Baby Food Market Report Scope & Overview:

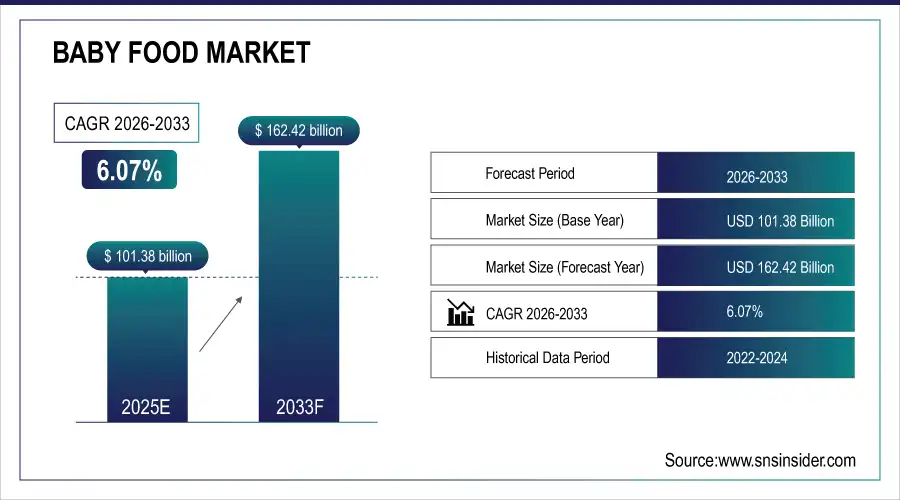

The Baby Food Market Size was valued at USD 101.38 billion in 2025E and is expected to reach USD 162.42 billion by 2033, growing at a CAGR of 6.07% over the forecast period of 2026-2033.

To Get more information on Baby Food Market - Request Free Sample Report

The Baby Food Market is experiencing robust growth due to several interlinked factors. Rising urbanization and dual-income households have increased demand for convenient, ready-to-eat, and nutritionally balanced baby food products. Parents are increasingly focused on health and wellness, seeking organic, fortified, and functional options that provide essential nutrients such as DHA, iron, and probiotics to support infant growth and development. Additionally, awareness of hygiene, food safety, and infant nutrition has surged globally, further boosting market adoption. Technological advancements in production, including cold-pressed, freeze-dried, and fortified formulations, enable longer shelf life and easier consumption, catering to modern lifestyles.

In the fiscal year 2022, the U.S. Food and Drug Administration (FDA) allocated an additional USD 18 million and 26 full-time equivalents to enhance maternal and infant health and nutrition initiatives. This investment underscores the FDA's commitment to improving the safety and quality of infant nutrition products.

Market Size and Forecast:

-

Baby Food Market Size in 2025E: USD 101.38 Billion

-

Baby Food Market Size by 2033: USD 162.42 Billion

-

CAGR: 6.07% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

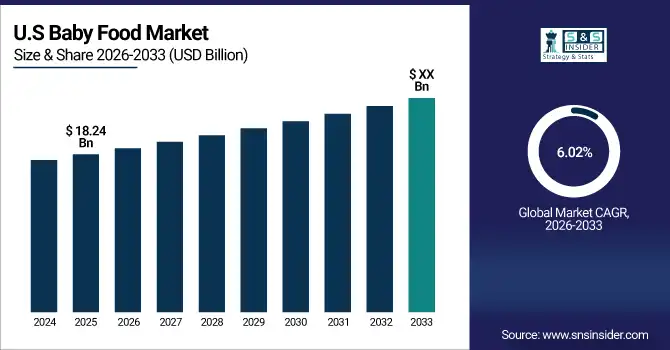

U.S. Baby Food Market Insights

The U.S. Baby Food Market was valued at USD 18.24 billion in 2025E and is projected to grow at a CAGR of 6.02% through 2033. Growth is driven by investments in advanced waste collection, composting facilities, and innovative recycling technologies. Expansion of retail, e-commerce, and foodservice partnerships further strengthens adoption, while government support for sustainability programs and small-scale waste management initiatives enhances market penetration.

