Automotive Gear Shift System Market Report Scope & Overview:

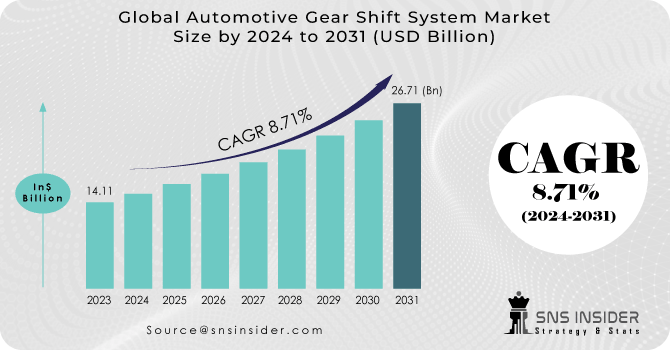

Automotive Gear Shift System Market size was valued at USD 14.11 billion in 2023 and is expected to reach USD 26.71 billion by 2031 and grow at a CAGR of 8.71% over the forecast period 2024-2031.

The operation of the Advanced Gear Shifter System includes both the arrangement and the disarrangement of the gears in the vehicle. It makes it possible for the car to function with the modern technology of having only two pedals. It does not have a clutch pedal, therefore the amount of work and effort required is significantly less. It provides the ease of maintenance that comes with an automatic transmission without sacrificing the fuel economy of the vehicle. The modern gear shift system has a number of advantages, including the facilitation of driving, the accessibility of technology, an increase in mileage, and a seamless transition between gears. It is applicable to a wide range of different autos.

Get More Information on Automotive Gear Shift System Market - Request Sample Report

The top company in the market for automotive gear shift systems, Friedrichshafen AG, has made an announcement on the debut of a new electrified clutch. The purpose of this clutch is to increase the efficiency of manual transmission in automobiles. The gadget is going to be marketed by the firm as a way to improve the fuel efficiency of vehicles that use gear shifting systems that are manually operated.

MARKET DYNAMICS:

KEY DRIVERS:

-

There is a high need for Automotive Gear Shift System Markets.

The developing automotive sector is expected to generate a considerable demand for Automotive Gear Shift System Markets throughout the projection period, owing mostly to rising demand for passenger automobiles. Furthermore, because most manufacturers are focusing on manufacturing more fuel- and emission-efficient automobile gear shift systems, vehicle requirements issued by various governments are expected to provide favorable growth opportunities in the near future. The growing popularity of electric vehicles is another major element generating opportunities for the global Automotive Gear Shift System Markets market.

-

It is expected that more advanced technology would be adopted.

-

Environmental degradation is becoming a growing concern as a result of emissions.

-

Demand for smooth and quick gear impulses to provide driving enjoyment is propelling market growth.

RESTRAINTS:

On the other hand, the less reliable characteristics of an advanced shifter may limit the market for automotive gear changing system. Furthermore, the high cost of raw materials needed to manufacture these components may act as a significant impediment to the growth of the global Automotive Gear Shift System Market market.

-

The high cost of raw materials and metal alloys makes it difficult to manufacture gears and motors.

-

Repairing an automatic gear shift system is both costly and time-consuming.

OPPORTUNITIES:

-

Increase in the EV Market

Because of the advancement of automatic gear shift transmission systems, automobile manufacturers may now boost the fuel efficiency of their vehicles. Compliance with Corporate Average Fuel Economy (CAFÉ) standards, as well as growing concerns about environmental deterioration caused by emissions, are expected to considerably increase the demand for automated gearbox systems. This is projected to fuel the expansion of the market for Automotive Gear Shift System Markets. Furthermore, with several automakers pledging investments in this cutting-edge technology, electric vehicles (EVs) are seeing steady adoption. Automotive NVH Materials manufacturers are expected to experience significant potential as the EV market increases.

-

Many technologies have advanced in their development.

-

Demand for fuel-efficient components is increasing.

-

Gear shift manufacturers will benefit from the proliferation of EVs.

CHALLENGES:

-

Increasing cost of production is the major challenge to deal with

The less reliable characteristics of an advanced shifter, on the other hand, may limit the market for auto gear change systems.

Furthermore, the high cost of the raw materials required to manufacture these components may act as a substantial impediment to the growth of the global market for Automotive Gear Shift System Market

Impact of Russian-Ukraine war:

While few parts suppliers operate in conflict zones, critical components like as wiring harnesses are manufactured by subcontractors in countries such as Ukraine. Leoni AG, which manufactures wire systems in Ukraine and sells them to European automakers, closed two factories in Ukraine and laid off approximately 7,000 workers in March. Magna International Inc. announced the closure of six sites and approximately 2,500 employees in Russia. Automakers who rely on Chinese and Eastern European parts are organizing task forces to map out alternate trading routes for part supplies. The battle exacerbates supply chain disruptions and chip shortages, which are already limiting supply. According to LMC Automotive, global production will be reduced by 400,000 units, resulting in 85.8 million global auto sales in 2022. That's far short of the 93 million vehicles that could be sold if automakers could meet demand. The deficit will continue to put higher pressure on the prices of new and secondhand cars. At the same time, rising loan rates and higher petrol costs enhance the cost of vehicle ownership, potentially leading to a major decline in vehicle demand. Russia has 34 auto manufacturing plants that produce automobiles, trucks, vans, buses, and engines. Many automakers with large operations in the region have seen their share values fall. The situation puts extra strain on gross margins, which have declined by 8 to 10% over the last six quarters. Many car manufacturers have stopped shipping vehicles to Russia. VW [including Audi and Porsche], Mercedes-Benz Daimler, BMW [including Mini], Honda, Toyota, Volvo, Nissan, Land Rover, and Ford are among the companies affected. Production is also interrupted in Eastern Europe. Batch releases of "shy built" vehicles missing parts such as semiconductors and wiring harnesses will throw off traditional seasonality forecasting methods.

Impact of Economic Slowdown:

An economic downturn can disrupt the automotive gear shift system market. With consumer spending tightening, industry analysts predict a 5-10% decline in vehicle sales, directly affecting the demand for gear shift systems. This translates to reduced production of new cars, leading manufacturers to adjust through production slowdowns or temporary plant closures. Moreover, consumers, facing tighter budgets, may prioritize used cars over new ones, further decreasing demand for gear shift systems in new vehicles.

However, the impact of the slowdown may not be uniform across all segments. The market for automatic gear shift systems, especially in luxury or fuel-efficient vehicles, may show resilience. Consumers may prioritize features that enhance comfort and fuel economy, maintaining the attractiveness of automatic gear shifts even during an economic downturn. Conversely, there might be a decrease in demand for manual gear shift systems, typically popular in budget-friendly cars.

Overall, while an economic slowdown poses challenges for the automotive gear shift system market, the extent of its impact may vary depending on the specific technology and vehicle segment.

Market, By SYSTEM TYPE:

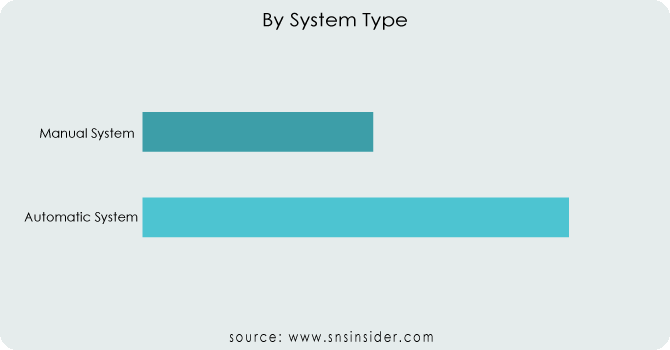

The global market has been divided into automatic systems, and manual systems based on the product segment. Automatic transmissions gain market share. This segment's technological advances are drawing more clients. The automatic gear shift technology improves user comfort by reducing driver effort. It improves vehicle fuel economy. Manual transmissions remain popular. Its popularity in conventional automobiles and its repairability contribute to its dominance. In the automotive gear shift system market, automatic systems reign supreme, capturing approximately 65% of the market share as of 2022, according to a SNS insider research report. This dominance can be attributed to several factors such as enhanced driver comfort, simplified operation, and their widespread adoption in luxury and fuel-efficient vehicles. On the other hand, manual systems, constituting around 35% of the market, cater primarily to driving enthusiasts who seek a more involved driving experience and potentially lower vehicle costs. However, the demand for manual systems is anticipated to experience a slight decline due to the increasing preference for automatic transmissions and the rising popularity of electric vehicles, which typically do not necessitate gear shifting.

Market, By COMPONENT:

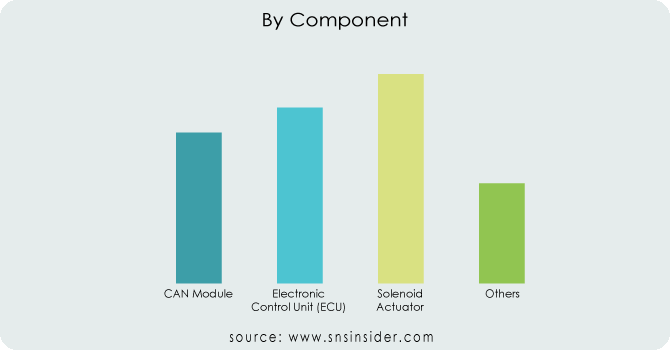

The global market has been divided into CAN Module, Electronic Control Unit (ECU), Solenoid Actuator, and Others Based on application segment. CAN modules are the fastest-growing component market for advanced gear shifter systems. Others follow. Modern vehicles employ CAN modules for communication and sophisticated shifting.

