Automotive Exhaust Emission Control Device Market Report Scope & Overview:

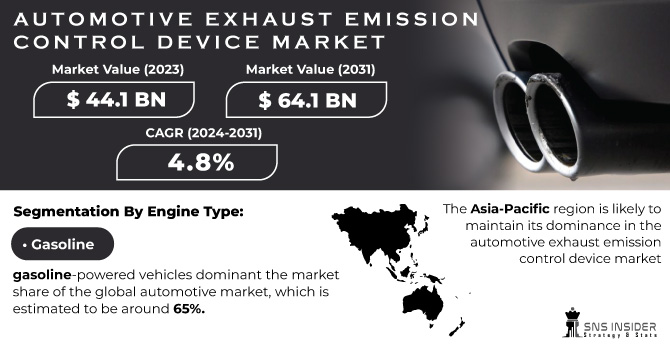

The Automotive Exhaust Emission Control Device Market Size was valued at USD 44.1 billion in 2023 and is expected to reach USD 64.1 billion by 2031 and grow at a CAGR of 4.8 % over the forecast period 2024-2031.

Get More Information on Automotive Exhaust Emission Control Device Market - Request Sample Report

Environmental considerations, regulatory pressures and technological advances are driving the automotive emission control equipment market. Governments worldwide are tightening emission standards to combat air pollution. This compels car manufacturers to integrate advanced exhaust control devices like Selective Catalytic Reduction (SCR) systems and Gasoline Particulate Filters (GPFs) into their vehicles. For instance, the European Union's Euro 7 regulations, expected in 2026, will mandate stricter NOx and particulate matter limits, creating a demand for more sophisticated control devices. Companies like Tenneco and Faurecia are actively developing and testing new technologies to meet these upcoming standards. Also, the Public consciousness about the detrimental effects of vehicle emissions is on the rise.

This will leads to a consumer preference for cleaner vehicles, pushing manufacturers towards cleaner technologies. Leading car companies like Toyota and Volkswagen Group are investing heavily in hybrid and electric vehicles, which require different but still crucial thermal management systems, presenting an opportunity for exhaust control device manufacturers to adapt their expertise. also With a vast existing fleet of gasoline and diesel vehicles on the road, the aftermarket for replacement and repair of exhaust control devices presents a significant growth opportunity.

Automotive Exhaust Emission Control Device Market Dynamics:

KEY DRIVERS:

-

Continuous Technological Advancements are leading to the development of more efficient and durable exhaust emission control devices.

-

The Growing Demand for Cleaner Vehicles

Rising environmental awareness and concerns about climate change are driving consumer demand for cleaner, more eco-friendly vehicles. This translates to a growing market for vehicles equipped with efficient exhaust emission control devices.

RESTRAINTS:

-

Advanced exhaust emission control devices can be expensive, impacting the overall cost of vehicles.

-

Limited Availability of Certain Materials

The production of some advanced exhaust emission control devices relies on specific raw materials, which can be subject to price fluctuations or supply chain disruptions. This can impact the overall cost and production of these devices.

OPPORTUNITIES:

-

The growing adoption of electric vehicles (EVs) presents a significant opportunity for the exhaust emission control device market.

-

The rising number of vehicles on the road creates a substantial demand for replacement and aftermarket exhaust emission control devices.

-

Expansion into Emerging Markets

As stricter emission regulations are implemented in developing countries, the market for exhaust emission control devices is expected to grow in these regions. Manufacturers can target these markets with cost-effective solutions tailored to specific emission standards.

CHALLENGES:

-

A lack of global standardization in emission regulations can create complexities for manufacturers who need to cater to different markets.

-

Integration with New Technologies

The integration of exhaust emission control devices with new vehicle technologies, such as hybrid and electric powertrains, presents engineering challenges that manufacturers need to address.

