Two Wheeler Suspension System Market Report Scope & Overview:

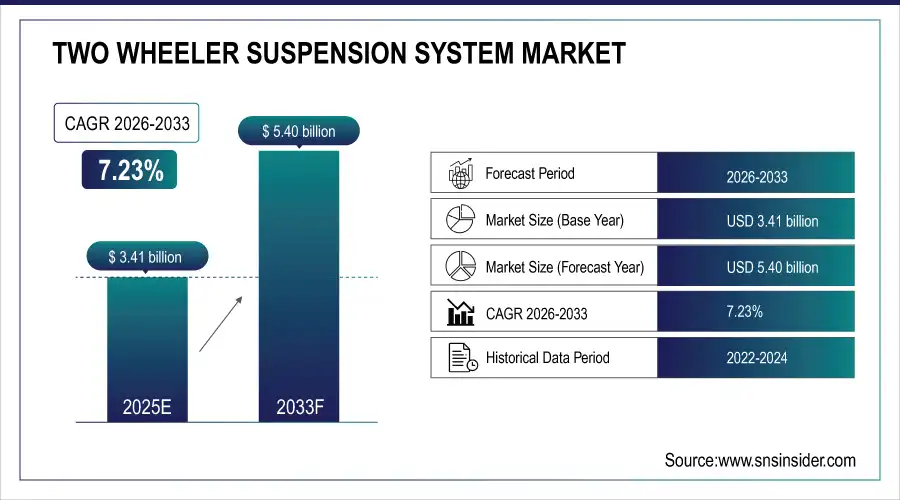

The Two Wheeler Suspension System Market size was valued at USD 3.41 Billion in 2025E and is projected to reach USD 5.40 Billion by 2033, growing at a CAGR of 7.23% during 2026–2033.

The Two Wheeler suspension system market is witnessing robust growth as demand rises for enhanced ride comfort, handling, and safety across motorcycles, enduro bikes, scooters, and e-bikes. Key players are investing in advanced damping technologies, semi-active and lightweight suspension systems, and optimized fork and shock designs. Growth is fueled by off-road, urban mobility, and recreational segments, with manufacturers like KYB, WP Suspension, YSS, and Yamaha driving innovation. Continuous R&D, product enhancements, and OEM and aftermarket adoption are positioning high-performance, durable, and adaptable suspension solutions as key differentiators in the global Two Wheeler market.

To Get more information on Two Wheeler Suspension System Market - Request Free Sample Report

On 16 September 2025, Yamaha refreshed its 2026 WR enduro bikes (WR250F, WR450F) and TT-R kids’ bikes (TT-R50, TT-R110) with updated styling, improved seats, and optimized suspension systems inspired by the YZ250F, enhancing comfort, handling, and performance while retaining the proven engines and frame designs.

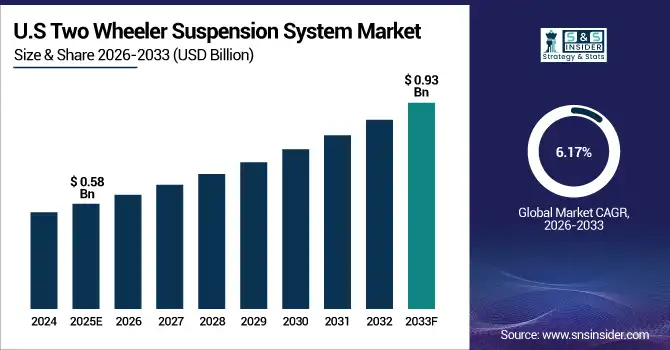

The U.S. Two Wheeler Market size was valued at USD 0.58 Billion in 2025 and is projected to reach USD 0.93 Billion by 2033, growing at a CAGR of 6.17% during 2026–2033. Growth is driven by rising demand for motorcycles, scooters, and e-bikes, increasing urbanization, last-mile connectivity needs, recreational riding trends, and growing consumer preference for fuel-efficient and eco-friendly mobility solutions.

Two Wheeler Suspension System Market Size and Forecast:

-

Market Size in 2025: USD 3.41 Billion

-

Market Size by 2032: USD 5.40 Billion

-

CAGR: 5.92% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Two Wheeler Suspension System Market Highlights:

-

Rising consumer demand for enhanced ride comfort, stability, and handling is driving growth in both OEM and aftermarket segments.

-

Advanced suspension technologies, including semi-active, progressive, and customizable systems, are gaining traction across motorcycles, scooters, and e-bikes.

-

High costs, maintenance requirements, and strict regulatory standards limit widespread adoption of premium suspension systems.

-

Opportunities exist in integrated, lightweight, and high-performance suspension components, fostering innovation and differentiation.

