Automotive Chip Market Report Scope & Overview:

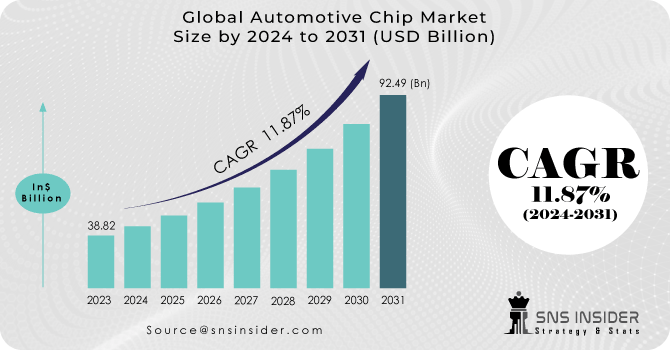

The Automotive Chip Market Size was valued at USD 38.82 billion in 2023 and is expected to reach USD 92.49 billion by 2031 and grow at a CAGR of 11.87% over the forecast period 2024-2031.

The automotive chip market is experiencing a profound surge, driven by a convergence of factors that signal significant growth ahead. Central to this momentum is the proliferation of intelligent vehicles, fueled by the escalating consumer appetite for advanced features such as ADAS and autonomous driving capabilities. To meet these demands, there's an increasing need for sophisticated chips capable of processing immense volumes of sensor data in real-time. According to forecasts from SNS Insider, the automotive semiconductor market is expected to reach USD 84.97 billion by 2031, with a projected annual growth rate of 8.3%. This will be a imperative factor which will be wholly responsible for the growth of the automotive chips during the forecasted period.

Get More Information on Automotive Chip Market - Request Sample Report

Governments are actively supporting this expansion. In the United States, the CHIPS Act has earmarked $52 billion to bolster domestic chip production, recognizing its pivotal role in the automotive sector. Meanwhile, China has unveiled a $150 billion initiative aimed at catapulting its chip industry forward. These substantial investments, combined with ongoing automotive innovation, underscore the imminent surge in demand for automotive chips. Also, the automotive car chip enables the driver to use their voices to control the navigation and automotive infotainment systems of the vehicle.

MARKET DYNAMICS:

KEY DRIVERS:

-

The need for personal transportation vehicles has grown in tandem with the expansion in car production

-

There has been a steady rise in the need for vehicle safety and the use of engine control units

-

The use of automotive chips is on the rise as a result of the growing popularity of these vehicles

The automotive chip market is witnessing unprecedented growth, driven by soaring demand for feature-rich electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These sophisticated chips serve as the cornerstone of modern automobiles, overseeing a range of functions including engine performance, fuel efficiency, in-car entertainment, and autonomous driving capabilities.This surge is further propelled by governmental initiatives globally. Notably, the European Union has unveiled a €43 billion investment scheme aimed at strengthening domestic chip manufacturing and diminishing dependence on international suppliers.

RESTRAINTS:

-

The chip's restraints may potentially be defective or fail. This could be a big impediment to the market

-

These chips may fail or suffer a major malfunction due to excessive current leakage

-

The chip used in automobiles is subject to developing flaws or failing entirely

OPPORTUNITIES:

-

Due to the development in safety-related electronic systems and automobiles

-

Fully automated vehicles will require high-powered chips to process real-time data from a large number of sensors

The future landscape of transportation hinges on the advanced capabilities of autonomous vehicles, powered by cutting-edge automotive chips. These technological marvels will serve as the cognitive engines behind self-driving cars, constantly analyzing a vast stream of data from LiDAR, radar, cameras, and other sensors. The real-time fusion of this sensory information demands substantial computational power to navigate intricate surroundings, interpret dynamic environments, and make instantaneous decisions. The automotive chip market stands at the brink of a transformative epoch, fueled by significant government initiatives. For instance, China has committed a substantial $1.5 billion investment to propel its domestic chip industry forward, with a specific emphasis on advancing autonomous driving technologies.

CHALLENGES:

-

It is expected that the cost of chip-based products and automobiles would rise as demand grows

IMPACT OF RUSSIA-UKRAINE WAR:

The conflict in Ukraine has exacerbated the already strained automotive chip market, causing disruptions to the supply chain. Although chip production itself was not severely impacted, the war has worsened shortages of critical raw materials. Russia's role as a major supplier of neon, essential for chip lithography, and Ukraine's expertise in neon purification have both been affected, leading to extended lead times and higher chip prices. Looking forward, there is a predicted geographical reshuffle in the chip industry.

