Automotive Over-The-Air Updates Market Report Scope & Overview:

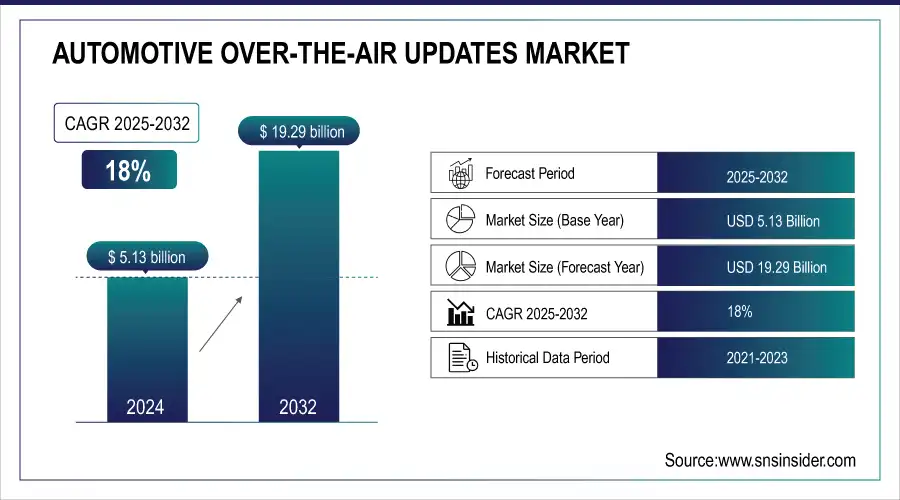

The Automotive Over-The-Air Updates Market Size was valued at USD 5.13 billion in 2024 and is expected to reach USD 19.29 billion by 2032 and grow at a CAGR of 18 % over the forecast period 2025-2032.

The rise in connected vehicles, holding an average penetration rate of over 70% in developed markets, necessitates frequent software updates for optimal performance and feature enhancements. Moreover, the escalating complexity of vehicle systems, including advanced driver assistance systems (ADAS) and autonomous driving technologies, demands continuous software refinement. Notably, electric vehicles (EVs) with their software-centric architectures exhibit a 90% software dependency, making OTA updates indispensable for battery management, charging efficiency, and performance optimization. Additionally, the imperative to address cybersecurity vulnerabilities, with over 60% of vehicles susceptible to cyberattacks, underscores the critical role of OTA updates in safeguarding vehicles. As consumers increasingly expect seamless digital experiences, automakers are under pressure to deliver timely software improvements, driving a 75% increase in OTA update frequency over the past three years.

Get Sample of Automotive Over-The-Air Updates Market - Request Sample Report

The proliferation of connected vehicles, now accounting for over 70% of new car sales in major markets, is a primary catalyst. This rise has intensified the demand for remote software updates to enhance vehicle performance, introduce new features, and address security vulnerabilities. Additionally, the electric vehicle revolution is accelerating OTA adoption, with over 35% of EVs equipped with OTA capabilities. The increasing complexity of vehicle software, coupled with the growing frequency of updates, is necessitating strong OTA infrastructure and cybersecurity measures.

Market Size and Forecast:

-

Market Size in 2024 USD 5.13 Billion

-

Market Size by 2032 USD 19.29 Billion

-

CAGR of 18% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Automotive Over-The-Air (OTA) Updates Market Trends:

-

Rising consumer demand for advanced telematics, infotainment, and navigation systems powered by IoT technologies.

-

Increasing integration of connectivity features by major vehicle manufacturers to enhance vehicle functionality.

-

Rapid growth in electric vehicle adoption, driving the need for robust OTA-enabled systems.

-

Government support through grants and incentives boosting EV sales and connectivity adoption.

-

Growing emphasis on safety, security, and efficient operation of modern interconnected automotive systems.

Automotive Over-The-Air (OTA) Updates Market Growth Drivers:

-

Increasing use of intelligent and interconnected technology

Major vehicle manufacturers are encouraged to shift their focus from the traditional manufacturing of motor vehicles and integrate advanced connectivity features into current models, due to increasing use of Internet of Things technologies. This is the response of people who are increasingly demanding advanced telematics, infotainment and navigation systems. In order to operate smoothly, these systems depend on the software installed on the embedded automotive hardware.

Automotive Over-The-Air (OTA) Updates Market Opportunities:

-

The worldwide demand for EVs is growing.

During the estimate period, demand for electric vehicles is expanding quickly and this will moreover lead to an increment in request for over the discuss. The expanding government support in the form of grants and incentives to buy electric vehicles is a reason for this advancement. Subsequently, in order to ensure the highest level of safety and security as well as compelling operation, about all electric vehicles are prepared with modern interconnected systems.