Market, By VEHICLE TYPE:

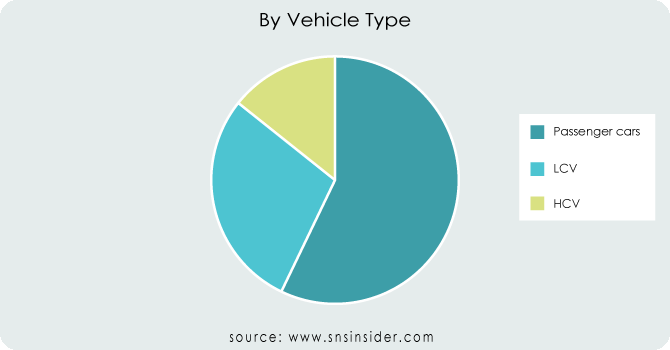

The global market has been divided into passenger cars, LCV, and HCV based on the material segment. It is the light commercial vehicle segment that is leading the industry. Their versatility and affordability make them ideal for a wide range of applications. The Passenger Vehicle segment, on the other hand, is gaining market share at a quicker rate because of the rising demand for budget-friendly cars. As of 2023, passenger cars commanded approximately 65% of the market share, as indicated by a SNS Insider research report. This dominance stems from the significantly higher production volume of passenger cars worldwide compared to Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs). LCVs, encompassing vans and pickup trucks, are forecasted to witness a growth rate of approximately 4.5%, driven by increasing demand for last-mile delivery services and heightened construction activities. In contrast, HCVs currently hold the smallest market share due to their lower production figures. Nevertheless, with a growing emphasis on automation and advanced driver-assistance systems within the trucking sector, the demand for electronically-controlled gear shifters in HCVs is expected to steadily increase in the forthcoming years.

Get Customized Report as per Your Business Requirement - Request For Customized Report

MARKET SEGMENTATION:

By System Type:

-

Automatic System

-

Manual System

By Component:

-

CAN Module

-

Electronic Control Unit (ECU)

-

Solenoid Actuator

-

Others

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

REGIONAL ANALYSIS:

The Asia-Pacific region is the world's most populous, leading the pack with the largest market share and an expected CAGR of approximately 4.8% from 2024 to 2031.This region's demand is being driven by a growing population with more disposable income. The strong economic expansion in this area is also a contributing aspect to the region's growth. Increasing demand is being driven by the vehicle industry's growth in China, India, Japan, and South Korea. In terms of gear shift systems, Europe is the second-largest market. Increasing sales of eco-friendly passenger automobiles are the primary driver of demand here.

As a result, Europe's well-established vehicle manufacturing industry has been able to meet consumer demand. We are seeing continuous expansion in the North American market. Demand for vehicles with cutting-edge technology is increasing. Despite their smaller market shares, these regions may experience slightly higher CAGRs compared to Asia-Pacific. People's increased discretionary income and desire for high-end and mid-range automobiles are also boosting the market for vehicle gear change systems. In addition, the usage of electric vehicles is increasing in this area.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Continental AG (Germany), ZF Friedrichshafen AG (Germany), Allison Transmission (U.S.), Aisin Seiki Co., Ltd. (Japan), GETRAG (Germany), and GKN PLC (U.K.). ZF Friedrichshafen AG (Germany), BorgWarner Inc. (U.S.), Eaton Corporation PLC (Republic of Ireland), Magna International Inc. (Canada), and JATCO Ltd. (Japan) are some of the affluent competitors with significant market share in the Automotive Gear Shift System Market.

Allison Transmission (U.S.)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In 2023, Continental AG of Germany introduced an upgraded iteration of its Electronic Horizon technology, now capable of seamless integration with gear shift systems. This innovation empowers drivers with predictive gear shifting recommendations, promising enhancements in both fuel efficiency and driving performance.

-

ZF Friedrichshafen AG, based in Germany, has been diligently advancing shift-by-wire technology. By eliminating the traditional mechanical linkage between gear shifter and transmission, ZF's technology presents numerous benefits including enhanced packaging flexibility, weight reduction, and the incorporation of cutting-edge features such as autonomous driving functionalities.

-

Atlantic, BorgWarner Inc., headquartered in the US, has been broadening its range of electric vehicle (EV) transmissions. Their latest offering, the eGearDrive transmission unveiled in 2022, is tailor-made for EVs and compatible with various gear shift systems, including the innovative shift-by-wire setups.

Automotive Gear Shift System Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.11 Billion |

| Market Size by 2031 | US$ 26.71 Billion |

| CAGR | CAGR of 8.71% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System Type (Automatic System, Manual System) • By Component (CAN Module, Electronic Control Unit (ECU), Solenoid Actuator, Others) • By Vehicle Type (Passenger cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Continental AG (Germany), ZF Friedrichshafen AG (Germany), Allison Transmission (U.S.), Aisin Seiki Co., Ltd. (Japan), GETRAG (Germany), and GKN PLC (U.K.). ZF Friedrichshafen AG (Germany), BorgWarner Inc. (U.S.), Eaton Corporation PLC (Republic of Ireland), Magna International Inc. (Canada), and JATCO Ltd. (Japan) |

| Key Drivers | • There is a high need for Automotive Gear Shift System Markets. • It is expected that more advanced technology would be adopted. • Environmental degradation is becoming a growing concern as a result of emissions. • Demand for smooth and quick gear impulses to provide driving enjoyment is propelling market growth. |

| Restraints | •The high cost of raw materials and metal alloys makes it difficult to manufacture gears and motors. • Repairing an automatic gear shift system is both costly and time-consuming. |