IMPACT OF RUSSIA-UKRAINE WAR

The war has disrupted the supply chain for key raw materials used in exhaust emission control devices, such as palladium and rhodium, which are primarily sourced from Russia. This has led to price hikes for these materials, estimated to be a 250% increase for palladium in 2022, The rising cost of raw materials translates to higher production costs for exhaust emission control devices. This can force manufacturers to raise prices or reduce profit margins, potentially impacting overall market growth. also The war has also caused production slowdowns in the automotive industry due to supply chain disruptions and sanctions on Russia. This translates to a decrease in demand for new exhaust emission control devices. Major car manufacturers like Ford and Toyota have been forced to temporarily halt production at some factories due to chip shortages exacerbated by the war. This directly impacts the demand for new exhaust emission control devices.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown create a complex scenario for the automotive exhaust emission control device market. consumers tend to tighten their budgets, prioritizing essential purchases over discretionary spending like new vehicles. This can lead to a decrease in demand for new cars, directly impacting the market for exhaust emission control devices that come equipped with them. While new car sales and demand for advanced devices might decline, the aftermarket segment could experience growth. for eg. The global aftermarket for automotive parts is expected to reach USD 1.4 trillion by 2028, with a significant portion driven by demand for replacement exhaust components. In Addition, Economic Slowdown can lead to people holding onto their existing vehicles for longer periods. This can create a surge in demand for replacement and repair services for exhaust emission control devices, boosting the aftermarket segment of the market.

Automotive Exhaust Emission Control Device Market Segment Overview

KEY MARKET SEGMENTS:

By Device Type

Based on Device Type, The Three-Way Catalytic Converter (TWC) is the dominating segment. Because TWCs are the workhorses of the market, which is employed in most gasoline-powered vehicles. Their versatility in tackling multiple pollutants simultaneously (hydrocarbons, carbon monoxide, and nitrogen oxides) makes them a one-stop shop for cleaner emissions. Unlike some newer devices, TWC technology is well-understood, and reliable, and cost-effective. This proven track record makes them a safe bet for manufacturers.

By Engine Type

Based on Engine Type, It is segmented into Gasoline, Dieseland Hybrid As of year 2024, gasoline-powered vehicles dominant the market share of the global automotive market, which is estimated to be around 65%. The widespread adoption of gasoline vehicles, particularly in developing countries, fuels the demand for their corresponding emission control devices. Additionally, the technology for gasoline exhaust control is well-established and cost-effective compared to some hybrid solutions.

While gasoline remains dominant, the hybrid segment is experiencing the most significant fastest growth rate during the forecasted period, . The increasing focus on environmental regulations, rising fuel costs, and growing consumer demand for eco-friendly vehicles are driving the adoption of hybrid technologies. Hybrid vehicles are expected to witness a Compound Annual Growth Rate (CAGR) of around 15% between 2024 and 2031.

By Sales Channel

Based on Sales Channel, OEMs hold the larger market share in the Automotive Exhaust Emission Control Devices market, estimated to be around 70% as of 2024, due to several factors like, Automakers purchase exhaust emission control devices in bulk directly from manufacturers for installation in new vehicles coming off the assembly line. also, The ongoing demand for new vehicles, particularly in developing regions, translates to a consistent demand for OEM-supplied exhaust emission control devices.

The aftermarket Segment is experiencing the significant fastest growth in the forecasted period, This can be attributed to several factors such as, vehicles age, their exhaust emission control devices wear out and require replacement, creating a demand for aftermarket parts., and For older vehicles, replacing a faulty exhaust emission control device with an aftermarket option can be more cost-effective than extensive repairs or purchasing a new car., The increasing popularity of do-it-yourself (DIY) car maintenance is driving the demand for readily available and affordable aftermarket exhaust emission control devices.

