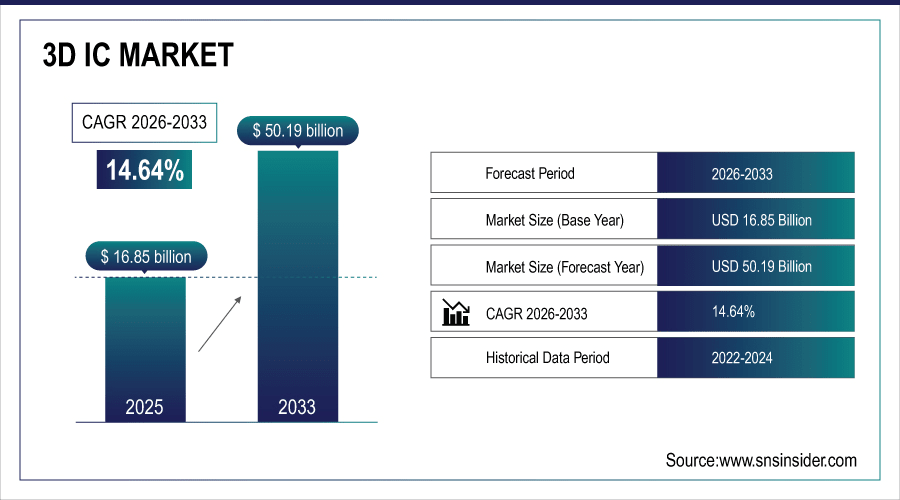

3D IC Market Size & Growth:

The 3D IC Market size was valued at USD 16.85 Billion in 2025E and is projected to reach USD 50.19 Billion by 2033, growing at a CAGR of 14.64% during 2026-2033.

The 3D IC Market is expanding due to the growing adoption of HPC, AI, and IoT that require significantly high bandwidth and low power capabilities along with advancements in chip manufacturing. Heterogeneous integration and Through-Silicon Via (TSV) technology continue to gain traction and facilitate faster data transfer and lower power. In addition, growing invasion in smartphones, data centre and automotive electronic systems is also contributing to the growth of the market.

70% of advanced AI/HPC chips now use some form of 3D integration (including CoWoS, InFO, Foveros, X-Cube)

To Get More Information On 3D IC Market - Request Free Sample Report

3D IC Market Trends

-

Increasing uptake of fast and smaller power consuming semiconductors is driving demand for 3D ICs in AI, 5G, HPC, and smartphones.

-

Advanced interconnect; technologies such as TSVs and hybrid bonding are enabling the 3D IC performance gains by lowering latency and increasing processing efficiency.

-

Growth of data centers and autonomous cars is driving the adoption of 3D ICs in the high-performance computing and automotive electronics spaces.

-

Increasing adoption of 3D ICs in AI accelerators, IoT devices, 5G networks is propelling latest app opportunities across the globe.

-

Significant R&D investments by leading players as well as the support provided by governments to semiconductor initiatives are driving innovation in 3D IC technology.

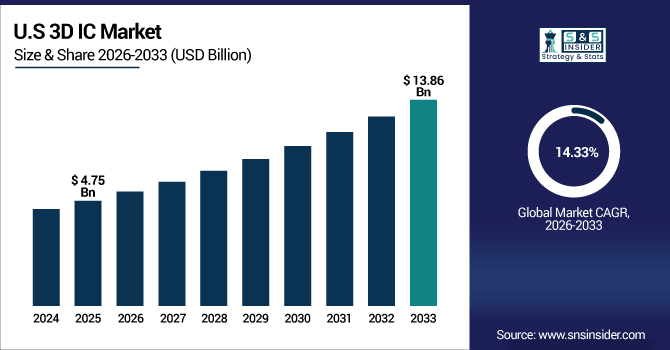

The U.S. 3D IC Market size was valued at USD 4.75 Billion in 2025E and is projected to reach USD 13.86 Billion by 2033, growing at a CAGR of 14.33% during 2026-2033. 3D IC Market growth is driven by increasing need for advanced packaging solutions in HPC, AI, and 5G devices. Several of US leading semiconductor and electronics companies like Intel, AMD and Micron are deeply working on 3D IC technology for better processing speed, low power and wearability. The growing demand for data centers and cloud computing infrastructure is driving 3D stacked memory and logic chip integration. Automotive, especially in electric and autonomous vehicles, is driving strong demand for small and fast 3D IC solutions.

