Automotive Smart Antenna Market Report Scope & Overview:

The Automotive Smart Antenna Market Size was valued at USD 2.8 billion in 2023 and is expected to reach USD 6.36 billion by 2031 and grow at a CAGR of 10.8% over the forecast period 2024-2031.

Smart antennas are arrays of antennas that use clever signal processing to improve reception. Unlike traditional antennas, they focus signals towards the target, improving reception and reducing interference. This is achieved by analysing signal properties and adjusting the antenna beam accordingly. It's important to differentiate them from single-element reconfigurable antennas. In cars, smart antennas play a crucial role in connecting devices like Bluetooth and mobile data. They can be wireless or wired, and handle all the vehicle's wireless communication needs, including safety and security features. Typically mounted on the roof, spoiler, or bumper, they eliminate signal loss issues that plagued traditional cabled antennas. Smart antennas are essential for functionalities like GPS navigation and telematics systems that rely on precise location data.

Get more information on Automotive Smart Antenna Market - Request Free Sample Report

MARKET DYNAMICS:

KEY DRIVERS:

-

Developments in communication technology are driving this trend.

-

The popularity of vehicles equipped with internet connectivity is growing.

Consumers are increasingly interested in cars with features like smartphone connections, internet access, and live traffic updates. These "connected vehicles" rely on smart antennas for smooth and fast communication. Smart antennas act like intelligent receivers and transmitters, guaranteeing a strong connection between the car and outside networks. As car manufacturers cater to this demand for connected car experiences, the market for smart antennas is rapidly growing.

RESTRAINTS:

-

Data security challenges could delay the connected car market growth

Connected cars generate massive amounts of data, including driver behaviour and engine performance. While this data offers valuable insights, managing and securing it poses challenges. Data breaches and privacy concerns are significant hurdles for both consumers and car companies. Smart antennas and other connected car components rely on networks vulnerable to cyberattacks. These security risks can disrupt smart antenna performance, ultimately hindering the growth of the connected car market.

OPPORTUNITIES:

-

The development of stronger communication networks for connected and self-driving cars.

CHALLENGES:

-

High cost and intricate installation processes can make implementing smart antennas challenging.

-

Interference from other signals and compatibility issues between different systems can hinder smart antenna performance.

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing war in Russia-Ukraine is disrupting the flow of essential components for automotive smart antennas. Russia-Ukraine plays a critical role in supplying various parts to the global automotive industry. With the war disrupting production and transportation within these countries, there's a potential shortage of these materials needed to manufacture smart antennas. This shortage could lead to production slowdowns or even temporary halts in smart antenna production lines. Consequently, the growth of the automotive smart antenna market might experience a setback. The extent of this impact depends on the war's duration and the agility of the automotive industry in finding alternative suppliers or adapting to the changing landscape. While other factors like rising material costs and shifting manufacturer focus might also influence the market, the war in Ukraine's immediate consequence lies in its potential to disrupt the supply chain of essential components for smart antennas.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown can lead cause to the automotive smart antenna market. When economic conditions tighten, consumers tend to tighten their belts too. This can lead to a decrease in demand for new vehicles, especially those packed with advanced features like smart antennas. Furthermore, economic downturns often prompt car manufacturers to cut costs. This might lead them to delay or even scrap the development of new connected car technologies, including smart antennas. While the market for smart antennas is projected for long-term growth, an economic slowdown can cause temporary setbacks. The severity of this impact depends on the depth and duration of the economic downturn. If consumers have less disposable income and car companies prioritize cost-saving measures, the adoption of smart antennas might see a temporary decline.

KEY MARKET SEGMENTS:

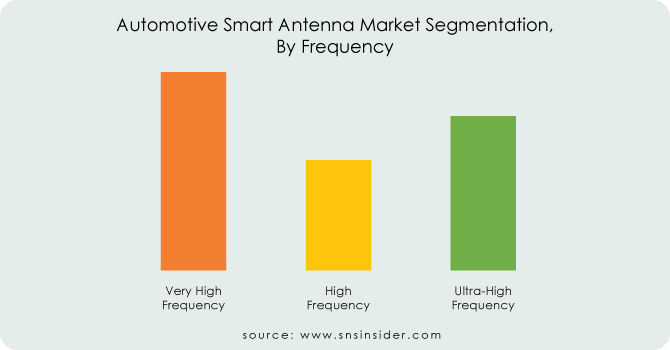

By Frequency

-

Very High Frequency

-

High Frequency

-

Ultra-High Frequency

Very High Frequency (VHF) is the dominating sub-segment in the Automotive Smart Antenna Market by frequency holding about 60-70% of market share. VHF offers a good balance between range and penetration, making it suitable for applications like AM/FM radio, navigation systems, and basic cellular connectivity. Traffic congestion concerns and the rising demand for in-dash features further drive the dominance of VHF in automotive smart antennas.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Vehicle Type

