Euro 7 Regulations Compliant Market Report Scope & Overview:

Get More Information on Euro 7 Regulations Compliant Market - Request Sample Report

The Euro 7 Regulations Compliant Market Size was valued at USD 2.60 billion in 2023 and is expected to reach USD 11.05 billion by 2032, growing at a CAGR of 17.48% over the forecast period 2024-2032.

The Euro 7 regulations are poised to revolutionize the automotive industry, driving technological innovation and fostering cleaner, more sustainable transportation solutions. As of 2023, the transportation sector is responsible for about 23% of global energy-related CO2 emissions and 28% of end-use energy emissions. Urban transport alone accounts for approximately 40% of end-use energy consumption. These statistics underline the urgent need to address emissions from transport, as CO2 remains in the atmosphere for over a century, significantly contributing to long-term global warming. In addition to CO2, black carbon is another critical pollutant that accelerates climate change, with a warming effect far more potent than CO2, though it stays in the atmosphere for only a few weeks. Reducing black carbon emissions is crucial for slowing the pace of global warming, and it also addresses the immediate health threats posed by particulate matter. Particulate pollution is linked to an increase in respiratory and cardiovascular diseases, contributing to higher mortality rates. The Euro 7 regulations aim to address these challenges by tightening emissions standards, targeting CO2, black carbon, and ground-level ozone.

One of the key drivers of the Euro 7 regulations is the promotion of alternative powertrains, specifically electric vehicles (EVs) and hybrid electric vehicles (HEVs). As car manufacturers strive to comply with these stricter emissions standards, the demand for low-emission and zero-emission vehicles is expected to grow. This shift will spur innovation in battery technology, charging infrastructure, and electric drivetrain components, creating new opportunities for investment and growth within the automotive industry. The Euro 7 regulations will also accelerate the transition toward electrification, making it a pivotal moment for the future of mobility. For regions outside the EU, Euro 7 will serve as a benchmark for setting similar environmental standards. As global awareness of climate change and air pollution increases, other countries may adopt similar regulatory frameworks, further driving the global development of cleaner vehicle technologies.

Euro 7 Regulations Compliant Market Dynamics

Drivers

-

With growing global concerns, organizations like the European Union (EU) face heightened demands to implement significant measures to tackle pollution and lower greenhouse gas emissions.

Euro 7 regulations aim to rectify the deficiencies of earlier emission standards (Euro 6) and further reduce the environmental effects of road transportation. The Euro 7 standards focus on lowering nitrogen oxide (NOx) emissions, particulate matter, and additional pollutants from vehicles, particularly those with diesel and gasoline engines. This has grown increasingly pressing since road transportation is among the major sources of air pollution, especially in city regions. The Euro 7 regulations will aid in reducing vehicle emissions, enhancing air quality, and supporting lasting public health advantages. The demand for tougher environmental regulations worldwide is compelling manufacturers to adjust to new criteria, thereby increasing the need for Euro 7-compliant vehicle technologies and solutions. The enactment of these regulations is in line with the EU's wider climate objectives, such as the European Green Deal, which strives for a carbon-neutral Europe by 2050. As global governments place increasing emphasis on sustainability, companies and automakers are required to adhere to updated emissions regulations, impacting the demand for technologies and products that fulfill Euro 7 standards.

-

As knowledge of environmental concerns expands, consumer demand for cleaner and more sustainable automobiles is on the rise.

Shoppers are growing more aware of the ecological effects of their buying choices and are progressively looking for sustainable options. This change in consumer habits is leading to the expansion of the Euro 7 regulations-compliant market, as producers need to adjust their product lines to align with the demands of eco-aware consumers. The popularity of electric vehicles (EVs) and hybrid vehicles, known for being more environmentally friendly than conventional internal combustion engine vehicles, is consistently increasing. Although Euro 7 regulations aim to lower emissions from various vehicle types, such as gasoline, diesel, and hybrids, they also present an opportunity for the expansion of electric vehicles and other low-emission options. Shoppers are seeking cars that provide lower emissions, improved fuel economy, and overall diminished environmental impacts. Furthermore, the public's understanding of the lasting health impacts of air pollution is affecting consumer buying choices. Substances like nitrogen oxides (NOx) and particulate matter are associated with respiratory and cardiovascular ailments, leading individuals to prefer vehicles that produce fewer emissions. Consequently, manufacturers are increasingly encouraged to create vehicles that meet Euro 7 standards, providing improved environmental performance to align with changing consumer preferences.

Restraints

-

A significant limitation to the Euro 7 regulations compliant market is the substantial expense of research and development (R&D) needed to adhere to the new emission standards.

