Automotive Engineering Services Outsourcing Market Report Scope & Overview:

Get More Information on Automotive Engineering Services Outsourcing Market - Request Sample Report

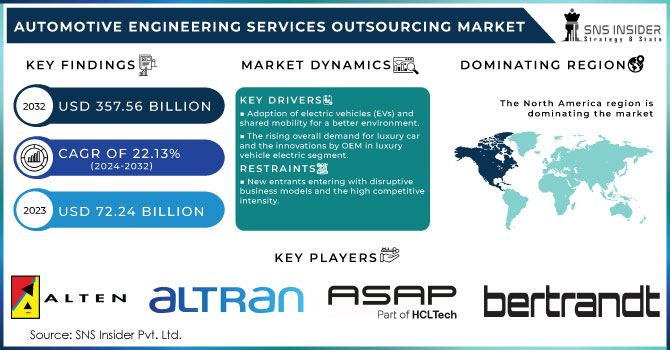

Automotive Engineering Services Outsourcing Market size was valued at USD 72.24 Bn in 2023 and is expected to reach USD 357.56 Bn by 2032, and grow at a CAGR of 22.13% over the forecast period 2024-2032.

-

"Maximizing Profit Pools": Key factors highlighted for Incumbents and New Entrants to focus on during the forecasted period.

The future course of the Automotive Engineering Services Outsourcing (ESO) market depends on transformative factors that will reshape demand and profitability for key players. One important shift is the ascendance of electric vehicles (EVs), anticipated to witness exponential growth exceeding 30% by 2031 according to SNS Insider analysis. This necessitates expertise in critical areas such as battery technology, powertrain design, and lightweight materials, areas where traditional ESO providers may require substantial upskilling or strategic partnerships. The escalating emphasis on autonomous driving presents a significant opportunity estimated at USD 2 trillion by 2031.

Also, to succeed here companies will need to be proficient in sensor fusion, artificial intelligence, and software development; this might change the competition among ESO providers. Furthermore, such megatrends as Industry 4.0 will increasingly impact on more automation and data-driven decision making along the ESO value chain. The trend could also promote the consolidation of smaller market participants that do not have enough capital for investing in advanced technologies or robust data analytics capabilities. To navigate the changing profit landscape, ESO firms must adjust their service portfolios, talent acquisition strategies and pricing models. There is an increasing demand for innovative networking solutions.Also, to succeed here companies will need to be proficient in sensor fusion, artificial intelligence, and software development; this might change the competition among ESO providers. Furthermore, such megatrends as Industry 4.0 will increasingly impact on more automation and data-driven decision making along the ESO value chain. The trend could also foster the consolidation of smaller market participants that do not have enough capital for investing in advanced technologies or robust data analytics capabilities. To navigate the changing profit landscape, ESO firms must adjust their service portfolios, talent acquisition strategies and pricing models. There is an increasing demand for innovative networking solutions.

MARKET DYNAMICS:

KEY DRIVERS:

-

Adoption of electric vehicles (EVs) and shared mobility for a better environment.

-

The rising overall demand for luxury car and the innovations by OEM in luxury vehicle electric segment.

This has raised a simultaneous increase in outsourcing of automotive engineering services with regard to luxury cars’ rising demand. For instance, today manufacturers like Bentley and Aston Martin are beginning to outsource highly specialized engineering assignments as part of their strategic adoption of state- of –the-art technology with personalization features and high performance cables.

The key factors include the need for expertise in emerging industries such as electric and autonomous vehicle technology. Outsourcing allows luxury car manufacturers to get engineers from across the globe, which lets them focus their internal resources on reinforcing brand identity and core design principles. This strategic move, helps them maintain leadership in innovation while meeting the needs of their discerning customers who want nothing but an unmatched driving experience.

Restrains:

-

New entrants entering with disruptive business models and the high competitive intensity.

OPPORTUNITY:

-

The rising demand for autonomous vehicles and the support from government for the same.

-

Implementation of stringent emission norms & environmental regulations.

There are strict emission regulations and environmental policies that help in controlling pollution levels. Remarkably, China’s adoption of tighter controls over vehicle emissions from 2017 up to 2022 led to a significant 39% decrease in new passenger cars’ nitrogen oxide (NOx) emissions. Besides, Euro 6 standards of the European Union have resulted in particulate matter emissions being cut by nearly 90% since they were first implemented for new gasoline-powered vehicles in 2014.

These rules are meant to encourage cleaner technologies in the automobile industry while at the same time enabling companies to adhere to them. For instance, The California Air Resources Board made a bold mandate of zero emission vehicles that have led manufacturers to heavily invest in electric vehicle production. As a result of this nudge, it is estimated that global sales of electric vehicles will reach over 10 million by 2025. There may be an initial cost implications for industries adopting these regulations but one should note that they clear way for a better living environment. Adapting to new regulations guarantees compliance with the changes being experienced by consumers and regulators alike hence fostering environmental safety and stewardship.

