Bandpass Filters Market Report Scope & Overview:

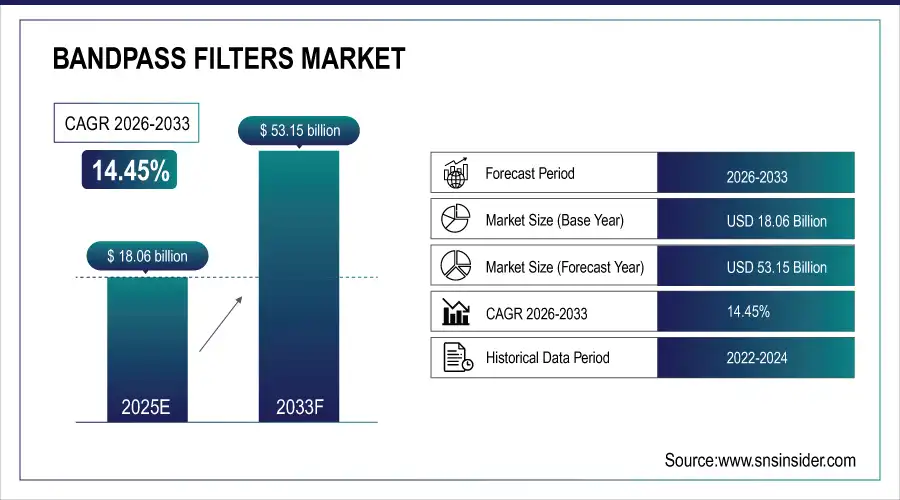

The Bandpass Filters Market was valued at USD 18.06 billion in 2025E and is projected to reach USD 53.15 billion by 2033, with projected CAGR of 14.45% in the forecasted period 2026-2033.

Strong growth is driven by advancements in wireless networks, rising adoption of 5G and IoT infrastructure, and increased demand for precision frequency filtering in communications, automotive, and medical applications. Bandpass filters support reliable signal transmission, low interference, and miniaturization, enabling next-generation connectivity across diverse sectors.

Bandpass Filters Market Size and Forecast:

-

Market Size in 2025E: USD 18.06 Billion

-

Market Size by 2032: USD 53.15 Billion

-

CAGR: 14.45% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Bandpass Filters Market Market - Request Free Sample Report

Key Bandpass Filters Market Trends:

-

Expansion of 5G networks accelerates demand for high-frequency and miniaturized RF bandpass filters.

-

Miniaturization of electronics drives widespread integration of MEMS-based and tunable bandpass filters in mobile and wearable devices.

-

Growth in defense, satellite, and radar applications increases development of robust and reliable filter solutions for critical communications.

-

Demand for secure connectivity in automotive, smart home, and medical devices fosters advanced bandpass filter adoption.

-

Rising use of eco-friendly and energy-efficient filter materials promotes sustainable product innovation.

-

Integration with IoT and Industry 4.0 platforms supports automation, real-time monitoring, and predictive data analytics.

U.S. Bandpass Filters Market Insights:

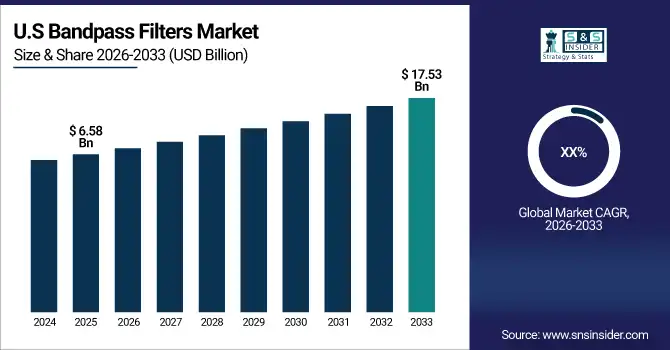

The U.S. Bandpass Filters Market size was USD 6.58 billion in 2025 and is expected to reach USD 17.53 billion by 2033. According to a research, surging IoT device proliferation and rapid wireless infrastructure upgrades are accelerating market growth. This cause, increased need for interference-free connectivity, effects robust demand from telecommunications, healthcare, and defense sectors. Advanced filter designs and material innovations enable enhanced performance, promoting adoption for critical real-time communications as the U.S. market shifts toward 5G and next-gen applications.

