Automotive VVT & Start-Stop System Market Size:

Get More Information on Automotive VVT & Start-Stop System Market - Request Sample Report

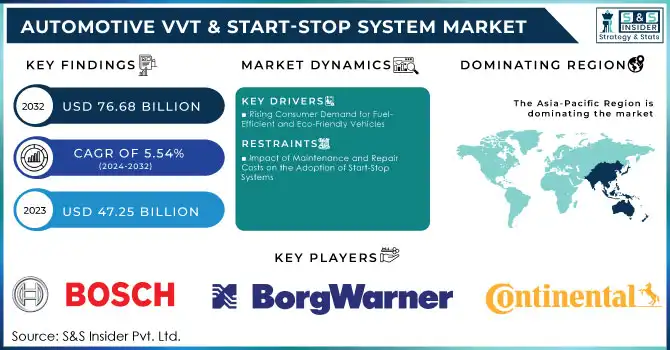

The Automotive VVT & Start-Stop System Market Size was valued at USD 47.25 Billion in 2023 and is expected to grow to USD 76.68 Billion by 2032 and grow at a CAGR of 5.54% over the forecast period of 2024-2032.

The demand for fuel-efficient and environmentally friendly vehicles is rising due to stricter global emissions regulations and technological advancements. Variable Valve Timing (VVT) technology, which optimizes valve timing for improved engine efficiency, has become a crucial component in modern internal combustion engines, enhancing power output and fuel consumption. As automakers focus on meeting stringent fuel economy standards, VVT systems are now integral to both conventional and hybrid engine designs. Additionally, Start-Stop systems, which automatically shut off the engine when the vehicle is at rest and restart it when the accelerator is pressed, are gaining popularity. These systems help reduce fuel consumption and emissions, particularly in urban areas with frequent stops. Start-Stop technology is becoming standard in both entry-level and luxury vehicles, especially in Europe and North America, driven by consumer demand for better fuel efficiency and regulatory pressures.

Studies show that Start-Stop systems can improve fuel efficiency by 5-10%, particularly in city driving, and contribute to reduced carbon emissions. As consumer demand for more sustainable, fuel-efficient vehicles grows, and governments enforce stricter environmental standards, Start-Stop systems are being adopted across a broader range of vehicles, from entry-level to luxury models. This trend supports the automotive industry's shift toward eco-friendly vehicles. Global adoption of Start-Stop and VVT technologies is expected to rise, further driven by the demand for sustainable transportation. According to the Society of Automotive Engineers (SAE), the fuel economy improvements from Start-Stop systems range from 7.27% to 26.4%. While VVT is not yet universally deployed, its increasing use by major manufacturers highlights its growing role in improving vehicle efficiency and performance.

Automotive VVT & Start-Stop System Market Dynamics

Drivers

-

Rising Consumer Demand for Fuel-Efficient and Eco-Friendly Vehicles

The increasing consumer demand for fuel-efficient and environmentally friendly vehicles is a key driver in the adoption of advanced automotive technologies like Variable Valve Timing (VVT) and Start-Stop systems. As fuel prices rise and environmental awareness grows, consumers are prioritizing cars that reduce fuel consumption and lower carbon emissions. According to Consumer Reports, fuel efficiency and the environmental impact of driving are now critical factors influencing vehicle purchase decisions, driving up demand for vehicles equipped with these technologies. Start-Stop systems, which automatically shut off the engine when the vehicle is idle, can enhance fuel efficiency by up to 10%, while VVT systems optimize engine performance to improve fuel economy and reduce emissions. This growing preference for hybrid and electric vehicles is further fueling the adoption of these technologies, as automakers work to meet increasingly stringent emissions standards. The integration of Start-Stop and VVT systems is becoming more common across various vehicle segments, from luxury models to economy cars, as consumers expect improved fuel economy and sustainability. For example, Ford's inclusion of Start-Stop technology in larger vehicles like the F-150 pickup highlights the widespread shift toward these systems, with the company estimating over USD 1,000 in savings over five years. As the automotive industry continues its transition toward eco-friendly transportation, VVT and Start-Stop systems play an essential role in delivering both environmental benefits and cost savings to consumers.

Restraints

-

Impact of Maintenance and Repair Costs on the Adoption of Start-Stop Systems

While Start-Stop systems offer significant fuel savings, they can increase long-term maintenance and repair costs, which may deter some consumers from adopting this technology. The frequent engine restarts required by Start-Stop systems place additional strain on essential components, such as the battery and starter motor, leading to faster wear and tear. Over time, this can result in more frequent replacements and repairs, driving up overall vehicle expenses. In regions with extreme temperatures, where battery performance is already a challenge, the additional stress on the battery can further exacerbate maintenance costs. Consumers may be hesitant to invest in vehicles with Start-Stop systems due to concerns over these potential long-term costs. The need for specialized parts and repairs may also limit adoption, especially in cost-conscious market segments where consumers prioritize vehicles with lower lifetime expenses. While the fuel savings provided by Start-Stop technology can be significant, the balance between initial savings and ongoing maintenance costs may influence consumer decisions, particularly in markets where affordability and long-term vehicle reliability are crucial factors. As a result, the increased maintenance requirements could slow the widespread adoption of Start-Stop technology in certain segments of the automotive market.