-

Technological advancements, such as improved damping systems and brake-suspension integration, are enhancing performance, safety, and rider experience.

-

Urbanization, traffic congestion, and off-road riding trends are fueling demand for durable and reliable suspension solutions globally.

Two Wheeler Suspension System Market Drivers:

-

Rising Demand for Enhanced Rider Comfort and Advanced Suspension Systems

The Two Wheeler suspension system market is driven by growing consumer demand for improved ride comfort, stability, and handling. As urbanization and traffic congestion increase, riders seek motorcycles, scooters, and e-bikes with advanced damping technologies and optimized shock absorbers. The demand for smoother rides on varied terrains, combined with a preference for lightweight, durable, and high-performance suspension systems, is encouraging manufacturers to invest in semi-active, progressive, and customizable suspension solutions. This trend is fueling innovation in both OEM and aftermarket segments, boosting market adoption and enabling safer, more comfortable, and reliable Two Wheeler mobility worldwide.

On 19 June 2025, Royal Enfield refreshed the Hunter 350 with significant upgrades, including a new rear suspension featuring progressive springs for a softer, more comfortable ride, and offered existing owners the option to retrofit their older models, enhancing ride quality while maintaining competitiveness against rivals like Jawa 42 FJ, Honda CB350 RS, and TVS Ronin.

Two Wheeler Suspension System Market Restraints:

-

High Costs, Maintenance, and Regulatory Challenges Limit Adoption in the Two Wheeler Suspension Market

The adoption of advanced Two Wheeler suspension systems is constrained by several factors. High costs of premium forks, shocks, and semi-active or electronic suspension technologies make them less accessible to price-sensitive consumers. Additionally, these systems often require regular maintenance and skilled servicing, increasing overall ownership expenses. Strict regulatory standards for vehicle safety and emissions in various regions further complicate production and compliance for manufacturers. Coupled with the availability of lower-cost aftermarket alternatives, these challenges limit widespread adoption despite growing consumer demand for enhanced ride comfort, stability, and performance, slowing overall market growth.

Two Wheeler Suspension System Market Opportunities:

-

Rising Demand for Integrated and High-Performance Suspension Systems

The Two Wheeler suspension system market presents significant opportunities as consumers increasingly seek enhanced ride comfort, stability, and handling. Growing demand for integrated, high-performance, and lightweight suspension components, such as advanced forks, monoshocks, and adaptive damping systems, is driving innovation. OEMs and aftermarket suppliers are investing in solutions that improve durability, reduce maintenance, and enhance safety across motorcycles, scooters, and e-bikes. Technological advancements and rising preference for premium and performance-oriented two-wheelers are expanding market potential, creating avenues for manufacturers to offer differentiated, high-quality suspension systems that cater to urban, off-road, and recreational riding needs globally.

On 10 March 2025, Hitachi Astemo, under Showa and Nissin, filed a patent for a redesigned lower fork with an integrated aerodynamic intake duct, improving brake cooling by 5% and reducing weight by 0.44 pounds, while maintaining compatibility with conventional bolt-on calipers for easier maintenance and enhanced suspension-brake integration.

Two Wheeler Suspension System Market Segment Highlights:

-

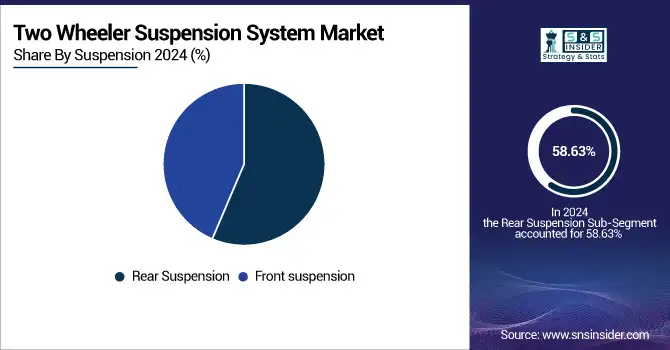

By Suspension Type: Dominant – Rear Suspension: 58.63% in 2025E, Fastest-growing – Front Suspension: 6.63% CAGR

-

By Product: Dominant – Telescopic Forks: 59.13% in 2025E, Fastest-growing – Mono Shock: 8.77% CAGR

-

By Vehicle: Dominant – Motorcycles: 54.38% in 2025E, Fastest-growing – Scooters: 7.17% CAGR

-

By Sales Channel: Dominant – OEM: 69.88% in 2025E, Fastest-growing – Aftermarket: 6.25% CAGR

Two Wheeler Suspension System Market Segment Analysis:

By Suspension Type, Rear Suspension Lead as Front Suspension Gain Traction

Rear suspension continues to lead due to its widespread adoption and proven performance, while front suspension is gaining traction as consumers increasingly prioritize enhanced ride comfort, improved handling, and stability, driving growth across motorcycles, scooters, and emerging segments like electric and off-road two-wheelers.

