Agricultural Tractors Market Report Scope & Overview:

Get More Information on Agricultural Tractors Market - Request Sample Report

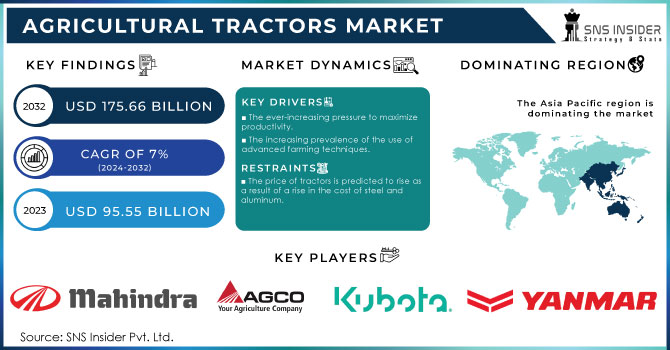

The Agricultural Tractors Market Size was valued at USD 95.55 billion in 2023 and is expected to reach USD 175.66 billion by 2032 and grow at a CAGR of 7% over the forecast period 2024-2032.

A power-driven vehicle with engineering functions that are dependent on its tractive power, the agricultural tractor is used in farming. It was developed specifically for use in a variety of agricultural contexts, including pulling or pushing agricultural machinery or trailers for plowing, tilling, disking, harrowing, planting, and spraying or pesticide applications, among other agricultural chores. It is designed to tow or push agricultural equipment or trailers and can perform a variety of agricultural chores, such as harrowing and planting seeds as well as spraying insecticide. Due to the fact that they supply the power and traction necessary to mechanize agricultural operations, tractors are also known as farm vehicles in today's modern world.

As of the latest market analysis, the Agricultural Tractors Market is experiencing a dynamic landscape characterized by technological advancements and a growing focus on sustainability. The demand for agricultural tractors has surged owing to the increasing global population and the need for enhanced productivity in the agricultural sector. Precision farming and autonomous tractor technologies are gaining momentum, revolutionizing traditional farming practices. Sustainable and eco-friendly features, such as electric and hybrid tractor models, are becoming more prevalent as the industry aligns with environmental concerns. Additionally, the integration of smart farming solutions and data-driven analytics is fostering greater efficiency in crop management. With a wave of innovation sweeping the sector, the Agricultural Tractors Market reflects a promising future driven by technological breakthroughs and a commitment to sustainable agriculture.

Agricultural Tractors Market Dynamics:

KEY DRIVERS:

-

The ever-increasing pressure to maximize productivity.

-

The increasing prevalence of the use of advanced farming techniques.

-

Growing demand for efficiency and an increase in the use of smart farming technologies.

The Agricultural Tractors Market is experiencing a significant surge in demand, fueled by a growing emphasis on efficiency and the widespread adoption of smart farming technologies. Farmers and agricultural businesses are increasingly recognizing the transformative potential of advanced tractor systems that integrate artificial intelligence, precision agriculture, and data analytics. These smart farming solutions enable real-time monitoring, data-driven decision-making, and optimized resource utilization, resulting in enhanced productivity and sustainability. As the agricultural sector evolves towards a more technologically-driven landscape, the demand for modern and intelligent tractor solutions continues to rise, marking a pivotal shift in the traditional practices of farming towards a more connected and efficient future.

RESTRAINTS:

-

The price of tractors is predicted to rise as a result of a rise in the cost of steel and aluminum.

-

The expansion of the market for tractor rentals will act as a brake on industry growth.

OPPORTUNITIES:

-

Promising public measures are expected to promote the market's growth over this time frame.

-

The need for precision agriculture equipment would give chances for industry players to build their businesses.

The demand for precision agriculture equipment presents a compelling opportunity for industry players to cultivate and expand their businesses within the Agricultural Tractors Market. As modern farming practices continue to evolve, there is an increasing recognition of the benefits derived from precision agriculture, such as improved efficiency, reduced resource wastage, and enhanced yield outcomes. Agricultural tractors equipped with advanced technologies, including GPS guidance systems, sensors, and data analytics, play a pivotal role in facilitating precision farming. This burgeoning trend not only addresses the pressing need for sustainable agricultural practices but also opens avenues for innovation and market growth. Companies that invest in and develop cutting-edge precision agriculture equipment stand poised to carve out a niche in this dynamic market, capitalizing on the growing awareness and adoption of smart farming solutions worldwide.

CHALLENGES:

-

A lack of semiconductors and supply chain interruption are all affecting OEMs right now.

-

Uncertainty about the tractor industry's demand and supply networks.

Agricultural Tractors Market Segmentation Overview:

Market, By Type:

The global market has been divided into Orchard Tractors, Row-crop Tractors, and Other Tractors based on the type segment. It's estimated that row-crop tractors are the most popular type of agricultural tractor in the world. Some of the biggest names in the industry are investing heavily in R&D in order to keep up with the competition and develop cutting-edge products.

