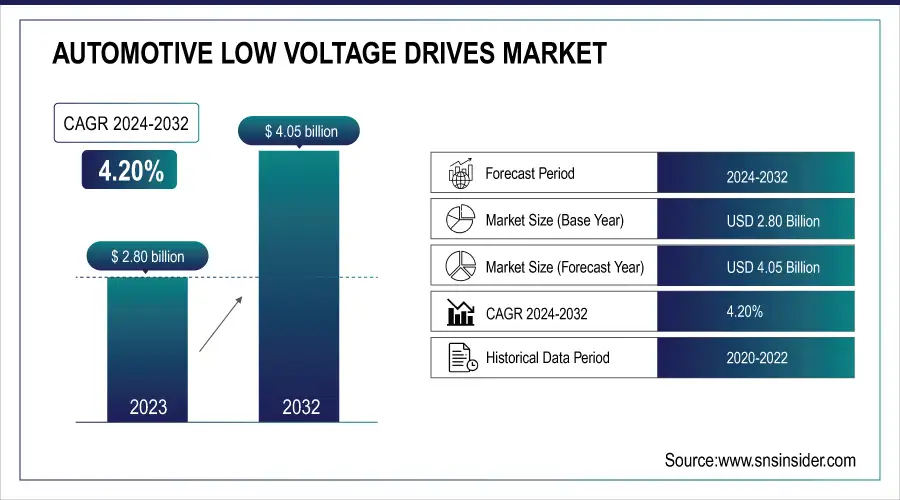

Automotive Low Voltage Drives Market Size & Growth:

The Automotive Low Voltage Drives Market was valued at USD 2.80 billion in 2023 and is expected to reach USD 4.05 billion by 2032, growing at a CAGR of 4.20% over the forecast period 2024-2032.

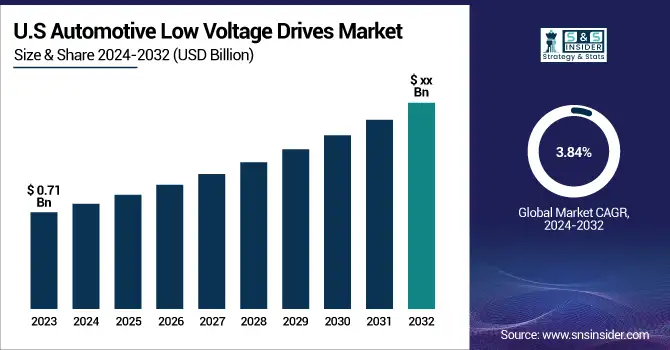

The Automotive Low Voltage Drives market is tapping into the effectiveness of fab/assembly line utilization rates, which is significantly aiding the optimization of the production process. This gives huge scope for energy saving, combined with better motor control and lesser power consumption. System-level Integration metrics focus on exciting vehicle performance improvements with system complexity reduction. Combined with AI, software-enhanced drive integration facilitates predictive maintenance, performance optimization, and adaptive control, making automotive applications even more efficient and reliable. The U.S. automotive low voltage drives market is driven by increased vehicle production, in 2023, around 10.6 million units will be manufactured, and also by a growing need for EVs. EV adoption and domestic battery supply chains are poised to benefit from government incentives, like the USD 370 billion investment under the Inflation Reduction Act. All of these create an added drive for low-voltage drive technologies in the U.S. automotive industry.

To Get more information on Automotive Low Voltage Drives Market - Request Free Sample Report

The U.S. Automotive Low Voltage Drives Market is estimated to be USD 0.71 Billion in 2023 and is projected to grow at a CAGR of 3.84%. Expanding automotive sector owing to rising need for energy efficient solutions in vehicles is propelling the growth of U.S. low voltage drives market in automotive applications. Such growth can be attributed to technology development in motor control and the expanding electric vehicle (EV) ecosystem, in addition to increasing demands for enhanced performance and energy efficiency in conventional and electric drivetrains.