By Product, Telescopic Forks While Mono Shock Expands Rapidly

Telescopic forks remain the most widely used product due to their reliability and versatility, while mono shocks are expanding rapidly, driven by growing demand for improved ride comfort, better handling, and advanced suspension technologies across motorcycles, scooters, and high-performance Two Wheeler segments.

By Vehicle, Motorcycles Lead as Scooters See Fastest Growth

Motorcycles continue to lead due to their large user base and extensive adoption, while scooters are experiencing the fastest growth, driven by rising urbanization, demand for convenient last-mile mobility, and increasing adoption of electric and compact two-wheelers in city environments.

By Sales Channel, OEM Lead as Aftermarket Grow Fastest

The OEM segment continues to lead as manufacturers supply high-quality suspension systems directly with new vehicles. Meanwhile, the aftermarket segment is growing the fastest, driven by rising demand for replacement parts, performance upgrades, and customization options, enabling consumers to enhance ride comfort, handling, and overall vehicle performance across motorcycles, scooters, and electric two-wheelers.

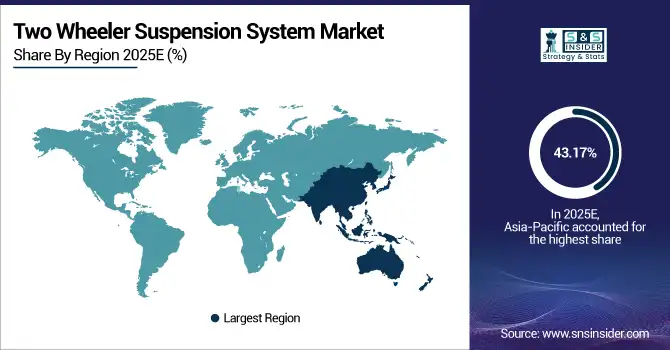

Two Wheeler Suspension System Market Regional Highlights:

-

By Region – Dominating: Asia-Pacific (43.17% in 2025E → 41.04% in 2033, CAGR 5.27%)

-

Fastest-Growing Region: North America (25.58% in 2025E → 27.96% in 2033, CAGR 7.12%)

-

Europe: 20.46% → 21.97% (CAGR 6.88%)

-

South America: 6.01% → 5.01% (CAGR 3.55%, declining)

-

Middle East & Africa: 4.87% → 4.02% (CAGR 3.32%, declining)

Two Wheeler Suspension System Market Regional Analysis:

Asia-Pacific Two Wheeler Suspension System Market Trends:

The Asia-Pacific Two Wheeler suspension system market is the largest regional market, driven by high adoption of motorcycles and scooters, increasing urbanization, and growing demand for affordable mobility solutions. Rising production of motorcycles, scooters, and electric two-wheelers is fueling market growth. Manufacturers are focusing on advanced suspension technologies, including mono shocks, telescopic forks, and lightweight components, to improve ride comfort, handling, and safety.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

India Two Wheeler Suspension System Market Insights:

India leads the Asia-Pacific market due to its massive Two Wheeler population, expanding urban mobility infrastructure, and rising consumer preference for performance-oriented and durable suspension systems.

North America Two Wheeler Suspension System Market Trends:

The North American Two Wheeler suspension system market is the fastest growing region , driven by rising demand for motorcycles, scooters, and electric two-wheelers. Consumers increasingly seek enhanced ride comfort, handling, and safety, prompting manufacturers to introduce advanced suspension technologies such as mono shocks, telescopic forks, and lightweight components. The market growth is supported by strong OEM presence and increasing aftermarket upgrades.

-

U.S Two Wheeler Suspension System Market Insights:

The United States is the dominant country in the North American Two Wheeler suspension system market, driven by high motorcycle ownership, strong consumer demand for performance and comfort, and well-established OEM and aftermarket networks that support advanced suspension technologies and upgrades across motorcycles, scooters, and electric two-wheelers.

Europe Two Wheeler Suspension System Market Trends:

The European Two Wheeler suspension system market is growing steadily, fueled by increasing demand for motorcycles, scooters, and electric two-wheelers across urban and recreational segments. Consumers prioritize ride comfort, handling, and safety, encouraging manufacturers to adopt advanced suspension technologies such as mono shocks, telescopic forks, and lightweight components. Strong OEM presence and aftermarket support further bolster market growth.

-

Germany Two Wheeler Suspension System Market Insights:

Germany leads the European market due to its mature Two Wheeler industry, high adoption of premium motorcycles, and strong focus on technological innovation and performance-oriented suspension systems.