Governments worldwide are prioritizing domestic chip production to enhance supply chain resilience. Initiatives such as the US CHIPS Act, with a $52 billion allocation for semiconductor manufacturing subsidies, and the EU's goal to double chip production by 2030, aim to achieve this. However, expanding capacity takes time. In the short to medium term, volatility in the automotive chip market is expected to persist, potentially prompting automakers to adjust production schedules or features due to chip constraints. Prices may also remain elevated until new production capacity is established. This highlights the importance of ongoing government investment and industry collaboration to build a more stable and secure chip supply chain for the future.

IMPACT OF ECONOMIC SLOWDOWN:

An economic downturn can set off a chain reaction in the automotive chip sector, impacting major chip producers and vehicle manufacturers alike. A decrease in consumer spending during such times leads to a drop in car sales, consequently reducing the demand for automotive chips. This scenario might prompt leading chipmakers such as Nvidia, NXP, and Infineon to reconsider their production forecasts and contend with potential profit margin pressures.

Nevertheless, amidst this slowdown lies an opportunity for industry consolidation and strategic investments. Governments worldwide are acknowledging the pivotal role of chip manufacturing and are taking measures to strengthen domestic production. For example, the EU has pledged €43 billion to fortify the European chip ecosystem. These governmental initiatives, combined with possible mergers and acquisitions within the sector, have the potential to reshape the automotive chip market landscape.

Although the immediate future may involve adjustments due to the economic slowdown, these investments position the market for a more robust and resilient future.

Market, By Component:

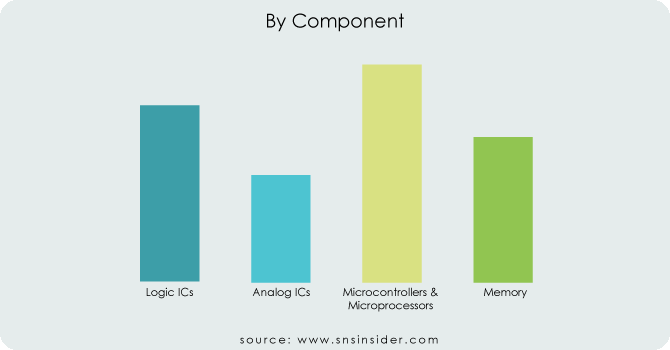

The automotive chip market is composed of several critical components, each fulfilling distinct roles. Logic ICs serve as the backbone of electronic systems, managing fundamental digital operations such as signal routing and amplification. They hold a substantial share, approximately 25%, driven by their prevalence in driver assistance systems, instrument clusters, and infotainment units.

Analog ICs, constituting around 20% of the market, play a crucial role in real-world signal processing. They convert physical quantities like temperature, pressure, and sound into electrical signals comprehensible to digital systems. Microcontrollers (MCUs) and microprocessors (MPUs), which collectively occupy about 30% of the market, serve as the brains of embedded systems. MCUs act as miniaturized computers overseeing specific tasks, while MPUs provide enhanced processing power for intricate operations. Finally, memory accounts for the remaining 25% of the market share. It is indispensable for data storage and retrieval in vehicles, facilitating functions like engine control and diagnostics. The demand for each component segment varies based on factors such as car features and the adoption rate of technology.

Market, By Application:

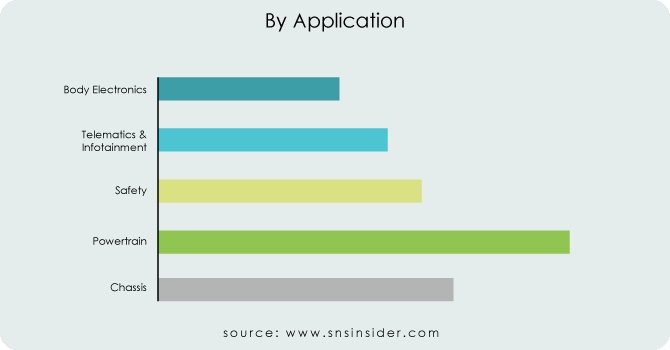

The global market has been divided into Chassis, Powertrain, Safety, Telematics & Infotainment, and Body Electronics based on the apllication type segment. The automotive chip market is segmented into key applications crucial for modern vehicle functionality. Powertrain applications, essential for engine and drivetrain operation, hold the largest market share at 35%. This dominance mirrors the increasing complexity of combustion engines and the rise of electric vehicles, necessitating advanced chipsets for efficient power management. Chassis applications, covering steering, suspension, and braking systems, account for 20% of the market. Safety features, including airbags and advanced driver-assistance systems (ADAS), represent another significant segment at 20%, driven by regulatory demands and consumer preferences for crash prevention technologies. Telematics and infotainment systems, offering navigation, entertainment, and connectivity, capture 15% of the market share. Lastly, body electronics, facilitating comfort and convenience features such as automatic windows and climate control, constitute the remaining 10%. This distribution reflects the automotive industry's focus on efficient operation, safety, and enhancing the driver experience.

