Aviation Crew Management Systems Market Report Scope & Overview:

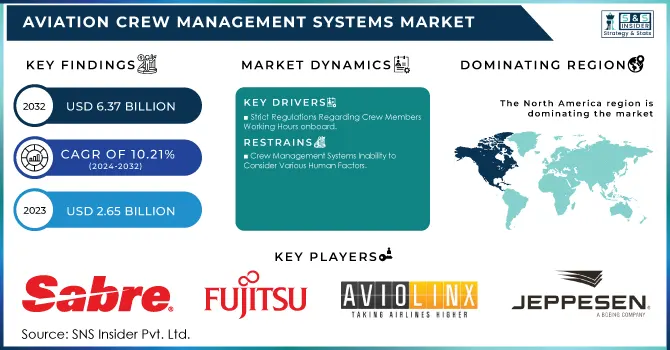

The Aviation Crew Management Systems Market size was valued at USD 2.65 billion in 2023 and is projected to reach USD 6.37 billion by 2032, exhibiting a robust compound annual growth rate (CAGR) of 10.21% during the forecast period from 2024 to 2032.

Crew management systems are crucial for ensuring safe flight operations. The importance and necessity of these technologies, as well as their efficiency in maintaining safe and efficient aircraft operations, are widely recognised. As a result, airlines are increasingly utilising these technologies to guarantee that crew members have adequate rest time between flights in order to reduce fatigue. The global market is increasingly fragmented, with many competitors catering to rising demand. Government regulations limiting the working hours of on-board workers are also expected to fuel market growth. The high costs of developing these systems, as well as the insufficiency of staff management systems in accounting for human variables, may limit market expansion.

To get more information on Aviation Crew Management Systems Market - Request Free Sample Report

Commercial aviation crew management is a system that uses all of its resources, including equipment, processes, and people, to ensure a safe and efficient flight. Global demand for these technologies is increasing due to increased air traffic and expanding airline fleets. Furthermore, the growing demand for professional automated systems that enable quick decision-making is a key driver of the global market. This sector is expected to grow globally as a result of increased research and development initiatives by various government and non-government entities worldwide.

MARKET DYNAMICS

KEY DRIVERS

-

Crew Member Utilization Optimization Reduces Costs

-

Strict Regulations Regarding Crew Members Working Hours onboard

RESTRAINTS

-

Crew Management Systems Inability to Consider Various Human Factors

OPPORTUNITY

-

New Airlines Arrive in Developed Countries

-

In these wealthy countries, several airlines are entering the aviation market.

CHALLENGES

-

Development of Crew Management Systems to Meet Specific Airlines' Requirements

-

Changes in Crew Members' Work Plans Due to Unforeseen Circumstances

IMPACT OF COVID-19

The impact of the Coronavirus COVID-19 is discussed in the report: Since the COVID-19 virus emerged in December 2019, the disease has spread to nearly every country on the earth. prompting the World Health Organization to declare it a public health emergency. The global consequences of the coronavirus illness 2019 (COVID-19) are already being felt, and they will have a substantial impact on the Aviation Crew Management System Market in 2022

Flight cancellations; travel bans and quarantines; restaurants closed; all indoor/outdoor events restricted; over forty countries declared states of emergency; massive slowing of the supply chain; stock market volatility; falling business confidence, growing public panic, and anxiety about the future

The on-cloud segment is expected to lead the staff management systems market during the forecast period. It is clear that more and more airlines are embracing cloud technology in order to improve operational efficiency and client satisfaction. Cloud software has fast become an essential component of flight crew operations. Online airline services for cabin crew include, among other things, e-ticketing, lodging arrangements, flight schedules, and weather forecasts.

The tablet segment of the crew management systems market is expected to develop at the fastest CAGR during the projected period. This is due to the introduction of tablets for cabin crew in order to decrease cumbersome paper-based/manual procedures in executing day-to-day activities such as meal delivery and passenger management.

The crew operations application segment of the crew management systems market is expected to develop at the fastest CAGR during the forecast period. This application of the crew management system is in charge of merging staff schedules with real-time flight data to allow controllers to focus on specific areas such as flight delays caused by inclement weather.

KEY MARKET SEGMENTATION

By Device

-

Smartphones

-

PCS

-

Tablets

By Application

-

Crew Planning

-

Crew Services

-

Crew Training

-

Crew Operations

By System

-

On-Cloud

-

Server Based

REGIONAL ANALYSIS

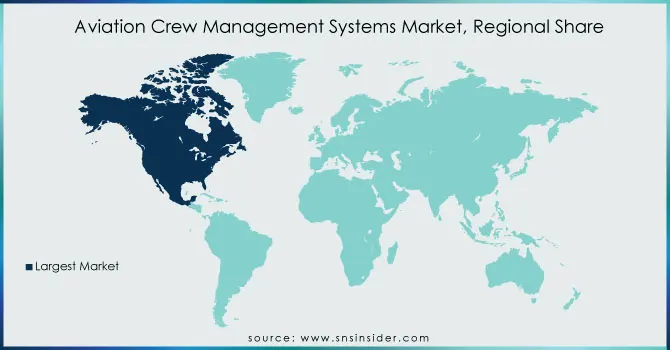

During the projected period, North America is expected to lead the crew management systems market. The increase in the number of airlines joining the market is projected to boost the expansion of the North American crew management industry. Because of the presence of world-leading airlines such as American Airlines, Delta Air Lines, and Southwest Airlines, among others, the North American market is predicted to have the biggest demand for crew management system suppliers.

From 2021 to 2028, the Asia-Pacific crew management systems market is expected to develop at the fastest CAGR. Increasing demand for new aircraft in the region has resulted from increased passenger traffic, which is expected to drive the market throughout the forecast period.

Need any customization research on Aviation Crew Management Systems Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Sabre Corporation, Fujitsu, PDC A/S , Aviolinx, Hexaware Technologies Limited, Jeppesen, IBS Software, Lufthansa Systems, BlueOne Software, InteliSys Aviation Systems and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 2.41 Billion |

| Market Size by 2030 | US$ 5.25 Billion |

| CAGR | CAGR of 10.21% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (Smartphones, PCS, Tablets) • By Application (Crew Planning, Crew Services, Crew Training, Crew Operations) • By System (On-Cloud, Server Based) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sabre Corporation, Fujitsu, PDC A/S , Aviolinx, Hexaware Technologies Limited, Jeppesen, IBS Software, Lufthansa Systems, BlueOne Software, InteliSys Aviation Systems. |

| DRIVERS | • Crew Member Utilization Optimization Reduces Costs • Strict Regulations Regarding Crew Members' Working Hours onboard |

| RESTRAINTS | • Crew Management Systems' Inability to Consider Various Human Factors |