Automotive Exhaust Emission Control Device Market Regional Analysis

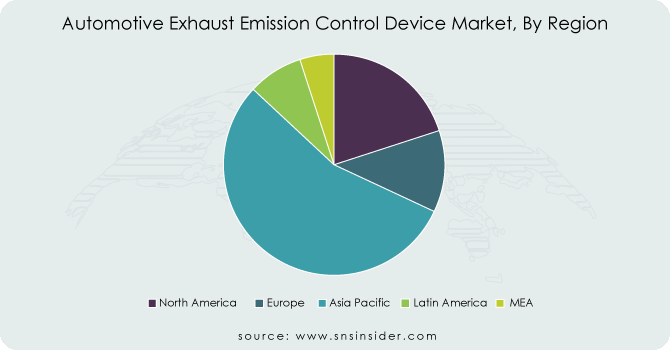

The Asia-Pacific region is likely to maintain its dominance in the automotive exhaust emission control device market due to its booming vehicle ownership and manufacturing base. The percentage of people owning vehicles in this region is steadily increasing. China alone boasts a staggering 278 million privately-owned automobiles as of 2022, highlighting the vast potential market for exhaust control devices. Countries like Japan, China, and South Korea are major hubs for automobile production. This high level of manufacturing activity translates to a significant demand for exhaust control devices to comply with emission regulations. While Asia-Pacific holds the top leading position, Europe's exhaust emission control device market is projected to experience significant growth in the coming years. This growth is driven by two main forces Ist one is Expanding Auto Industry, and other is Stricter Regulations.

North America is an established market with many vehicles. This means potentially saturated demand for traditional emission control devices in new vehicles. Like Europe, the United States has strict emissions standards enforced by the Environmental Protection Agency (EPA). This encourages the development and implementation of advanced emission control devices in existing vehicles. Due to the large existing vehicle fleet, the aftermarket for replacement and repair of emission control devices is expected to be a significant growth factor in North America. The growing popularity of electric vehicles (EV) in North America, especially in California and other environmentally conscious states, may present a long-term challenge to the market for traditional emission controls.

Get Customized Report as per Your Business Requirement - Request For Customized Report

KEY PLAYERS

The major key players are Faurecia (France), Denso Corporation (Japan), Robert Bosch (Germany), Johnson Matthey (UK), Continental Emitech Gmbh (Germany), Tenneco Inc. (USA), Bosal (Belgium), Eberspächer (Germany), CDTi Advanced (California), and Albonair GmbH (Germany), and other key players.

RECENT DEVELOPMENT

In May 12, 2024, BASF, a chemical giant, unveiled its new high-efficiency silicon carbide (SiC) filters for diesel exhaust aftertreatment systems. These advanced filters offer superior durability and thermal resistance compared to traditional ceramic filters, enabling them to capture a wider range of particulate matter more effectively.

In May 18, 2024, Johnson Matthey (JM), a leading manufacturer of automotive catalysts, announced a partnership with Umicore, a global materials technology company. This collaboration aims to develop next-generation catalysts for gasoline and diesel vehicles that comply with stricter emission regulations.

In May 5, 2024, Cummins Inc., a leading diesel engine manufacturer, announced a significant investment in research and development of zero-emission powertrains for commercial vehicles. While not directly related to exhaust emission control devices, this development signifies a broader industry shift towards cleaner technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 44.1 Billion |

| Market Size by 2031 | US$ 64.1 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Three-Way Catalytic Converter (TWC), Diesel Particulate Filter (DPF), Selective Catalytic Reduction (SCR), Diesel Oxidation Catalyst (DOC), Lean NOx Trap (LNT), Gasoline Particulate Filter (GPF)) • By Engine Type (Gasoline, Diesel, Hybrid) • By Vehicle Type (Passenger Vehicles, Commercial Vehicles) • By Material(Platinum, Palladium, Rhodium) • By Sales Channel(OEMs, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Faurecia (France), Denso Corporation (Japan), Robert Bosch (Germany), Johnson Matthey (UK), Continental Emitech Gmbh (Germany), Tenneco Inc. (USA), Bosal (Belgium), Eberspächer (Germany), CDTi Advanced (California), and Albonair GmbH (Germany) |

| Key Drivers | • Continuous Technological Advancements are leading to the development of more efficient and durable exhaust emission control devices. • The Growing Demand for Cleaner Vehicles |

| Restraints | • Advanced exhaust emission control devices can be expensive, impacting the overall cost of vehicles. • Limited Availability of Certain Materials |