Automotive Human Machine Interaction Market Report Scope & Overview:

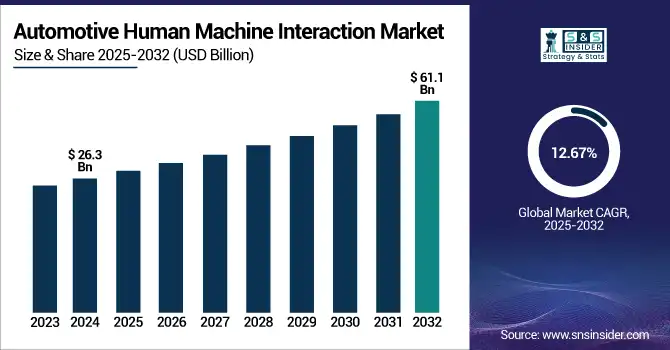

The Automotive Human Machine Interaction Market size was valued at USD 26.3 billion in 2024 and is expected to reach USD 61.1 billion by 2032, growing at a CAGR of 11.1% during 2025-2032.

To Get more information on Automotive Human Machine Interaction Market - Request Free Sample Report

The Automotive Human Machine Interaction Market is witnessing rapid evolution, driven by the integration of advanced digital technologies such as AI, AR, and voice recognition. Increasing consumer demand for safer, more intuitive driving experiences and the rise of connected and autonomous vehicles are fueling market expansion. Growth factors include rising adoption of infotainment systems, biometric interfaces, and multi-modal HMI solutions across electric and autonomous vehicles. OEMs are focusing on personalization and user-centric designs. According to Automotive Human Machine Interaction Market Analysis, the market is expected to grow significantly through 2032, supported by innovations in AI and cloud-based HMI systems. Emerging trends in the Automotive Human Machine Interaction Market include gesture control, emotion recognition, and haptic feedback, reshaping the future of in-vehicle communication and enhancing driver-vehicle synergy.

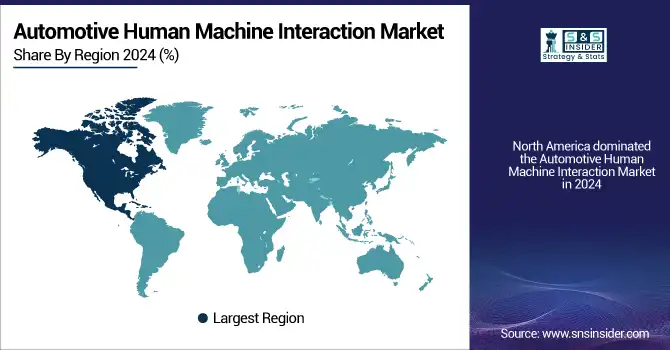

In 2024, the U.S. commands a dominant 78% revenue share of the North American Automotive Human Machine Interaction Market, driven by strong consumer demand for connected infotainment, advanced safety systems, and intuitive interfaces. Growth is fueled by the rapid adoption of electric and autonomous vehicles, integration of AI/ML, voice and gesture recognition, and augmented reality HUDs.

Market Dynamics:

Drivers:

-

Increased Demand for Smarter, Safer Driving Experiences is Accelerating the Adoption Of Advanced HMI Technologies.

The growing integration of connected technologies and autonomous features in vehicles is significantly boosting the Automotive Human Machine Interaction (HMI) Market. Consumers now expect seamless digital experiences, pushing OEMs to embed voice, gesture, and AI-based interfaces into vehicles. Autonomous driving requires advanced HMIs to ensure safe communication between the driver and the vehicle system. Furthermore, infotainment, real-time navigation, and personalized controls are becoming standard expectations. With the shift towards Level 3–5 autonomy, systems such as AR head-up displays and intelligent voice assistants are increasingly essential, driving market adoption across premium and mid-range vehicles. This surge in intelligent vehicular infrastructure directly fuels HMI innovation and deployment.

Restraints:

-

The Expensive Hardware and Software Required for Advanced HMI Systems Limits Adoption in Budget Vehicles.

Despite growing demand, the high cost associated with integrating advanced HMI systems poses a significant challenge for widespread adoption. Technologies like AI, haptic feedback, AR displays, and biometric recognition require sophisticated sensors, processors, and software, driving up production costs. These expenses are particularly burdensome for economy and mid-range vehicle manufacturers, limiting accessibility for mass-market consumers. Moreover, continual system upgrades and the need for cybersecurity add to lifecycle costs. Smaller OEMs and Tier-2 suppliers may struggle to keep pace with the rapid advancements due to resource constraints. This cost barrier may delay adoption in price-sensitive regions, slowing overall market penetration despite strong innovation trends.

