Motorcycles Market Size & Overview

Get More Information on Motorcycles Market - Request Sample Report

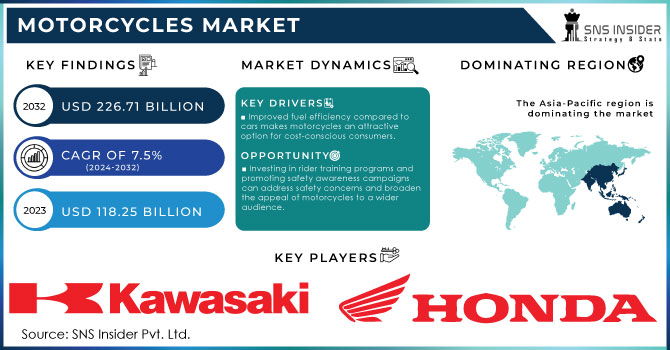

The Motorcycles Market Size was valued at USD 118.25 billion in 2023 and is expected to reach USD 226.71 billion by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

Rising disposable incomes, particularly in developing economies, are putting motorcycles within reach of a larger population. This affordability makes them a viable alternative to automobiles, especially in regions with limited public transport infrastructure. The motorcycles offer greater fuel efficiency compared to cars, which is a significant advantage in a world increasingly focused on environmental consciousness. The unit sales of Motorcycles market in the United States are expected to reach 641.90k motorcycles in 2029.

Manufacturers are continuously innovating to produce lighter, more powerful, and fuel-efficient engines. Improved braking systems, suspension, and safety features enhance rider confidence and control. For instance, the development of Anti-lock Braking Systems (ABS) has significantly reduced the risk of skidding during emergency braking. These advancements improves the overall riding experience and also address safety concerns, attracting a wider range of riders.

Stringent safety regulations implemented in developed countries can add to production costs and limit the affordability of some models. The lack of proper infrastructure, especially designated parking spaces and dedicated lanes, can be a deterrent for potential riders in congested urban areas.

Motorcycles Market Dynamics:

KEY DRIVERS:

-

Improved fuel efficiency compared to cars makes motorcycles an attractive option for cost-conscious consumers.

-

Advancements in motorcycle technology like lighter engines and improved braking systems enhance rider experience and safety.

By utilizing advanced materials like aluminium and carbon fibre, manufacturers are crafting engines that are not only more powerful but also lighter. This reduction in weight translates to a more nimble and responsive motorcycle, making it easier to move and control, especially when navigating tight corners or navigating city streets. This improved handling fosters a more enjoyable and engaging riding experience, particularly for those who value agility and precision. Traditional braking systems can lock up the wheels during emergency situations, causing the rider to lose control. Modern motorcycles, however, are increasingly equipped with Anti-lock Braking Systems (ABS). This technology prevents the wheels from locking, ensuring the rider retains steering control even during hard braking. This not only minimizes the risk of skidding and accidents but also inspires greater confidence in riders, allowing them to push their limits with a sense of security.

RESTRAINTS:

-

The environmental impact of motorcycle emissions, although generally lower than cars, can still be a concern for eco-conscious consumers.

-

Stricter safety regulations in developed countries can increase production costs, making some motorcycles less affordable.

The significant restraint for the motorcycle industry is the implementation of stricter safety regulations in developed countries. While these regulations aim to create a safer riding environment, they can also lead to increased production costs for manufacturers. This is because complying with these regulations often necessitates incorporating more sophisticated safety features, such as Anti-lock Braking Systems (ABS) and airbags. While these features undoubtedly enhance rider safety, they can also add to the overall price tag of the motorcycle. This price hike can push some models out of reach for budget-conscious consumers, particularly in developing economies where affordability is a key consideration. The motorcycle market thrives on offering a cost-effective mode of transportation, and stricter regulations that inflate prices can inadvertently limit the accessibility of these vehicles for a segment of the population.

OPPORTUNITIES:

-

Investing in rider training programs and promoting safety awareness campaigns can address safety concerns and broaden the appeal of motorcycles to a wider audience.

-

Highlighting the fuel efficiency and cost-saving benefits of motorcycles can attract budget-conscious riders, especially in regions with rising fuel costs.

CHALLENGES:

-

Motorcycle emissions, though lower than cars, can still be a concern for environmentally conscious consumers.

Motorcycles Market Segments:

By Motorcycles Type

-

Off-Road Motorcycles

-

On-Road Motorcycles

-

Scooters

The on-road motorcycle is the dominating sub-segment in the Motorcycles Market by motorcycle type holding around 60-70% of market share. On-road motorcycles offer greater versatility compared to off-road models. They can handle a wider range of terrains, including highways, city streets, and even some light off-road riding. Additionally, on-road motorcycles tend to be more comfortable for longer journeys due to their ergonomic design and touring capabilities. This makes them a compelling choice for commuters, long-distance riders, and touring enthusiasts. Scooters, while offering fuel efficiency and practicality for urban commutes, lack the power and versatility of on-road motorcycles, limiting their appeal to a smaller segment of riders.