Market, By Vehicle type:

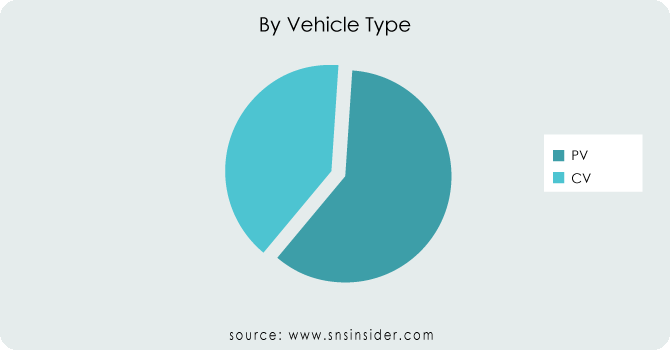

In 2023, the global automotive chip market was distinctly segmented into two primary categories: passenger cars and commercial vehicles. Passenger cars emerged as the dominant force, commanding approximately 68% of the total market share. This preeminence can be attributed to a confluence of factors propelling the demand for personal transportation solutions. Notably, the surge in consumer preference for private vehicles has been instrumental in bolstering the prominence of this segment. Additionally, the pervasive integration of sophisticated functionalities such as advanced driver-assistance systems (ADAS) and cutting-edge infotainment systems has further cemented the dominance of passenger cars in the automotive chip market.

MARKET SEGMENTATION:

By Component:

-

Logic ICs

-

Analog ICs

-

Microcontrollers & Microprocessors

-

Memory

By Application:

-

Chassis

-

Powertrain

-

Safety

-

Telematics & Infotainment

-

Body Electronics

By Vehicle Type:

-

Passenger cars

-

Commercial vehicles

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

The size of the market in North America was assessed at USD 11.64 billion in 2023, and it is anticipated that over the next few years, it will likely register strong growth. On the other hand, Asia Pacific is anticipated to reach a value of USD 30.05 billion by the year 2031. This is mostly attributable to the growing production of automobiles in India, China, and Japan. As a result of the fact that this region was responsible for more than half of the total annual production of automobiles across the globe, Asia Pacific was awarded the most prestigious place. During this time, Europe was responsible for the second-largest proportion of the market. As a result of the presence of numerous notable luxury automobile manufacturers, it is anticipated that the European market would experience significant development over the course of the time under consideration.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

Robert Bosch GmbH (Germany), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Toshiba Corporation (Japan), ON Semiconductor (US), Renesas Electronics (Japan), Infineon Technologies (Germany), Texas Instruments Incorporated (US), ROHM Semiconductor (Japan), Denso Corporation (Japan) are some of the affluent competitors with significant market share in the Automotive Chip Market.

Recent Developments:

-

Intel's Automotive Ambitions: Intel has been actively pursuing opportunities in the automotive chip market. They have been working on developing chips for autonomous driving, vehicle connectivity, and infotainment systems. In recent times, they might have introduced new automotive-grade processors or collaborated with automakers to integrate their technologies into vehicles.

-

NVIDIA's Advancements: NVIDIA has been a prominent player in supplying chips for autonomous driving and advanced driver assistance systems (ADAS). They might have introduced new iterations of their DRIVE platform, which includes hardware and software solutions for autonomous vehicles. Partnerships with automotive companies for integrating NVIDIA's technology into their vehicles are also significant developments to watch out for.

Toshiba Corporation (Japan)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 38.82 Billion |

| Market Size by 2031 | US$ 92.49 Billion |

| CAGR | CAGR of 11.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Logic ICs, Analog ICs, Microcontrollers & Microprocessors, Memory) • by Application (Chassis, Powertrain, Safety, Telematics & Infotainment, Body Electronics), • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), NXP Semiconductors (Netherlands), STMicroelectronics (Switzerland), Toshiba Corporation (Japan), ON Semiconductor (US), Renesas Electronics (Japan), Infineon Technologies (Germany), Texas Instruments Incorporated (US), ROHM Semiconductor (Japan), Denso Corporation (Japan) |

| Key Drivers | •The need for personal transportation vehicles has grown in tandem with the expansion in car production. •There has been a steady rise in the need for vehicle safety and the use of engine control units. |

| RESTRAINTS | •The chip's restraints may potentially be defective or fail. This could be a big impediment to the market. •These chips may fail or suffer a major malfunction due to excessive current leakage. |