Opportunities:

-

Advancements in AI And Cloud Connectivity Enable Personalized, Scalable, and Upgradeable HMI Solutions.

The rising integration of artificial intelligence (AI) and cloud connectivity into HMI platforms presents a major opportunity for market growth. AI enables predictive user behavior analysis, voice personalization, real-time emotion detection, and adaptive system responses, elevating the in-vehicle experience. When combined with cloud-based infrastructure, HMIs can support over-the-air updates, remote diagnostics, and dynamic content delivery, reducing the need for physical upgrades. This also allows for integration with smart home systems, digital assistants, and mobility platforms. As EVs and autonomous vehicles continue to rise, AI and cloud-powered HMIs will become the foundation for next-generation vehicle interfaces, offering scalability, personalization, and improved safety features.

Challenges:

-

Growing Data Usage in Connected HMIs Raises Concerns Over Hacking, User Privacy, And Regulatory Compliance.

As vehicles become more connected and reliant on cloud-based and AI-driven HMIs, cybersecurity and data privacy emerge as critical challenges. These systems collect vast amounts of personal and behavioral data, making them attractive targets for hackers. Unauthorized access can compromise vehicle control systems, endanger passenger safety, and violate user privacy. Inadequate encryption, outdated software, and unsecured networks further elevate risk. Regulatory bodies are increasing scrutiny on automotive data practices, requiring OEMs and tech providers to implement robust compliance strategies. Addressing these concerns involves high costs, continual software updates, and multi-layered security frameworks, which may hinder development timelines and affect user trust in digital vehicle interfaces.

Segmentation Analysis:

By Interface Type:

Touch-Based Interfaces dominated the Automotive Human Machine Interaction Market in 2024 and accounted for significant revenue share, due to their widespread integration in infotainment systems and dashboard controls. Their intuitive design, affordability, and consumer familiarity drive high adoption across all vehicle types. With strong OEM preference and consistent demand in both premium and mass-market vehicles, this segment maintains the largest market share globally.

The Augmented Reality (AR) Interface segment is expected to register the fastest CAGR, driven by rising integration in head-up displays (HUDs) and ADAS systems. Enhanced safety, real-time navigation overlays, and immersive user experiences are fueling its adoption. As autonomous and electric vehicles evolve, AR interfaces will become central to driver assistance, user engagement, and next-generation vehicle communication.

By Product Type:

Infotainment Systems dominated the Automotive Human Machine Interaction Market in 2024 and represented significant revenue share, due to their central role in delivering media, navigation, and connectivity. Increasing demand for integrated smartphone functions, voice assistants, and in-car entertainment boosts their presence across all vehicle categories. OEMs prioritize infotainment upgrades, ensuring continued dominance in both premium and economy vehicles through 2032.

Head-Up Displays (HUDs) are projected to witness the fastest CAGR, driven by growing adoption in advanced driver assistance systems (ADAS) and premium vehicles. Enhanced safety through real-time projection of navigation, speed, and alerts directly onto the windshield is a key driver. As AR and Level 2–3 autonomy expand, HUDs will become standard in next-gen vehicles.

By Technology:

Visual Interface dominated the Automotive Human Machine Interaction Market in 2024, due to widespread integration of digital displays, touchscreens, and HUDs across vehicle interiors. Their intuitive design, real-time data visualization, and enhanced driver awareness make them essential. With increasing screen size, resolution, and AR integration, visual interfaces will continue leading in both luxury and mainstream vehicles.

Artificial Intelligence & Machine Learning Integration is expected to register the fastest CAGR during the forecast period, driven by rising demand for personalized, predictive, and adaptive in-vehicle experiences. AI enhances voice recognition, driver behavior prediction, and emotion detection. As vehicles shift toward automation and connected ecosystems, AI-driven HMI systems will become central to next-generation automotive intelligence and user interaction.

By Vehicle Type:

Passenger Cars dominate the Automotive Human Machine Interaction Market in 2024 and accounted for significant revenue share, due to high production volumes and growing consumer demand for advanced infotainment, safety, and comfort features. Widespread adoption of touchscreens, voice controls, and digital dashboards in both economy and premium segments sustains this lead. OEMs continuously upgrade HMIs in passenger cars, ensuring their dominance through 2032.

Autonomous Vehicles (Level 3–5) are projected to register the fastest CAGR, driven by the need for intelligent, hands-free HMI systems that ensure safety and user engagement. AI-powered voice assistants, AR HUDs, and gesture controls are critical for non-driving tasks. As autonomy advances, HMI innovations will be central to vehicle-user interaction in self-driving environments.

