Automotive E-Axle Market Report Scope & Overview:

Get More Information on Automotive E-axle Market - Request Sample Report

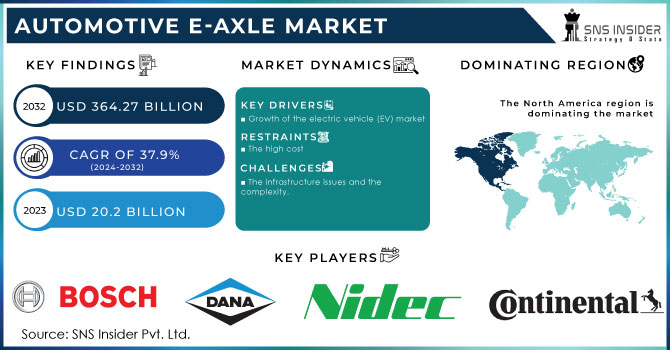

The Automotive E-axle Market is expected to reach USD 364.27 Bn by 2032, the base value of the market was recorded USD 20.2 Bn in 2023, the CAGR is expected to be 37.9% over the forecast period of 2024-2032.

E-axles are small, multi-component modules that save room in the vehicle's chassis. This makes it possible to create more adaptable vehicle designs and packaging, as well as to make room for batteries. By combining the motor and transmission, they are able to minimise the number of moving parts in the powertrain system. This may result in greater dependability and less need for maintenance. E-axles can increase powertrain efficiency by lowering the energy losses connected to conventional powertrains. Internal combustion engines are less efficient at delivering power across a larger RPM range than electric motors. Regenerative braking systems, which can be included into E-axles, absorb and transform kinetic energy into electricity during braking, improving overall energy efficiency. E-axles can improve a vehicle's performance by delivering rapid torque and smooth power distribution, which helps the car accelerate quickly and handle well. E-axles in fully electric cars contribute zero to the reduction of greenhouse gas emissions and the fight against climate change.

E-axles are versatile and can be made to match a variety of vehicle platforms and power needs, making them suited for a variety of vehicle types, from compact cars to SUVs. E-axles can be used to power both the front and back axles of a car, enabling all-wheel drive (AWD) without the need for a separate mechanical connection. Advanced e-axle systems can offer torque vectoring, which distributes torque to individual wheels as efficiently as possible, increasing vehicle stability.

Market Dynamics

Driver

- Growth of the electric vehicle (EV) market

E-axle development is mostly fuelled by the rising demand for electric vehicles, which is fuelled by environmental concerns, governmental laws, and customer interest in clean and efficient transportation. An essential part of EV powertrains are e-axles. Automakers are being pushed to electrify their fleets of vehicles as a result of strict fuel economy and pollution regulations in several areas. E-axles increase powertrain efficiency and save emissions, which help to satisfy these regulations. E-axles contribute to extending the driving range of electric cars. They contribute to extending the range that electric vehicles can travel on a single charge by optimising power delivery and raising energy efficiency, which is a major concern for consumers.

Restrain

- The high cost

Opportunity

Due to considerations including cheaper operating costs, a less environmental impact, and improved charging infrastructure, consumer interest in electric vehicles is rising. To meet this demand, automakers release more e-axle-equipped electric car models. The shift towards electrification in the car sector is motivated by worries about air quality and climate change. E-axles aid in lowering air pollution and greenhouse gas emissions. The creation of more effective and compact e-axles is made possible by ongoing developments in material science, electric motor, and power electronics technology.

Challenge

- The infrastructure issues and the complexity.

Impact of Recession

Due to considerations including cheaper operating costs, a less environmental impact, and improved charging infrastructure, consumer interest in electric vehicles is rising. To meet this demand, automakers release more e-axle-equipped electric car models. The shift towards electrification in the car sector is motivated by worries about air quality and climate change. E-axles aid in lowering air pollution and greenhouse gas emissions. The creation of more effective and compact e-axles is made possible by ongoing developments in material science, electric motor, and power electronics technology.

