Automotive e-Call Market Size & Overview:

Get More Information on Automotive e-Call Market - Request Sample Report

The Automotive e-Call Market size was valued at USD 1.51 billion in 2023 and is expected to reach USD 3.48 billion by 2031 and grow at a CAGR of 11% over the forecast period 2024-2031.

Cars are getting safer due to built-in emergency call systems. These systems, called eCall, can automatically dial emergency services in the event of an accident, breakdown, or other serious situation. Sensors in the car, like those that trigger airbags, can initiate the automatic call. But there's also a manual eCall button that passengers can press if needed. This push for improved safety is driving the growth of the eCall market. Major carmakers like Ford, Toyota, and Volkswagen are already including eCall in many of their models. Testing these systems is important, and luckily there are all-in-one solutions that can efficiently check everything from GPS to cellular communication. This one-stop shop approach reduces the complexity and cost of ensuring eCall compliance across different regions (eCall, ERA-GLONASS). Thus, these testers can handle not only today's systems but also upcoming eCall advancements like NG eCall (next-generation LTE-based) and even future 5G technology.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising urbanization, safety concerns, and government initiatives drive the global automotive eCall systems market due to their ability to reduce road fatalities.

Cars are selling well due to a growing global population, rising incomes, and better living standards. This translates to more traffic and accidents, making drivers seek safety features like eCall. Automakers are responding by installing eCall systems to improve safety and get help to accident victims faster. European manufacturers are leading the way, raising awareness for this potentially life-saving technology. As more countries adopt eCall standards, the demand for these systems is expected to soar.

-

Rising traffic congestion and accidents are fueling consumer demand for eCall's life-saving features.

RESTRAINTS:

-

In-vehicle positioning issues hinder eCall effectiveness due to unreliable GPS, signal jamming, and regional configuration needs.

When accidents occur and occupants are unable to call for help themselves, the system transmits crucial data (vehicle status, location) to the nearest responder. However, a major challenge is unreliable positioning. GPS can fail, and signal jamming can disrupt communication. This can significantly delay help, especially for unconscious passengers. To ensure smooth operation, eCall systems also need regional configuration.

OPPORTUNITIES:

-

Linking eCall with connected car services can offer additional insights for improved post-accident care.

-

Advancements in cybersecurity can address signal jamming concerns and enhance system reliability.

CHALLENGES:

-

Signal jamming, both intentional and unintentional, can disrupt communication between eCall and emergency services.

-

Unconscious occupants involved in accidents may be unable to utilize the manual eCall button.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the automotive e-Call market in several ways. The sanctions and economic fallout have significantly impacted Russian car production, a major eCall market pre-war. This has caused a direct decline in e-Call system demand. The war exacerbated global supply chain issues, particularly for wiring harnesses, a crucial e-Call component often sourced from Ukraine. This has led to production slowdowns and potential shortages for e-Call systems in other regions. The rising oil prices due to the conflict incentivize consumers towards fuel-efficient cars, potentially delaying the adoption of advanced safety features like eCall in some markets.

Due to ongoing uncertainties, there is a decline in Russian car production by around 60% compared to pre-war levels. This translates to a significant drop in e-Call demand within that market. The impact on global e-Call production is harder to quantify, but industry reports suggest potential slowdowns due to component shortages.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can disrupt the automotive eCall market in many ways. The consumers may delay car purchases or opt for cheaper models without advanced safety features like eCall. This directly reduces demand for new vehicles with eCall systems. The economic hardship can force automakers to cut costs, potentially leading to delays in eCall implementation or compromises in component quality. Furthermore, economic downturns can strain government budgets, potentially hindering initiatives that promote eCall adoption or standardization. The combined effect can be a stagnation or even decline in eCall market growth by 5-10% during an economic downturn. This can be attributed to a decrease in car sales and potential delays in eCall implementation by automakers.

KEY MARKET SEGMENTS:

By Trigger Type

-

Manually Initiated eCall (MIeC)

-

Automatically Initiated eCall (AIeC)

Automatically Initiated eCall (AIeC) is the dominating sub-segment in the Automotive e-Call Market by trigger type holding around 70-80% of market share. AIeC offers a critical advantage during emergencies when occupants are unconscious or unable to call for help themselves. It automatically triggers based on accident severity (airbag deployment, sudden deceleration) and transmits vital data to emergency services, potentially saving lives.