Market Segmentation Analysis:

By Application:

In the automotive ESO market, powertrain and after treatment segment held the highest revenue share in 2023. This has resulted from replacing internal combustion engine powered by petroleum and gasoline with electrification in powertrains which can clip off carbon emissions from affecting the environment negatively. The adoption of electric powertrain technology by OEMs is likely to positively affect growth within the powertrain and after treatment sectors. Moreover, due its ability to sense, perceive its surroundings and provide safe.

By Service:

By 2032, the prototype segment is expected to continue to dominate the global automotive ESO market as per forecast. It has been fueled by the increased use of 3D printing technology in the automotive industry for creating prototypes of assemblies, parts or whole cars. Thus, producers can utilize 3D printing technology which can help them find defects quickly and rectify them within an efficient manner resulting in a more cost-effective approach. In order to expand and cater for an increasingly matured market for car testing, ESPs are expected to embark on establishing new test centers making this category grow faster with CAGR throughout forecast years.

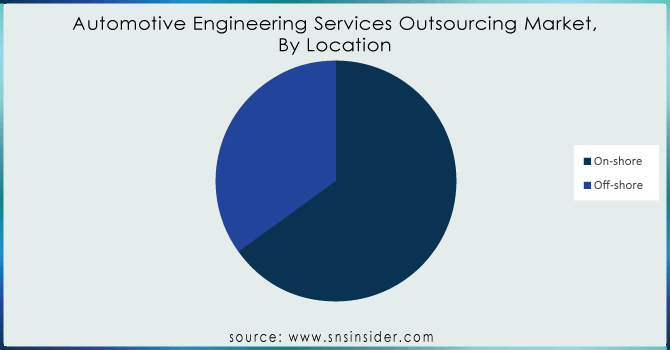

By Location:

The on-shore category is the highest in terms of revenue share and is expected to grow fast during the forecast period, considering that its original equipment manufacturers (OEMs) are more inclined to work with local ESPs. This will help them evade risks as many countries do not have copyright laws to protect their intellectual properties. The preference of OEMs for onshore markets has resulted in a significant increase in demand as a result of barriers such as different time zones, language barrier, stringent government regulations and more which make it difficult for OEMs to outsource services from any other country. However, the off-shore segment is anticipated to witness a significant boost throughout the projection period because oems prefer outsourcing services into low-cost nations like India, China, Brazil, Mexico or Ukraine. With maximum number of engineering graduates and appropriate capabilities among all cheap nations towards ESO, india is strongly favored by Oems leading to growth in this area.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

According to our SNS Insider research, North America region will grow at a CAGR of 20.21% over the period of 2024-2032. North America has a rich automotive manufacturing history with automobile production forming one of the pillars of its economy. In particular, the United States acts as an economic engine and propellers such expansion. The policy support for electric vehicles (EVs) and energy-efficient vehicles are boosting demand for EVs thus creating favorable conditions for automotive engineering services. Moreover, the growing promise of self-driving cars is another major growth factor here. With the US having an established automotive industry that continually increases Research and Development (R&D) investments, there are possibilities it may emerge as a key market leader in North America.

The bright future prospects for Automotive Engineering Services landscape have seen different regions taking significant positions. As such, Asia-Pacific was the dominant region in 2023 accounted for 46.11% global share (SNS). This dominance mainly derives from reasons like fast economic growth and an increasing middle class that needs new cars. Europe follows closely holding a considerable percentage of the market at around 25.20%.

KEY PLAYERS:

The major key players are Alten Group, Altran, ARRK Product Development Group Ltd., ASAP Holding Gmbh, AVL List GmbH, Bertrandt AG, EDAG Group, ESG Elektroniksystem- und Logistik-GmbH, FEV Group GmbH, and Horiba, LTD.

RECENT DEVELOPMENTS:

-

Alten Group, with its keen eye for expansion, has been augmenting its global reach through a series of calculated acquisitions and symbiotic partnerships. Among its notable conquests are Calsoft Labs, a venerated name in technology consulting within the automotive domain, and Cyient Europe Ltd., a stalwart in European engineering consultancy. These acquisitions serve as pillars upon which Alten fortifies its position in the ever-evolving automotive landscape.

-

Bertrandt AG has been carving its niche by sharpening its focus on the vanguards of automotive evolution: electric mobility, autonomous driving, and digitalization. Their collaborative endeavors with automotive titans underscore their commitment to pioneering innovative solutions for the mobility of tomorrow. Through a relentless pursuit of expertise and a penchant for cutting-edge projects, Bertrandt stands as a beacon of innovation in the automotive sphere.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 72.24 Billion |

| Market Size by 2032 | US$ 357.56 Billion |

| CAGR | CAGR of 22.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Autonomous Driving/ADAS, Body & Chassis, Powertrain and After-treatment, Infotainment & Connectivity, and Others) • by Basis of Service (Designing, Prototyping, System Integration, Testing, and Others) • by Location (On-shore and Off-shore) • by Vehicle Type (Passenger cars and Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alten Group, Altran, ARRK Product Development Group Ltd., ASAP Holding Gmbh, AVL List GmbH, Bertrandt AG, EDAG Group, ESG Elektroniksystem- und Logistik-GmbH, FEV Group GmbH, and Horiba, LTD. |

| Key Drivers |

|

| RESTRAINTS |

|