AUTOMOTIVE EMISSION TEST EQUIPMENT MARKET SIZE:

Get More Information on Automotive Emission Test Equipment Market - Request Sample Report

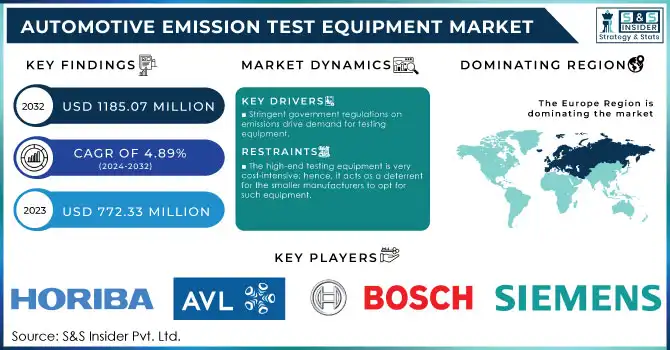

The Automotive Emission Test Equipment Market Size was valued at USD 772.33 Million in 2023 and is expected to reach USD 1185.07 Million by 2032 and grow at a CAGR of 4.89% over the forecast period 2024-2032.

Stringent environmental regulations and overall reduction of vehicular emissions worldwide are having an impact on the Automotive Emission Test Equipment Market. With the looming air pollution and climate change concerns, the developed nations governments are strictly enforcing strict emissions standards within their countries. These regulatory implementations require that vehicles undergo rigorous tests based on the stringent demands of the standards. As such, advanced emission test equipment will be in high demand as it is one of the critical pieces of equipment required to achieve such rigorous testing.

In the United States, the standards of vehicular emissions are stridently enforced by the Environmental Protection Agency. These standards, and the efforts made by states like California (which inducted standards from their very own California Air Resources Board, or CARB) to continue to demand more accurate and efficient emission testing devices across the country, feed into this ever-growing need.

The emission standards are getting tighter all over the world. For example, by the next decade, in Europe, the standards will be evolved as Euro 7, where the limits on pollutants like NOx and PM will be even stricter than today. Countries such as Germany, France, and the UK demand better compliance with Real Driving Emissions and the Worldwide Harmonized Light Vehicle Test Procedure, which requires more advanced testing. China has introduced some of the world's strictest vehicle emission regulations, under China VI standards, encouraging further new developments in testing equipment.

Technology has been the biggest influencer in dictating the automotive emission test equipment market. Portable Emissions Measurement Systems (PEMS) adoption revolutionized the emission testing and strengthened the capability of manufacturers and regulators to conduct on-road testing, in real time, whereas lab-based methods have traditionally been used, for actual accurate measurements. Coupled with a connectivity that depended on IoT-enabled devices interconnected on a cloud-based emission monitoring and analytics platform, it made tracking and analysing data even easier. Another important technology area is particulate matter sensors. Over the past few years, there have been significant improvements to detection efficiency for fine particulates and the technology is vital for tighter emission standards in regions such as Europe and China.

MARKET DYNAMICS

KEY DRIVERS:

-

Stringent government regulations on emissions drive demand for testing equipment.

Government rules and regulations, particularly in the developed region, are a great motivator for automotive emission test equipment. For example, in the United States, the Environmental Protection Agency and state agencies, such as California Air Resources Board, enforce strict standards of emission to prevent air pollutants from vehicles, including nitrogen oxides and particulate matter. The requirement for Tier 3 in the U.S. and Euro 6/7 in Europe is a level of emissions. Vehicles need to be extremely low in emissions. Therefore, the same needs measuring with very precise, advanced equipment.

-

There is a growing need for testing solutions for hybrid and electric vehicles.

Hybrid vehicles are types of electric vehicles but far from being fully emission-free as they still sport an internal combustion engine. For this reason, the interest makes it essential to ensure that the hybrid vehicles satisfy the rules with a comprehensive emission test. Thirdly, with the phasing out of traditional gasoline and diesel vehicles, hybrid sales will continue to rise; in 2022, hybrid sales rose by 32% in the United States, the International Energy Agency (IEA) reported. The growth has created new demand for innovative emission-testing systems, customized to hybrid engines. Moreover, countries like Japan and the European Union have pledged to provide zero-emission zones (ZEZs) in each city across the globe, thereby increasing the demand for the periodic monitoring of emissions by all means, including PHEVs. As the country is persuading to enforce strict restrictions over the emission standards.