Automotive Over-The-Air (OTA) Updates Market Segment Analysis:

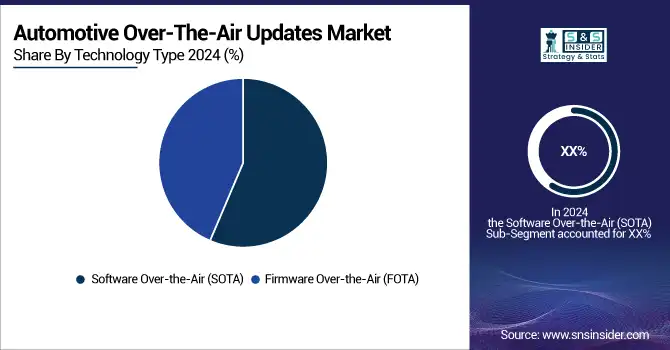

By Technology Type:

The Software Over-the-Air (SOTA) update sub-segment dominates the Automotive Over-the-Air (OTA) Updates Market by technology type. SOTA updates deal with modifying a car's software, which encompasses a wider range of functionalities compared to Firmware Over-the-Air (FOTA) updates. Moreover, SOTA updates introduces new features like advanced driver-assistance systems, improved infotainment functionalities, and bug fixes in the car's operating system. This broader scope and focus on user experience make SOTA the dominant technology type in the current market landscape.

By Application:

The Telematics Control Unit (TCU) currently holds the leading position within the application segment of the Automotive Over-The-Air (OTA) Updates Market. TCUs act as the communication hub for connected car features, enabling functionalities like remote diagnostics, vehicle tracking, and emergency assistance. These updates ensure compatibility with evolving network standards and optimize the performance of connected car features. Additionally, the increasing adoption of electric vehicles, which heavily rely on telematics for battery management and charging optimization, further strengthens the dominance of the TCU segment in the Automotive OTA update landscape.

By Vehicle Type:

Passenger vehicles sub-segment dominates the Automotive Over-The-Air (OTA) Upgrades Market by vehicle type. Passenger vehicles represent a much bigger market share compared to commercial vehicles and electric vehicles. Thus, the developing centre on in-car innovation and advanced features like driver assistance system is essentially seen in passenger cars. Also, the increasing adoption of mid-range and premium passenger vehicles prepared with modern program systems further drives the request for OTA updates in this section.

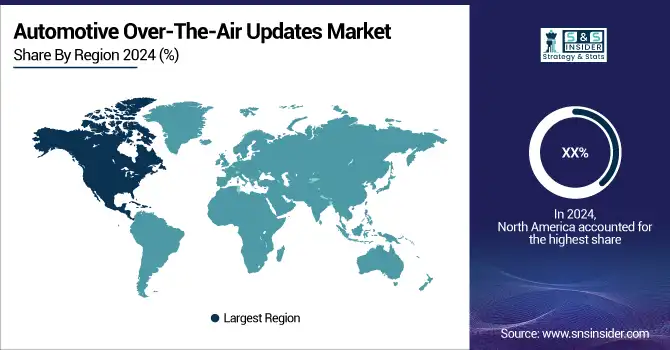

Automotive Over-The-Air (OTA) Updates Market Regional Analysis:

North America Automotive Over-The-Air (OTA) Updates Market Insights

North America currently dominating the Automotive Over-The-Air (OTA) Upgrades Market. This dominance is fueled by the presence of established automakers and technology companies actively adopting Automotive OTA updates. Additionally, legislative support for connected car technologies and a high density of electric vehicles, which heavily rely on OTA updates, contribute to North America's leadership. Europe is the second highest region in this market. Similar factors like a strong automotive industry, emphasis on technological innovation, and government regulations promoting connected car safety features drives the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Automotive Over-The-Air (OTA) Updates Market Insights

The Asia-Pacific region is projected to experience the most rapid growth in due to the rapid rise of the automotive industry in countries like China and India, coupled with a growing demand for connected car features and increasing government support for electric vehicle adoption.

Europe Automotive Over-The-Air (OTA) Updates Market Insights

Europe’s OTA updates market is driven by strong adoption of connected and electric vehicles, supported by EU regulations on vehicle safety, emissions, and cybersecurity. Automakers are leveraging OTA for real-time software enhancements, reducing recall costs, and improving user experience, while advancing autonomous driving and mobility-as-a-service ecosystems.

Latin America (LATAM) and Middle East & Africa (MEA) Automotive Over-The-Air (OTA) Updates Market Insights

LATAM and MEA are experiencing gradual adoption of OTA updates, fueled by rising connected vehicle penetration, urbanization, and expanding EV infrastructure. Automakers are increasingly using OTA to deliver software fixes and feature upgrades, enhancing vehicle performance. Growth is supported by government initiatives, though cost sensitivity and connectivity gaps remain challenges.

Automotive Over-The-Air (OTA) Updates Market Key Players:

Competitive Landscape for Automotive Over-The-Air (OTA) Updates Market:

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors N.V

- Verizon Communications, Inc.

- Airbiquity Inc

- Infineon Technologies AG

- Qualcomm Incorporated

- Intel Corporation

- HARMAN International

- Aptiv

- HERE Technologies

- BlackBerry QNX Software Systems Limited

- Garmin Ltd.

- Intellias Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.13 Billion |

| Market Size by 2032 | USD 19.29 Billion |

| CAGR | CAGR of 18% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Firmware Over-the-Air (FOTA), Software Over-the-Air (SOTA)) • by Application (Telematics Control Unit, Electronic Control Unit, Infotainment, Safety & Security, Others) • by Vehicle Type (Passenger Vehicles, Commercial vehicles, Electric vehicles) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, Continental AG, NXP Semiconductors N.V, Verizon Communications, Inc., Airbiquity Inc, Infineon Technologies AG, Qualcomm Incorporated, Intel Corporation, HARMAN International, Aptiv, HERE Technologies, BlackBerry QNX Software Systems Limited, Garmin Ltd., and Intellias Ltd |