Automotive Heat Exchanger Market Report Scope & Overview:

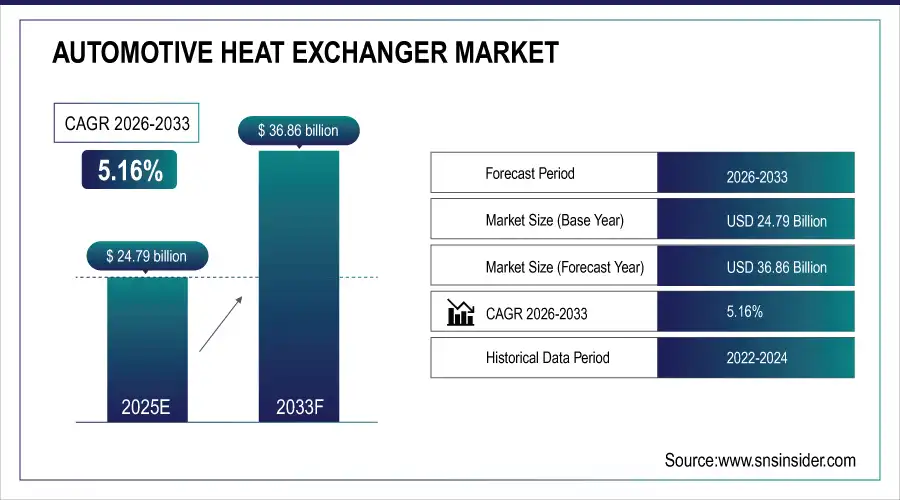

Automotive Heat Exchanger Market was valued at USD 24.79 billion in 2025E and is expected to reach USD 36.86 billion by 2032, growing at a CAGR of 5.16% from 2026-2033.

To Get more information On Automotive Heat Exchanger Market - Request Free Sample Report

The Automotive Heat Exchanger Market is growing due to increasing demand for fuel-efficient and low-emission vehicles, rising production of passenger and commercial vehicles, and the adoption of advanced thermal management systems. Growth in electric and hybrid vehicles, coupled with stringent emission regulations and the need for efficient engine cooling, is driving market expansion. Technological advancements in lightweight and high-performance heat exchangers further support the market’s steady growth globally.

The National Highway Traffic Safety Administration (NHTSA) has proposed Corporate Average Fuel Economy (CAFE) standards for model years 2024-2026, aiming to enhance fuel efficiency by 8% annually for passenger cars and light trucks, with a 10% increase in 2026.

In 2024, the U.S. had a domestic smelter capacity of 1.36 million tons per year, with primary aluminum production decreasing by 11% from 2023.

Market Size and Forecast

-

Market Size in 2025: USD 24.79 Billion

-

Market Size by 2033: USD 36.86 Billion

-

CAGR: 5.16% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Automotive Heat Exchanger Market Trends

-

Rising vehicle production and increasing adoption of EVs and hybrids are fueling the automotive heat exchanger market.

-

Growing need for efficient thermal management in engines, batteries, and power electronics is driving demand.

-

Stringent emission norms and fuel efficiency regulations are boosting adoption of advanced heat exchangers.

-

Expansion of lightweight and compact designs is enhancing vehicle performance and reducing energy consumption.

-

Increasing use of aluminum and composite materials is improving durability and cost-effectiveness.

-

Rapid growth in autonomous and connected vehicles is pushing demand for efficient cooling systems.

-

OEM collaborations and technological innovations are accelerating market expansion globally.

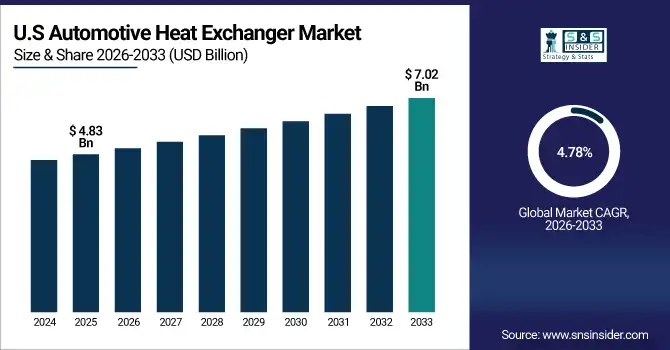

U.S. Automotive Heat Exchanger Market was valued at USD 4.83 billion in 2025E and is expected to reach USD 7.02 billion by 2032, growing at a CAGR of 4.78% from 2026-2033.

