Residential Energy Storage Market Size & Trends:

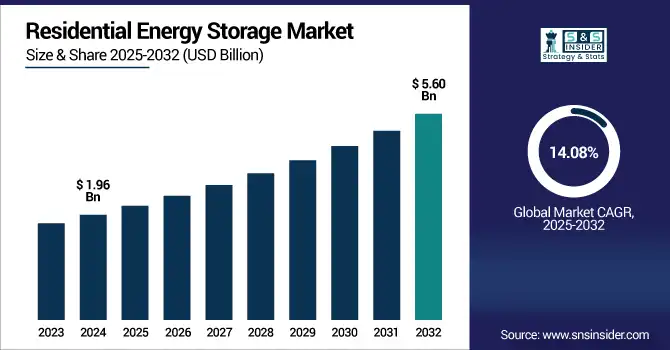

The Residential Energy Storage Market size was valued at USD 1.96 billion in 2024 and is expected to reach USD 5.60 billion by 2032, growing at a CAGR of 14.08% over the forecast period of 2025-2032.

To Get more information on Residential Energy Storage Market - Request Free Sample Report

Residential Energy Storage Market trends highlight growing integration with solar PV systems, smart home platforms, and EV chargers. Increasing demand for energy independence and backup solutions continues to accelerate global adoption.

One of the biggest contributors to the Residential Energy Storage Market growth is rising power outages from extreme weather events and grid instability, increasing the need for reliable backup paired with solar. Furthermore, increasing urbanization and electrification of home infrastructure, such as electric heating and cooling systems, leads to a larger energy consumption, turning residential energy storage as a strategic solution for energy management, cost reduction, and a larger energy security for modern homes.

-

The U.S. experienced over 25 major grid disturbances in 2024, mostly caused by hurricanes, wildfires, and winter storms, according to the U.S. Energy Information Administration (EIA).

The U.S. Residential Energy Storage Market size was valued at USD 0.49 billion in 2024 and is projected to grow at a CAGR of 13.55%, reaching USD 1.36 billion by 2032. Increase in weather-related outages, ageing grid infrastructure and rising adoption of solar-plus-storage systems will drive the U.S. Residential Energy Storage Market growth. Consumer demand is additionally accelerated by federal incentives such as the Investment Tax Credit (ITC) or programs at the state level.

Residential Energy Storage Market Dynamics:

Key Drivers:

-

Rising Energy Independence and Outage Resilience Drive Global Residential Energy Storage Market Expansion Rapidly

Demand for energy independence and rising installation of rooftop solar PV systems are the major factors driving the growth of global Residential Energy Storage Market. Power outages due to extreme weather events and old grid infrastructure are becoming more frequent, leading homeowners to move toward battery storage for reliability and backup. Additionally, soaring lithium-ion battery prices, government incentives, and smart energy management system advancements are further driving the market growth. Higher use of time-of-use electricity pricing is also incentivizing consumers to store energy and lower costs during peak hours.

-

Global rooftop solar capacity reached over 400 GW in 2024, with residential systems making up a large share, especially in the U.S., Germany, Australia, and India

Restraints:

-

Regulatory Barriers and Battery Safety Concerns Limit Residential Energy Storage Adoption in Urban Environments

One of the Key Restraints in the Residential Energy Storage Market Developing a market for selling electricity also poses significant challenges, with local utility protocols, safety standards, and permitting processes slowing grid integration. Moreover, the long-standing issues with battery safety like thermal runaway, fire, etc., further hinder consumer confidence and accelerate mass adoption, especially in a high-dense urban area.

Opportunities:

-

Home Electrification and Emerging Markets Unlock Major Growth Potential for Residential Energy Storage Providers

Electrifying heat pump installations, cooling at home, or electrification storage for the charging facilities is a major opportunity for providers of residential storage. Asia, Latin-America, and Africa present significant growth opportunities, as governments seek to fund distributed energy and rural electrification.

-

Brazil added over 250,000 new residential solar rooftops in 2024, with states like Minas Gerais and São Paulo encouraging battery storage to improve grid reliability.

