Automotive Repair and Maintenance Services Market Size & Overview:

Get More Information on Automotive Repair and Maintenance Services Market - Request Sample Report

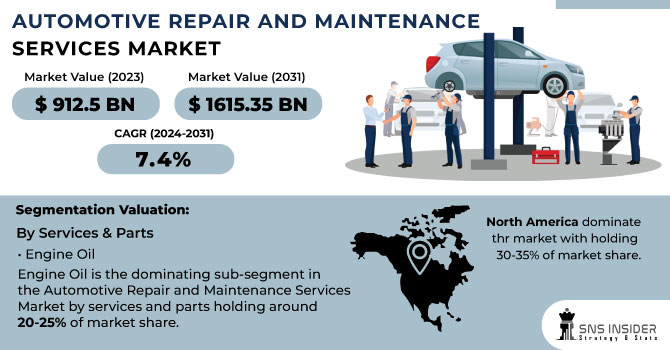

The Automotive Repair and Maintenance Services Market Size was valued at USD 912.5 billion in 2023 and is expected to reach USD 1615.35 billion by 2031 and grow at a CAGR of 7.4% over the forecast period 2024-2031.

The automotive repair and service industry keeps our cars running smoothly by offering maintenance and replacements for parts that wear down over time. This includes everything from oil filters and wiper blades to batteries and collision bodywork. The market itself is quite fragmented, with many independent repair shops and local suppliers competing for your business. This can be a good thing for consumers, as it often leads to competitive pricing and flexible service options. The industry caters to a wide range of vehicles, from passenger cars and SUVs to commercial trucks and motorcycles.

It's no surprise then that the market has seen significant growth in recent years, and this trend is expected to continue. As the number of vehicles on the road keeps rising, so will the demand for regular maintenance and repairs. People are also becoming more aware of the importance of keeping their cars in good condition, both for safety reasons and to extend the vehicle's lifespan.

MARKET DYNAMICS:

KEY DRIVERS:

-

Increasing vehicle age due to advancements in materials and technology is leading to more repair needs.

-

Rising car sales and the expansion of after-sales services are creating more business for repair shops.

The automotive repair industry is experiencing a rise due the increasing number of cars being sold translates directly to a larger pool of vehicles requiring maintenance and repairs. As more people own cars, there's a natural rise in demand for services to keep them running smoothly. The after-sales service sector is expanding. This means car manufacturers and dealerships are offering more comprehensive maintenance plans and extending the range of services available.

RESTRAINTS:

-

The increasing complexity of modern vehicles with advanced technology can make repairs expensive and require specialized skills.

Modern cars, packed with advanced technology and intricate parts offers improved performance and safety but their complexity can significantly hike repair costs. Fixing these high-tech components requires specialized skills and knowledge that not all mechanics possess. This can lead to a scenario where repairs become expensive due to the limited pool of qualified technicians and the specialized tools and software needed for diagnostics and fixes.

-

Consumers may choose to delay repairs due to high service costs, opting for temporary fixes or extending service intervals.

OPPORTUNITIES:

-

The rise of electric vehicles creates a need for specialized repair services and technician training.

-

Repair shops can leverage technology like online booking systems and remote diagnostics to improve customer convenience.

CHALLENGES:

-

Increasing complexity of vehicles with advanced tech makes repairs expensive and requires specialized skills.

-

High service costs may lead customers to delay repairs or seek cheaper, temporary fixes.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the automotive repair and maintenance market, impacting it in several ways. The supply chain disruptions are a major hurdle. Ukraine supplied key components like wiring looms and neon gas for semiconductors, crucial for modern vehicles. The conflict caused shortages and price hikes for these parts, potentially inflating repair costs by around 5-10% of share. The sanctions on Russia limited access to raw materials, potentially delaying repairs by 2-5% due to part shortages. The war-driven surge in oil and gas prices increased the cost of essential lubricants and fluids by an estimated 3-7%, potentially leading some consumers to delay non-critical repairs. While the exact market size impact is unclear, some analysts predict a global production decline of 1 million vehicles, meaning a smaller pool of new cars needing maintenance in the short term.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can disrupt the automotive repair and maintenance market. Limiting budgets lead consumers to delay non-essential repairs, potentially declining the market by 5-10%. This means people might prioritize urgent fixes while postponing routine maintenance or seeking cheaper options like used parts. The cost-conscious consumers during downturns might opt for do-it-yourself (DIY) repairs with the help of online resources, potentially reducing demand for professional services by 2-3%. Repair shops will have to face problems with lower customer traffic leading to decreased revenue. This can force them to cut costs by reducing staff or operating hours, and in extreme cases, some shops may even be forced to close their doors. Economic downturns can also lead people to hold onto their cars for longer, ultimately increasing the demand for maintenance and repairs as these vehicles age.

KEY MARKET SEGMENTS:

By Services & Parts

-

Engine Oil

-

Gear Oil

-

Brake Oil

-

Grease

-

Tires

-

Batteries

-

Wear & Tear Parts

-

Air Filter

-

Cabin Filter

-

Oil Filter

-

Wiper Blades

-

Others

Engine Oil is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by services and parts holding around 20-25% of market share. It's a critical component requiring regular replacement to maintain engine health and performance. Regardless of vehicle type or service provider, engine oil changes are a fundamental part of car maintenance.