Key Baby Food Market Trends

-

Rising adoption of organic, plant-based, and fortified baby food products to cater to health-conscious parents and infants with special dietary needs.

-

Growth of premium and artisanal baby food offerings, including cold-pressed, freeze-dried, and functional foods, driven by consumer preference for high-quality and nutrient-rich products.

-

Increasing use of e-commerce, subscription services, and direct-to-consumer (D2C) models to provide convenience and wider accessibility of baby food products.

-

Expansion of fortified and functional baby food lines, supported by investments in R&D and innovative ingredient inclusion such as probiotics, DHA/ARA, and prebiotics.

-

Rising government regulations and nutritional guidelines promoting safety, fortification, and allergen labeling across baby food products in key regions like the U.S., Europe, and India.

-

Integration of digital tools, IoT-enabled production monitoring, and traceability solutions to ensure quality, safety, and compliance throughout the baby food supply chain.

Baby Food Market Growth Driver

-

Rising Demand for Premium, Organic, and Fortified Baby Food

Parents and caregivers are increasingly seeking nutrient-rich, organic, and fortified baby food options to ensure infant health, wellness, and development. This demand has encouraged global and regional players to expand production lines, introduce plant-based and functional ingredients, and launch innovative packaging for convenience. Governments across Europe, the U.S., and India are implementing stricter nutritional labeling standards and fortification mandates, promoting safer and healthier products. For instance, in 2024, Nestlé invested USD 20 million to expand its organic infant formula production facility in Switzerland to meet rising consumer demand for premium and fortified baby nutrition.

Baby Food Market Restraint

-

High Production Costs and Compliance Complexity

Producing premium and fortified baby food involves high costs for quality raw materials, specialized processing equipment, cold-chain infrastructure, and R&D for nutrient optimization. Compliance with international regulations, such as FDA, EFSA, and FSSAI standards, adds additional challenges, particularly for small and medium enterprises seeking to expand globally. For example, in 2023, a mid-sized baby food manufacturer in the U.S. delayed the launch of a fortified organic product line due to prolonged regulatory approvals for allergen labeling and ingredient certification, highlighting barriers related to compliance and operational costs.

Baby Food Market Opportunity

-

Expansion into Emerging Markets and Digital Sales Channels

Companies are leveraging technological innovations, partnerships, and global expansions to capitalize on rising urbanization, disposable incomes, and health-conscious parental trends in emerging markets such as India, Southeast Asia, and Latin America. E-commerce and D2C models are enabling faster market penetration and greater accessibility of premium baby food. For instance, in 2025, Danone launched a direct-to-consumer online platform in India, offering fortified, organic, and plant-based baby food, supported by government incentives for infant nutrition programs and small-scale manufacturing subsidies. Strategic collaborations with local retailers and NGOs are also facilitating product adoption and education on infant nutrition.

Baby Food Market Segment Highlights:

-

By Product Type: Infant Formula – 40% share (largest); Snacks fastest-growing at 6.5% CAGR, driven by rising demand for convenient, fortified, and ready-to-eat baby nutrition options. Purees, Cereals, Juice & Smoothies, and Others also contribute to diversified growth across urban and semi-urban regions.

-

By Demography: Infant – 50% share (largest); Toddler fastest-growing at 6.2% CAGR, supported by increased parental focus on nutrition, protein-rich meals, and fortified food for toddlers. Pre-Schooler segment also shows steady adoption due to functional and fortified snack offerings.

-

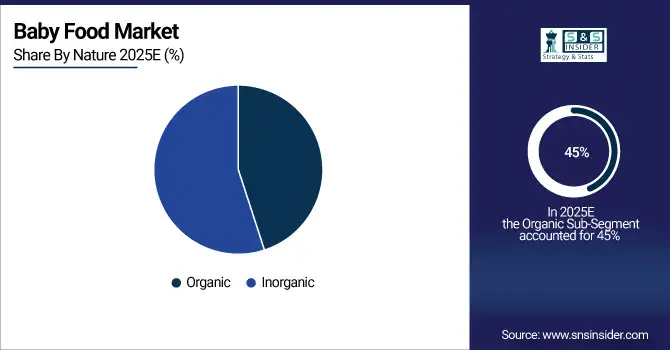

By Nature: Organic – 45% share (largest); Inorganic fastest-growing at 6.1% CAGR, driven by rising consumer awareness of clean-label ingredients, fortified formulas, and regulatory support for nutritional safety and labeling standards.