Bandpass Filters Market Drivers:

-

Growing Demand for High-Frequency Wireless Communication Technologies Spurs Market Expansion

The increasing deployment of 5G networks and next-generation wireless technologies has become a driving force in the Bandpass Filters Market. Higher data rates, dense urban coverage, and stringent frequency requirements boost demand for advanced RF bandpass filters. This cause, rising connectivity standards and bandwidth needs, effects manufacturers’ focus on miniaturization, improved selectivity, and low-loss filtering. Continuous innovation and targeted R&D accelerate mass production capabilities, ensuring reliable signal transmission for telecom, consumer, and industrial applications.

In July 2025, a major telecom provider implemented new RF bandpass filters across urban 5G base stations, enabling faster connections and improved user experience. This collaboration established performance benchmarks and expanded operator reach in competitive markets.

Bandpass Filters Market Restraints:

-

Raw Material Price Volatility and Complex Manufacturing Impede Growth

Volatility in the cost of high-purity ceramic, polymer, and metal materials, coupled with intricate production requirements, is restraining market acceleration. This cause, supply chain disruptions and high manufacturing costs, effects reduced profit margins and hesitation among emerging filter suppliers. Specialized fabrication techniques and stringent quality controls add complexity, challenging scalability and delaying launches. Manufacturers must balance quality improvement against expenses, limiting growth in price-sensitive applications and emerging economies.

In 2024, escalating ceramic procurement costs led several manufacturers to postpone filter shipments for new telecom installations, prompting temporary market supply tightness.

Bandpass Filters Market Opportunities:

-

Integration with IoT and Edge Computing Solutions Creates Growth Avenues

Rapid expansion of IoT and edge computing platforms unlocks significant opportunities in the Bandpass Filters Market, as more sectors demand selective frequency management for real-time, automated data transmission. This cause, increased adoption of connected devices—effects rising interest in miniaturized, energy-efficient, and tunable filter architectures. Manufacturers respond by creating embedded filter solutions for smart sensors, medical devices, and industrial gateways, supporting scalable connectivity across growing ecosystems.

In September 2025, a smart factory technology firm partnered with global filter producers to deploy advanced bandpass filters in wireless sensor networks, enabling seamless process monitoring and operational efficiency.

Bandpass Filters Market Segmentation Analysis:

By Product Type, Passive Bandpass Filters Lead Market While MEMS-Based Filters Register Fastest Growth

Passive Bandpass Filters dominate with a 32% share in 2025E, overwhelmingly used in telecom networks, consumer electronics, and industrial systems for reliable and cost-effective frequency selection. Their simplicity, durability, and broad-spectrum application ensure sustained market relevance amid infrastructure upgrades and mass deployments.

MEMS-Based Filters exhibit the fastest growth, driven by miniaturization needs in IoT, mobile, and medical electronics. MEMS technology maximizes selectivity and energy savings in ultracompact designs, supporting next-gen wireless protocols and emerging wearables, sensor platforms, and autonomous devices.

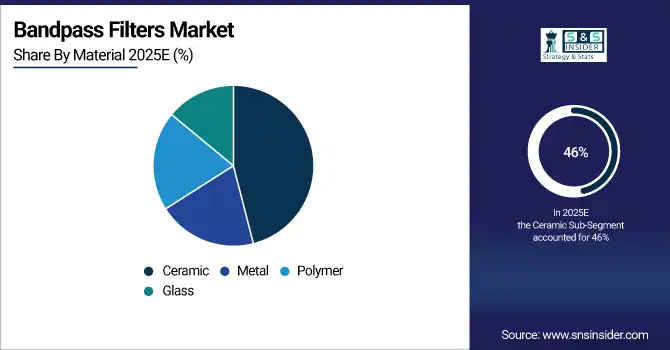

By Material, Ceramic Segment Leads While Polymer Registers Fastest Growth

Ceramic bandpass filters secure the largest share 46% due to their unique thermal stability and precision, essential for high-frequency applications in telecom, aerospace, and critical infrastructure. Advancements in ceramic processing reinforce market dominance through improved reliability and signal performance.

Polymer filters are growing fastest, prized for flexibility and lightweight integration into wearable, portable, and 5G-enabled electronics. Material innovations boost tunability and energy efficiency, propelling widespread adoption in emerging consumer and industrial markets.