Creating and evaluating cutting-edge technologies, including enhanced exhaust after treatment systems, upgraded fuel injection systems, and different powertrains, necessitates substantial investment from automotive manufacturers. Meeting Euro 7 standards involves intricate engineering solutions, leading to higher development expenses. For instance, the necessity to cut emissions even more while upholding vehicle performance and fuel efficiency adds extra pressure on manufacturers. Small and medium-sized manufacturers, especially, may find it challenging to cope with the financial strain of these R&D investments, which could hinder their competitiveness in the market. Furthermore, the necessary testing and certification procedures can be protracted and expensive. Manufacturers must ensure their vehicles comply with the strict Euro 7 standards before market sale, resulting in additional delays and higher expenses. The significant development expenses might be transferred to consumers as increased vehicle prices, potentially hindering the uptake of Euro 7-compliant vehicles, particularly in cost-sensitive markets.

Euro 7 Regulations Compliant Market Segmentation

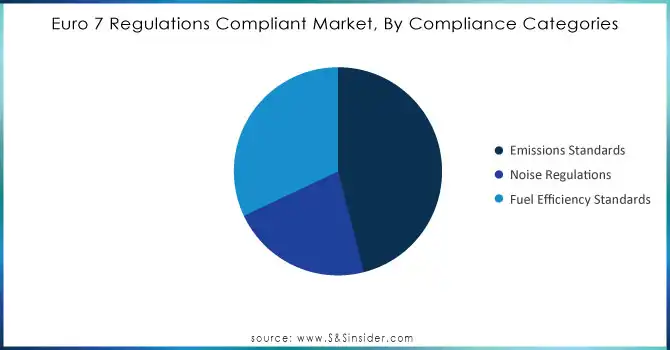

By Compliance Categories

Emissions standards led the market with 46% of the market share in 2023. These regulations seek to minimize harmful vehicle emissions, including carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter, to lessen environmental pollution and enhance air quality. As the Euro 7 regulations take effect, manufacturers must comply with more stringent emission limits than those set by earlier standards. Firms such as Bosch and Denso are significant contributors in this field, offering sophisticated technologies for exhaust after-treatment systems and engine management to guarantee compliance.

Fuel efficiency standards are expected to experience substantial growth from 2024 to 2032. Under the Euro 7 regulations, manufacturers are required to innovate to enhance fuel efficiency by using lighter materials, refining engine designs, and implementing advanced hybrid or electric technologies. The growth of this segment is driven by the rising global need for energy-efficient and economical vehicles due to environmental worries and escalating fuel costs. Firms such as Toyota and Volkswagen are at the forefront of fuel-efficient innovations, utilizing technologies like hybrid powertrains, lightweight materials, and regenerative braking systems.

Need Any Customization Research On Euro 7 Regulations Compliant Market - Inquiry Now

By Vehicle Type

In 2023, passenger vehicles dominated the Euro 7 regulations-compliant market, accounting for 42% of the market share. The Euro 7 regulations require car manufacturers to lower emissions of harmful substances, including nitrogen oxides (NOx) and particulate matter (PM), necessitating that passenger vehicles use advanced technologies such as electric power, hybrid systems, and improved exhaust treatments. Firms like Volkswagen Group and Toyota have taken the lead in advancing these technologies for compliance, which includes integrating hybrid engines and creating electric vehicle (EV) platforms. Volkswagen's ID series and Toyota's Prius serve as examples of cars built with Euro 7-compliant technologies, demonstrating advancements in fuel efficiency and reduced emissions.

Light commercial vehicles (LCVs) are expected to become the fastest-growing segment between 2024 and 2032. As Euro 7 regulations aim to implement tighter emission standards, LCV manufacturers are quickly embracing cleaner technologies like electric powertrains and alternative fuel systems. This trend is backed by firms such as Mercedes-Benz with their eSprinter electric van and Ford with the fully electric E-Transit van. These vehicles serve companies that need low-emission options for city deliveries, aligning with sustainability objectives. As the demand for zero-emissions transportation in urban areas grows, LCVs are poised to grow quickly as regulations advocate for cleaner options in commercial transport.

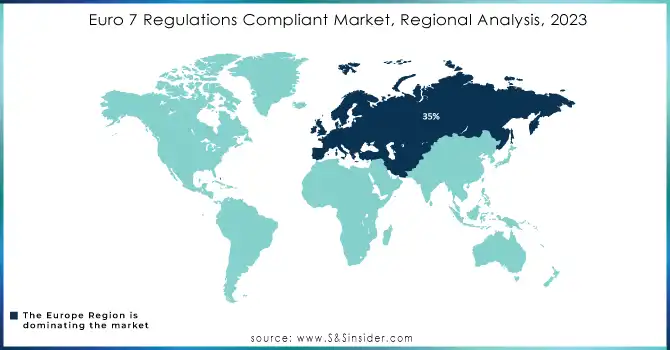

Euro 7 Regulations Compliant Market Regional Analysis

Europe dominated the Euro 7 regulations compliant market in 2023, accounting for approximately 35% of the market share. The introduction of the Euro 7 regulations in Europe is pivotal, focusing on lowering pollutants from vehicles through advanced emission control technologies, such as selective catalytic reduction (SCR) and diesel particulate filters (DPF). Major automotive manufacturers in countries like Germany, the UK, and France are rapidly adopting these technologies to meet compliance standards, benefiting companies like FORVIA, Tenneco, and Johnson Matthey, which offer emission control products tailored for Euro 7 compliance.

