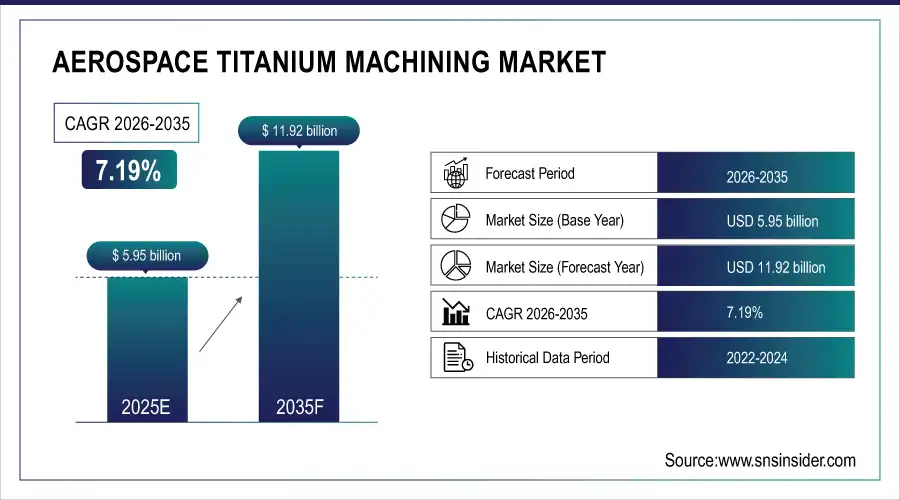

Aerospace Titanium Machining Market Size & Trends:

The Aerospace Titanium Machining Market size was valued at USD 5.95 billion in 2025 and is projected to reach USD 11.92 billion by 2035, growing at a CAGR of 7.19% during 2026–2035.

The market is experiencing significant growth due to rising demand for lightweight, high-strength aerospace components. Titanium alloys offer superior corrosion resistance, durability, and fuel efficiency, which are critical for commercial aircraft, defense, and space applications. Advancements in CNC machining, precision manufacturing, and additive technologies are enabling complex component production. Increased aircraft production, defense contracts, and the push for fuel-efficient, high-performance materials are further driving market expansion.

Aerospace Titanium Machining Market Size and Forecast:

-

Market Size in 2025: USD 5.95 billion

-

Market Size by 2035: USD 11.92 billion

-

CAGR: 7.19% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Aerospace Titanium Machining Market - Request Free Sample Report

Key trends in the Aerospace Titanium Machining Market:

-

Rising demand for lightweight and fuel-efficient aircraft is increasing titanium adoption.

-

Growth in defense and space exploration programs is driving precision machining requirements.

-

Advancements in CNC, additive, and hybrid machining technologies are enabling complex, high-performance parts.

-

Focus on corrosion-resistant and high-strength materials is extending aircraft and component service life.

-

Increasing commercial and private aircraft production is broadening market opportunities.

-

Integration of smart manufacturing and automation is improving machining accuracy, productivity, and cost efficiency.

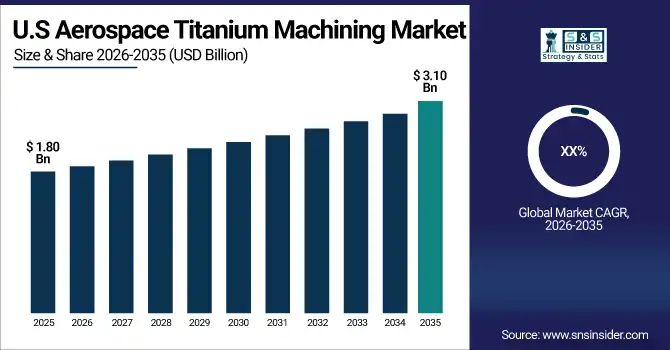

U.S. Aerospace Titanium Machining Market:

The U.S. Aerospace Titanium Machining Market size was valued at USD 1.80 billion in 2025 and is projected to reach USD 3.10 billion by 2035, driven by rising demand for high-performance titanium components in commercial and defense aircraft. Adoption of advanced machining technologies, fuel-efficiency initiatives, and expansion of aerospace manufacturing facilities are further boosting market growth.