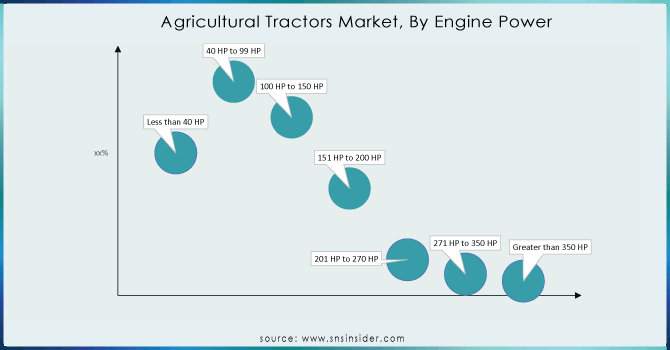

Market, By Engine Power:

The global market has been divided into Less than 40 HP, 40 HP to 99 HP, 100 HP to 150 HP, 151 HP to 200 HP, 201 HP to 270 HP, 271 HP to 350 HP, and Greater than 350 HP based on the engine power segment. In terms of volume, the less than 40 HP sector accounted for more than 61% of the market. The significant growth may be attributable to the low cost, compact size, and greater convenience offered by tractors with less than 40 horsepower to manage all core farm operations.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Less than 40 HP: This segment holds the largest market share, accounting for around 20-45% of the market. This dominance is attributed to several factors. These tractors are the most cost-effective option, making them accessible to small and medium-sized farmers, especially in developing regions like Asia Pacific.Their smaller size makes them suitable for navigating smaller farms and performing efficient operations in tight spaces.

Market, By Drive Type:

The global market has been divided into 2WD, 4WD, and Autonomous based on the drive type segment. In terms of volume, the 2WD sector accounted for more than 79.5 percent of the market. The section is also expected to grow at the fastest rate over the projection period. Long-term factors that are likely to promote demand in the 2WD class include lower upfront costs and improved maneuverability.

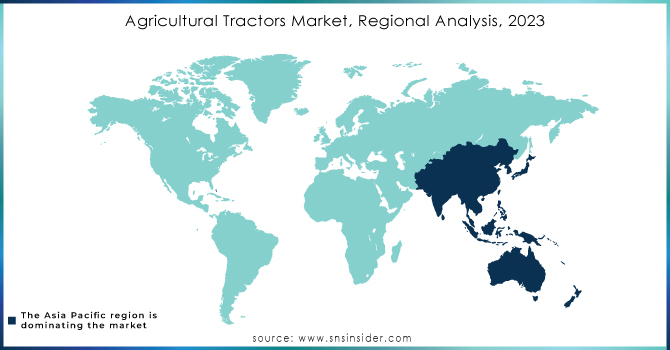

Agricultural Tractors Market Regional Analysis:

The global agricultural tractors market is projected to witness significant growth, driven by factors like rising concerns over food security, increasing disposable incomes in developing economies, and growing adoption of precision farming techniques. However, regional variations exist. The Asia Pacific region, led by China and India, is expected to dominate the market due to the presence of vast agricultural landholdings, rising government support for farm mechanization, and a growing demand for low-powered tractors suitable for small farms. In contrast, North America and Europe are expected to witness slower growth due to market saturation and a shift towards high-powered tractors with advanced technologies like GPS guidance and automation, catering to larger farms and increasing labor shortages. This regional analysis highlights the diverse growth dynamics of the agricultural tractors market, emphasizing the influence of factors specific to each region.

KEY PLAYERS:

Some of the major agricultural tractors market players are:

-

Mahindra & Mahindra Ltd. - Mahindra Tractors, Arjun Novo, Jivo, Swaraj tractors

-

AGCO Corporation - Massey Ferguson, Fendt, Challenger, Valtra tractors

-

CNH Industrial N.V. - New Holland Agriculture tractors, Case IH tractors

-

Deere & Company - John Deere tractors (5, 6, 7, 8, and 9 Series)

-

Escorts Ltd. - Farmtrac tractors, Powertrac tractors

-

International Tractors Ltd. - Solis tractors

-

Kubota Corporation - Kubota compact and utility tractors (BX, L, M Series)

-

CLAAS KGaA mbH - CLAAS tractors (AXION, ARION, XERION Series)

-

Tractors and Farm Equipment Ltd. (TAFE) - Massey Ferguson tractors (under license), Eicher tractors

-

Yanmar Co., Ltd. - Yanmar compact and utility tractors

-

SAME Deutz-Fahr - SAME tractors, Deutz-Fahr tractors

-

Sonalika Group - Sonalika tractors

-

Argo Tractors S.p.A. - Landini tractors, McCormick tractors

-

Zetor Tractors a.s. - Zetor tractors

-

Lovol Heavy Industry Co., Ltd. - Lovol tractors

Recent Development:

-

Deere & Company: Announced a collaboration with Microsoft to develop and deploy autonomous tractor solutions at scale

-

CNH Industrial: Showcased its autonomous concept tractor featuring advanced obstacle detection and path planning capabilities at Agritechnica 2022.

-

AGCO Corporation: Unveiled the Fendt MOMENTUM autonomous tractor designed for automated harvesting and transport task.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 95.55 Billion |

| Market Size by 2032 | US$ 175.66 Billion |

| CAGR | CAGR of 7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Orchard Tractors, Row-crop Tractors, Other Tractors) • by Engine Power (Less than 40 HP, 40 HP to 99 HP, 100 HP to 150 HP, 151 HP to 200 HP, 201 HP to 270 HP, 271 HP to 350 HP, Greater than 350 HP) • by Drive Type (2WD, 4WD, Autonomous) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mahindra & Mahindra Ltd.; AGCO Corp.; CNH Industrial N.V.; Deere & Company; Escorts Ltd.; International Tractors Ltd, Kubota Corp.; CLAAS KGaAmbH; Tractors and Farm Equipment Ltd.; YanmarCo., Ltd. |

| Key Drivers | • The ever-increasing pressure to maximize productivity. • The increasing prevalence of the use of advanced farming techniques. |

| RESTRAINTS | • The price of tractors is predicted to rise as a result of a rise in the cost of steel and aluminum. • The expansion of the market for tractor rentals will act as a brake on industry growth. |