North America is expected to be the fastest-growing region in the Euro 7 Regulations Compliant Market from 2024 to 2032, driven by increasing regulatory pressures and the gradual alignment with stricter global emission standards, including Euro 7. U.S. manufacturers are increasingly focusing on adopting sustainable and innovative technologies to meet both regional and international emission standards, particularly in light of the U.S. Environmental Protection Agency's (EPA) more stringent requirements. Companies like Tenneco and Johnson Matthey are already contributing to this transition by offering advanced catalytic converters and filtration systems tailored to North American needs.

Key Players in Euro 7 Regulations Compliant Market

The major key players in the Euro 7 Regulations Compliant Market are:

-

Bosch (Diesel fuel injectors, Gasoline direct injectors)

-

Continental (Air management system, Exhaust gas sensors)

-

Magneti Marelli (Emissions control systems, Catalytic converters)

-

Denso (NOx sensors, EGR valves)

-

Valeo (Exhaust gas recirculation valves, Sensors)

-

Delphi Technologies (Fuel injectors, Engine control modules)

-

ZF Friedrichshafen (Transmission systems, Emission reduction systems)

-

Hella (Oxygen sensors, Catalytic converters)

-

Faurecia (Selective catalytic reduction systems, Exhaust gas after-treatment)

-

Honeywell (Turbochargers, Exhaust gas recirculation systems)

-

BorgWarner (Turbochargers, Electronic control systems)

-

Cummins (Selective catalytic reduction systems, Diesel particulate filters)

-

Schaeffler (Engine components, Emission control systems)

-

Aisin Seiki (Emission control systems, Automatic transmission components)

-

Mann+Hummel (Air filters, Emission control components)

-

Mahle (Pistons, Filters)

-

Tenneco (Exhaust systems, Catalytic converters)

-

Wabco (Emission control sensors, Exhaust after-treatment)

-

Eberspächer (Exhaust systems, Diesel particulate filters)

-

Johnson Matthey (Catalysts, Emission control technologies)

Suppliers Providing Components:

-

Siemens (Software for emission control and engine management)

-

Infineon Technologies (Sensors for exhaust gas measurement)

-

Autoliv (Airbags and safety sensors for vehicle systems)

-

STMicroelectronics (Microcontrollers for emission management systems)

-

NXP Semiconductors (Vehicle electronics, Emission control chips)

-

Renesas Electronics (Microcontrollers for engine control systems)

-

Texas Instruments (Sensors, control systems)

-

Eaton (Emission control and filtration components)

-

Ricardo (Engine software solutions, Performance optimization tools)

-

AVL List GmbH (Powertrain simulation software)

Recent Developments

-

July 2024: Bosch has created a test bench for measuring brake emissions that surpasses the standards set by Euro 7.

-

April 2024: Honeywell announced today that Bosch's latest series of heat pumps will use Honeywell's energy-efficient Solstice refrigerant, which has a low global warming potential (GWP).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.60 Billion |

| Market Size by 2032 | USD 11.05 Billion |

| CAGR | CAGR of 17.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Compliance Categories (Emissions Standards, Noise Regulations, Fuel Efficiency Standards) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) • By Engine Type (Internal Combustion Engine, Hybrid Engine, Electric Engine) • By Technology (Exhaust Aftertreatment, On-Board Diagnostics, Alternative Fuels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Continental, Magneti Marelli, Denso, Valeo, Delphi Technologies, ZF Friedrichshafen, Hella, Faurecia, Honeywell, BorgWarner, Cummins, Schaeffler, Aisin Seiki, Mann+Hummel, Mahle, Tenneco, Wabco, Eberspächer, Johnson Matthey |

| Key Drivers | • With growing global concerns, organizations like the European Union (EU) face heightened demands to implement significant measures to tackle pollution and lower greenhouse gas emissions. • As knowledge of environmental concerns expands, consumer demand for cleaner and more sustainable automobiles is on the rise. |

| RESTRAINTS | • A significant limitation to the Euro 7 regulations compliant market is the substantial expense of research and development (R&D) needed to adhere to the new emission standards. |