Bag Clips Market Report Scope & Overview:

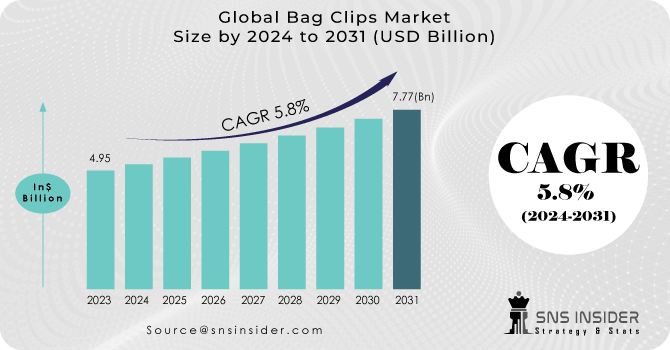

The Bag Clips Market size was USD 4.95 billion in 2023 and is expected to Reach USD 7.77 billion by 2031 and grow at a CAGR of 5.8% over the forecast period of 2024-2031.

The market for bag clips, which offer practical solutions to seal and maintain the freshness of different packaged goods, is a vital part of the packaging industry. Bag clips, usually made of plastic or metal, have a critical role to play in the resealing of bags of snacks, vegetables and other perishables that are unperishable.

Get More Information on Bag Clips Market - Request Sample Report

These clips are a cost effective and convenient way for consumers to keep their food items fresh, extend their shelf life, and prevent spills. The market is marked by notable growth due to the growing demand for packaged foods, an increase in a trend towards environmentally sustainable products and rising retail sales.

To meet evolving consumer preferences for sustainable, easy and visually pleasing packaging solutions, manufacturers are constantly innovating the design, materials and functions of bag clips. In addition, sustainability initiatives, lifestyle changes and developments in packaging technology are also having a significant influence on the bag clips market; these have contributed to its dynamism and evolution.

MARKET DYNAMICS

KEY DRIVERS:

-

The need to clip bags is driven by growing demand for packaged goods

Due to the increasing consumption of packaged foods and other food products, effective sealing and preservation is necessary as a result of this demand for bag clips. With modern, convenience oriented consumers' demands in mind, packaging clips ensure that products are kept fresh and properly stored.

-

Growth in the market may be beneficial for food safety and hygiene.

RESTRAIN:

- The market can be affected by concerns about the environment and regulations

The demand for reducing the use of plastics and increasing recycling has increased as a result of environmental awareness. Due to their contribution to waste in the form of plastics, bag clips are under scrutiny. The market for bags clips is facing a serious challenge from the restrictive legislation intended to limit plastics that are used only in one application.

OPPORTUNITY:

-

Due to increased online shopping, there is considerable opportunity for the development of special bags clips which secure packages during transit.

CHALLENGES:

-

Bag clip manufacturers are facing important challenges from increased environmental regulations and a greater focus on sustainability.

IMPACT OF RUSSIAN UKRAINE WAR

In Hungary, Slovakia, the Czech Republic, Poland and the former East Germany, the imposition of sanctions against Russia in the event of an invasion of Ukraine would threaten the supply of crude oil through pipelines and the operation of oil refineries and petrochemical plants. ICIS data predicts that by 2022, the refinery along the Druzhba pipeline will have 2.79 million tons of ethylene (11% of total European capacity) and 2.34 million tons of propylene (12% of total European capacity).

Due to unavailability of raw materials the production may be affected in various regions across the globe and cost of production may also rise.

IMPACT OF ONGOING RECESSION

Demand for consumer products which use plastic closures or caps such as food and beverages, personal hygiene items etc. is also expected to be reduced due to the recession. Due to the high cost of plastic, there is a forecast increase in competition with alternatives such as metals and glass. The result is expected to be a decline in demand for Bag Clips.

The American Bag Clips market is projected to decline by 2% in 2023 as a result of the recession. This, too, is due to increased fuel and energy costs. As a result of the recession, Europe's market for Bag Clips is estimated to decrease by 2.5% in 2023. This will lead to higher production costs as energy prices increase in this region.

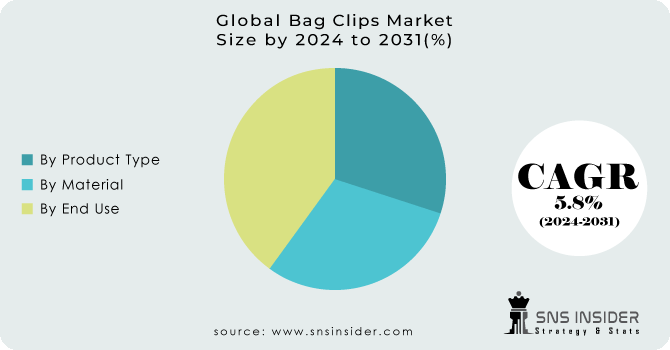

KEY MARKET SEGMENTS

By Material

-

Metal

-

Wood

-

Plastic

Plastic is leading the Bag clips market. Plastic bag clips are very lightweight which make them suitable for various applications. They are also cost-effective.

By Product Type

-

Magnetic

-

Non-magnetic

By End Use

-

Residential

-

Commercial

-

Institutional

Get Customized Report as per your Business Requirement - Request For Customized Report

Residential segment is the dominating end use segment. There is huge demand for storage of food snacks, cereals which need bag clips.

REGIONAL ANALYSIS

Due to the high consumption of packaged goods in this region, the North American for bags clips market is characterised by maturity and stability. In addition to increasing awareness of the environment, consumers are showing greater preference for eco-friendliness and reusable bags clips.

The market for bag clips in Europe is expected to grow at a modest pace, driven by increased consumption of packaged products. As a result, the demand for advanced bag clips is being affected in this region by more and more consumers favouring sealed and sealable packaging. The main drivers of demand for ecofriendly bag clips in Europe are environmental concerns and a drive to reduce plastic waste.

The Asia Pacific market for clip bags is on a strong growth path, underpinned by an expansion of the food and retailing industries. Consumers are looking for convenience and reusable bag clips as they change lifestyles and become more urbanised. The regions market is expected to grow with the cagr of 6.1%.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Bag Clips market are Polybags Limited, KLR Systemes, Haircap, Klippit, The Gripstic, Strobigo, BST Detectable Products, Entheos Group, Laurel Klammern GmBH, Kwik Lok Corporation and other players.

Haircap-Company Financial Analysis

RECENT DEVELOPMENT

-

Kwik Lok announced in 2021 the launch of a new line of bag clips made from recycled materials and recyclable in standard paper recycling streams.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.95 Bn |

| Market Size by 2031 | US$ 7.77 Bn |

| CAGR | CAGR of 5.8 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Metal, Wood, Plastic) • by Product Type (Magnetic, Non-magnetic) • by End Use (Residential, Commercial, Institutional) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Polybags Limited, KLR Systemes, Haircap, Klippit, The Gripstic, Strobigo, BST Detectable Products, Entheos Group, Laurel Klammern GmBH, Kwik Lok Corporation |

| Key Drivers | • The need to clip bags is driven by growing demand for packaged goods • Growth in the market may be beneficial for food safety and hygiene. |

| Key Restraints | • The market can be affected by concerns about the environment and regulations |