Electrical Resistor Market Size & Growth Trends:

The Electrical Resistor Market Size was valued at USD 5.92 billion in 2023 and is expected to reach USD 9.56 billion by 2032, growing at a CAGR of 5.51% over the forecast period 2024-2032. The Electrical Resistor Market finds that production capacity utilization is on the increase owing to the demand across consumer electronics, automotive, and industrial sectors resulting in manufacturers’ efforts to optimize efficiency. Innovation adoption curve Advanced resistor technologies such as thin-film and MEMS-based resistors keep entering the market at a rapid pace to meet the miniaturization and high-performance requirements.

To Get more information on Electrical Resistor Market - Request Free Sample Report

Exacting product customization and design wins are of great importance as OEMs strive for tailored solutions for specific applications that include EV power management and 5G infrastructure. On top of that, the integration rate of technology is escalating, and resistors are being integrated into new technologies like IoT devices/renewable energy systems and ADAS (advanced driver-assistance systems).

Electrical Resistor Market Dynamics

Key Drivers:

-

Surging Demand for Electrical Resistors Driven by EVs 5G Networks and Energy Efficiency Initiatives

The demand for electronic devices and equipment in different sectors such as automotive, consumer electronics, and industrial machinery is one of the key factors providing a boost to the growth of the Electrical Resistor Market. Fast production-switching from ICs to electric vehicles (EVs) is driving demand for resistors for many applications, from power supplies and inverters to electric motors. Also, transformers in communication technologies are being upgraded to more 5G network solutions that need precise power management which also builds a demand for resistors. The market is also flourishing due to government initiatives that provide funding and promote energy efficiency along with growing demand for advanced power distribution systems.

Restrain:

-

Miniaturization Precision and Environmental Regulations Challenge Growth in Electrical Resistor Market

The increasing complexity and demand for a smaller form factor for electronic appliances is one of the key restraints in the Electrical Resistor Market. The need for high precision and reliability but in a very small form factor as devices get smaller and smaller, creates challenges for design and manufacturing engineers for the resistors themselves. Further, these parts require resistors to work in a higher temperature and environmental conditions that restrict their area of application range too in the industrial and automotive fields. The market is further constrained due to strict regulatory standards concerning electronic waste and environmental sustainability, as stringent guidelines must be followed by manufacturers when designing and developing products, prolonging product development timelines.

Opportunity:

-

Renewable Energy Automation and IoT Drive Growth Opportunities in Electrical Resistor Market

With the trend towards renewable energy sources, such as solar and wind energy the electrical resistor market holds immense growth potential in the future. They need to have efficient components for power generation, transmission, and distribution, boosting the need for resistors in turn. Additionally, the increasing automation and digitization in industrial sectors are driving the demand for accurate and reliable resistor solutions. Key players in the market will be able to gain significant expansion opportunities due to infrastructure development in emerging economies in Asia-Pacific and Latin America. The growing penetration of IoT devices and smart home applications also creates more opportunities for the resistor market to innovate and address untapped market segments.

Challenges:

-

Technological Advances and Supply Chain Issues Pose Challenges for Electrical Resistor Manufacturers

Resistor manufacturers face a serious challenge in the form of the rapid pace of technological advances. This unending pressure to innovate, particularly in the face of developing technologies like electric vehicles, renewable energy systems, and IoT devices, requires constant research and development investments. Additionally, supply chain delays for basic components such as ceramic and metal alloys are causing production holdups and making it difficult to project market requirement fulfillment times. Moreover, challenges in differentiating the attributes of smart medical pipettes among various key players further compel manufacturers to primarily keep up quality and performances in product lines, which is ultimately expected to impact market growth negatively. Companies must overcome these challenges to continue growing and remain competitive in their respective industries.

Electrical Resistor Market Segmentation Outlook

By Type

In 2023, Fixed Resistors held the highest share of 32.7% in the Electrical Resistor Market due to high use in consumer electronics, automotive applications, and industrial machinery. They provide accurate and stable resistance values and are cheaper and packed into various circuits, making them a good option for maintaining constant resistance values. The global fixed resistors market is consolidated due to their extensive usage in communication devices, power supplies, and household appliances.

Variable resistors will grow with the highest CAGR during the forecast period 2024–2032. As they are increasingly preferred in modern electronics and their applications for adjustable resistance such as audio systems, lighting control, and sensors, this, in turn, is the attributed growth of the market. It is also driving the growth of adoption of automation, smart home technologies, and electric vehicles.

By Product

In 2023, Power supplies were the largest application in the Electrical Resistor Market, with a market share of 34.6%, owing to their role in maintaining stable voltage and current in electronic equipment. These are extensively used in consumer electronics, industrial equipment, and communication systems. This is mainly attributed to the increasing need for efficient power management solutions in data centers, renewable energy systems, and portable devices.

Electric motors are forecast to exhibit the highest compound annual growth rate (CAGR) of all light commercial vehicle applications during 2024 and 2032. The demand for Industrial Drive is anticipated to grow in the coming years owing to the surge in the adoption of electric vehicles, industrial automation, and high demand for energy-efficient appliances. Resistors for Electric Motors The demand for resistors utilized in electric motors is also benefiting from advances in the motor control sector and the transition toward renewable energy applications.

By Application

In 2023, distribution channels led the electrical resistor market with a share of 35.8% due to their key characteristics and relevance as the crucial components of power transmission and distribution networks. Increasing electricity demand and the need to modernize grid infrastructure have driven demand for reliable resistors, specifically those focused on voltage regulation and system stability. Along with the global growth of urbanization and industrialization, a trend that has strengthened their market position even more.