-

By Distribution Channel: Supermarkets/Hypermarkets – 48% share (largest); Online Stores fastest-growing at 7.0% CAGR, fueled by increasing e-commerce adoption, D2C subscription models, and convenience-focused parents. Grocery Stores & Pharmacy Stores and Others also support regional penetration and accessibility.

Baby Food Market Segment Analysis

By Product Type

Infant Formula continues to dominate the market with a 40% share in 2025, driven by high nutritional value, established brand trust, and widespread adoption among parents globally. Snacks are the fastest-growing sub-segment, expected to register a CAGR of 6.5%, fueled by demand for convenient, fortified, and ready-to-eat baby nutrition options. Growth is further supported by product innovation in flavors, portion sizes, and functional ingredients such as probiotics and DHA.

By Demography

Infants lead the market with a 50% share in 2025, owing to strong demand for age-appropriate nutrition, fortified formulas, and clinical-grade infant food products. Toddlers are the fastest-growing segment, projected at a CAGR of 6.2%, driven by increasing focus on protein-rich meals, healthy snacks, and fortified offerings suitable for early childhood development. Pre-Schoolers also see steady adoption due to fortified snacks and ready-to-eat meal products.

By Nature

Organic baby food holds a 45% market share in 2025, benefiting from rising consumer preference for clean-label ingredients, non-GMO formulations, and chemical-free products. Inorganic baby food is the fastest-growing segment, growing at a CAGR of 6.1%, supported by fortified and functional formulations, regulatory compliance on nutrient enrichment, and increasing availability through organized retail and e-commerce platforms.

By Distribution Channel

Supermarkets/Hypermarkets dominate with a 48% share in 2025, supported by bulk sales, brand visibility, and strong retail penetration in urban and semi-urban areas. Online Stores are the fastest-growing sub-segment, with a CAGR of 7.0%, driven by rising e-commerce adoption, D2C subscription models, mobile app ordering, and convenience-focused parents. Grocery Stores & Pharmacy Stores and Other channels also contribute to regional penetration and product accessibility.

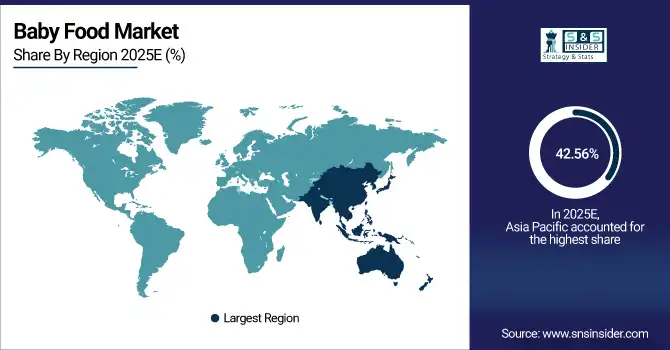

Baby Food Market Regional Analysis

Asia Pacific Baby Food Market Insights

Asia Pacific is the largest market with a 42.56% share in 2025, driven by rapid urbanization, rising disposable incomes, and increasing exposure to global food trends. Lower manufacturing costs, expanding retail networks, and supportive government policies for food processing and waste management solutions contribute to market growth. China and Japan are leading markets, with local players investing in advanced waste collection, recycling, and composting infrastructure. Adoption of e-commerce and cold chain systems enhances accessibility in semi-urban and urban areas, sustaining strong CAGR growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Baby Food Market Insights

North America accounts for 23.67% share in 2025 and is one of the fastest-growing regions in the market. Growth is fueled by mature waste collection and recycling infrastructure, high consumer awareness of sustainable solutions, and widespread retail and e-commerce penetration. The U.S. leads the region with advanced cold chain logistics, R&D investments in eco-friendly disposal technologies, and government incentives supporting sustainable waste practices. In 2025, companies such as Veolia and Waste Management expanded operations and introduced innovative recycling and composting programs to meet increasing domestic and commercial demand.