By Propulsion Type

-

ICE

-

Electric

The Internal Combustion Engine (ICE) is the dominating sub-segment in the Motorcycles Market by propulsion type. This dominance is primarily due to the affordability and established infrastructure associated with ICE motorcycles. The vast network of gas stations makes refuelling convenient, while the lower upfront cost compared to electric motorcycles continues to be a significant deciding factor for many buyers. However, the electric motorcycle segment is poised for significant growth in the coming years, driven by rising environmental concerns, government incentives, and advancements in battery technology that are extending range and improving performance.

By Engine Capacity

-

Up to 200cc

-

200cc to 400cc

-

400cc to 800cc

-

More than 800cc

"Up to 200cc" and "200cc to 400cc” are the dominating sub-segment in the Motorcycles Market by engine capacity. These segments cater to a large portion of the market, particularly in developing economies, due to their affordability and fuel efficiency. Smaller engine motorcycles are ideal for navigating congested city streets and offer a practical and economical transportation solution. Additionally, these segments often have lower insurance premiums compared to larger motorcycles, making them even more attractive to budget-conscious riders and new riders seeking entry-level options. While larger engine motorcycles exceeding 400cc offer more power and performance, their higher price tag and fuel consumption limit their market share.

Motorcycles Market Regional Analyses

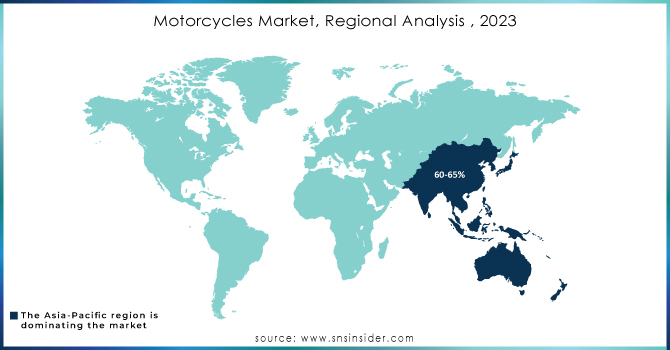

The Asia-Pacific is the dominating region in the Motorcycle Market holding around 60-65% of market share. Rapid urbanization creates a demand for affordable and motile transportation. The massive populations in countries like China and India translate to a vast customer base. The government support through production incentives and purchase subsidies fuels affordability. Motorcycles are simply cheaper to buy and maintain compared to cars in Asia, making them accessible to a wider demographic.

Europe is the second highest region in this market. A long-standing motorcycle culture fosters a passion for high-performance machines, and it boasts well-developed infrastructure with dedicated lanes and scenic routes that enhance the riding experience. This market also caters to a premium segment with renowned brands offering technologically advanced motorcycles.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Motorcycles Market Key Players

The major key players are Honda Motor Co., Ltd. (Japan), Kawasaki Heavy Industries, Suzuki Motor Corporation (Japan), Eicher Motors Limited (India), Yamaha Motor Co., Ltd. (Japan), Harley-Davidson, Inc. (the US), PIERER Mobility AG (Austria), BMW AG (Germany), Triumph Motorcycles (UK), Polaris Industries, Inc. (US) and other key players.

Motorcycles Market Recent Development

-

In Jan. 2024: EV startup Raptee Energy unveiled its high-powered electric motorcycle at the Tamil Nadu investor meet. Boasting a 150 km range and 135 km/hr top speed, the motorcycle is slated for an April 2024 launch.

-

In March 2023: Hero MotoCorp invested $60 million in California's Zero Motorcycles to co-develop electric motorcycle powertrains. Hero will leverage its manufacturing, sourcing, and marketing muscle to bring Zero's electric technology to market.

-

In Feb. 2023: Yamaha India upgraded all its two-wheelers to OBD-II systems from April 2023. This includes adding traction control for better grip and safer cornering to their 150cc motorbikes. They also plan to make all their bikes compatible with E20 fuel by year-end.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 118.25 Billion |

| Market Size by 2032 | US$ 226.71 Billion |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Motorcycles Type (Off-Road Motorcycles, On-Road Motorcycles, Scooters) • by Propulsion Type (ICE, Electric) • by Engine Capacity (Up to 200cc, 200cc to 400cc, 400cc to 800cc, More than 800cc) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honda Motor Co., Ltd. (Japan), Kawasaki Heavy Industries, Suzuki Motor Corporation (Japan), Eicher Motors Limited (India), Yamaha Motor Co., Ltd. (Japan), Harley-Davidson, Inc. (the US), PIERER Mobility AG (Austria), BMW AG (Germany), Triumph Motorcycles (UK), Polaris Industries, Inc. (US) |

| Key Drivers | Due to an increase in demand for sleep management systems, warning systems, and alert systems to prevent motorcycle accidents. The addition of larger gasoline tanks and improved mileage. |

| RESTRAINTS | The related standards' absenteeism. The motorbike market is projected to be hampered by a lack of infrastructure in offering uniform platforms. |