Power generation is expected to grow fastest from 2024 to 2032. This is growing due to the growing trend towards renewable energy, including solar, wind, and hydropower, which require efficient power conversion and regulation. The rising expenditures on smart grid systems & distributed energy resources and their applications further drive the resistors demand in power generation applications.

By End Use

In 2023, consumer electronics was the leading application segment in the Electrical Resistor Market with a 28.7% revenue market share, which is majorly attributed to the high consumption of smartphones, laptops, wearable devices, and home appliances during the year. Research and development in fields such as smart homes and connected technology led to a surge in the demand for smart and compact resistors to enhance functionalities as well as power regulation.

From 2024 to 2032, the automotive category will be the most significant development in terms of CAGR on the market. High-growth demand-driven industry segment the rapid adoption of EVs and autonomous drive (AD) and advanced driver-assistance systems (ADAS) is the primary factor propelling growth in this industry. The trend for vehicle electrification, coupled with the need for more complex electronic systems to support safety, connectivity, and infotainment applications requires new high-performance resistor designs for automotive applications.

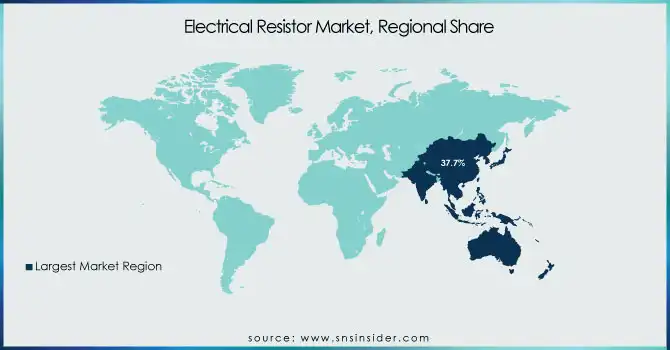

Electrical Resistor Market Regional Analysis

The Electrical Resistor Market was dominated by Asia Pacific, accounting for a 37.7% share in 2023, and is anticipated to register the highest CAGR from 2024 to 2032. The strong increase can be attributed to a well-established electronics manufacturing base in the region, with the countries of China, Japan, and South Korea commanding a higher share individually. These countries are at the forefront of the production of consumer electronics such as smartphones, laptops, and home appliances that integrate resistors for power management and circuit protection. At the same time in China and Japan, the growing acceptance of electric vehicles (EVs) is boosting requirements for resistors for power supplies, inverters, and motor control applications.

A prime example of this expansion comes in the form of EV leadership through China, with companies like BYD and NIO, utilizing vast quantities of high-performance resistors for battery management, motor control, etc. Similarly, automotive giants in Japan like Toyota and Honda are also focusing on advancing hybrid and electric vehicles, which is expected to create a higher demand for power electronics that contain resistors. In addition, South Korean behemoths such as Samsung and LG continue to push the envelope of consumer electronics which further establishes the demand for small form-factor, high-performance resistors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Electrical Resistor Market are:

-

Vishay Intertechnology (foil resistors, foil resistance strain gauges)

-

Mersen (carbon brushes, industrial fuses)

-

Rohm (resistors, semiconductors)

-

Schurter (fuses, varistors)

-

Yageo Corporation (chip resistors, through-hole resistors)

-

KOA Speer Electronics (thick film chip resistors, thin film chip resistors)

-

TE Connectivity (fixed resistors, variable resistors)

-

TT Electronics (wire-wound resistors, SMD resistors)

-

Bourns, Inc. (precision resistors, power resistors)

-

Panasonic Electronic Components (metal film resistors, carbon film resistors)

-

Ohmite Manufacturing Company (power resistors, high voltage resistors)

-

Caddock Electronics, Inc. (high-performance film resistors, precision resistors)

-

Riedon Inc. (current sense resistors, high power resistors)

-

Susumu Co., Ltd. (thin film chip resistors, precision resistors)

-

Isabellenhütte Heusler GmbH & Co. KG (precision resistors, shunt resistors)

Recent Developement

-

In December 2024, Vishay Intertechnology expanded its precision thin film MELF resistors for automotive and telecom applications, offering resistance values up to 10 MΩ.

-

In February 2025, ROHM Semiconductor introduced the MCRx series of general-purpose chip resistors, enabling greater miniaturization for automotive and industrial applications. The new lineup offers high power and low resistance options in compact sizes, enhancing design flexibility.

-

In February 2024, TT Electronics launched the LRMAH2512 high-power shunt resistor for precise current measurement in automotive and industrial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.92 Billion |

| Market Size by 2032 | USD 9.56 Billion |

| CAGR | CAGR of 5.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Linear Resistor, Fixed Resistor, Variable Resistor, Non-linear Resistor, Others) • By Product (Power Supplies, Electric Motors, Drives, Inverters, Others) • By Application (Power Generation, Transmission, Distribution Channels, Others) • By End Use (Consumer Electronics, IT and Telecommunication, Automotive, Industrial, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vishay Intertechnology, Mersen, Rohm, Schurter, Yageo Corporation, KOA Speer Electronics, TE Connectivity, TT Electronics, Bourns Inc., Panasonic Electronic Components, Ohmite Manufacturing Company, Caddock Electronics Inc., Riedon Inc., Susumu Co. Ltd., Isabellenhütte Heusler GmbH & Co. KG. |