Electric Mobility Market Report Scope & Overview:

Get More Information on Electric Mobility Market - Request Sample Report

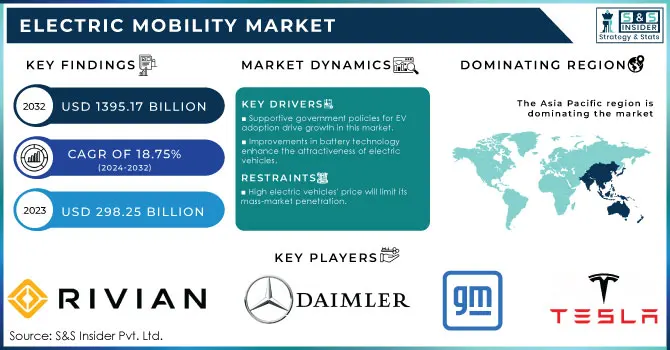

The Electric Mobility Market Size was valued at USD 298.25 Billion in 2023 and is expected to reach USD 1395.17 Billion by 2032 and grow at a CAGR of 18.75% over the forecast period 2024-2032.

The electric mobility market has been growing rapidly due to increasing demand for ecologically friendly transport, new government policies, and technological advancements. In the U.S., China, the UK, France, and Japan, governments are imposing drastic measures aimed at reducing carbon emissions. The United States has provided incentives, such as tax credits, to the buyers of EVs, but China is investing in a massive amount of electric vehicle infrastructure to become the world's biggest electric vehicle market.

The target of ending all gasoline and diesel vehicles by 2030 for the UK and France has been set by Europe. The shift towards sustainability has encouraged investment in electric mobility across the globe, while companies have focused on raising innovation. In terms of unit sales, Electric Vehicles had the sales of 3.5 million units higher compared to 2022, a year-on-year increase of 35% according to GEVO-2023. In 2023, over 250 000 new cars were registered every week, which exceeds the annual totals for 2013, ten years ago. Electric cars now make up around 18% of all the cars sold, up from 14% in 2022 and only 2% five years ago, in 2018

Above all, the rapid growth of electric mobility has been driven in recent times by developments in battery technology. Batteries have mainly been supplied by lithium-ion (Li-ion) technologies because they offer a very high energy density, substantial lifespan, and efficiency. Even newer technologies, such as solid-state batteries, promise yet greater range and performance for electric vehicles, thus opening up more opportunities for market growth. According to the International Energy Association, costs of electric vehicles declined, since the cost of lithium-ion batteries-the component making up approximately 40-60% of EV expense-fell by 90% from USD 1,400 per kilowatt hour in 2010 to USD 140 per kilowatt hour in 2023.

Electric Mobility Market Dynamics

Key Drivers:

-

Supportive government policies for EV adoption drive growth in this market.

Government Incentives, Subsidies, and Regulations Take Center Stage in Promotion of Electric Mobility. For example, in the U.S., the federal government has introduced tax credits of up to USD 7,500 for electric vehicle purchasers. The federal government is also looking forward to the fact that by doing so, it will enable consumers to pay less in the upfront cost of EVs. The Inflation Reduction Act pays more attention to the enhancement of the infrastructure of EV charging. That will in turn encourage more adoption of EVs. Similarly, in China, it offers subsidies to consumers and manufacturers and compels the manufacturers to produce under certain quotas. These policies also spur the development of a full recharging infrastructure needed to realize mass adoption of electric mobility. In past years, the supportive measures for electrical vehicles have gained momentum as the government began to tighten up emission standards globally to bring upward pressure on the demand for electric vehicles in the electric mobility market.

-

Improvements in battery technology enhance the attractiveness of electric vehicles.

Battery technology forms the heart of an electric mobility market. Innovations in the past few decades have pushed the ranges and performance of vehicles a little further every quarter-century. The current industry standard, of course, is the Lithium-ion (Li-ion) battery, with its higher energy density, longer life span, and faster recharging times that make these batteries answer most of the questions hitherto subjecting their consumers to high anxiety issues, such as "range anxiety" and charging time.

With these objectives in mind, companies are also developing next-generation solid-state batteries to offer even more energy density and charging times while further improving safety. For example, in September 2024, Panasonic said it is ready to begin mass production of its much-anticipated 4680 lithium-ion battery cells, designed specifically to boost the range, power, charging, and efficiency within electric cars but reduce their cost. Standard EV packs are generally built around 2170 cells – 21mm diameter by 70mm length (0.83 x 2.8 inches). The 4680 cells, as their name would suggest, are much bigger and a little longer at 46 x 80 mm (1.8 x 3.1 inches).

Alongside making electric vehicles better, the developments in technology will also reduce the cost of such vehicles overall, making them more affordable to large populations. Electric cars will be pushed faster into markets worldwide with advancements in battery technology.