3D IC Market Growth Drivers:

-

Rising Demand for High-Performance, Miniaturized, and Energy-Efficient Chips Across Diverse End-Use Applications.

Fast, compact and power efficient semiconductors are a driving force for the 3D IC Market. Strong demand driven by AI, 5G, HPC, and smartphones is increasingly adopting. TSVs and Hybrid Bonding Optimized for Performance and Latency 3D IC penetration increases with the growing installation of data centers and autonomous vehicles. Huge investments by the big players for R&D purposes also add to market growth.

3D ICs reduce interconnect length by up to 100x vs. 2D, cutting power by 15–40% and improving speed by 20–50%.

3D IC Market Restraints:

-

High Manufacturing Complexity, Yield Challenges, and Rising Cost of Advanced 3D IC Packaging Solutions

However, there are some restraints or challenges for 3D IC market due to complex manufacturing and yield considerations. Advanced packaging has expensive equipment to be involved with that, in the end, that pushes the cost of production up overall. Issues such as wafer alignment, thermal removing and defect density also by no means go away. High barriers to entry make it tough for smaller players to compete. These constraints hinder the uptake in the price sensitive markets.

3D IC Market Opportunities:

-

Growing Adoption of 3D ICs in AI, IoT, Automotive Electronics, and Next-Generation 5G Infrastructure

Growing use cases in AI accelerators, IoT, and autonomous vehicles provide strong prospects. Because 5G networks rely on high-performance, miniaturized chips for better connections. Bringing the memory and logic layers closer together leads to better performance for advanced computing applications. Innovation in 3D IC technology is being driven by government support and semiconductor programs. scatter” such elements creates huge opportunity in markets worldwide.

Each 5G base station uses 4–8 advanced RF modules, 70%+ of which use 3D IC packaging for size/performance.

3D IC Market Segment Analysis

-

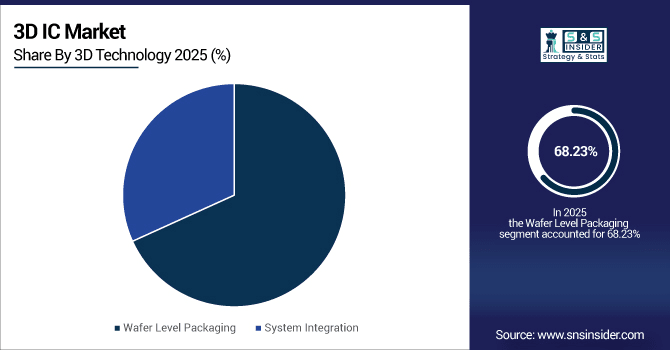

By 3D Technology, wafer-level packaging is forecasted to account for the largest share at 68.23% in 2025, whereas system integration will emerge as the fastest-growing technology with a CAGR of 14.79%.

-

By Product, sensors are expected to lead the 3D IC market in 2025 with an estimated share of 33.14%, while memories are projected to be the fastest-growing segment, recording a CAGR of 15.33%.

-

By Application, ICT/Telecommunication is anticipated to dominate the market with 34.65% share in 2025, whereas consumer electronics will witness the fastest growth with a CAGR of 15.92%.

-

By Component, through silicon vias (TSVs) are projected to hold the largest share at 46.32% in 2025, while through glass vias (TGVs) are expected to grow at the fastest CAGR of 15.16%.

By 3D Technology, Wafer Level Packaging Lead While Integrated System Integration Fastest

In 2025E, Wafer Level Packaging is still the leading market segment, thanks to the trend of miniaturization, performance enhancement and cost saving in electronic applications. Its unique scalability and unparalleled reliability make it very attractive for consumer and industrial applications. Meanwhile, the system integration market is growing as the fastest growing technology due to the increasing demand for heterogeneous integration, improved computing performance and effective interconnect solutions for emerging applications such as AI, 5G and automotive electronics.

