Automotive Bushing Market Report Scope & Overview:

Get More Information on Automotive Bushing Market - Request Sample Report

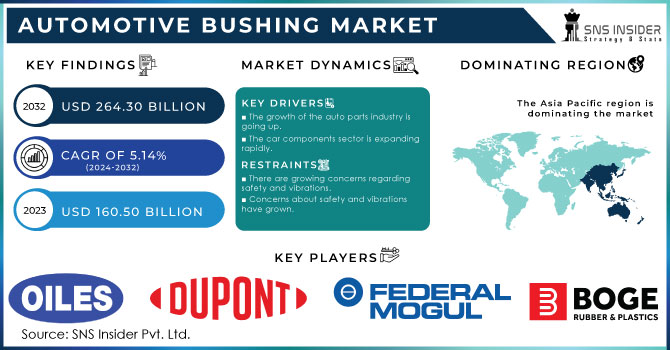

The Automotive Bushing Market size was valued at USD 160.50 billion in 2023, and expected to reach USD 264.30 billion by 2032, and grow at a CAGR of 5.14% over the forecast period 2024-2032.

The automotive bushing market becomes very high-growth driven by some converging trends. The increasing emphasis on comfort and fuel economy has driven the use of lightweight materials in vehicle construction. As a result, there will be growing requirements for bushings that better handle vibration and noise in lighter vehicle frames. Another era on the horizon, that of EVs, is coming into play and will require specialized bushing materials that can withstand loads and stresses specific to electric motors.

Government initiatives the U.S. Infrastructure Investment and Jobs Act provides USD 7.5 billion for electric vehicle charging infrastructure—are likely to further increase EV adoption, influencing bushing demand positively. Moreover, huge investments in autonomous vehicles, which are expected to surpass more than USD 50 billion globally by 2024, according to an estimate from SNS Insider forecasts models, are going to further push the boundaries of bushing technology to ensure flawless and safe vehicle performance. The aftermarket segment is expected to retain a significant share, as the global vehicle parc has been gradually increasing, meaning that it refers to the total number of vehicles on the road at any given point of time.

Market Dynamics:

Drivers:

-

The growth of the auto parts industry is going up

-

The car components sector is expanding rapidly

-

A growing number of people are worried about the comfort of their vehicles' rides

-

An increase in luxury vehicle purchases are projected to fuel the market's growth in the near future.

Growth in the luxury segment is likely to get much-needed traction in the coming years, mainly due to the sudden rise in demand for premium cars. Recent data has shown a stunning 25% rise in luxury car sales over the past one year, which was led by SUVs. It's driven by factors such as the growing affluent population, the requirement for status and exclusivity, and technological innovation, which ensures a very high level of driving experience in luxury. Furthermore, the electric vehicle and hybrid variants that are being introduced in this luxury segment also help to raise the sales numbers appreciably, driven by desires for both sustainability and performance. This may be continued with the sustained growth of luxury vehicle purchases, which will continue to fuel market expansion and stimulate manufacturers for innovation.

Restraints:

-

There are growing concerns regarding safety and vibrations.

Concerns about safety and vibration have grown, leading a renewed emphasis on providing safe and steady experiences. Construction and automobile industries, for example, are prioritizing methods to reduce possible dangers and improve user experience. Technological advancements are assisting in the creation of more dependable and robust solutions to solve these developing concerns.

-

In the automotive part sector, there is fierce rivalry for automotive bushing advancements.

-

High competition in the market for automotive bushing advances in the automotive part sector.

-

Concerns about safety and vibrations have grown.

Market Segmentation Analysis:

By Application:

Suspension bushings dominate the automotive bushing market, with a share of about 28%. Their prevalence is explained by the fact that they form an intrinsic part of the system responsible for the absorption of shocks and vibrations from the road in order to ensure a smooth ride. Next in line are the engine bushings, with a market share of about 32%, which turn out to be of great help in isolating the vibrations of the engine from transmitting them to the chassis and passenger compartment. Chassis bushings represent about 18% of the market because they make a strong connection between suspension and body, thus enhancing vehicle handling and stability. Interior bushings come next with approximately 15% because they improve passenger comfort inside the cabin by absorbing noise, vibration, and harshness. Other key segments involve exhaust bushings, at $7.53 billion, and transmission bushings, at $5.21 billion. These, too, are smaller applications but of equal importance in their respective systems if vibration is to be controlled and proper operation ensured.