Restraints

-

High electric vehicles' price will limit its mass-market penetration.

Though costs have plummeted, many hold the high initial cost of electric vehicles to be the single biggest impediment to their inclusion in the mainstream, especially for emerging markets. Electric vehicle manufacturing costs are significantly higher compared to a traditional ICE vehicle due to expensive components, mainly batteries. The lions' share of contribution comes from the lithium-ion batteries that actually power most electric vehicles. On the whole, the batteries make the EVs costlier than the gasoline or diesel counterparts.

Government incentives and subsidies are used to reduce the associated costs, though it often remains pretty inadequate for mass consumer adoption in that market, especially in developing regions. Furthermore, while the operating costs for electric vehicles are commonly lower than for conventional vehicles in maintenance and fuel use, the consumers of the time perceive the base price as a huge hurdle to adoption. Indeed, without significant advancement in the depreciation of battery cost or more effective financial incentives, the sticker shock of electric vehicles might slow up the pace into the mass market, more so in locations where consumers are relatively more price-sensitive.

Electric Mobility Market Segmentation Overview

By Battery

The electric mobility market has three major battery types, namely, Sealed Lead Acid, Nickel-Metal Hydride (NiMH), and Lithium-ion (Li-ion).

In the year 2023, Li-ion batteries had dominated the entire market with a whopping 74.91%. The Li-ion battery is strong in terms of high energy density, lightweight, and life cycle, thus making it appropriate for use in electric vehicles. Li-ion technology has also made tremendous mileage in the last few years with faster charge times and longer ranges, both of which are essential for consumers when it comes to adoption.

While the nickel-metal hydride (NiMH) battery segment is supposed to experience the most rapid growth, a CAGR of 20.58% during the period between 2024 and 2032 is envisioned. The demand for NiMH batteries is high for the features of safety and longer life cycles as against lead-acid batteries and hence are suitable for limited commercial applications. With manufacturers scouring for cost-effective battery alternatives, the growth of the NiMH segment is also likely to be extremely fast in electric vehicle markets growing in various regions.

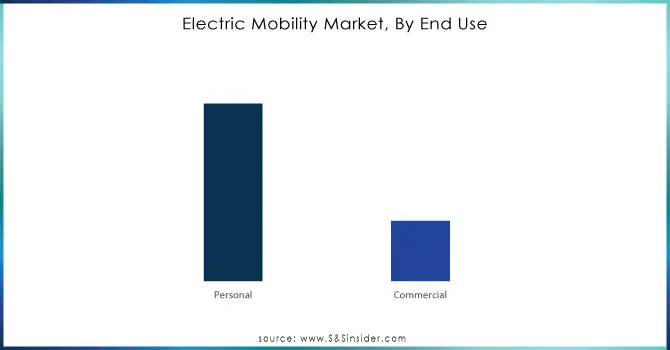

By End User

The electric mobility market can also be segmented based on end use, personal use and commercial use. Among them in 2023 the Personal Use held the largest share at 74.69%. That is mainly because of the spurt in electric cars, e-bikes, and electric scooters that are being adopted in sustainable transport. With a galloping pace of urbanization and climate change awareness among citizens, the demand for this segment is also on the rise as consumers are getting keen to reduce their carbon footprint.

Commercial Use is projected to be the most significant growing market, with a CAGR of 19.38% during 2024 to 2032. The use of the electric buses, delivery vans, and other fleet electric vehicles will come under this category. Saving operational costs for logistics companies and future sceneries of public transportation abiding by the environmental regulations will boost up the usage of commercial electric vehicles. The growth in the electric mobility market is likely to be driving the commercial use of electric vehicles as companies focus on sustainability and the governments provide incentives to electrify the fleet.

Need Any Customization Research On Electric Mobility Market - Inquiry Now

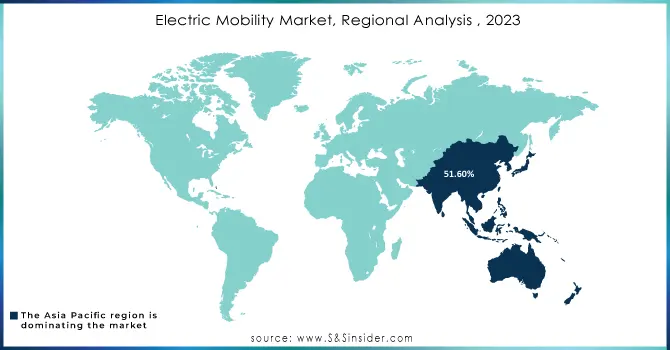

Electric Mobility Market Regional Analysis

Asia Pacific contributing 51.60% of the market share in the year 2023 in Electric Mobility Market. This dominance is primarily led by China, the world's largest electric vehicle market, supported through various government subsidies, extensive charging infrastructure, and a growing consumer base. For instance, In China, new electric vehicle registrations for the year 2023 were at 8.1 million while it registered an increase of 35% from the year 2022. In terms of sales units, it is projected that the sold China Electric Vehicle market will reach a certain milestone by the year 2032.