RESTRAIN:

-

The high-end testing equipment is very cost-intensive; hence, it acts as a deterrent for the smaller manufacturers to opt for such equipment.

While emission testing equipment is a must comply with the various environmental regulations, the high cost of purchasing and maintaining this equipment remains one of the major constraints, especially for smaller automotive manufacturers and service providers. Advanced systems, including Portable Emission Measurement Systems, chassis dynamometers, and sophisticated software, can cost hundreds of thousands of dollars. For example, a modern engine dynamometer test cell costs over USD 250,000 up to half a million dollars, depending on the extent of bespoke developments and the testing capabilities. It is quite difficult for small firms in some of these emerging markets to have premier emission test equipment with such capital-expenditure-intensive modifications. The ongoing process of operation and maintenance in readjusting the equipment would also incur costs on the human resource needed to operate it. This therefore means that some of the small and medium-sized enterprises (SMEs) may look for third-party emissions testing services, which would effectively constrain the total market expansion for the sales of equipment.

KEY MARKET SEGMENTS

BY SOLUTION

In 2023, Emission Test Equipment accounted for a share of 45% as physical testing equipment is an integral measure of vehicle emissions in terms of meeting the requirements of the regulations. The dynamometers and gas analyzers are, in fact, key devices necessary for laboratory as well as bench-top testing to ensure compliance with such stringent standards as Euro 6/7, Tier 3, and China VI. In the other direction, Emission Test Services is becoming increasingly sought out as third-party providers offer specialized testing to smaller manufacturers who could never dream of purchasing in-house equipment.

The emission test software is also likely to grow as regulations become increasingly complex. Emission Test Software, from 2024-2032, will have a CAGR of around 5.53%. This is because the process of emission testing requires effective data management, higher frequency and accuracy of real-time monitoring, and advanced analytics to aid manufacturers in monitoring compliance and vehicle performance.

Need Any Customization Research On Automotive Emission Test Equipment Market - Inquiry Now

BY PRODUCT TYPE

Chassis Dynamometer had the highest share in the market in 2023 with around 24%. Chassis dynamometers are important as they allow for actual driving conditions to be simulated in order to check a vehicle's emissions within a controlled environment. This has seen their widespread application by manufacturers and regulatory bodies.

The segment of Vehicle Emission Test System, however will grow at the highest rate with a 6.55% CAGR from 2024-2032. These systems have gained so much popularity due to their real-world testing of emissions, especially in these times of increasing trends in regulation such as Euro 6 and Euro 7, wherein Real Driving Emissions Testing becomes a mandate. Other reasons for such a demand include the rising trend of automobile manufacturers shifting towards hybrid and alternative fuel vehicles, as such vehicles need more varied and accurate assessments of emission.

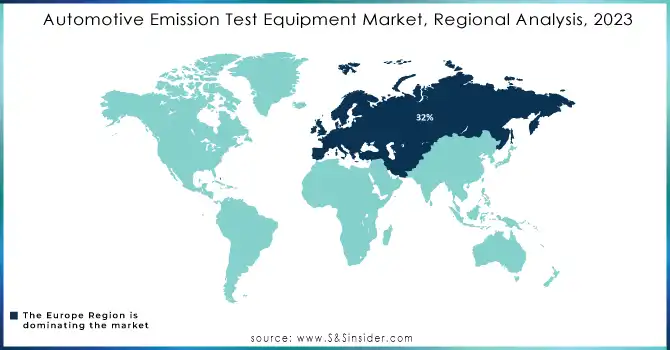

REGIONAL ANALYSIS

In 2023, Europe dominated the Automotive Emission Test Equipment Market with a 32% share, driven by stringent regulations like Euro 6 and upcoming Euro 7 standards, imposing strict emission limits on NOx and PM. Countries such as Germany, France, and the UK lead the region with robust automotive industries and government policies supporting low-emission vehicles. Added to this is the commitment by the European Union to achieve Climate Neutrality by 2050, so the above regulations will undoubtedly fuel such advanced emission-testing technologies across the region.

The Asia Pacific region is expected to grow the fastest, with a CAGR of 5.82% during the period of 2024 through 2032. China VI and India's Bharat Stage VI emissions standards, among others, are driving growth in automotive production in China, India, and Japan. Moving forward with electric and hybrid vehicles in these countries increases even more the need for complete emission testing against changed regulatory infrastructures.