The U.S. Automotive Heat Exchanger Market is growing due to rising vehicle production, increasing adoption of fuel-efficient and electric vehicles, stringent emission regulations, and demand for advanced thermal management systems that enhance engine performance and reduce energy consumption.

Automotive Heat Exchanger Market Growth Drivers:

-

Rising Demand for Fuel-Efficient Vehicles and Improved Engine Performance Driving Heat Exchanger Market Growth Globally in Automotive Sector

Increasing focus on fuel efficiency and stringent emission regulations are boosting the adoption of advanced automotive heat exchangers. These components improve engine cooling, reduce energy consumption, and enhance overall vehicle performance. With growing demand for lightweight, high-efficiency vehicles, heat exchangers play a pivotal role in thermal management. The integration of aluminum and other high-conductivity materials further optimizes heat transfer. Additionally, the rise in hybrid and electric vehicles is prompting manufacturers to adopt innovative heat exchanger designs to maintain battery and engine efficiency, supporting market expansion worldwide.

|

Company |

Initiative / Product & Key Impact |

|

DENSO Corporation |

“Everycool” advanced cooling system for commercial vehicles, improving energy efficiency and engine performance while reducing fuel consumption |

|

Valeo SA |

Next-generation HVAC systems, including Dual Layer climate systems, providing up to 25% energy gain and supporting higher fuel efficiency in vehicles |

|

MAHLE GmbH |

Thermal management systems for over 20 electrified vehicle platforms (2022–2026), enhancing engine and battery efficiency while reducing energy consumption |

|

Hanon Systems |

R744 heat pump components for Volkswagen’s MEB electric platform, enabling efficient thermal management to maintain battery and engine performance in EVs |

|

Modine Manufacturing Company |

Thermal management solutions for zero-emission commercial vehicles, reducing energy consumption and improving engine performance in hybrid and electric powertrains |

|

AKG Group |

Expanded production with a new plant in Brazil, enhancing supply of high-efficiency heat exchangers to improve engine cooling and fuel efficiency in lightweight vehicles |

Automotive Heat Exchanger Market Restraints:

-

Stringent Environmental and Safety Regulations Pose Challenges for Automotive Heat Exchanger Manufacturing and Market Expansion

Stringent emission and safety regulations across major automotive markets are restraining manufacturers from freely adopting innovative heat exchanger designs. Compliance with environmental standards demands additional testing, certification, and modification of existing products, increasing operational complexities and costs. These regulations also necessitate continuous monitoring of material selection, energy consumption, and recyclability. Non-compliance can lead to penalties, product recalls, and reputation damage. Small-scale manufacturers face difficulties meeting these standards due to limited resources. Consequently, such regulatory constraints limit rapid adoption of new technologies and slow the overall growth of the automotive heat exchanger market, especially in highly regulated regions.

Automotive Heat Exchanger Market Opportunities:

-

Increasing Electrification and Rising EV Production Creates Significant Opportunities in Automotive Heat Exchanger Market Worldwide

The growing shift toward electric vehicles and hybrid models is creating a huge demand for innovative heat exchangers. EVs require efficient thermal management systems to maintain battery life, motor performance, and inverter efficiency. This shift opens opportunities for manufacturers to develop compact, lightweight, and high-performance cooling solutions. Rising government incentives, increased R&D investments, and collaboration between automakers and component suppliers further enhance market potential. Moreover, the trend toward connected and autonomous vehicles demands advanced thermal management systems, creating a substantial growth avenue. The market is poised to expand rapidly as electrification accelerates globally.

Automotive Heat Exchanger Market Segment Highlights

-

By Sales Channel, OEM dominated with ~74% share in 2025; Aftermarket fastest growing (CAGR).