Latin America Two Wheeler Suspension System Market Trends:

The Latin American Two Wheeler suspension system market is gradually expanding, driven by rising motorcycle and scooter adoption for urban mobility and commercial use. Demand for improved ride comfort, handling, and safety is prompting manufacturers to introduce advanced suspension solutions, including telescopic forks, mono shocks, and durable lightweight components, supporting both OEM and aftermarket growth in the region.

-

Brazil Two Wheeler Suspension System Market Insights:

Brazil is the leading country in the Latin American market, owing to its large Two Wheeler population, growing urban transport needs, and increasing demand for high-performance and reliable suspension systems.

Middle East & Africa Two Wheeler Suspension System Market Trends:

The Middle East & Africa Two Wheeler suspension system market is witnessing moderate growth, driven by increasing demand for motorcycles and scooters for urban commuting and recreational purposes. Manufacturers are focusing on durable, lightweight, and performance-oriented suspension technologies, including telescopic forks and mono shocks, to enhance ride comfort and handling. Both OEM and aftermarket channels are contributing to market expansion.

-

United Arab Emirates Two Wheeler Suspension System Market Insights:

The United Arab Emirates leads the Middle East & Africa market, supported by high Two Wheeler adoption, growing urban infrastructure, and rising consumer preference for advanced suspension systems.

Two Wheeler Suspension System Market Competitive Landscape:

Gabriel India Limited – Established in 1961, Gabriel India is a leading manufacturer of high-performance suspension systems for motorcycles, cars, commercial vehicles, and trains. Leveraging decades of automotive expertise, the company delivers innovative, durable, and efficient solutions, now expanding into the bicycle segment with advanced suspension forks and shock absorbers.

-

On 17 Apr 2025, Gabriel India expands into the European bicycle market, offering advanced suspension solutions for city, cargo, SUV, and mountain bikes, leveraging automotive expertise for high-performance, durable, and sustainable systems.

KYB Corporation – Founded in 1919 and established as KYB Corporation in 1974, KYB is a leading manufacturer of hydraulic equipment and suspension systems. Supplying OEM suspensions for two- and four-wheeled vehicles worldwide, the company leverages decades of expertise to deliver high-performance, reliable solutions across automotive, industrial, and consumer mobility applications.

-

On 30 June 2025, KYB announced plans to expand its consumer product lineup under the slogan “OFF WE GO!”, introducing high-performance suspensions for mountain bikes, e-bikes, trucks, and SUVs, leveraging decades of hydraulic and suspension expertise to enhance safety, comfort, and performance across diverse mobility applications.

WP Suspension GmbH – Founded in 1977, WP Suspension GmbH is a leading manufacturer of high-performance motorcycle suspension systems. Known for innovation and precision engineering, the company develops forks, shocks, and cartridges for motocross, enduro, and street motorcycles, enhancing ride quality, handling, and safety for riders worldwide.

-

On 29 July 2024, WP Suspension launched cutting-edge PRO COMPONENTS for 2025 85cc motocross models, including KTM 85 SX, GASGAS MC 85, and Husqvarna TC 85, featuring XACT PRO 7543 Fork with CONE VALVE Technology, XACT PRO 8946 SHOCK with SUPERTRAX, and XACT PRO 6500 Cartridge for enhanced damping and ride performance.

Two Wheeler Suspension System Market Key Players:

-

Marzocchi Moto

-

Showa Corporation

-

KYB Corporation

-

WP Suspension GmbH

-

BITUBO S.r.l.

-

Nitron Racing Shocks

-

YSS Suspension

-

Racetech Suspension

-

Progressive Suspension

-

Endurance Technologies Ltd.

-

Gabriel India Limited

-

TechnoFlex Suspension

-

Chongqing Chuandong Shock Absorber

-

Fox Factory

-

Mando Corporation

-

Tenneco Inc.

-

Öhlins Racing AB

-

ZF Friedrichshafen AG

-

Paioli Suspension

-

Racetech Shocks

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.41 Billion |

| Market Size by 2032 | USD 5.40 Billion |

| CAGR | CAGR of 5.92% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Suspension (Front suspension, Rear suspension) • By Product (Telescopic forks, Mono shock, Twin shock absorbers, Spring and damper units) • By Vehicle (Motorcycles, Scooters, Electric two-wheelers) • By Sales Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Marzocchi Moto, Showa Corporation, KYB Corporation, WP Suspension GmbH, BITUBO S.r.l., Nitron Racing Shocks, YSS Suspension, Racetech Suspension, Progressive Suspension, Endurance Technologies Ltd., Gabriel India Limited, TechnoFlex Suspension, Chongqing Chuandong Shock Absorber, Fox Factory, Mando Corporation, Tenneco Inc., Öhlins Racing AB, ZF Friedrichshafen AG, Paioli Suspension, and Racetech Shocks. |