Aerospace Titanium Machining Market Drivers:

-

Rising Demand for Lightweight and High-Strength Titanium Components in Commercial and Defense Aircraft

Increasing demand for lightweight, high-strength titanium components in commercial and defense aircraft is a major driver of the aerospace titanium machining market. Titanium alloys offer superior corrosion resistance, durability, and fuel efficiency compared to traditional aluminum and steel, which directly drives their adoption in airframes, engine parts, and structural components. The surge in aircraft production for models such as Boeing 737 MAX, Airbus A320neo, and defense modernization programs is further fueling demand for precision-machined titanium components. Additionally, advancements in CNC machining, additive manufacturing, and hybrid machining techniques allow the production of complex geometries with high accuracy, accelerating market growth. Continuous investment in high-performance titanium machining capabilities by OEMs and Tier-1 suppliers ensures the industry can meet rising aerospace production and performance requirements.

In March 2025, Boeing partnered with Spirit AeroSystems to co-develop and manufacture titanium machined components for next-generation commercial aircraft, demonstrating how rising aircraft production directly drives aerospace titanium machining demand.

Aerospace Titanium Machining Market Restraints:

-

High Production Costs and Complex Machining Challenges Limiting Titanium Adoption in Aerospace Manufacturing

High production costs and complex machining processes act as key restraints for the aerospace titanium machining market. Titanium extraction, smelting, and billet production are energy-intensive and expensive, while machining titanium alloys requires specialized tooling, advanced cooling strategies, and experienced technicians. These challenges cause longer production cycles, increased tool wear, and higher scrap rates, limiting cost-effective adoption. Additionally, volatility in raw material supply and prices further constrains procurement and budgeting for aerospace manufacturers. These factors combine to slow titanium machining integration in cost-sensitive projects despite the material’s performance advantages, creating barriers to market growth.

Aerospace Titanium Machining Market Opportunities:

-

Growth of Hypersonic and Space Launch Programs Driving Demand for Advanced Titanium Machined Components

The aerospace titanium machining market presents significant opportunities due to the rapid growth of hypersonic vehicles and space launch programs. These next-generation platforms require lightweight, high-strength, and heat-resistant materials, which directly increases the adoption of titanium alloys for structural and engine components. As governments and private aerospace companies invest in reusable launch systems and hypersonic aircraft, demand for precision-machined titanium components grows. The adoption of additive and hybrid manufacturing technologies enables the production of large, complex titanium geometries, allowing suppliers to capture emerging aerospace segments. This shift offers manufacturers an opportunity to expand capabilities and meet specialized high-performance requirements.

In August 2025, researchers successfully 3D-printed a titanium fuel tank for space applications, passing durability tests, illustrating how additive machining enables complex, lightweight titanium components for extreme aerospace environments.

Aerospace Titanium Machining Market Segmentation Analysis:

By Titanium Type, Titanium Alloys Segment Dominates with 47% Share in 2025, High-Temperature Titanium Alloys to Record Fastest Growth with 9.69% CAGR

The Titanium Alloys segment held a dominant aerospace titanium machining market share of approximately 47% in 2025. The growing demand for lightweight and corrosion-resistant components in commercial and defense aircraft drives market growth. Titanium alloys are preferred for wing structures, fuselage reinforcements, and engine mounts due to their superior strength-to-weight ratio. Advancements in CNC and additive manufacturing enable precise production of complex titanium components, further accelerating market adoption.

The High-Temperature Titanium Alloys segment is expected to experience the fastest growth over 2026–2035 with a CAGR of 9.69%. Increasing requirements for extreme-environment components in jet engines, hypersonic vehicles, and space launch systems are driving this growth. Precision machining technologies allow production of high-strength, heat-resistant components like turbine discs and exhaust systems, which are critical for aerospace performance, thereby expanding titanium machining opportunities in high-performance applications.