-

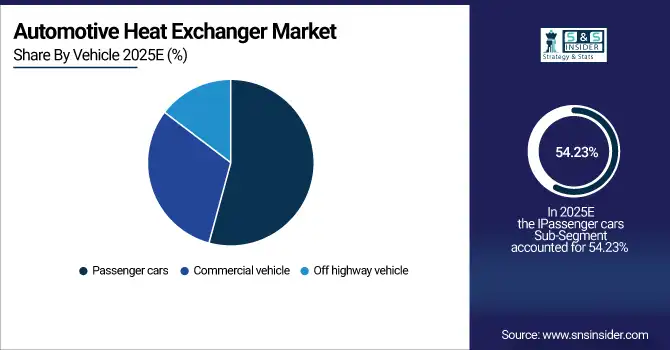

By Vehicle, Passenger Cars dominated with ~54.23% share in 2025; Commercial Vehicle fastest growing (CAGR).

-

By Product, Radiators dominated with ~36% share in 2025; Exhaust Gas Recirculation (EGR) fastest growing (CAGR).

-

By Design, Tube Fin dominated with ~52% share in 2025; Plate Bar fastest growing (CAGR).

-

By Material, Aluminium dominated with ~73% share in 2025; Aluminium fastest growing (CAGR).

Automotive Heat Exchanger Market Segment Analysis

By Sales Channel, OEM dominated in 2025; aftermarket expected fastest growth 2026–2033 driven by aging vehicles and replacement demand.

OEM segment dominated the Automotive Heat Exchanger Market in 2025 due to strong partnerships with automakers, ensuring consistent supply and integration in new vehicles. Their focus on high-quality, durable, and performance-optimized heat exchangers meets stringent emission and efficiency standards, driving higher adoption and revenue compared to other segments.

Aftermarket segment is expected to grow at the fastest CAGR from 2026-2033 as aging vehicles require replacement parts. Increasing vehicle parc, rising maintenance awareness, and demand for cost-effective, high-quality heat exchangers drive aftermarket growth. Growth in refurbished and customized automotive parts also supports expansion, creating a significant opportunity for segment players globally.

By Vehicle, Passenger cars led in 2025; commercial vehicles projected fastest growth 2026–2033 due to rising freight and fleet expansion.

Passenger cars segment dominated the Automotive Heat Exchanger Market in 2025 due to high global production and sales volumes. The demand for efficient cooling systems in compact and mid-sized vehicles, along with widespread adoption of advanced engine technologies, drives dominance. Passenger cars contribute significantly to total automotive heat exchanger revenue.

Commercial vehicle segment is expected to grow at the fastest CAGR from 2026-2033 due to rising freight and logistics activities. Heavy-duty engines require robust thermal management, and growth in e-commerce, transportation, and industrial sectors increases demand for efficient heat exchangers. Expansion of commercial fleets globally further accelerates market adoption and growth.

By Product, Radiators dominated in 2025; EGR expected fastest growth 2026–2033 from stringent emission regulations and fuel efficiency focus.

Radiators segment dominated the Automotive Heat Exchanger Market in 2025 due to their essential role in engine cooling. High demand for reliable thermal management systems in passenger and commercial vehicles, coupled with cost-effectiveness and ease of manufacturing, ensures widespread adoption. Radiators remain a core component across vehicle types.

Exhaust Gas Recirculation (EGR) segment is expected to grow at the fastest CAGR from 2026-2033 driven by stringent emission norms. Increasing focus on reducing NOx emissions and enhancing fuel efficiency in both passenger and commercial vehicles propels adoption. Rising integration of EGR systems in modern engines boosts segment growth globally.

By Design, Tube fin led in 2025; plate bar expected fastest growth 2026–2033 driven by compact, high-performance cooling needs.

Tube Fin segment dominated the Automotive Heat Exchanger Market in 2025 due to efficiency, lightweight design, and ease of manufacturing. Their widespread application in radiators and condensers, coupled with superior heat transfer performance, ensures large-scale adoption across various vehicle types, maintaining a leading market position.

Plate Bar segment is expected to grow at the fastest CAGR from 2026-2033 as demand rises for compact, high-performance heat exchangers. Advanced thermal efficiency, suitability for electric and hybrid vehicles, and growing preference for innovative cooling solutions drive the segment. Increasing R&D in automotive thermal management supports expansion globally.