Automotive Low Voltage Drives Market Dynamics

Key Drivers:

-

Driving Forces Behind Automotive Low-Voltage Drives Market Growth in Electric and Hybrid Vehicles

Expanded Demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) is one of the most prominent factors driving the automotive low voltage drives market since most components in EVs and HEVs rely on efficient and compact drive systems such as HVAC systems, power steering, and infotainment, low voltage drives for automotive are highly preferred. Moreover, growing regulations on fuel efficiency and emissions are forcing OEMs to adopt low-voltage drives to manage energy consumption throughout the vehicle subsystems. The expanding use of vehicle electrification, from electric pumps to compressors and auxiliary systems, only serves to drive the demand up even higher. Lower-voltage drive technology developments in power electronics and motor control systems are also improving the performance and efficiency of low-voltage drives, which are contributing to increased adoption.

Restrain:

-

Challenges in Integrating Automotive Low Voltage Drives with Advanced Vehicle Architectures and Systems

Integration of automotive low-voltage drives with modern vehicle architectures is one of the chief restraints in the automotive low-voltage drives market. As vehicles gain in sophistication with the addition of electronic control units (ECUs), sensors, and features driven by software, communicating and performing consistently across subsystems presents a major technical challenge. Additionally, ensuring reliability and safety in critical functionalities such as steering or braking necessitates extensive testing and validation, thereby prolonging product development and deployment.

Opportunity:

-

Opportunities in Automotive Low Voltage Drives Driven by Autonomous Vehicles and Smart Connected Systems

As autonomous vehicles and intelligent vehicle control systems gain traction, the market is creating new opportunities through the development of smart and connected drive systems. The widespread adoption of 48V in many new vehicles presents a new opportunity for low-voltage drive technologies that offer a sweet spot between cost, performance, and efficiency. There are fresh opportunities in emerging economies, especially in the Asia Pacific and Latin America, arising from rapid urbanization, growth in automotive production, and government initiatives encouraging the adoption of electric mobility. In addition to this, the growing implementation of IoT and AI in automotive systems is fuelling the requirements for accurate, responsive, and efficient drive solutions, which will further contribute to the growth of the automotive gearbox market in the coming years.

Challenges:

-

Harmonization and Engineering Challenges in Automotive Low Voltage Drive Technologies Across Vehicle Platforms

The other big issue is the harmonization of low-voltage drive technologies between various vehicle platforms and from different manufacturers. Due to the absence of common protocols and specifications, the focus of customization will lie with each model or brand due to compatibility issues. As systems continue to be packed tightly and operate at higher power levels, thermal management and EMI (electromagnetic interference) suppression in small automotive spaces are other distance-engineering challenges of the future. Lastly, in such a fast-changing tech scenario, manufacturers need constant investment in R&D to remain competitive, which requires skilled technical know-how and agility.

Automotive Low Voltage Drives Market Segment Analysis

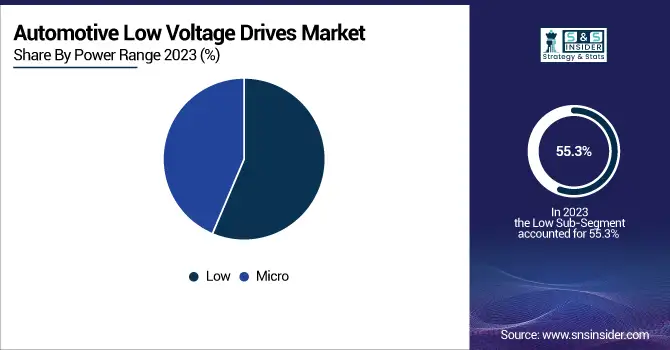

By Power Range

The Low power range segment accounted for the highest market share of 55.3% in 2023. These include HVAC systems, power steering, electric pumps, etc., for automotive applications, key automotive applications that support the prevalence of the low-power drives sector, thereby accounting for its dominance. These provide the same balance between performance and energy efficiency, serving both functions well, which is the reason they are more popular today and in modern cars or vehicles, particularly for those that are electric or hybrid.

The Micropower range segment is expected to have the fastest CAGR from 2024 to 2032. This growth can be attributed to the rising demand for compact electronic systems in vehicles, such as infotainment systems, electric mirrors, power windows, and seat actuators. In addition, the growing trend toward lightweight, energy-efficient vehicle architectures is creating opportunities for micro drives, wherein the ability to save space and energy is of utmost importance, particularly in compact cars and next-gen EVs.