KEY PLAYERS

Some of the major players in the Automotive Emission Test Equipment Market are

-

Horiba Ltd. (Emission Measurement Systems, Chassis Dynamometers)

-

AVL List GmbH (Engine Dynamometers, Emission Analyzers)

-

Robert Bosch GmbH (Exhaust Gas Analyzers, Emission Testing Software)

-

Siemens AG (Emission Test Systems, Software Solutions)

-

ABB Ltd. (Air Emission Monitoring Systems, Gas Analyzers)

-

MAHA Maschinenbau Haldenwang GmbH (Dynamometers, Gas Analyzers)

-

Applus+ IDIADA (PEMS, Emission Test Services)

-

Emission Systems Inc. (Emission Test Equipment, Maintenance Services)

-

SGS SA (Emission Test Services, Inspection Solutions)

-

TÜV SÜD (Emission Testing, Certification Services)

-

Intertek Group plc (Emission Test Services, Automotive Testing)

-

Cambridge Sensotec (Gas Analyzers, Air Quality Monitoring)

-

Opus Inspection (Vehicle Emission Inspection, Maintenance Equipment)

-

Sensors Inc. (PEMS, Gas Measurement Equipment)

-

Red Mountain Engineering (Emission Control Devices, Test Systems)

-

Actia Group (Emission Test Equipment, Diagnostic Tools)

-

Dürr Group (Test Systems, Emission Control Technologies)

-

Green Instruments (Emission Monitoring, Gas Analyzers)

-

MKS Instruments (Exhaust Gas Analyzers, Emission Testing Software)

-

EMC Test Systems (Emission Testing Equipment, Measurement Systems)

MAJOR CLIENTS

-

General Motors

-

Ford Motor Company

-

Volkswagen Group

-

BMW

-

Toyota Motor Corporation

-

Honda Motor Co., Ltd.

-

Daimler AG

-

Nissan Motor Co., Ltd.

-

Stellantis

-

Hyundai Motor Company

RECENT TRENDS

-

July 2024: HORIBA India, a group company of HORIBA Ltd., a Japanese leader in analytical equipment and measurement solutions for the three megatrend fields - Energy & Environment, Bio & Healthcare and Materials & Semiconductor that form so much of what characterizes our lives today, has officially inaugurated its state-of-the-art medical equipment and consumables manufacturing facility at Butibori, Nagpur. The facility will be well aligned with the vision of Atmanirbhar Bharat and Make in India for the World and will be one of India's largest medical equipment and consumables (reagents) manufacturing unit.

-

April 2024: The 10th AVL High Power Systems Conference brought industry decision-makers together to discuss how the global shipping industry can achieve-and possibly overachieve-future decarbonisation and sustainability goals. The conference generally agreed that these reductions will be achieved through new technologies in the engines that support new fuels. Such is the scope of this development space that it will take the unification of efforts by the wider industry to develop, test, and launch solutions developed within it.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 772.33 Million |

| Market Size by 2032 | US$ 1185.07 Million |

| CAGR | CAGR of 4.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Emission Test Equipment, Emission Test Services, Emission Test Software), • By Product Type (Chassis Dynamometer, Engine Dynamometer, Vehicle Emission Test System, Wheel Alignment Tester, Fuel Injection Pump Tester, Transmission Dynamometer), • By Vehicle Type (Passenger Cars, Commercial Vehicles), • By Technology (ADAS Testing, ECU Testing, Data Logger System, Simulation Testing, EV Testing), • By Application (Periodic Testing Inspections, Inspection & Maintenance) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Horiba Ltd., AVL List GmbH, Robert Bosch GmbH, Siemens AG, ABB Ltd., MAHA Maschinenbau Haldenwang GmbH, Applus+ IDIADA, Emission Systems Inc., SGS SA, TÜV SÜD, Intertek Group plc, Cambridge Sensotec, Opus Inspection, Sensors Inc., Red Mountain Engineering, Actia Group, Dürr Group, Green Instruments, MKS Instruments, EMC Test Systems. |

| Key Drivers | • Stringent government regulations on emissions drive demand for testing equipment. • There is a growing need for testing solutions for hybrid and electric vehicles. |

| Restraints | • The high-end testing equipment is very cost-intensive; hence, it acts as a deterrent for the smaller manufacturers to opt for such equipment. |