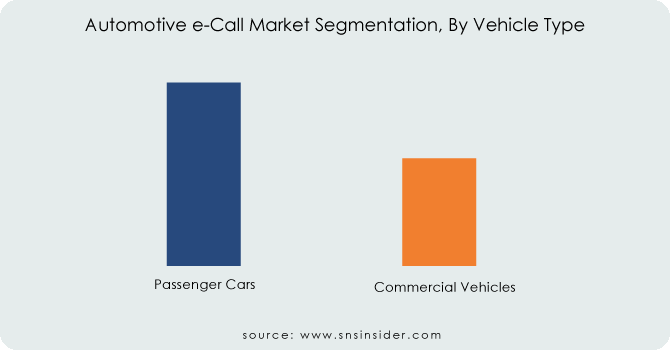

By Vehicle Type

-

Passenger Cars

-

Commercial Vehicles

Passenger Cars is the dominating sub-segment in the Automotive e-Call Market by vehicle type holding around 60-70% of market share. Passenger cars account for a larger share of the overall vehicle market compared to commercial vehicles. This translates to a higher volume of passenger cars equipped with eCall systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Propulsion Type

-

IC Engine

-

Electric

IC Engine Vehicles is the dominating sub-segment in the Automotive e-Call Market by propulsion type holding around 80-90% of market share. Internal Combustion (IC) engine vehicles still comprise the majority of cars on the road today. However, with the increasing popularity of electric vehicles (EVs), eCall adoption in this segment is expected to rise rapidly. As EV technology matures and safety regulations adapt, eCall will be a crucial feature for both IC engine and electric vehicles.

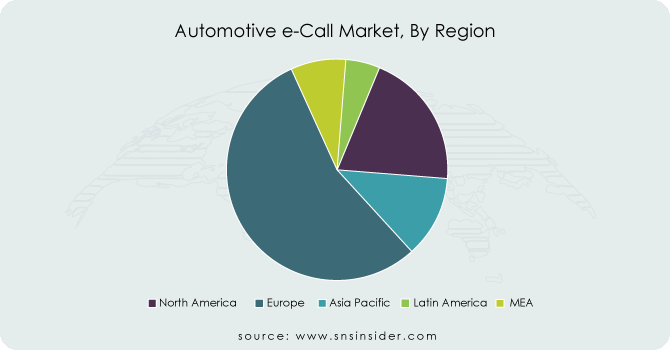

REGIONAL ANALYSES

Europe is the dominating region in the automotive eCall market holding 60-65% of share due to its long-standing commitment to road safety. Strict regulations, like the mandatory eCall systems in new cars have significantly boosted adoption. Additionally, it’s strong focus on advanced driver-assistance systems (ADAS) creates a supportive environment for eCall technology to thrive.

North America is the second highest region in this market with its well-established auto industry and growing consumer demand for safety features. While regulations aren't as stringent as major car manufacturers are actively integrating eCall due to consumer interest and potential future mandates.

The Asia Pacific is the fastest-growing region where car ownership is skyrocketing. Rising disposable income and increasing safety concerns are fueling the demand for advanced features like eCall. Government initiatives promoting eCall adoption in this region are further accelerating its growth.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Continental AG, STMicroelectronics, Infineon Technologies AG, Texas Instruments Incorporated, Thales Group, Valeo, Fujitsu, Delphi Automotive PLC (UK), Telit Communications PLC (UK), TRL, Aptiv, Robert Bosch GmbH, U Blox and other key players.

Continental AG-Company Financial Analysis

RECENT DEVELOPMENT

-

In Dec. 2023: Applus and Rohde & Schwarz collaborated to seamlessly integrate eCall testing within electromagnetic compatibility (EMC) chambers. This allows for testing eCall systems in various setups, simulating real-world conditions.

-

In Aug. 2023: FIH Mobile, a subsidiary of Hon Hai Technology Group, has become the first Taiwanese automotive supplier to receive eCall certification. This achievement was awarded after passing rigorous testing conducted by TÜV Rheinland.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.51 Billion |

| Market Size by 2031 | US$ 3.48 Billion |

| CAGR | CAGR of 11% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Trigger Type (Manually Initiated eCall, Automatically Initiated eCall) • By Vehicle Type (Passenger Cars, Commercial Vehicles) • By Propulsion Type (IC Engine, Electric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Continental AG, STMicroelectronics, Infineon Technologies AG, Texas Instruments Incorporated, Thales Group, Valeo, Fujitsu, Delphi Automotive PLC (UK), Telit Communications PLC (UK), TRL, Aptiv, Robert Bosch GmbH, U Blox |

| Key Drivers | • Rising urbanization, safety concerns, and government initiatives drive the global automotive eCall systems market due to their ability to reduce road fatalities. • Rising traffic congestion and accidents are fueling consumer demand for eCall's life-saving features. |

| Restraints | • In-vehicle positioning issues hinder eCall effectiveness due to unreliable GPS, signal jamming, and regional configuration needs. |