Automotive Ignition Coil Market Size & Overview:

Get More Information on Automotive Ignition Coil Market - Request Sample Report

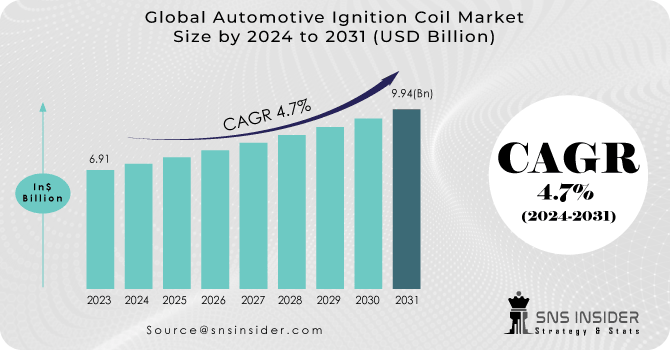

The Automotive Ignition Coil Market size was valued at USD 6.91 billion in 2023 and is expected to reach USD 10.44 billion by 2032 and grow at a CAGR of 4.7% over the forecast period 2024-2032.

The growth of the ignition coil market is propelled by several key factors. The substantial presence of internal combustion engine (ICE) vehicles ensures a consistent demand for replacement coils. Governmental initiatives aimed at enforcing stricter emission standards are driving manufacturers towards advanced ignition coils that enhance engine efficiency and reduce pollutants. For example, the implementation of more stringent BS-VI emission norms in India is anticipated to notably boost the demand for next-generation ignition coils, particularly in the two-wheeler segment.

Also, the surge in investments in electric vehicles (EVs) presents a new avenue for market growth. While EVs do not utilize traditional ignition coils, they require similar conversion technology, providing established ignition coil manufacturers with opportunities to adapt and serve the evolving market. This is evident in the escalating investments in EV infrastructure, with China alone projected to invest a substantial $1.8 trillion by 2025 in developing its EV charging network, indirectly creating avenues for the ignition coil market to evolve and prosper.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increase in automotive sales and Increase in urbanization

-

Growing emphasis on sustainability

-

Government initiatives to minimize fuel use and pollution

Government initiatives aim to reduce fuel consumption and pollution by promoting sustainable transportation methods and implementing stricter emissions standards. These efforts encourage the adoption of electric vehicles, invest in public transportation infrastructure, and incentivize green initiatives in industries to mitigate environmental impact while fostering economic growth.

RESTRAINTS:

-

Increased sales of plug-in hybrid and battery electric vehicles may limit market growth to some extent

-

These vehicles do not use an automobile ignition coil, which can greatly reduce demand

-

An increase in demand for compact ignition coils due to engine downsizing

-

Increased technological advancements toward solar energy-powered vehicles

OPPORTUNITIES:

-

The rise of e-tailing may present significant business prospects

CHALLENGES:

-

Limited space in engine compartments, higher ignition voltage is required

-

Electric automobiles do not use ignition coils, the ignition coil industry is projected to face considerable headwinds

IMPACT OF RUSSIA-UKRAINE:

The previously promising trajectory of the automotive ignition coil market has been overshadowed by the ongoing Russia-Ukraine war. Disruptions across global supply chains, particularly those reliant on Ukrainian wiring harnesses and neon gas crucial for ignition coil production, have resulted in production slowdowns and price escalations. Industry experts anticipate a potential 5-10% decline in ignition coil production in 2023 compared to pre-war forecasts, potentially translating to a substantial revenue loss of billions of dollars. Europe, heavily dependent on Ukrainian parts, faces the brunt of the impact, with car manufacturers experiencing production halts amidst sanctions and economic uncertainty. North America and Asia are also grappling with the repercussions as major ignition coil manufacturers confront raw material shortages and escalating transportation expenses. Although the market's long-term growth prospects remain promising, the Russia-Ukraine conflict has undeniably created a temporary setback, compelling manufacturers to recalibrate their sourcing strategies and prepare for heightened volatility in the foreseeable future.