By Service Providers

-

Automobile Dealerships

-

Franchise General Repairs

-

Specialty Shops

-

Locally Owned Repair Shops

-

Tire Shops

-

Others

Locally Owned Repair Shops is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by service providers holding around 40-45% of market share. These shops hold the largest market share due to several factors. They often offer competitive pricing compared to dealerships and franchises. Additionally, they build long-term relationships with customers, fostering trust and loyalty. Their local presence allows for convenient service and flexibility in repairs.

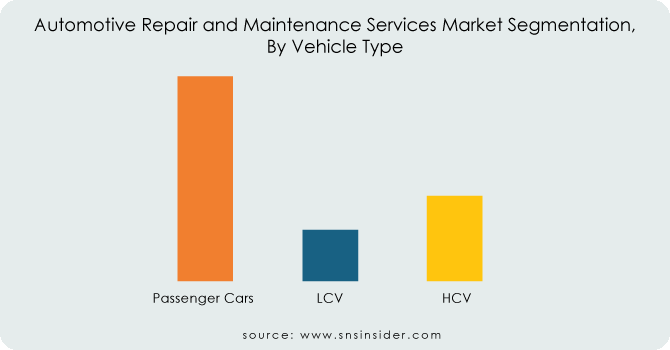

By Vehicle Type

-

Passenger Cars

-

LCV

-

HCV

Passenger Cars is the dominating sub-segment in the Automotive Repair and Maintenance Services Market by vehicle type holding around 60-65% of market share due to the sheer number of passenger cars on the road compared to other vehicle types. The widespread ownership and frequent use of passenger cars lead to a consistent demand for maintenance services. Rising disposable income and increasing urbanization further contribute to the dominance of this segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSES

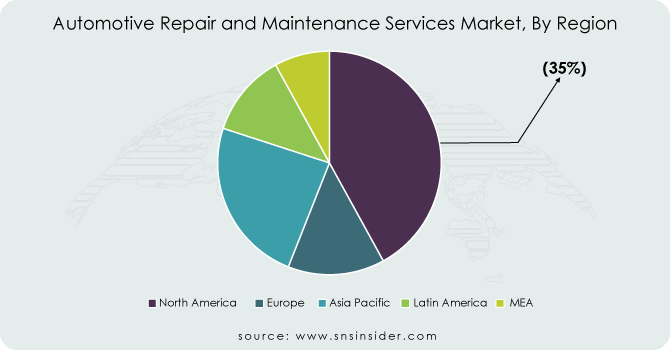

The North America is the dominating region in the Automotive Repair and Maintenance Services Market holding around 30-35% of market share due to its long-established automotive industry, high car ownership, and ingrained car maintenance culture. Strict emission regulations further drive demand for frequent check-ups and repairs.

The Asia Pacific is fastest-growing region holding the CAGR of 10%. Rapid economic development, urbanization, and a growing middle class with more disposable income to spend on car maintenance are fueling this growth. Government initiatives promoting vehicle safety and emission control further propel the market forward.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Arnold Clark Automobiles Limited, Asbury Car Group, Inc., Ashland Automotive, Inc., Belron International Ltd., LKQ Corporation, Mobivia Groupe, Inter Cars, Mekonomen Group, Hance's European, EUROPART Holding GmbH, USA Automotive, CarParts.com, Inc., myTVS, M & M Auto Repair, Bosch Car Service, Halfords Group Plc, Wrench, Inc., Sun Auto Service. Carmax Autocare Center, Firestone Complete Auto Care, Inc., Goodyear Tire & Rubber Company., Jiffy Lube International, Inc. and other key players.

Arnold Clark Automobiles Limited-Company Financial Analysis

RECENT DEVELOPMENT

-

In July 2023: KwikFix Automotive Repairs in India has launched a user-friendly mobile app. This app streamlines car maintenance and accessory purchases, allowing users to manage everything from their smartphones. It even personalizes repair recommendations based on driving habits and vehicle type.

-

In Oct. 2023: In collaboration with Amazon, Ford offers a new in-vehicle service in the US. Ford owners can now use Alexa voice commands to schedule, track, and pay for car repairs and maintenance, simplifying the service experience. This program is expected to expand to other regions in the future.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 912.5 Billion |

| Market Size by 2031 | US$ 1615.35 Billion |

| CAGR | CAGR of 7.4% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services & Parts (Engine Oil, Gear Oil, Brake Oil, Grease, Tires, Batteries, Wear & Tear Parts, Air Filter, Cabin Filter, Oil Filter, Wiper Blades, Others) • By Service Providers (Automobile Dealerships, Franchise General Repairs, Specialty Shops, Locally Owned Repair Shops, Tire Shops, Others) • By Vehicle Type (Passenger Cars, LCV, HCV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arnold Clark Automobiles Limited, Asbury Car Group, Inc., Ashland Automotive, Inc., Belron International Ltd., LKQ Corporation, Mobivia Groupe, Inter Cars, Mekonomen Group, Hance's European, EUROPART Holding GmbH, USA Automotive, CarParts.com, Inc., myTVS, M & M Auto Repair, Bosch Car Service, Halfords Group Plc, Wrench, Inc., Sun Auto Service. Carmax Autocare Center, Firestone Complete Auto Care, Inc., Goodyear Tire & Rubber Company., Jiffy Lube International, Inc. |

| Key Drivers | • Increasing vehicle age due to advancements in materials and technology is leading to more repair needs. • Rising car sales and the expansion of after-sales services are creating more business for repair shops. |

| Restraints | • The increasing complexity of modern vehicles with advanced technology can make repairs expensive and require specialized skills. • Consumers may choose to delay repairs due to high service costs, opting for temporary fixes or extending service intervals. |