By Frequency Range, RF Bandpass Filters Lead While Optical Bandpass Registers Fastest Growth

RF Bandpass Filters remain the cornerstone 49% share in telecom, aerospace, and IoT devices, delivering effective spectrum management and signal integrity as network density increases. Proven utility positions RF filters at the heart of connectivity solutions globally.

Optical Bandpass Filters flourish in imaging, photonics, and fiber-optic networks, owing to advances in wavelength selectivity and performance. Their adoption in medical, environmental, and data transmission is accelerating as applications diversify with technical advances.

By End-User, Telecommunications Leads While Automotive Applications Register Fastest Growth

Telecommunications dominate with a 43% revenue share, fueled by investment in 5G, broadband, and smart infrastructure. Filter solutions are integral for reliable, high-speed digital communications, supporting connectivity in densely populated regions.

Automotive applications are expanding rapidly as advanced driver assistance, in-vehicle infotainment, and wireless V2X (vehicle-to-everything) depend on robust bandpass filtering. Partnerships with OEMs, growth of connected mobility, and tech standardization drive market advancement.

Bandpass Filters Market Regional Insights

North America Dominates Bandpass Filters Market in 2025E

In 2025E, North America holds an estimated 52% share of the Bandpass Filters Market, solidifying its position as the leading regional market. The region’s dominance stems from early 5G deployment, rapid growth in IoT ecosystems, and significant investments in telecommunications infrastructure. Government-backed broadband funding and defense-driven technological innovation further fuel demand for high-performance bandpass filters. These filters are widely adopted in wireless communication, radar systems, and precision medical devices, enabling North America to maintain a competitive edge in advanced electronics and connectivity solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

United States Leads North America’s Bandpass Filters Market

The United States drives the regional market due to its strong R&D base, aggressive smart city implementation, and expansion of medical device and telecom manufacturing. Leading filter manufacturers in the U.S. excel in rapid prototyping and mass production of specialized RF filters, setting global benchmarks for performance and innovation. Strategic investments in defense electronics, aerospace communication systems, and next-gen wireless networks ensure the U.S. remains the dominant market within North America.

Asia Pacific is the Fastest-Growing Region in the Bandpass Filters Market in 2025E

Asia Pacific is projected to grow at the fastest CAGR 17.34% during the forecast period, driven by nationwide 5G rollouts, booming electronics manufacturing, and rapidly expanding consumer device markets. Massive investments in wireless infrastructure and government-supported tech ecosystems are propelling demand for compact and cost-efficient bandpass filters. The region’s manufacturing-centric economy encourages faster product adoption and large-volume production.

China Leads Asia Pacific’s Bandpass Filters Market

China dominates the region, backed by large-scale electronics manufacturing, extensive rural broadband expansion, and rapid deployment of smart city projects. The country integrates bandpass filters into telecom equipment, connected vehicles, and smart devices, maximizing efficiency and scale. With strong supply chain control and government-backed innovation programs, China remains the primary force driving Asia Pacific’s growth in the bandpass filters sector.

Europe Bandpass Filters Market Insights, 2024

Europe represents a significant share of the global Bandpass Filters Market, supported by stringent sustainability standards and digital transformation across telecom and manufacturing sectors. The European Union’s push for eco-friendly smart infrastructure and autonomous systems accelerates filter adoption.

Germany Leads Europe’s Bandpass Filters Market

Germany dominates due to its advanced industrial base, leadership in automotive electronics, and regulatory support for high-performance communication technologies. Strong investments in R&D and innovation enable German companies to integrate advanced filtering technologies into telecom networks, automotive systems, and industrial automation.

Middle East & Africa and Latin America Bandpass Filters Market Insights, 2024

The Bandpass Filters Market in the Middle East & Africa (MEA) and Latin America shows steady momentum, supported by increasing digitalization and strong government-led technology initiatives. In MEA, the UAE leads adoption. Large investments in smart city ecosystems, telecom infrastructure modernization, and resilient digital programs sustain filter demand even under challenging climate conditions. In Latin America, Brazil drives growth through expanding smart agriculture, strengthening telecom networks, and emerging export-oriented technology sectors. The adoption of connected industrial systems boosts the need for advanced RF filtering solutions.