Challenges:

-

Skilled Workforce Shortage and Grid Saturation Create Major Hurdles for Residential Energy Storage Systems

One of the biggest hurdles is the number of qualified technicians that are available to install, maintain, and integrate SOFCs with solar PV and home energy systems. However, grid saturation in high-penetration sections leads to reverse power flow and volatilities, bringing along performance concerns and limiting system approval. Additionally, supply chain issues of battery components are giving operational challenges regularly, even in rare earth materials.

Residential Energy Storage Market Segmentation Analysis:

By Solution

In 2024, Lithium-Ion accounted for a commanding 78.4% of the Residential Energy Storage Market and is projected to record the fastest CAGR from 2025 to 2032. Such dominance is due to its high energy density, long cycle life and ever-decreasing prices, making it the technology of choice for residential applications worldwide. Better battery chemistry and safety standards are helping to bolster consumer confidence and propel adoption. In addition, lithium-ion batteries can swiftly be rolled out as they are compatible with smart energy management systems and rooftop solar PV systems.

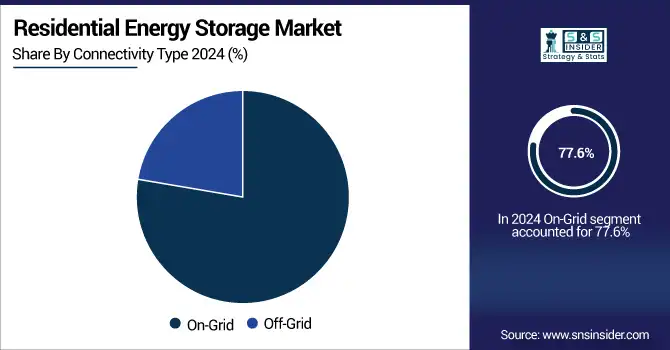

By Connectivity Type

On-Grid held the largest share of 77.6% in 2024 and is predicted to grow at the fastest CAGR during 2025 to 2032 in the Residential Energy Storage Market. This robust positioning comes on the back of increased adoption of grid-connected rooftop solar systems that allow homeowners to compensate for the cost of excess solar energy and use it during peak demand and during outages. There are also net metering policies and time-of-use pricing to steer on-grid the systems to fuller fracturing, and the more and more users are encouraged to choose the goal of the system regarding energy use and the reduction of the utility bill. Additionally, rising grid modernization initiatives, along with smart grid deployments, further facilitate integration of grid-tied residential storage in the market. The on-grid storage is even more attractive and poised for higher growth due to its scalability, real-time monitoring, and VPP potential.

By Ownership Type

Customer-owned systems to grow to 59.7% of the Residential Energy Storage Market share in 2024. There has been an uptick among homeowners who want to purchase and own battery systems outright, especially when combined with rooftop solar, since doing so maximizes the savings on their power bills and creates the opportunity for government incentives. The ownership model also allows complete control in storage usage, performance of the systems, and potential linkages to home energy management platforms.

Between 2025 to 2032, third-party owned systems are expected to have the fastest CAGR growth. But this growth is spurred by the increased consumer adoption of leasing, power purchase agreement (PPA) and battery-as-a-service (BaaS) that minimizes initial investment and installation hassle for cost-conscious or less technically-minded homeowners.

By Power Rating

In 2024, 3–6 kW segment held the largest share of Residential Energy Storage Market, at 46.5%. This capacity is perfect for small to middle-sized homes with average energy demands, hence this is the capacity range that has the widest penetration in the world. It is widely popular due to its compatibility with most rooftop solar PV installations out there and relatively low initial investment. It also provides backup during outages, and it powers daily efficiency improvement, especially where grid electricity is cheap but very stable, e.g., summer and winter power use in the same day.

From 2025 to 2032, the 6–10 kW segment is anticipated to experience the highest CAGR growth. This growth driven by the increasing adoption of electric vehicles, smart appliances, and home electrification trends, all of which require greater absorption capacity. National homeowners looking for more energy independence and longer-duration backup are moving to larger systems.