By Material. Aluminium dominated in 2025 and expected fastest growth 2026–2033 due to lightweight, efficient, and durable properties.

Aluminium segment dominated the Automotive Heat Exchanger Market in 2025 due to its lightweight, high thermal conductivity, and corrosion-resistant properties. These characteristics improve fuel efficiency, reduce emissions, and enhance overall engine performance, making aluminium the preferred choice for manufacturers. The segment is also expected to grow at the fastest CAGR from 2026-2033 as demand rises for electric and hybrid vehicles, which require compact, efficient, and durable heat exchangers. Increasing adoption of advanced manufacturing techniques further supports growth.

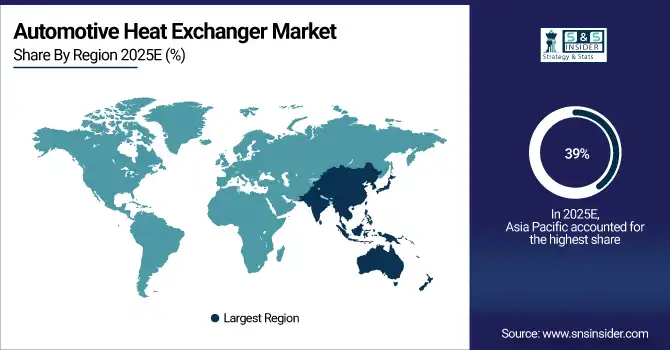

Automotive Heat Exchanger Market Regional Analysis

Asia Pacific Automotive Heat Exchanger Market Insights

Asia Pacific dominated the Automotive Heat Exchanger Market with the highest revenue share of about 39% in 2025 due to rapid industrialization, high vehicle production, and growing demand for passenger and commercial vehicles. Rising adoption of electric and hybrid vehicles, increasing investments in automotive manufacturing, and supportive government policies further drive market growth. The region’s expanding automotive supply chain and focus on advanced thermal management solutions contribute to its leading revenue share.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Automotive Heat Exchanger Market Insights

North America in the Automotive Heat Exchanger Market is growing steadily due to increasing demand for fuel-efficient and electric vehicles, stringent emission and safety regulations, and technological advancements in thermal management systems. The presence of major automotive manufacturers, rising replacement and aftermarket activities, and investments in R&D for high-performance and lightweight heat exchangers further support market expansion, making the region a significant contributor to global automotive heat exchanger revenue.

Europe Automotive Heat Exchanger Market Insights

Europe in the Automotive Heat Exchanger Market is expanding due to strict emission norms, growing adoption of electric and hybrid vehicles, and rising focus on fuel efficiency. The presence of key automotive manufacturers, advanced R&D facilities, and demand for high-performance thermal management systems drive market growth. Additionally, government incentives for sustainable mobility and increasing vehicle production across countries such as Germany, France, and the UK contribute to Europe’s significant revenue share globally.

Middle East & Africa and Latin America Automotive Heat Exchanger Market Insights

Middle East & Africa and Latin America in the Automotive Heat Exchanger Market are witnessing steady growth due to rising vehicle production, increasing demand for commercial and passenger vehicles, and growing focus on engine efficiency. Expanding automotive industries, supportive government initiatives, and adoption of modern thermal management systems contribute to market development. Additionally, rising replacement and aftermarket activities in these regions further drive the demand for reliable and cost-effective automotive heat exchangers.

Automotive Heat Exchanger Market Competitive Landscape:

DENSO Corporation

DENSO Corporation is a global leader in automotive technology, manufacturing advanced components and systems for thermal, powertrain, and electrification solutions. The company emphasizes innovation in sustainable mobility, energy efficiency, and smart vehicle systems, serving both conventional and electrified vehicle markets worldwide. DENSO invests in collaborative R&D to advance next-generation technologies, including hydrogen energy, heat management, and electric vehicle thermal systems, supporting global decarbonization and efficiency initiatives.

-

August 5, 2024: DENSO and JERA Co., Inc. announced a joint development of high-efficiency hydrogen generation technology combining SOEC with waste heat utilization, aiming to enhance energy efficiency in thermal power stations.