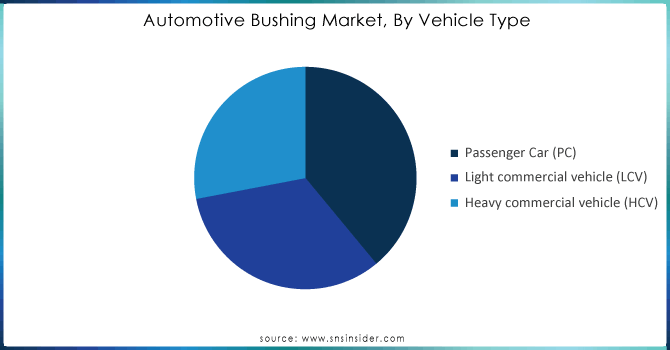

By Vehicle Type:

In 2023, the worldwide automotive bushing market was segmented based on vehicle types as passenger cars (PC), light commercial vehicles (LCV), and heavy commercial vehicles (HCV). Of these, the maximum market share was captured by passenger cars contributing to approximately 65% of the total market share because of the high production volume of passenger cars. LCV captured almost a huge share comprising 20%, while the rest of the share, 15%, was by HCV. This distribution represents the tremendous diversity associated with bushing requirements between different classes of vehicles. The riding comfort and reducing noise levels afforded in passenger cars require the use of materials in the bushings to minimize vibration. For the low riding comfort and high cargo carrying capacity demanded in light commercial vehicles such as vans and pick-up trucks, this leads to variations in design and materials used in manufacturing bushings.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Electric Vehicle Type:

By 2031, BEVs will capture more than 40% of the market, driven in part by higher bushing content to support electric motor vibrations and special drivetrain designs that are unique to BEV applications versus ICE vehicle applications. Meanwhile, PHEVs will exhibit the greatest growth, propelled by government incentives and consumer preference for greener transportation. Since PHEVs have both electric motors and internal combustion engines, the demands for bushings vary with the driving mode.

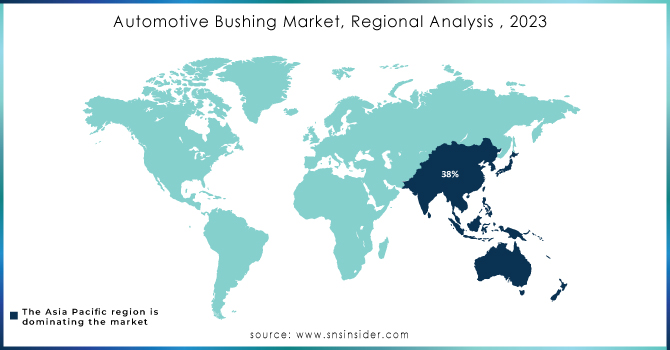

Regional Analysis:

The Asia Pacific holds a strong share of around 38% in the global automotive bushing market, stimulated majorly by strong vehicle production within countries, such as China, India, and Japan. Economic development within these countries has stimulated increased demand for motor vehicles, accelerated by government policy aimed at boosting local production through industrialization and fostering urbanization. Trailing only slightly behind is North America and Europe, combining for approximately 44.0% of the market share, with well-established automotive industries that have over the years, crafted themselves as historical powerhouses in automobile manufacturing. These regions experience steady growth driven by great technological advancements in the production of high-performance vehicles. The growth potential for these regions in South America is moderate, and for the Middle East & Africa it is low; together they possess a market share of 18.0%. The market for automotive bushings is expected to witness exponential growth over the coming years with a rise in disposable income, urbanization trends, and infrastructural investments in these regions.

Key Players:

Oiles Corporation, ZF Group, DuPont, Federal-Mogul LLC, BOGE Rubber & Plastics, Sumitomo Riko Company Limited, Paulstra SN, Vibracoustic GmbH, Continental AG, Mahle GmbH are the major key player in the Automotive Bushing Market.

RECENT DEVELOPMENT:

-

In November 2022, the acquisition of Tenneco by the Apollo Funds was completed. The acquisition is likely to furnish Tenneco with the required resources and platform to grow across business segments and geographies. This acquisition will provide Tenneco with the opportunity to further its global presence and pursue growth in several end-markets.

-

In February 2023, vibracoustic, a key supplier of automotive components, perfected the new chassis bushings for purely battery-powered electric automobiles. Equipped with the innovative BEV-specific chassis mount, it is now able to give electric cars the opportunity to reduce concerns such as extra vehicle weight and other noise and vibration problems.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 160.50 Billion |

| Market Size by 2032 | US$ 264.30 Billion |

| CAGR | CAGR of 5.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Application (Engine, Suspension, Chassis, Interior, Exhaust, Transmission) • by Vehicle Type (Passenger car (PC), Light commercial vehicle (LCV), Heavy commercial vehicle (HCV)) • by Electric Vehicle Type (Battery electric vehicle (BEV), Hybrid electric vehicle (HEV), Plug-in-hybrid electric vehicle (PHEV)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Oiles Corporation, ZF Group, DuPont, Federal-Mogul LLC, BOGE Rubber & Plastics, Sumitomo Riko Company Limited, Paulstra SN, Vibracoustic GmbH, Continental AG, Mahle GmbH |

| Key Drivers | • The growth of the auto parts industry is going up. • The car components sector is expanding rapidly. • A growing number of people are worried about the comfort of their vehicles' rides. • An increase in luxury vehicle purchases are projected to fuel the market's growth in the near future. |

| RESTRAINTS | • There are growing concerns regarding safety and vibrations. • In the automotive part sector, there is fierce rivalry for automotive bushing advancements. • High competition in the market for automotive bushing advances in the automotive part sector. • Concerns about safety and vibrations have grown. |