By Drive

The automotive low-voltage drives market for AC drives had the largest share in 2023, contributing to 53.2% of the total revenue. This position is primarily caused by the high effectiveness, dependability, and wide range of scale utilization of wrench drives in car frameworks, for example, AC engines in HVAC, cooling fans, pumps, and footing frameworks for electric vehicles. The lower maintenance needs and compatibility with new vehicle architectures make them ideal for mass adoption across conventional or electric vehicle platforms.

The Servo drive segment is expected to register the fastest compound annual growth rate (CAGR) from 2024 to 2032. The growth is attributed to its increased demand for precise control in emerging vehicle systems such as automated driving, adaptive headlights, electronically controlled braking, and steering systems. Servo drives deliver leading speed, accuracy, and feedback control performance, which is critical for smart vehicle generations and highly automated functions going forward.

Automotive Low Voltage Drives Market Regional Analysis

In 2023, North America accounted for a 32.3% share of the automotive low-voltage drives market, primarily attributable to the presence of a large number of leading automakers in the region, early investment in automotive technology, and heavy demand for electric and hybrid vehicles in the region. Many of the OEMs and Tier-1 suppliers on the largest base in North America seek cutting-edge innovations in areas like vehicle electrification, energy efficiency, and other facets of smart mobility Tesla is an actual example that leverages low voltage AC drives in its EV models to drive systems such as battery cooling, HVAC, and traction motors. Energy-efficient drive technologies have been expanded in the region, given its strong R&D ecosystem as well as stringent emission regulations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific is expected to be the fastest-growing region from 2024 to 2032, owing to the growth of the automotive market, high adoption of EVs, and supportive government initiatives for electrification. Smart Mobility and Green Transportation Investments Smart mobility and green transportation are also garnering huge interest as countries like China, India, South Korea, and Japan have heavily invested in these functionalities in their automotive industry. BYD (China), a top EV manufacturer, incorporates a lot of low-voltage drives in its electric vehicles used for vehicle systems like battery management, climate control, and drive control. It is undoubtedly a major hotspot for future growth due to the region's low-cost manufacturing and growing consumer base.

Key Players in the Automotive Low Voltage Drives Market are:

-

Siemens AG (SINAMICS V20)

-

ABB Ltd (ACS150)

-

Schneider Electric (Altivar 12)

-

Rockwell Automation (PowerFlex 4M)

-

Mitsubishi Electric Corporation (FR-D700)

-

Yaskawa Electric Corporation (GA500)

-

Danfoss Group (VLT Micro Drive FC 51)

-

WEG Industries (CFW100 Mini Drive)

-

Hitachi Ltd (WJ200 Series)

-

Fuji Electric Co., Ltd. (FRENIC-Mini)

-

Toshiba Corporation (TOSVERT VF-S15)

-

Lenze SE (i500 Inverter)

-

Nidec Corporation (Commander C200)

-

SEW-Eurodrive (MOVITRAC B)

-

Delta Electronics, Inc. (VFD-E Series)

Recent Trends

-

In November 2024, ABB launched the ACS8080, a next-gen medium voltage drive offering up to 98% efficiency and advanced diagnostics for faster troubleshooting. Designed for versatile industrial use, it features improved motor control and ABB’s Crealizer software platform for enhanced performance.

-

In July 2024, Danfoss Power Solutions launched the ePanda eDrive, a compact and high-efficiency low-voltage drive designed for mobile work platforms. It delivers up to 94% efficiency and meets ISO 13849 safety standards.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.80 Billion |

| Market Size by 2032 | USD 4.05 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Range (Micro, Low) • By Drive (AC, DC, Servo) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, ABB Ltd, Schneider Electric, Rockwell Automation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Danfoss Group, WEG Industries, Hitachi Ltd, Fuji Electric Co., Ltd., Toshiba Corporation, Lenze SE, Nidec Corporation, SEW-Eurodrive, Delta Electronics, Inc. |