IMPACT OF ONGOING ECONOMIC SLOWDOWN:

Amidst an ongoing economic slowdown, the automotive ignition coil market is facing uncertain times. Following years of robust growth, global demand for ignition coils, crucial components in spark ignition engines, is projected to decelerate in 2023. Forecasts suggest a growth rate of approximately 4-6%, a significant decline from the impressive 10-12% witnessed in 2021 and 2022. Additionally, inflationary pressures are squeezing disposable incomes, causing consumers to postpone non-essential vehicle maintenance tasks, including ignition coil replacements. However, despite these challenges, the future outlook for the market remains promising. The growing adoption rates of electric vehicles (EVs) is anticipated to bring disruptive changes in the coming years. Nevertheless, with EVs still representing a minority share of the overall vehicle fleet and the continued dominance of internal combustion engines, there is expected to be a consistent demand for replacement ignition coils. Moreover, the market stands to benefit from the increasing integration of advanced driver-assistance systems (ADAS) and stringent emission regulations, driving the need for high-performance ignition coils

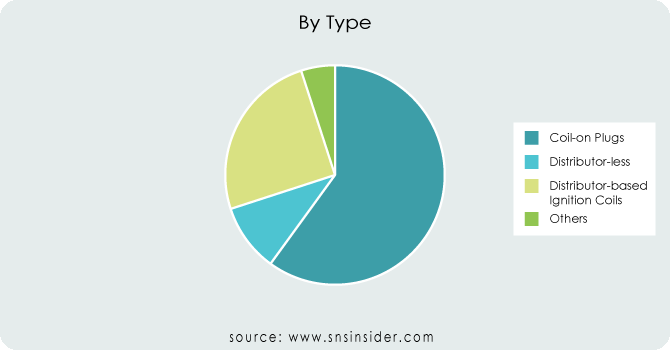

Market, By Type:

In the automotive ignition coil market, segmentation by type reveals Coil-on-Plugs (COP) as the frontrunner. Holding a commanding market share of approximately 60%, COP coils are favored for their efficient delivery of high voltage directly to spark plugs, minimizing power loss. Following closely are distributor-less ignition coils, projected to capture around 25% of the market share. These coils eliminate the need for a distributor, streamlining the ignition system. In contrast, distributor-based coils, a more traditional technology, are anticipated to hold a diminishing share of approximately 10%. The remaining 5% is attributed to the "Others" category, which may include specialty high-performance coils or those tailored for unique engine configurations. This segment analysis underscores the prevalence of COP technology and the ongoing trend towards more simplified and effective ignition systems.

Get Customized Report as per your Business Requirement - Request For Customized Report

Market, By Vehicle Type:

Segmentation within the automotive ignition coil market revolves around vehicle types, with passenger cars taking the lead and expected to command a significant market share of roughly 60-65%. This dominance finds its roots in several factors. Firstly, the sheer volume of passenger car manufacturing and sales globally far exceeds that of commercial vehicles. Secondly, the rising trend of individual car ownership, particularly in emerging markets, further amplifies the demand. Conversely, Light Commercial Vehicles (LCVs), encompassing vans and pickups, are forecasted to secure a market portion of 20-25%. This growth is propelled by the flourishing e-commerce sector and the surging pace of urbanization, which fosters a heightened need for last-mile delivery services. Lastly, Heavy Commercial Vehicles (HCVs), such as trucks and buses, are expected to occupy a relatively smaller share of approximately 15-20%. Despite their indispensable role in transporting goods, factors like lower production volumes and longer operational lifespans compared to passenger cars contribute to the segment's smaller size.

Market, By Distribution Channel:

The automotive ignition coil market divides into two primary distribution channels: Original Equipment Manufacturer (OEM) and Aftermarket. Presently, the Aftermarket claims dominance, capturing a significant market share of about 60-65%. This supremacy stems from various factors. Firstly, with the aging of vehicles, ignition coils naturally degrade, necessitating replacements. The Aftermarket addresses this demand from a vast pool of older vehicles, offering a wide array of coil options, often at more competitive prices compared to OEM counterparts. Secondly, the surge in global car ownership translates to a larger fleet requiring aftermarket coil replacements.