Valeo SA

Valeo is a global automotive supplier specializing in innovative technologies for electrification, thermal management, and mobility solutions. The company focuses on energy efficiency, reducing environmental impact, and advancing connected and autonomous vehicle systems. Valeo’s portfolio includes thermal systems, electric powertrain components, and advanced cooling solutions for high-performance vehicles and industrial applications, serving both OEMs and aftermarket sectors.

-

January 7, 2025: Valeo entered commercial production with Heat Reuse Units (HRU) compatible with ZutaCore's two-phase direct-to-chip liquid cooling, addressing the growing demand for liquid cooling in data centers supporting high-density servers.

Hanon Systems

Hanon Systems is a leading provider of thermal and energy management solutions for the automotive industry, focusing on electrification, eco-friendly technologies, and high-efficiency HVAC systems. The company develops heat pumps, compressors, and cooling systems that optimize vehicle energy consumption and environmental performance. Hanon emphasizes sustainable innovation, producing components that enhance thermal efficiency in electric and hybrid vehicles while supporting global emissions reduction efforts.

-

November 11, 2024: Hanon Systems reported a 28.3% increase in operating profit for Q3 2024, attributed to the launch of vehicles equipped with the fourth-generation heat pump, enhancing thermal management efficiency.

-

September 16, 2025: Hanon Systems surpassed 1 million units in cumulative production of eco-friendly R744 electric compressors, demonstrating growth in sustainable thermal management solutions.

Modine Manufacturing Company

Modine Manufacturing Company specializes in thermal management solutions for automotive, commercial, and industrial applications. The company develops advanced heating, cooling, and energy-efficient systems for conventional and electrified vehicles. Modine focuses on sustainable innovation, including electric vehicle thermal systems, battery cooling, and cabin climate control, serving OEMs and off-highway vehicle markets globally. Its solutions enhance vehicle performance, reliability, and efficiency across multiple platforms.

-

October 22, 2024: Modine was selected as the thermal solutions supplier for GILLIG's hybrid-electric bus platform, providing EVantage thermal management systems to optimize battery and power electronics thermal performance.

-

July 2, 2024: Modine expanded its EVantage portfolio with an advanced cabin climate system (CCS) offering 12kW cooling and 10kW heating capacity, designed for various vehicle applications, including commercial and specialty EVs.

-

January 9, 2024: Modine partnered with Bosch Rexroth to advance thermal management for electrified off-highway machinery, aiming to enhance the state of the art in industrial vehicle electrification.

Key Players

Some of the Automotive Heat Exchanger Market Companies

-

DENSO Corporation

-

Valeo SA

-

MAHLE GmbH

-

Hanon Systems

-

Modine Manufacturing Company

-

T.RAD Co., Ltd.

-

Sanden Corporation

-

AKG Group

-

Marelli Holdings Co., Ltd.

-

Dana Incorporated

-

Spectra Premium

-

Behr Hella Service GmbH

-

Kelvion Holding GmbH

-

Alfa Laval AB

-

Nissens A/S

-

GEA Group

-

Garrett Motion Inc.

-

American Industrial Heat Transfer, Inc.

-

Banco Products Ltd.

-

Nippon Light Metal Holdings, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 24.79 Billion |

| Market Size by 2033 | USD 36.86 Billion |

| CAGR | CAGR of 5.16% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Radiators, Intercoolers, Oil coolers, Exhaust gas recirculation (EGR), Others) • By Vehicle(Passenger cars, Commercial vehicle, Off highway vehicle) • By Material(Aluminium, Copper, Others) • By Design(Plate Bar, Tube Fin, Others) • By Sales Channel(OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | DENSO Corporation, Valeo SA, MAHLE GmbH, Hanon Systems, Modine Manufacturing Company, T.RAD Co., Ltd., Sanden Corporation, AKG Group, Marelli Holdings Co., Ltd., Dana Incorporated, Spectra Premium, Behr Hella Service GmbH, Kelvion Holding GmbH, Alfa Laval AB, Nissens A/S, GEA Group, Garrett Motion Inc., American Industrial Heat Transfer, Inc., Banco Products Ltd., Nippon Light Metal Holdings, Inc. |