Automotive VVT & Start-Stop System Market Segmentation Overview

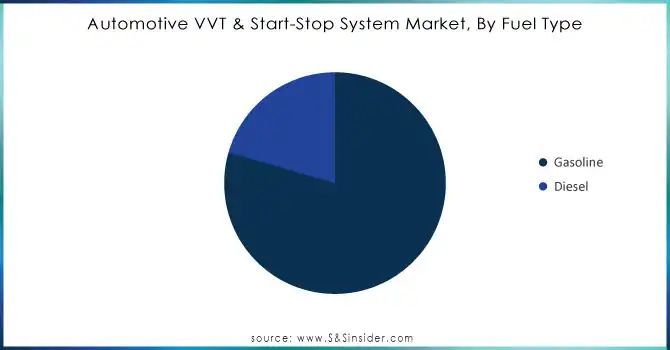

By Fuel Type

In 2023, gasoline-powered vehicles continued to dominate the Automotive VVT & Start-Stop System Market, accounting for approximately 80% of the revenue. Leading automakers, including Ford and Mercedes-Benz, are integrating Variable Valve Timing (VVT) and Start-Stop systems into their gasoline models to enhance fuel efficiency and reduce emissions. For instance, Ford launched the 2024 Ford Escape PHEV, featuring advanced VVT and Start-Stop technology, while Mercedes-Benz expanded its fleet of gasoline-powered vehicles with similar systems to improve fuel economy and lower CO2 emissions. Bosch also advanced its Start-Stop hybrid system, introducing coasting modes to further reduce fuel consumption. These innovations highlight the automotive industry's push for eco-friendly, cost-effective driving solutions.

Need Any Customization Research On Automotive VVT & Start-Stop System Market - Inquiry Now

By Product Type

In 2023, Continuous Variable Valve Timing (CVVT) technology captured 68% of the Automotive VVT & Start-Stop System Market, driven by its ability to enhance engine performance, fuel efficiency, and reduce emissions. Unlike traditional VVT systems, CVVT continuously adjusts the intake and exhaust valve timing, optimizing performance across various engine speeds. Automakers like Hyundai and Toyota have adopted CVVT in models such as the Elantra, Sonata, Corolla, and Camry, focusing on improving fuel efficiency and emissions. Leading suppliers like Bosch and Valeo have also made significant advancements in CVVT technology, with Bosch introducing a system for hybrid and electric vehicles, and Valeo unveiling a next-generation system for better fuel economy. This ongoing innovation supports the shift toward more sustainable, fuel-efficient vehicles.

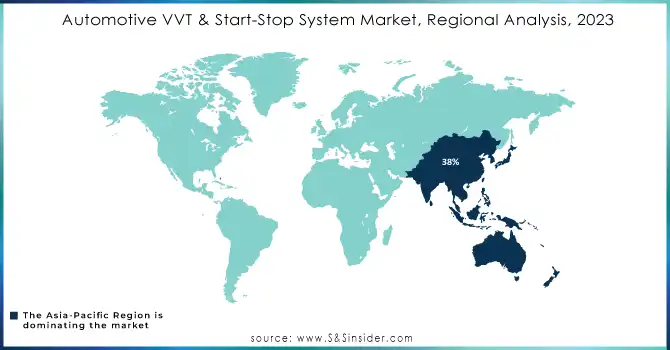

Automotive VVT & Start-Stop System Market Regional Analysis

In 2023, the Asia-Pacific region led the Automotive VVT & Start-Stop System Market, capturing around 38% of the revenue. This growth is driven by the region’s booming automotive sector, particularly in China, Japan, South Korea, and India, where demand for fuel-efficient and eco-friendly vehicles is rising due to higher fuel costs and stricter emissions regulations. Major automakers like Japan’s Toyota and Honda, as well as South Korea’s Hyundai and Kia, are integrating Variable Valve Timing (VVT) and Start-Stop systems into their models. Additionally, China’s focus on low-emission vehicles has further propelled the adoption of these technologies. Suppliers such as Bosch and Valeo, with strong manufacturing and R&D capabilities, are also contributing to market expansion, positioning Asia-Pacific as a key driver of automotive innovation.