Conversely, the OEM segment, comprising approximately 35-40% of the market share, supplies coils for new vehicles straight from production lines. Here, emphasis lies on quality and reliability, as these coils must endure the vehicle's initial warranty period. OEM suppliers collaborate closely with car manufacturers to craft coils tailored precisely to each engine platform, ensuring optimal performance and fuel efficiency. Although the OEM segment currently holds a smaller share, it is poised for steady growth alongside the rising production of new vehicles.

MARKET SEGMENTATION:

By Type:

-

Coil-on Plugs

-

Distributor-less

-

Distributor-based Ignition Coils

-

Others

By Vehicle Type:

-

Passenger cars

-

LCV

-

HCV

By Distribution Channel:

-

OEM

-

Aftermarket

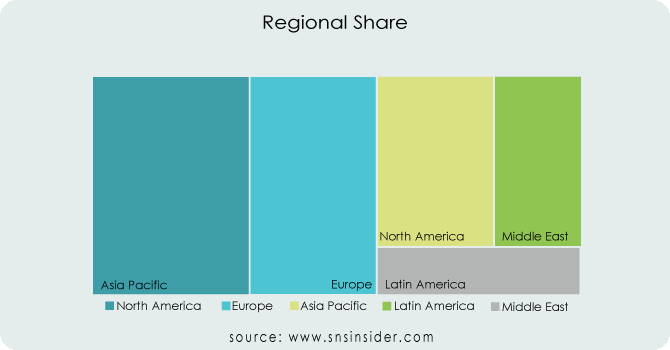

REGIONAL ANALYSIS:

The Asia-Pacific region asserts its dominance in the automotive ignition coil market, projected to maintain its leading position throughout the forecast period. This supremacy stems from a notable upsurge in automobile manufacturing, particularly in nations like China and India. China, in 2023 alone, produced over 26 million vehicles, underscoring a substantial demand for ignition coils. Moreover, stringent emission standards in these territories drive market growth, with advanced ignition coils playing a pivotal role in promoting cleaner combustion practices.

Meanwhile, North America and Europe, renowned as traditional automotive powerhouses, anticipate a gradual uptick in replacement coil demand. With a considerable on-road vehicle fleet, the aftermarket segment in these regions flourishes. Here, demand extends beyond mere replacements, with performance-oriented upgrades bolstering market expansion. Despite the emergence of electric vehicles posing a potential challenge in these areas, the technology remains in its infancy stage. Consequently, ignition coils retain their indispensable status, ensuring sustained market growth in the foreseeable future.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY MARKET PLAYERS:

Diamond Electric Mfg. Corp, Federal-Mogul, HELLA GmbH & Co. KGaA, Hitachi Automotive, Hitachi Automotive Systems Americas, Robert Bosch GmbH (Germany), BorgWarner Ludwigsburg GmbH (Germany), Delphi Automotive PLC (UK), Mitsubishi Electric Corporation (Japan), Denso Corporation (Japan), Wings Automobile Products Pvt. Ltd (India), NGK Spark Plug, and Valeo SA are among the key ignition coil market participants.

Hitachi Automotive Systems Americas-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.91 Billion |

| Market Size by 2032 | US$ 10.44 Billion |

| CAGR | CAGR of 4.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Coil-on Plugs, Distributor-based Ignition Coils, Distributor-less, Others) • by Vehicle Type (Passenger cars, LCV, HCV) • by Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Diamond Electric Mfg. Corp, Federal-Mogul, HELLA GmbH & Co. KGaA, Hitachi Automotive, Hitachi Automotive Systems Americas, Robert Bosch GmbH (Germany), BorgWarner Ludwigsburg GmbH (Germany), Delphi Automotive PLC (UK), Federal-Mogul Corporation (US), Mitsubishi Electric Corporation (Japan), Inc. (U.S.), Denso Corporation (Japan), Wings Automobile Products Pvt. Ltd (India), NGK Spark Plug, and Valeo SA |

| Key Drivers | • An increase in automotive sales. • Increase in urbanization. • The level of living and per capita income. |

| RESTRAINTS | • Increased sales of plug-in hybrid and battery electric vehicles may limit market growth to some extent. • These vehicles do not use an automobile ignition coil, which can greatly reduce demand. |