By Sales Channels:

OEMs (Factory-Fitted) dominated the Automotive Human Machine Interaction Market in 2024 as automakers increasingly integrate advanced HMI technologies during vehicle production. Built-in infotainment, HUDs, and digital clusters are now standard, especially in premium and mid-range models. Strong OEM partnerships with tech firms ensure cutting-edge, brand-specific HMI solutions, reinforcing factory-fitted dominance across global automotive markets through 2032.

Aftermarket Upgrades are expected to register the fastest CAGR, driven by rising consumer demand for cost-effective enhancements in older vehicles. Users seek to retrofit infotainment systems, HUDs, and voice assistants without buying new cars. Increasing availability of plug-and-play HMI kits and growing interest in digital personalization will accelerate aftermarket growth, particularly in developing and tech-savvy regions.

Regional Analysis:

North America dominated the Automotive Human Machine Interaction Market in 2024 and accounted for significant revenue share, due to high adoption of advanced vehicle technologies, strong presence of leading OEMs, and a tech-savvy consumer base. The U.S. alone accounts for a major share, supported by the rapid rollout of autonomous features, infotainment systems, and AI-integrated platforms. High spending power, regulatory focus on driver safety, and robust R&D investments ensure continued dominance of North America in the global HMI landscape through 2032.

Asia-Pacific is expected to register the fastest CAGR in the Automotive Human Machine Interaction Market, driven by surging vehicle production, growing urbanization, and increasing demand for connected and electric vehicles, particularly in China, India, Japan, and South Korea. Government initiatives promoting EV adoption and digitalization in the automotive sector are accelerating HMI integration. Rising consumer expectations for in-car technology and expanding automotive OEM operations make Asia-Pacific a hotspot for future HMI growth.

The European Automotive Human Machine Interaction Market is experiencing steady growth driven by stringent EU safety regulations, strong demand for premium vehicles, and rising investments in electric and autonomous mobility. Automakers are increasingly integrating advanced HMIs such as AR-based HUDs, AI-powered voice controls, and biometric systems to meet consumer expectations for enhanced safety and comfort. Europe’s focus on sustainable transportation and smart mobility further fuels demand.

Germany leads the European Automotive HMI Market due to its robust automotive manufacturing base, presence of global OEMs (like BMW, Audi, and Mercedes-Benz), and high investment in R&D. German automakers are pioneering the integration of multi-modal HMI systems in luxury and electric vehicles, including AI, gesture control, and AR interfaces.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major Automotive Human Machine Interaction Market companies are Robert Bosch GmbH, Continental AG, Denso Corporation, Panasonic Corporation, Valeo SA, Visteon Corporation, Harman International, Aptiv PLC, Alps Alpine Co. Ltd., Magna International Inc. and others.

Recent Developments:

-

In Dec 2024, Continental AG showcased its “Intelligent Vehicle Experience Car” at CES 2025, featuring contactless biometric recognition for seamless, secure vehicle access and AI-powered intention detection.

-

In Jan 2025, Continental AG introduced an “Emotional Cockpit” with a 1.3 m E‑Ink Prism display and customizable side-window projection system at CES 2025.

-

In April 2025, Continental AG at Auto Shanghai 2025 unveiled its Luna and Astra ADAS systems, a Central Light Computer, interactive displays, and a software‑defined “Road to Cloud” vehicle ecosystem.

| Report Attributes | Details |

| Market Size in 2024 | US$ 26.3 Billion |

| Market Size by 2032 | US$ 61.1 Billion |

| CAGR | CAGR of 11.1% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Interface Type (Touch-Based Interface, Gesture Recognition Interface, Voice Recognition Interface, Haptic Interface, Multi-Modal Interface, Augmented Reality (AR) Interface) • By Product Type (Instrument Cluster, Head-Up Display (HUD), Infotainment System, Steering-Mounted Controls, Rear Seat Entertainment System, Central Control Touch Panels) • By Technology (Visual Interface (Displays, HUDs), Acoustic Interface (Voice Control, Natural Language Processing), Haptic Feedback Systems, Artificial Intelligence & Machine Learning Integration, Biometric HMI (Face/Emotion Recognition), Cloud-Based Connected HMI Systems) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), Autonomous Vehicles (Level 3–5)) • By Sales Channel (OEMs (Factory-Fitted), Aftermarket Upgrades, Tier-1 Suppliers' Integrations). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH, Continental AG, Denso Corporation, Panasonic Corporation, Valeo SA, Visteon Corporation, Harman International, Aptiv PLC, Alps Alpine Co. Ltd., Magna International Inc. and others in the report |