Competitive Landscape for the Bandpass Filters Market

Murata Manufacturing Co., Ltd.

Murata Manufacturing Co., Ltd. is a Japan-based global leader in electronic components, specializing in high-performance ceramic and MEMS bandpass filters for telecommunications, automotive electronics, and IoT devices. The company’s advanced filtering technologies play a crucial role in improving network efficiency, minimizing interference, and enabling next-generation wireless infrastructure. Murata’s strong research capabilities and vertically integrated production allow the company to maintain technical leadership and rapid innovation cycles across global markets.

-

In April 2025, Murata introduced a new line of 5G-ready ceramic bandpass filters tailored for mobile communication devices and base station equipment, strengthening its presence in the high-frequency RF solutions market.

Qorvo, Inc.

Qorvo, Inc., headquartered in the United States, is a pioneer in high-frequency RF solutions, providing bandpass filters used in telecommunications, radar, aerospace, and defense applications. The company integrates advanced materials with MEMS and ultra-low-loss technology, ensuring superior signal integrity and compact performance. Qorvo’s strength lies in its ability to scale cutting-edge RF components for both commercial and mission-critical systems.

-

In March 2025, Qorvo launched MEMS-based bandpass filters designed for compact wearables and IoT platforms, enhancing power efficiency and expanding the company’s presence in emerging connected device ecosystems.

Skyworks Solutions, Inc.

Skyworks Solutions, Inc. is a U.S.-based leader in analog and RF semiconductor technologies, offering high-performance bandpass filters for mobile devices, broadband connectivity, satellite communication, and automotive applications. The company focuses on scalable RF architectures that enable high-speed data transfer and minimize signal distortion in increasingly congested wireless environments.

-

In January 2025, Skyworks introduced tunable bandpass filters optimized for vehicle-to-everything (V2X) communication, accelerating secure and efficient data exchange in next-generation connected and autonomous vehicles.

Broadcom Inc.

Broadcom Inc. is a global technology leader providing integrated filtering solutions for wireless infrastructure, networking, and satellite systems. The company’s filters support high-bandwidth and low-latency data transmission, enabling seamless connectivity across 5G networks and cloud-based applications. Broadcom’s strategic investments in advanced RF technologies strengthen its footprint in telecom and aerospace verticals.

-

In June 2025, Broadcom unveiled a new suite of RF bandpass filters engineered for 5G and satellite communication platforms, reinforcing the company’s role in advancing high-speed global data connectivity.

Bandpass Filters Market Key Players:

-

Murata Manufacturing Co., Ltd.

-

Qorvo, Inc.

-

Skyworks Solutions, Inc.

-

Broadcom Inc.

-

Analog Devices, Inc.

-

Infineon Technologies AG

-

NXP Semiconductors N.V.

-

TDK Corporation

-

CTS Corporation

-

Qualcomm Technologies, Inc.

-

Pasternack Enterprises, Inc.

-

Anatech Electronics, Inc.

-

K&L Microwave, Inc.

-

Knowles Precision Devices

-

Mini-Circuits

-

Crystek Corporation

-

Kyocera Corporation

-

TE Connectivity Ltd.

-

Tai SAW Technology Co., Ltd.

-

Cobham plc

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 18.06 Billion |

| Market Size by 2032 | US$ 53.15 Billion |

| CAGR | CAGR of 14.45 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Active Bandpass Filters, Passive Bandpass Filters, MEMS-Based Filters, Tunable Filters) • By Material (Ceramic, Metal, Polymer, Glass) • By Frequency Range (RF Bandpass Filters, Microwave Bandpass Filters, Optical Bandpass Filters, Audio Bandpass Filters) • By End-Use (Telecommunications, Consumer Electronics, Automotive Applications, Aerospace & Defense) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Murata Manufacturing Co., Ltd., Qorvo, Inc., Skyworks Solutions, Inc., Broadcom Inc., Analog Devices, Inc., Infineon Technologies AG, NXP Semiconductors N.V., TDK Corporation, CTS Corporation, Qualcomm Technologies, Inc., Pasternack Enterprises, Inc., Anatech Electronics, Inc., K&L Microwave, Inc., Knowles Precision Devices, Mini-Circuits, Crystek Corporation, Kyocera Corporation, TE Connectivity Ltd., Tai SAW Technology Co., Ltd., and Cobham plc. |