By Product, Sensors Leads Market While Memories Registers Fastest Growth

In 2025E, Sensors continue to lead the 3D IC market given their key role in allowing real-time data processing and offering convenient integration in smart phones, autonomous vehicles and IoT. The fact of their converging functionality with minimal size is increasing the degree to which they are embraced in various areas. Indeed, memory is growing at the fastest rate as growth in cloud computing, artificial intelligence and high-performance computing creates an urgency for storage and processing that is faster and more energy-efficient.

By Application, ICT/Telecommunication Dominate While Consumer Electronics Shows Rapid Growth

In 2025E, ICT/telecommunication area continues to be the dominant application field for 3D ICs, being fueled by the increase of high-speed networking, fast 5G up take and continued increase in data transport capacity. Efficient, small, scalable semiconductor solutions are optimal for these technologies. Meanwhile, consumer electronics is seeing high growth rates, uptake of advanced smartphones, smart wearables, and gaming accessories is on the rise, all of which will benefit from 3D ICs to achieve better performance, increased battery lifetime, and better user experience.

By Component, Through Silicon Vias Lead While Through Glass Vias Registers Fastest Growth

In 2025E, Silicon Vias (TSVs) are the dominating component technology in 3D IC market, offering better vertical interconnections, higher bandwidth, and lower power consumption. Their use in higher-performance applications derives from their role in supporting advanced chip-stacking solutions. So far, Through Glass Vias (TGV) have been the fastest-growing component and are now being used in, for instance, radio-frequency, imaging, and optical devices because of their outstanding electrical properties and the ability to enable the next step in semiconductor packaging evolution.

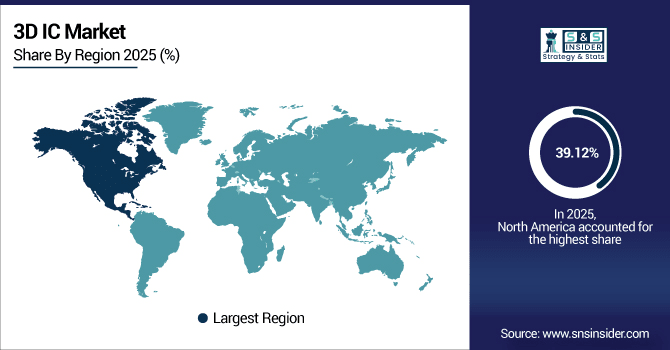

North America 3D IC Market Insights

In 2025E North America dominated the 3D IC Market and accounted for 39.12% of revenue share, this leadership is due to the R&D efforts in AI, HPC and cloud computing. R&D and advanced packaging are lead by key players including Intel, AMD, and Micron. Growing data centers and increasing demand for high-speed, energy-efficient semiconductors are driving growth. Compact and powerful 3D IC solutions are also appreciated in automotive and aerospace applications.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. 3D IC Market Insights

U.S. Holds Top Market Position in 3D IC The U.S. leads the 3D IC market in terms of innovation, as the market is highly impacted by the development and reliance on the semiconductor sector. The growth is being propelled by demand for cloud computing, A.I. accelerators and 5G infrastructure. The auto sector (EVs and autonomous in particular) is a key growth driver.

Asia-pacific 3D IC Market Insights

Asia-pacific is expected to witness the fastest growth in the 3D IC Market over 2026-2033, with a projected CAGR of 15.45% due to strong semiconductor manufacturing base in Taiwan, South Korea and Japan. Fast growth in electronics production and rising demand for smartphones and consumer devices are driving adoption. Key foundries and OSATs in region fast track advanced packaging capabilities. Growing spending on AI, 5G, and automotive electronics are also driving growth.

China 3D IC Market Insights

China is becoming an important market for 3D ICs with the growth of the electronics and semiconductor industry. Demand is also being driven by higher government investments and policies in favor of chips being produced locally. The advanced packaging market in Taiwan is further propelled with the country's emphasis on AI, IoT and 5G adoption.

Europe 3D IC Market Insights

In 2025E, Europe is growing continually on account of high demands across automotive, industrial and telecommunication sectors. Strong automotive and electronics sectors in Germany, France, and the U.K. make these countries key for adoption. A focus on energy-efficient chips dovetails with the region’s goal of promoting sustainability. Rising penetration of ADAS fuels 3D packaging demand.

