Automotive Electronics Sensor Aftermarket Market Report Scope & Overview:

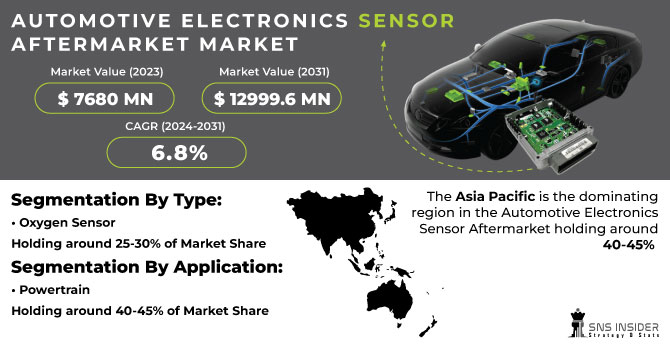

The Automotive Electronics Sensor Aftermarket Market size was valued at USD 7680 million in 2023 and is expected to reach USD 12999.6 million by 2031 and grow at a CAGR of 6.8% over the forecast period 2024-2031.

The growing complexity of cars, packed with electronics and sensors, is creating a thriving aftermarket for replacement and upgrade sensors. These sensors monitor everything from engine performance to safety systems. As cars age, sensors wear out, and drivers seek reliable replacements compatible with their vehicles. This aftermarket caters to that need. The advancements in cars, like self-driving features and electric cars, require new types of sensors. Aftermarket suppliers are racing to keep pace, developing innovative sensors to work with these evolving technologies. Aftermarket sensors can offer more precise data or faster response times compared to the original parts. This is especially attractive for racing enthusiasts who crave optimal engine function. The stricter environmental regulations are pushing demand for sensors that help cars meet emission standards. Aftermarket options can help drivers maintain compliance and keep their cars running cleanly.

Get More Information on Automotive Electronics Sensor Aftermarket Market - Request Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Aging Vehicles Drive Demand for Replacement Sensors in Automotive Electronics Aftermarket

Worn-out sensors are a major reason the aftermarket for car sensors is growing. With more vehicles on the road for longer, the electronic sensors that control everything from engines to airbags inevitably wear out. This creates a demand for replacements that keep cars running smoothly and safely. Aftermarket sensors offer a cost-effective way for drivers to get their vehicles back to top performance.

-

Advanced driver tech drives aftermarket demand for upgraded car sensors

RESTRAINTS:

-

The requirement for skilled technicians for proper installation and programming of aftermarket sensors.

-

The presence of low-quality, counterfeit sensors compromising performance and safety.

OPPORTUNITIES:

-

Growing demand for repair and replacement as vehicles age.

-

Rising interest in customization and performance upgrades.

CHALLENGES:

-

Fast-changing car tech makes it tough for aftermarket suppliers to keep up with the latest sensors.

The rapid development of car technology, particularly in sensor design, presents a hurdle for aftermarket parts suppliers. As car manufacturers (OEMs) equip vehicles with new and advanced sensors, aftermarket suppliers must continuously invest in research and development to create compatible replacements. The key difficulty lies in ensuring that aftermarket solutions can keep up with the fast-paced advancements in sensor technology implemented by OEMs.

-

Counterfeit sensors threaten aftermarket with safety and performance risks

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the automotive electronics sensor aftermarket. The Ukraine played a key role in manufacturing crucial components for sensor systems, particularly wiring harnesses essential for various electronic functions in cars. The disruption caused by the war has exacerbated existing supply chain issues, leading to a shortage of these components. This shortage is expected to cause production slowdowns at major car manufacturers, impacting the overall demand for new sensors. Additionally, rising raw material prices due to the war are likely to inflate the cost of aftermarket sensors. While a precise estimate is difficult due to the ongoing nature of the conflict as there’s a potential decline in aftermarket sensor sales by around 5-10%. This could be further amplified if the war disrupts critical logistics routes or widens the chip shortage.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the automotive industry, negatively impacting the aftermarket for electronic sensors. Consumers facing financial strain prioritize essential repairs over routine maintenance, leading to a decline in non-critical sensor replacements. This directly affects aftermarket sales. Thus, a sluggish economy often translates to fewer new car sales. This has a secondary impact on the aftermarket, as fewer new vehicles on the road translates to a smaller pool of cars requiring sensors in the future. To make matters worse, drivers might postpone non-urgent repairs like sensor replacements to save money. While this might seem like a short-term saving, it can extend the lifespan of malfunctioning sensors, potentially leading to bigger problems and costlier repairs down the line. Industry estimates suggest a potential decline in sales by 5-10% during a moderate economic slowdown, putting pressure on aftermarket players to adapt their strategies and navigate these challenging times to maintain profitability.

KEY MARKET SEGMENTS:

By Type:

-

Oxygen Sensor

-

Lidar Sensor

-

Temperature Sensor

-

Position Sensor

-

Pressure Sensor

-

Speed Sensor

-

Others

Oxygen Sensors is the dominating sub-segment in the Automotive Electronics Sensor Aftermarket Market by type holding around 25-30% of market share. Oxygen sensors play a critical role in maintaining optimal engine performance and fuel efficiency. As a result of regular wear and tear, they are frequently replaced, making them a significant segment in the aftermarket.