By Application, Engine Components Segment Dominates with 29% Share in 2025, Space & Launch Vehicle Components to Record Fastest Growth with 12.16% CAGR

The Engine Components segment held a dominant aerospace titanium machining market share of 29% in 2025. Rising commercial jet deliveries and defense aircraft programs drive demand for machined titanium parts, including fan blades, casings, and discs. Advancements in precision CNC and multi-axis machining allow complex engine geometries to be manufactured efficiently, improving performance, fuel efficiency, and reliability, which directly supports titanium machining market growth.

The Space & Launch Vehicle Components segment is expected to experience the fastest growth over 2026–2035 with a CAGR of 12.16%. Increased investment in reusable launch systems, hypersonic vehicles, and satellite programs drives demand for high-strength, lightweight titanium alloys. Advanced machining and additive manufacturing technologies enable production of large and intricate components, such as fuel tanks and structural frames, creating new opportunities in aerospace titanium machining for space and defense applications.

By Aircraft Type, Commercial Aircraft Segment Dominates with 42% Share in 2025, UAVs Segment to Record Fastest Growth with 13.28% CAGR

The Commercial Aircraft segment held a dominant aerospace titanium machining market share of 42% in 2025. Fleet expansions and replacement cycles drive demand for high-strength titanium components in airframes, landing gear, and engine assemblies. Advanced machining techniques enable precision production, which improves fuel efficiency, structural integrity, and aircraft performance, directly boosting titanium machining adoption.

The UAVs segment is expected to experience the fastest growth over 2026–2035 with a CAGR of 13.28%. Rising demand for military, surveillance, and delivery UAVs drives the need for lightweight, high-strength titanium components. Additive and precision machining allow production of complex small-scale titanium parts, optimizing UAV performance and flight endurance, which expands the aerospace titanium machining market in emerging unmanned aerial applications.

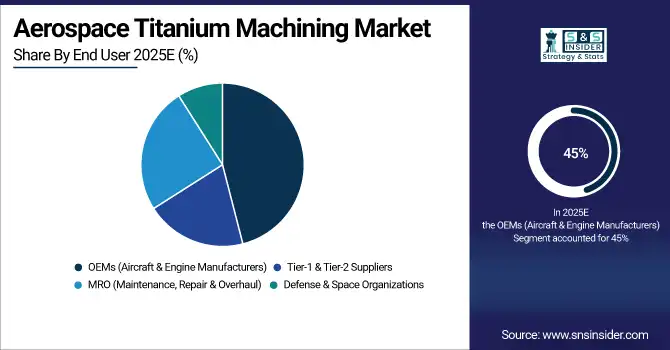

By End User, OEMs Segment Dominates with 45% Share in 2025, MRO Segment to Record Fastest Growth with 10.19% CAGR

The OEMs (Aircraft & Engine Manufacturers) segment held a dominant aerospace titanium machining market share of 45% in 2025. Commercial and defense OEMs require high volumes of precision-machined titanium for engines, airframes, and landing gear. Advancements in CNC and additive machining allow faster production of complex components, supporting structural reliability and fuel efficiency, which directly drives titanium machining demand.

The MRO (Maintenance, Repair & Overhaul) segment is expected to experience the fastest growth over 2026–2035 with a CAGR of 10.19%. Aging fleets and increasing maintenance cycles create higher demand for replacement titanium parts. Advanced machining and additive manufacturing technologies enable quick turnaround of high-strength components for engines and structural assemblies, directly boosting aerospace titanium machining market growth in aftermarket and repair applications.

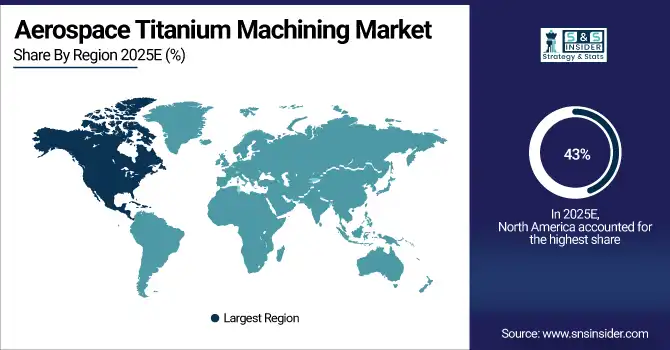

Aerospace Titanium Machining Market Regional Insights:

North America Dominates Aerospace Titanium Machining Market in 2025

In 2025, North America commands an estimated 43% share of the aerospace titanium machining market, driven by high aircraft production, defense modernization programs, and advanced aerospace manufacturing capabilities. Leading OEMs such as Boeing, Lockheed Martin, and Northrop Grumman drive demand for high-strength, corrosion-resistant titanium components in airframes, engines, and UAVs. Investments in CNC machining, additive manufacturing, and high-performance titanium alloys enable precise production of complex geometries, accelerating adoption and supporting market leadership in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

The United States dominates North America’s aerospace titanium machining market due to its mature aerospace ecosystem, extensive commercial and defense aircraft production, and advanced R&D infrastructure. Continuous innovations in machining technologies and additive manufacturing allow U.S. suppliers to meet strict regulatory and performance requirements. Additionally, strong government defense contracts and large-scale aircraft programs ensure sustained demand for precision-machined titanium components, cementing the U.S. as the largest contributor to North America’s market share.

Asia-Pacific is the Fastest-Growing Region in Aerospace Titanium Machining Market During 2026–2035

Asia-Pacific is projected to grow at an estimated CAGR of 9.39% from 2026 to 2035, driven by rising commercial aircraft manufacturing, defense modernization programs, and increasing UAV production. The rapid expansion of aerospace infrastructure, investments in R&D, and adoption of advanced CNC and additive machining technologies directly boost demand for titanium components across airframes, engines, and space applications.

China dominates the Asia-Pacific aerospace titanium machining market due to its rapidly expanding commercial aircraft industry and growing defense programs. Companies like COMAC and AVIC are increasing production of regional jets and narrow-body aircraft, while UAV and satellite programs require high-strength, lightweight titanium components. Strategic government investments in aerospace R&D, manufacturing infrastructure, and additive machining enable China to lead the region’s market growth.

Europe Aerospace Titanium Machining Market Insights, 2025

Europe held a significant portion of the aerospace titanium machining market in 2025, accounting for approximately 25% of revenue, driven by commercial aircraft production and defense initiatives. High adoption of advanced machining technologies, coupled with regulatory compliance standards, supports precise titanium component manufacturing for engines, airframes, and landing gear.

France dominates Europe’s aerospace titanium machining market due to Airbus and Safran’s major aircraft and engine production programs. Continuous investment in CNC machining, additive manufacturing, and high-performance titanium alloys allows French suppliers to produce complex, lightweight components. Government support for aerospace innovation and large-scale aircraft projects further strengthens France’s leadership in the European market.

Middle East & Africa and Latin America Aerospace Titanium Machining Market Insights, 2025

In 2025, the Middle East & Africa market showed steady growth driven by defense modernization, regional airline expansions, and increased investments in precision titanium components. The UAE and Saudi Arabia lead the region with high adoption of aerospace technology and collaborations with global OEMs.

Latin America experienced moderate growth in 2025, led by Brazil and Mexico, driven by EMBRAER’s commercial aircraft production, expanding MRO facilities, and defense modernization programs. Investments in CNC and additive machining technologies support high-strength titanium component production, gradually increasing regional adoption of aerospace titanium machining solutions.

Competitive Landscape for the Aerospace Titanium Machining Market:

Kennametal

Kennametal is a U.S.-based leader in precision cutting tools and engineering solutions for aerospace titanium machining. The company specializes in carbide cutting inserts, drills, end mills, and reamers designed for high-strength titanium alloys, supporting engine components, airframe structures, and UAV parts. With decades of experience in tooling for aerospace applications, Kennametal provides advanced solutions for precision CNC and additive manufacturing processes. Its role in the aerospace titanium machining market is vital, offering high-performance tools that enhance production efficiency, reduce wear, and enable complex geometries in high-strength titanium components.

-

In March 2025, Kennametal launched its “AeroMax Ti-Series” carbide inserts, designed specifically for high-temperature titanium alloys, improving tool life by 25% and precision in machining complex aerospace components.