Germany 3D IC Market Insights

Germany is among the key players that are accelerating the growth of the 3D IC market in Europe with the proliferation of world-class automotive and industrial electronics industry in the region. Chip demand is also being fueled by the rollout of ADAS, electric vehicle (EV) technology and Industry 4.0 solutions. More smaller and energy-saving semiconductors are being produced by Germany company.

Latin America (LATAM) and Middle East & Africa (MEA) 3D IC Market Insights

The 3D IC Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to developing regions for 3D ICs and there is slow penetration in consumer electronics, automotive and smart infrastructure. In Brazil, Mexico and Gulf countries, demand is being fueled by connected devices, industrial automation and digital transformation programs. Rising smartphone penetration and burgeoning cloud services landscape additionally contribute towards market potential.

3D IC Market Competitive Landscape:

IBM is leading the way in the development of the 3D IC market with its constant semiconductor research innovation. Company’s emphasis on heterogeneous integration, AI-based computing and quantum technologies are propelling 3D IC adoption. Working with premier foundries and research organizations, IBM is a first mover in advancing packaging that delivers unprecedented levels of connectivity and bandwidth for cloud computing, AI, 5G, as well as other data-intensive applications.

-

In May 2025, IBM and Deca Technologies entered an agreement to implement Deca’s M-Series fan-out interposer (MFIT™) production at IBM’s Bromont advanced packaging facility in North America

ASE Technology Holding Co., Ltd. is a world leading provider of outsourced semiconductor assembly and test, driving 3D IC integration with a broad array of technology platforms, including 3D SiP, 2.5D/2.5D Integration, PoP, and copper pillar. The Company specializes in advanced packaging technologies which are crucial for DIMM performance, including 2.5D/3D integration, and wafer level solutions.

-

In February 2025, ASE projected its advanced packaging and testing revenue to more than double to $1.6 billion, driven by surging global demand for AI chips.

Samsung is a leading force in the 3D IC market, a leader in memory and logic co-integration. Its patented eFlash, 3D NAND, high bandwidth memory (HBM), and through silicon via (TSV) design acceleration technologies enable fast, reliable product development. 3D IC commercialization headaches Samsung's extensive investment in R&D and mass production capabilities leads the 3D IC commercialization for worldwide smartphone, AI, cloud and automotive applications.

-

In June 2025, Samsung announced the availability of its silicon-proven 3D IC technology "X-Cube" for advanced process nodes (7 nm and beyond), enabling 3D SRAM-logic stacking via TSVs.

Key 3D IC Companies are:

-

IBM

-

STMicroelectronics

-

SAMSUNG

-

Taiwan Semiconductor Co., Ltd.

-

TOSHIBA CORPORATION

-

MonolithIC 3D Inc.

-

Intel Corporation

-

TEZZARON

-

Amkor Technology

-

Jiangsu Changdian Technology Co., Ltd.

-

United Microelectronics Corporation

-

Advanced Micro Devices, Inc.

-

ANSYS, Inc.

-

Cadence Design Systems, Inc.

-

EV Group (EVG)

-

SUSS MicroTec SE

-

Siliconware Precision Industries Co., Ltd.

-

Camtek

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 16.85 Billion |

| Market Size by 2033 | USD 50.19 Billion |

| CAGR | CAGR of 14.64% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Sensors, Memories, Logics, Light Emitting Diodes (LED) and Micro Electro Mechanical Systems (MEMS)) • By Application (Consumer Electronics, ICT/Telecommunication, Military, Automotive, Biomedical and Others) • By Component (Through Silicon Vias, Through Glass Vias, Silicon Interposer and Others) • By 3D Technology (Wafer Level Packaging and System Integration) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IBM, ASE Technology Holding Co., Ltd., STMicroelectronics, SAMSUNG, Taiwan Semiconductor Co., Ltd., TOSHIBA CORPORATION, Micron Technology, Inc., MonolithIC 3D Inc., Intel Corporation, TEZZARON, Amkor Technology, Jiangsu Changdian Technology Co., Ltd., United Microelectronics Corporation, Advanced Micro Devices, Inc., ANSYS, Inc., Cadence Design Systems, Inc., EV Group (EVG), SUSS MicroTec SE, Siliconware Precision Industries Co., Ltd., Camtek |