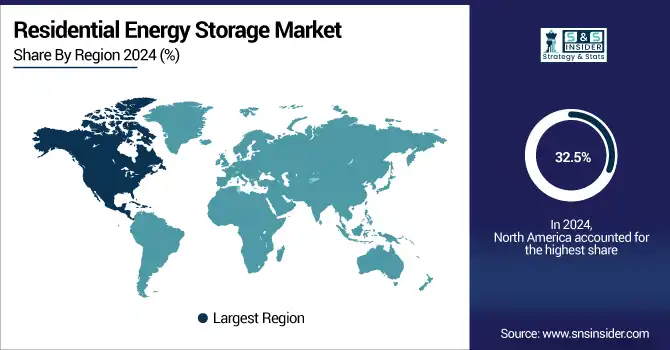

Residential Energy Storage Market Regional Outlook:

The Residential Energy Storage Market in North America held the highest share of 32.5% in 2024 owing to increasing inclination towards rooftop solar, government backing & incentives and rising frequency of power outages due to unfavorable climatic conditions. Residential battery deployment has been significantly bolstered by strong policy frameworks like the U.S. Investment Tax Credit (ITC), time-of-use pricing, and net metering programs. Furthermore, the increasing adoption of smart energy management systems and rising awareness about energy resiliency among consumers is also driving demand.

The North American Market was led by the U.S. in 2024, supported by the federal incentives for the realization of the energy transition, the increasing installation of rooftop solar, and the growing need for backup power to cope with the extreme-wether events.

From 2025 to 2032, the Residential Energy Storage Market is anticipated to grow at the fastest CAGR of 14.98% in Asia Pacific. Driven by rapid urbanization, rising electricity demand, and strong government support for Solar-Plus-Storage adoption throughout the region, this growth. China, Japan, South Korea and Australia all have leading policies, high energy prices, and more natural disasters pushing steady residential backup adoption. The market is being further accelerated by technological developments, falling battery prices and the incorporation of smart energy solutions. In addition, increasing electric vehicle application is triggering the home energy storage compatibility and demand in all major countries in APAC.

China led the Asia Pacific Market in 2024, owing to its extensive implementation of large-scale rooftops solar, its well-sustained production capacity of batteries, and the government incentives supporting domestic distributed energy systems.

Europe benefits from aggressive climate policies, high electricity prices coupled with rapid penetration of rooftop solar. Germany, Italy, and the UK lead the way with large subsidies, time-of-use tariffs, and carbon reductions. This is also fuelling adoption, particularly since geopolitical tensions have laid bare the need for both increased energy independence targets as well as resilience against grid instability. Residential batteries with heat pumps and EVs are also being integrated, part of the broader energy transition and decarbonization efforts in Europe.

Middle East & Africa and Latin America market is gradually picking-up with increasing electrification efforts, unreliable grid infrastructure, and more reliance on the adoption of solar PV systems. Only storage: Off-grid and hybrid storage solutions are becoming popular in isolated, underdeveloped areas. Meanwhile, national and international advocacy around sustainable energy access is further driving market growth in both regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major Global Residential Energy Storage Companies are Tesla, LG Energy, Panasonic, Samsung SDI, Enphase, Sonnen, BYD, Generac, Eaton, and ABB.

Recent Developments:

-

In January 2025, The first Tesla-powered residential community in the U.S. launched in Houston, equipped with solar roof tiles and Powerwalls in 11 homes nearly sold out at ~USD 524k–USD 545k each.

-

In March 2024, LG Energy Solution agreed to supply Delta with 4 GWh of U.S.-made residential lithium battery cells from 2025‑2030.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.96 Billion |

| Market Size by 2032 | USD 5.60 Billon |

| CAGR | CAGR of 14.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Lithium-Ion, Lead-Acid) • Connectivity Type (On-Grid, Off-Grid) • Ownership Type (Customer-owned, Utility-owned, Third-Party Owned) • Power Rating (3-6 Kw, 6-10 Kw, More Than 10 Kw) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Tesla, LG Energy, Panasonic, Samsung SDI, Enphase, Sonnen, BYD, Generac, Eaton, and ABB. |