axis adjustment and wiring.

By End-User:

Based on the end-user segment, the global market has been divided into Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, and Others. The automobile category will hold a 15% share of the market. Ultrasonic sensors are frequently employed in applications in the automotive industry. Because of the increased need for ultrasonography and ultrasonic scanning, the healthcare segment is expected to grow at the fastest rate over the forecast period.

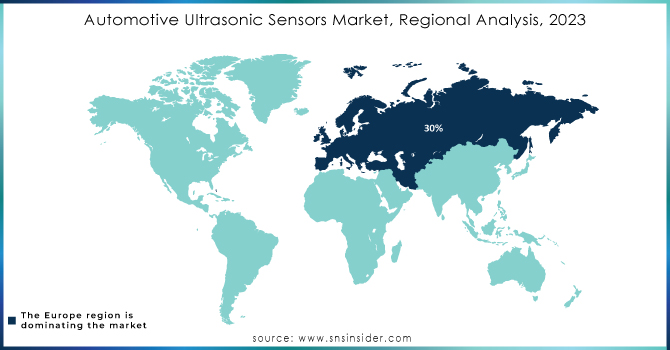

Automotive Ultrasonic Sensors Market Regional Analysis:

Europe dominated the market with a 30% market share in 2023. Ultrasonic sensors help surgeons work with pinpoint accuracy in minimally invasive surgery. Countries like Germany and France, which are home to the world's largest video gaming networks, have seen a sharp surge in the usage of these systems in augmented reality and virtual reality devices in the region. Ultrasonic sensors are used to measure the distance to an item in augmented reality and virtual reality headsets for gaming consoles. Because of the increasing need for factory automation in the region's manufacturing sector, the Asia Pacific region is expected to grow at a promising CAGR over the projection period. The region's rapidly expanding car manufacturing industry is expected to drive demand for these systems even higher.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS:

Some of the major Automotive Ultrasonic Sensors Market players are as follows:

-

Balluff GmbH: (BSU Series, BU Series)

-

Baumer Group: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Hans Turck GmbH & Co. KG (Turck): (Ultrasonic Proximity Sensors, Ultrasonic Sensors for Harsh Environments)

-

Banner Engineering Corp.: (QS Series Ultrasonic Sensors, QS Series Ultrasonic Sensors for Harsh Environments)

-

Honeywell International Inc.: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

OMRON Corporation: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Pepperl+Fuchs SE: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Murata Manufacturing Co., Ltd: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

IIFM Electronics: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Rockwell Automation, Inc.: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Siemens: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

-

Sick AG: (Ultrasonic Sensors, Ultrasonic Sensors for Harsh Environments)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.7 Billion |

| Market Size by 2032 | US$ 6.20 Billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Level Measurement, Distance Measurement, Obstacle Detection, Others) • by Technology (Retro-reflective Sensor, Through-beam Sensor, Others) • by End-user (Consumer Electronics, Automotive, Aerospace & Defense, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Balluff GmbH, Baumer Group, Hans Turck GmbH & Co. KG (Turck), Banner Engineering Corp., Honeywell International Inc., OMRON Corporation, Pepperl+Fuchs SE, Murata Manufacturing Co., Ltd, IIFM Electronics, Rockwell Automation, Inc., Siemens and Sick AG |

| Key Drivers | • Rising demand for AMRs in industries and sectors is expected to considerably enhance market growth. • Ultrasonic sensors are increasingly being used in a variety of sectors, which is propelling the market forward. |

| RESTRAINTS | • The market's expansion could be hampered by a limited detecting range. • The limited detection range of ultrasonic sensors is a major barrier to the ultrasonic sensor market revenue. |