-

Passenger Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

BEV

-

Fuel Cell EV

-

Plug-In Hybrid Vehicle

Passenger Cars is the dominating sub-segment in the Automotive Smart Antenna Market by vehicle type holding about 70-80%of market share. The passenger car segment is the largest and fastest-growing segment in the automotive industry. Growing disposable income and increasing demand for comfort and safety features in passenger cars fuel the dominance of smart antennas in this segment.

By Components

-

Transceivers

-

Electronic Control Unit

-

Others

Transceivers is the dominating sub-segment in the Automotive Smart Antenna Market by components holding about 509-60% of market share. Transceivers are the core functional component of a smart antenna, responsible for signal transmission and reception. The rising integration of smart antennas in luxury cars, which require high-performance transceivers, further strengthens their dominance in the market.

By Sales Channel

-

OEM

-

Aftermarket

Original Equipment Manufacturer (OEM) is the dominating sub-segment in the Automotive Smart Antenna Market by sales channel. OEMs pre-install smart antennas in vehicles during the manufacturing process. As the demand for connected car features rises, car manufacturers are increasingly integrating smart antennas as standard equipment, leading to OEM channel dominance.

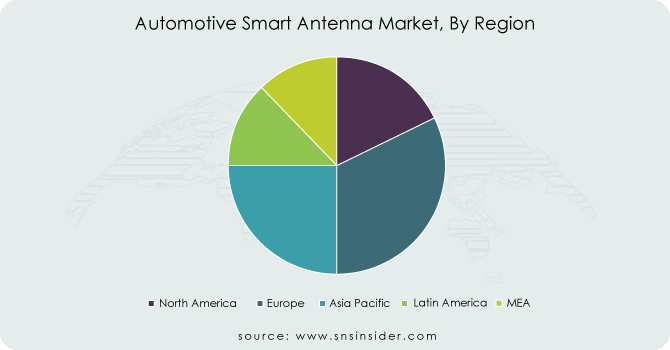

REGIONAL ANALYSES

The Asia Pacific is currently dominating the automotive smart antenna market. This dominance is fueled by the growing automotive industry, particularly in China and India, growing government support for electric vehicles which heavily rely on smart antennas, and a rising middle class with increasing disposable income for feature-rich cars.

North America holds the second-highest position due to the strong presence of established car manufacturers and their focus on integrating advanced technologies. High consumer demand for safety and convenience features in cars drives the adoption of smart antennas in this region.

Europe is the fastest-growing region in the automotive smart antenna market. Stringent government regulations promoting fuel efficiency and connected car technology, coupled with increasing investments in electric vehicle infrastructure, are propelling market growth here.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Laird Connectivity, Harada, Hirschmann Car Communication, Kathrein Automotive, Continental AG, Autotalks, TE Connectivity, Antenova, Taoglas, Yageo Corporation and other key players.

Laird Connectivity-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In August 2023 - TE Connectivity launched their FP20 and FP40 antennas, combining multiple functions like LTE/5G, Wi-Fi 6E/7, and Bluetooth. This simplifies car installations, minimizes roof clutter, and improves aesthetics. Passengers benefit from faster internet, reliable navigation, and smoother Bluetooth connections, all future-proofed with 5G and Wi-Fi 6E/7 support. These antennas are designed specifically for connected cars.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.8 Billion |

| Market Size by 2031 | US$ 6.36 Billion |

| CAGR | CAGR of 10.8 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency (Very High Frequency, High Frequency, Ultra-High Frequency) • By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle, BEV, Fuel Cell EV, Plug-In Hybrid Vehicle) • By Components (Transceivers, Electronic Control Unit, Others) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Laird Connectivity, Harada, Hirschmann Car Communication, Kathrein Automotive, Continental AG, Autotalks, TE Connectivity, Antenova, Taoglas, Yageo Corporation |

| Key Drivers | • Developments in communication technology are driving this trend. • The popularity of vehicles equipped with internet connectivity is growing. |

| RESTRAINTS | • Data security challenges could delay the connected car market growth |