Impact of Russia Ukraine

Economic instability brought on by geopolitical conflicts can make it more difficult for companies that build e-axles to get funding for R&D and manufacturing growth. Unfavourable news about global events may affect the attitudes of consumers and investors. Consumers may be hesitant to purchase electric vehicles, and investors may be more cautious about investing in electric vehicle technologies.

To reduce the risks to the supply chain, several automakers may think about moving production and component sourcing out of conflict-ridden areas. This may have an effect on current e-axle production processes. Due to supply chain disruptions and economic uncertainties brought on by geopolitical crises, smaller electric vehicle startups may be especially vulnerable. They may have difficulties in creating electric vehicles with e-axles.

Market Segmentation

By Electric Vehicle Type

-

BEV

-

PHEV

By Vehicle Type

-

Passenger Cars

-

Commercial vehicles

By Drive Type

-

All Wheel Drive

-

Front Wheel Type

-

Rear Wheel Drive

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

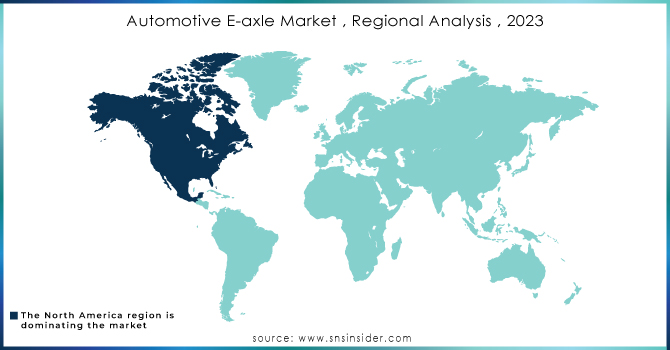

Regional Analysis

The adoption of electric vehicles has significantly increased in North America, especially in the United States, thanks to customer demand, environmental concerns, and government incentives. As manufacturers engage in electrified vehicle models, e-axle technology is becoming more and more important in the area. Mexico and Canada both have expanding markets for electric vehicles. Particularly in Canada, there has been a growth in demand for electric vehicles, and Mexico is a significant centre for the production of automotive parts, particularly e-axles.

APAC is the region which will be dominating the region because the world's largest and fastest-growing market for electric vehicles is China. The region's e-axles have been developed and produced as a result of the Chinese government's promotion of EV adoption and incentives for automakers.

To meet domestic and global demand, Japanese automakers are investing in electric and hybrid vehicle technology, including e-axles. Home to significant automakers with an emphasis on electrification, South Korea is a crucial market for e-axle technology. As more automakers release electrified models, the Indian market for electric vehicles is rapidly expanding, and e-axles are becoming increasingly significant. A number of Southeast Asian nations are only beginning to adopt electric vehicles, and e-axle technology is expected to contribute to the region's expanding electric vehicle market.

Need any customization research on Automotive E-axle Market - Enquiry Now

Key Players

The major key players are Dana Limited, Robert Bosch, Nidec Corporation, Continental AG, ZF Friedrichshafen AG, GKN Automotive Limited, Schaeffler AG, AxleTech, Linamar Corporation, Magna International and others.

Recent Development

Dana Limited: The company has launched e-Axles for class 7 & 8 vehicles, the objective behind the product development is to expand commercially available heavy duty powertrain offerings.

Nidec Corporation: Nidec and Renesas has strategically collaborated to increase the production of semiconductor solution for the next generation E-axle.

| Report Attributes | Details |

| Market Size in 2023 | US$ 20.2 Bn |

| Market Size by 2032 | US$ 364.27 Bn |

| CAGR | CAGR of 37.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Electric Vehicle Type (BEV, PHEV), • By Vehicle Type (Passenger Cars, Commercial vehicles), • By Drive Type (All Wheel Drive, Front Wheel Type, Rear Wheel Drive), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dana Limited, Robert Bosch, Nidec Corporation, Continental AG, ZF Friedrichshafen AG, GKN Automotive Limited, Schaeffler AG, AxleTech, Linamar Corporation, Magna International |

| Key Drivers | • Growth of the electric vehicle (EV) market |

| Market Restraints | • The infrastructure issues and the complexity. |