In 2023, North America became the fastest-growing region in the Automotive VVT & Start-Stop System Market, driven by rising demand for fuel-efficient vehicles and stricter emissions standards. Both the U.S. and Canada are seeing an increase in the adoption of technologies like Variable Valve Timing (VVT) and Start-Stop systems to meet consumer needs for better fuel economy and sustainability, especially with rising fuel prices. Leading automakers such as Ford and General Motors are expanding these systems across their vehicle lines. For instance, Ford has integrated Start-Stop technology in its 2024 Ford Escape to improve fuel efficiency without compromising engine performance, while GM has expanded these systems in models like the Chevrolet Silverado. Additionally, key suppliers like Bosch and Continental are advancing these technologies, with Bosch's Start-Stop hybrid tech and Continental's VVT systems helping automakers meet stringent emissions regulations. These developments highlight North America's role in shaping the future of fuel-efficient automotive technologies

Key Players n Automotive VVT & Start-Stop System Market

Some of the major key players in Automotive VVT & Start-Stop System Market with product:

-

BorgWarner Inc. – (VVT systems, Turbochargers, Start-Stop systems)

-

Delphi Technologies (now part of BorgWarner) – (VVT and Start-Stop technology solutions)

-

Valeo – (Active grille shutters, Start-Stop systems, VVT systems)

-

Aisin Seiki Co., Ltd. – (VVT systems, Automatic transmissions, Start-Stop technology)

-

Bosch – (VVT actuators, Start-Stop systems, Engine management systems)

-

Continental AG – (Engine components, VVT actuators, Start-Stop systems)

-

Magneti Marelli (Calsonic Kansei) – (VVT systems, Turbocharging, Start-Stop systems)

-

Hitachi Automotive Systems – (VVT actuators, Fuel injectors, Start-Stop solutions)

-

Eaton Corporation – (VVT technology, Start-Stop systems, Engine control components)

-

Denso Corporation – (VVT systems, Engine control units, Start-Stop technology)

-

ZF Friedrichshafen AG – (Transmission systems, VVT systems, Start-Stop technologies)

-

Mahle GmbH – (VVT systems, Start-Stop systems, Engine components)

-

Schaeffler Group – (Engine components, VVT actuators, Clutch systems)

-

Hyundai Mobis – (VVT actuators, Engine control systems, Start-Stop solutions)

-

Tenneco Inc. – (Exhaust systems, VVT solutions, Start-Stop system components)

-

Toyota Motor Corporation – (Hybrid engines with VVT systems, Start-Stop systems)

-

Honda Motor Co., Ltd. – (VVT systems in fuel-efficient and hybrid models, Start-Stop solutions)

-

Ford Motor Company – (EcoBoost engines, VVT technologies, Start-Stop systems)

-

General Motors (GM) – (VVT systems in gasoline and hybrid engines, Start-Stop technology)

-

Renesas Electronics Corporation – (VVT control ICs, Start-Stop system components)

List of potential customer companies for the Automotive VVT & Start-Stop System Market:

-

Toyota Motor Corporation

-

Volkswagen Group

-

General Motors (GM)

-

Ford Motor Company

-

Honda Motor Co., Ltd.

-

BMW AG

-

Nissan Motor Co., Ltd.

-

Hyundai Motor Company

-

Fiat Chrysler Automobiles (FCA)

-

Kia Corporation

-

Renault-Nissan-Mitsubishi Alliance

-

Mercedes-Benz (Daimler AG)

-

Audi AG

-

Peugeot SA (Stellantis)

-

Tata Motors

-

Geely Automobile Holdings

-

Subaru Corporation

-

Mazda Motor Corporation

-

Volvo Cars

-

Suzuki Motor Corporation

Recent Development

-

July 9, 2024: Maruti Suzuki launched the Fronx with a wide range of variants, offering both 1.2-litre Dual Jet and 1.0-litre Turbo engines, alongside advanced features like Progressive Smart Hybrid Technology and Idle Start-Stop for improved fuel efficiency and performance. The lineup includes Sigma, Delta, Zeta, and Alpha variants, each enhancing comfort, safety, and infotainment options.

-

On September 25, 2023, BorgWarner announced that it has supplied its advanced Start-Stop system to Renault. This system enhances fuel efficiency and reduces CO2 emissions by automatically stopping and restarting the engine when needed, supporting Renault's efforts to improve sustainability in its vehicles.

-

On January 11, 2024, Valeo celebrated 20 years of its Stop-Start StARS (Starter Alternator Reversible System) technology. This system, which automatically shuts off and restarts the engine to reduce fuel consumption and CO2 emissions, has revolutionized driving efficiency, especially in city traffic. Its seamless operation ensures comfort for drivers and passengers while enhancing vehicle sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 47.25 Billion |

| Market Size by 2032 | USD 76.68 Billion |

| CAGR | CAGR of 5.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Fuel Type (Gasoline, Diesel) • By Product Type( Continuous VVT, Non-continuous VVT) • By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electrical Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BorgWarner Inc., Delphi Technologies, Valeo, Aisin Seiki Co., Ltd., Bosch, Continental AG, Magneti Marelli (Calsonic Kansei), Hitachi Automotive Systems, Eaton Corporation, Denso Corporation, ZF Friedrichshafen AG, Mahle GmbH, Schaeffler Group, Hyundai Mobis, Tenneco Inc., Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, General Motors (GM), and Renesas Electronics Corporation. |

| Key Drivers | • Rising Consumer Demand for Fuel-Efficient and Eco-Friendly Vehicles |

| Restraints | • Impact of Maintenance and Repair Costs on the Adoption of Start-Stop Systems |