By Application

-

Powertrain

-

Body Electronics

-

Safety & Control

-

Telematics

-

Others

Powertrain is the dominating sub-segment in the Automotive Electronics Sensor Aftermarket Market by application holding around 40-45% of market share. The powertrain segment encompasses sensors essential for engine operation and performance, such as oxygen sensors, temperature sensors, and pressure sensors. These sensors directly impact fuel efficiency, emissions control, and overall vehicle drivability, leading to a high demand for replacements in the aftermarket.

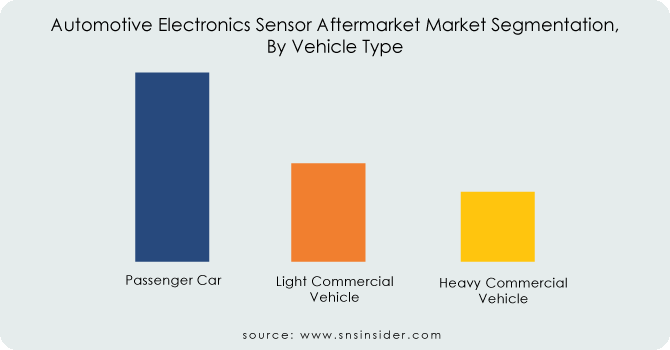

By Vehicle Type

-

Passenger Car

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

Passenger Cars is the dominating sub-segment in the Automotive Electronics Sensor Aftermarket Market by vehicle type holding around 60-65% of market share. The passenger car segment has the largest vehicle population globally compared to light and heavy commercial vehicles. This translates to a larger pool of vehicles requiring sensor replacements, making it the dominant segment in the aftermarket.

Get Customized Report as per your Business Requirement - Ask For Customized Report

REGIONAL ANALYSES

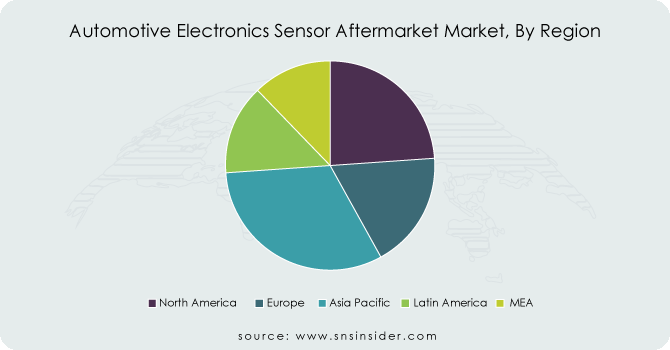

The Asia Pacific is the dominating region in the Automotive Electronics Sensor Aftermarket holding around 40-45% of market due to its growing car ownership. This surge translates to a massive need for replacements as these vehicles age. The government regulations pushing for vehicle safety and emission control further fuel the demand for sensors.

Europe is the second highest region in this market with its well-established auto industry and focus on road safety. Stringent regulations mandating features like electronic stability control and advanced driver-assistance systems create a high demand for sophisticated aftermarket sensors.

North America exhibits the fastest growth due to its large and mature aftermarket with a strong preference for performance upgrades and customization. The increasing adoption of electric vehicles in the region necessitates specialized sensors, creating significant opportunities for the aftermarket.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Denso Corporation (Japan), Standard Motor Products, Inc. (US), Delphi Technologies (UK), NGK Spark Plug CO., LTD (Japan), BorgWarner Inc. (US), Robert Bosch GmbH (Germany), Valeo (France), Continental AG (Germany), Hella GmbH & Co. KGaA (Germany) Dorman Products (US), Sensata Technologies Inc. (US) and other key players.

Denso Corporation (Japan)-Company Financial Analysis

RECENT DEVELOPMENT

-

In January 2024: Uno Minda offers new side stand sensors to prevent motorcycle riders from accidentally starting off with the stand down. These magnetic sensors disable the engine and include LED indicators to warn riders of an unsafe stand position.

-

In Dec. 2023: Delphi expands its aftermarket offerings with new nitrogen oxide (NOx) sensors. These sensors help monitor exhaust emissions, ensuring compliance with environmental regulations and contributing to cleaner air.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7680 Million |

| Market Size by 2031 | US$ 12999.6 Million |

| CAGR | CAGR of 6.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Oxygen Sensor, Lidar Sensor, Temperature Sensor, Position Sensor, Pressure Sensor, Speed Sensor, Others) • By Application (Powertrain, Body Electronics, Safety & Control, Telematics, Others) • By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Denso Corporation (Japan), Standard Motor Products, Inc. (US), Delphi Technologies (UK), NGK Spark Plug CO., LTD (Japan), BorgWarner Inc. (US), Robert Bosch GmbH (Germany), Valeo (France), Continental AG (Germany), Hella GmbH & Co. KGaA (Germany) Dorman Products (US), Sensata Technologies Inc. (US) |

| Key Drivers | • Aging Vehicles Drive Demand for Replacement Sensors in Automotive Electronics Aftermarket • Advanced driver tech drives aftermarket demand for upgraded car sensors |

| Restraints | • The requirement for skilled technicians for proper installation and programming of aftermarket sensors. • The presence of low-quality, counterfeit sensors compromising performance and safety. |