The countries like Japan and South Korea also add a significant contribution toward the region's strength through advanced technological innovations in the electric vehicle and battery technologies. Further, the unprecedented rate of urbanization in Asia Pacific has gone hand in hand to complement and support the cause for sustainable transport, hence propelling the electric mobility market growth in this region.

Europe, on the other hand, is going to show the most aggressive growth from 2024 to 2032 with a CAGR of 20.74%. The UK, France, and Germany are becoming pretty aggressive in reducing carbon emissions. In fact, new policies by governments in these countries are planning to phase out internal combustion engine vehicles by 2030 itself, and the region has been investing comprehensively in EV charging infra and renewable energy sources that are set to help this rapid growth. For instance, ENGIE Vianeo strives for excellence in the national charging station network in order to have seamless travel with electric vehicles throughout France. In new electric mobility, they require a reliable partner for the charging infrastructure. Public charging stations are situated all over the highways in France. As such, ENGIE Vianeo is now able to provide sustainable mobility on a national level.

Key Players in Electric Mobility Market

Some of the major players in the Electric Mobility Market are

-

Tesla Inc. (Electric Cars, Battery Storage)

-

BYD Company (Electric Buses, Electric Cars)

-

NIO Inc. (Electric SUVs, Battery Swapping Services)

-

General Motors (Electric Vehicles, Charging Infrastructure)

-

Volkswagen Group (Electric Cars, Charging Solutions)

-

BMW Group (Electric Cars, Charging Stations)

-

Daimler AG (Electric Trucks, Electric Buses)

-

Rivian Automotive (Electric Trucks, Adventure Vehicles)

-

Ford Motor Company (Electric SUVs, Electric Pickup Trucks)

-

Lucid Motors (Luxury Electric Cars, Battery Technology)

-

Hyundai Motor Group (Electric Cars, Hydrogen Fuel Cell Vehicles)

-

XPeng Motors (Electric Sedans, Autonomous Driving Technology)

-

Volvo Cars (Electric SUVs, Electric Commercial Vehicles)

-

Renault Group (Electric Cars, EV Charging Solutions)

-

Geely Auto Group (Electric Cars, Battery Technology)

-

Polestar (Electric Performance Cars, EV Charging Infrastructure)

-

Proterra (Electric Buses, Battery Systems)

-

Kia Corporation (Electric Cars, EV Charging Solutions)

-

Fisker Inc. (Electric SUVs, EV Battery Technology)

-

Workhorse Group (Electric Delivery Vans, Drones for Package Delivery)

Recent Trends

-

August 2024: Mahindra & Mahindra (M&M) and Skoda Auto Volkswagen India (SAVWIPL), a unit of the Volkswagen Group, are in the final stages of establishing a 50:50 joint venture that will help split costs, technology, and vehicle platforms on which new products are developed going ahead.

-

May 2024: The Volkswagen Group's Board of Management has resolved to make entry-level mobility more widespread through all-electric models. Brand Group Core will introduce affordable electric vehicles from Europe, for Europe. The world premiere is scheduled for 2027. Volkswagen has already been working on compact cars-particularly very affordable ones-in the under 20,000 euros range for a long time.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 298.25 Billion |

| Market Size by 2032 | US$ 1395.17 Billion |

| CAGR | CAGR of 18.75% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Electric Car, Electric Motorcycle, Electric Scooter, Electric Bicycle, Electric Skateboard, Electric Wheelchair) • By Voltage (Less than 24V, 24V, 36V, 48V, and Greater than 48V) • By Battery (Sealed Lead Acid, NiMH, and Li-ion) • By End Use (Personal Use, Commercial Use) • By Drive (Belt Drive, Belt Drive, Hub Drive) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tesla Inc., BYD Company, NIO Inc., General Motors, Volkswagen Group, BMW Group, Daimler AG, Rivian Automotive, Ford Motor Company, Lucid Motors, Hyundai Motor Group, XPeng Motors, Volvo Cars, Renault Group, Geely Auto Group, Polestar, Proterra, Kia Corporation, Fisker Inc., Workhorse Group. |

| Key Drivers | • Supportive government policies for EV adoption drive growth in this market. • Improvements in battery technology enhance the attractiveness of electric vehicles. |

| Restraints | • High electric vehicles' price will limit its mass-market penetration. |