Sandvik Coromant

Sandvik Coromant is a Sweden-based global leader in tooling solutions for aerospace titanium machining. The company offers precision end mills, drills, turning inserts, and milling cutters engineered for machining titanium alloys in engines, landing gear, and structural components. Sandvik Coromant combines advanced material science with cutting-edge coating technologies to enhance tool durability, reduce machining forces, and improve surface quality. Its role in the aerospace titanium machining market is central, enabling manufacturers to achieve faster cycle times and higher precision while handling difficult-to-machine titanium materials.

-

In January 2025, Sandvik Coromant introduced the “Inveio Aero Coated End Mills,” designed for high-temperature titanium machining, enabling aerospace manufacturers to achieve tighter tolerances and improved productivity in critical engine and airframe parts.

FPD Company

FPD Company is a U.S.-based aerospace materials specialist, focusing on titanium machining and alloy fabrication. The company provides high-quality titanium plates, sheets, and precision components for airframes, engine parts, and UAV structures. With expertise in precision forming, cutting, and surface treatment, FPD Company supports OEMs and MRO service providers in delivering lightweight, high-strength titanium components. Its role in the aerospace titanium machining market is significant, supplying both raw materials and finished components that meet stringent aerospace performance and regulatory standards, enabling enhanced structural integrity and operational reliability.

-

In February 2025, FPD Company unveiled its “Ti-6Al-4V Pre-Machined Plates” for jet engine applications, designed for improved machinability and dimensional stability in high-performance aerospace parts.

Gould Alloys

Gould Alloys is a U.S.-based manufacturer specializing in aerospace-grade titanium alloys and precision machining services. The company produces high-performance titanium sheets, bars, and custom components for engines, landing gear, and structural airframe assemblies. Gould Alloys integrates advanced CNC and additive machining processes with alloy expertise to deliver components with high strength, corrosion resistance, and tight tolerances. Its role in the aerospace titanium machining market is pivotal, enabling OEMs and MRO providers to meet growing demand for lightweight, durable titanium parts while maintaining high-quality standards.

-

In May 2025, Gould Alloys launched its “G-Alloy Ti-64 Ultra Series,” a pre-machined titanium alloy bar optimized for high-temperature aerospace engine components, enhancing production efficiency and component durability.

Aerospace Titanium Machining Market Companies are:

-

Kennametal

-

Sandvik Coromant

-

FPD Company

-

Gould Alloys

-

RTI International Metals

-

Maniko

-

Protolabs

-

Dynamic Metal

-

Ural Boeing Manufacturing

-

Universal Metal

-

Precision Castparts Corp.

-

Spirit AeroSystems Holdings Inc.

-

Triumph Group Inc.

-

GE Aerospace

-

Rolls-Royce Holdings plc

-

Safran SA

-

RTX Corporation

-

Allegheny Technologies Incorporated (ATI)

-

VSMPO-AVISMA Corporation

-

GKN Aerospace

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | US$ 5.95 Billion |

| Market Size by 2035 | US$ 11.92 Billion |

| CAGR | CAGR of 7.19 % From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Titanium Type (Titanium Alloys, Commercially Pure Titanium, High-Temperature Titanium Alloys, Specialty / Beta Titanium Alloys) • By Application (Airframe Components, Engine Components, Landing Gear Components, Fasteners & Hardware, Control & Actuation Components, Space & Launch Vehicle Components) • By Aircraft Type (Commercial Aircraft, Military Aircraft, Business Jets, Helicopters & Rotorcraft, Unmanned Aerial Vehicles (UAVs), Spacecraft & Launch Vehicles) • By End User (OEMs (Aircraft & Engine Manufacturers), Tier-1 & Tier-2 Suppliers, MRO (Maintenance, Repair & Overhaul), Defense & Space Organizations) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Kennametal, Sandvik Coromant, FPD Company, Gould Alloys, RTI International Metals, Maniko, Protolabs, Dynamic Metal, Ural Boeing Manufacturing, Universal Metal, Precision Castparts Corp., Spirit AeroSystems Holdings Inc., Triumph Group Inc., GE Aerospace, Rolls-Royce Holdings plc, Safran SA, RTX Corporation, Allegheny Technologies Incorporated (ATI), VSMPO-AVISMA Corporation, GKN Aerospace |