Europe Baby Food Market Analysis

Europe holds a 18.34% market share in 2025, supported by strong consumer preference for premium, artisanal, and sustainable waste management solutions. Germany, Italy, and France are key contributors, with investments in industrial and artisanal waste collection, recycling facilities, and eco-friendly technology adoption. The region benefits from well-established retail chains, specialty stores, and government regulations promoting sustainable food and waste management practices. Tourism in urban and leisure destinations also boosts demand for efficient Baby Food services.

Latin America (LATAM) and Middle East & Africa (MEA) Baby Food Market Insights

LATAM and MEA hold 7.43% and 8% market share in 2025, respectively, and are emerging as strategically important regions. Brazil leads LATAM due to a strong dairy industry and growing adoption of premium and plant-based waste management solutions. Chile and Argentina are investing in cold chain and collection infrastructure to expand artisanal offerings. In MEA, the UAE and Saudi Arabia are witnessing rising adoption of premium and imported solutions, supported by growing disposable incomes, tourism, and hospitality sector expansion. Government initiatives promoting sustainable production and waste management practices are driving market growth in both regions.

Competitive Landscape for Baby Food Market:

Nestlé S.A.

Nestlé produces and distributes a wide range of baby food products, including infant formula, cereals, purees, and snacks.

-

In January 2025, Nestlé launched a new infant formula production facility in Germany to expand capacity for premium and plant-based formulations targeting European and North American markets.

Danone S.A.

Danone focuses on organic and specialized baby nutrition products, including dairy-based and plant-based formulas.

-

In March 2025, Danone opened a state-of-the-art research and development center in France to innovate organic baby food lines and functional formulations.

Abbott Laboratories

Abbott manufactures infant formula and nutritional supplements, with a strong presence in North America and Asia-Pacific.

-

In February 2025, Abbott expanded its Abbott Nutrition facility in the U.S. to increase production of hypoallergenic and specialty infant formulas.

Mead Johnson & Company, LLC

Mead Johnson offers premium infant formula and toddler nutrition products globally.

-

In April 2025, the company launched a new infant nutrition line in China, enhancing plant-based and organic formula offerings.

Baby Food Market Key Players

Some of the Baby Food Companies

-

Nestlé S.A.

-

Danone S.A.

-

Abbott Laboratories

-

Mead Johnson & Company, LLC

-

Heinz Baby Food (Kraft Heinz Company)

-

Hero Group

-

FrieslandCampina N.V.

-

Arla Foods

-

Wyeth Nutrition (part of Nestlé)

-

Perrigo Company plc

-

Bellamy’s Organic

-

HiPP GmbH & Co. Vertrieb KG

-

Meiji Holdings Co., Ltd.

-

Beingmate Baby & Child Food Co., Ltd.

-

Yashili International Holdings Ltd.

-

Abbott Nutrition

-

Baby Gourmet

-

Nestlé Health Science

-

Plum Organics

-

Earth’s Best Organic

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD101.38 Billion |

| Market Size by 2033 | USD 162.42 Billion |

| CAGR | CAGR of6.07% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Infant Formula, Snacks, Purees, Cereals, Juice & Smoothies, Others) • By Demography(Infant, Toddler, Pre Schooler) • By Nature (Organic, Inorganic) • By Distribution Channel (Supermarkets/Hypermarkets, Grocery Stores & Pharmacy Stores, Online Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson & Company, LLC, Heinz Baby Food (Kraft Heinz Company), Hero Group, FrieslandCampina N.V., Arla Foods, Wyeth Nutrition (part of Nestlé), Perrigo Company plc, Bellamy’s Organic, HiPP GmbH & Co. Vertrieb KG, Meiji Holdings Co., Ltd., Beingmate Baby & Child Food Co., Ltd., Yashili International Holdings Ltd., Abbott Nutrition, Baby Gourmet, Nestlé Health Science, Plum Organics, Earth’s Best Organic |