Probe Card Market Size & Trends:

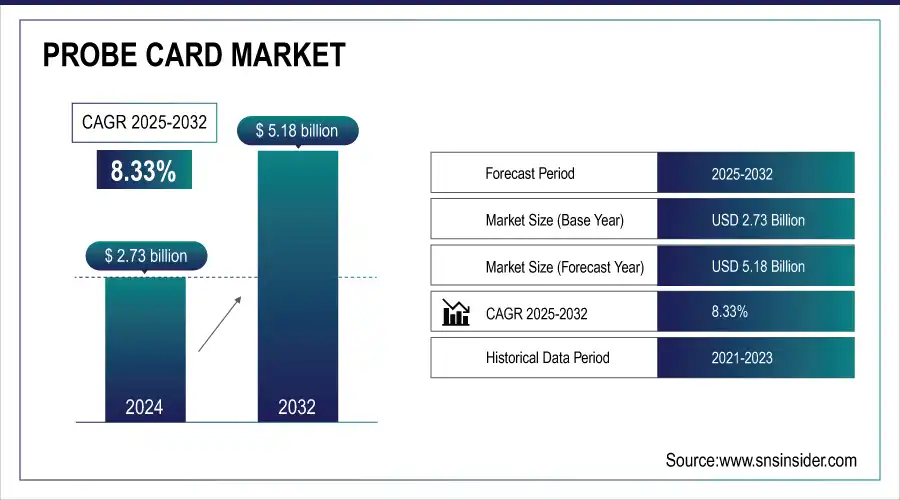

The Probe Card Market size was valued at USD 2.73 Billion in 2024 and is projected to reach USD 5.18 Billion by 2032, growing at a CAGR of 8.33% during 2025-2032.

The probe cards market is witnessing strong momentum, due to the increasing complexities in the semiconductor device, which in turn demand the test performances of the devices coming together with the wafer testing time and its cost. As the nodes becomes smaller and the packaging technologies advance, customers are demanding higher pin count, fine pitch capability and supportable in full wafer contact testing probe card solutions. MEMS-based probes are being employed as a tool of choice since they are sufficiently robust, accurate and they provide signal integrity at high speeds and high temperatures. Furthermore, the marketplace is trending towards modular, easily serviceable designs that cut lead times and shredder downtime. These advancements enable cost efficiencies and scalability, resulting in probe card becoming a key enabler in semiconductor testing for DRAM, NAND, logic and RF applications.

FormFactor launches SmartMatrix 100 full-wafer probe card for DRAM testing Built on MEMS-based MicroSpring tech, the SmartMatrix 100 boosts DRAM test efficiency while extending existing test equipment lifespan.

To Get More Information On Probe Card Market - Request Free Sample Report

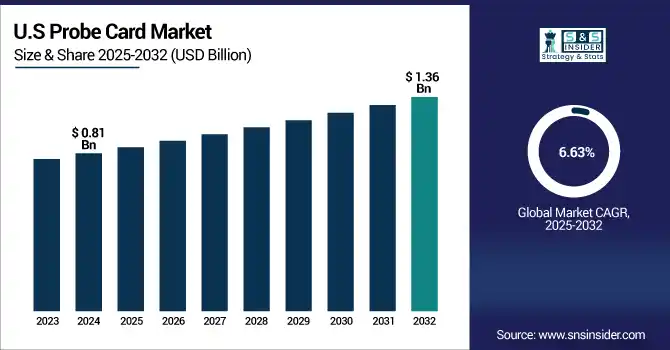

The U.S Probe Card Market size was valued at USD 0.81Billion in 2024 and is projected to reach USD 1.36 Billion by 2032, growing at a CAGR of 6.63% during 2025-2032, owing to increasing demand for high-performance testing in advanced semiconductor production. Rising proliferation of MEMS-based technologies, growth in AI and 5G chip production and the demand for full-wafer and fine-pitch testing are the drivers. The market features significant differentiation across innovation, cost-efficiency and next-gen design architectures for devices.

Probe Card Market Dynamics:

Drivers:

-

Rising Demand for High-Volume Optical Testing Drives Innovation in Silicon Photonics Probe Solutions

The growing complexity of silicon photonics and hybrid-bonded wafers is driving a strong push for scalable, high-throughput electro-optical testing solutions. As AI, high-performance computing, and next-gen data centers demand faster, energy-efficient interconnects, traditional single-sided wafer probing proves inadequate. The market now prioritizes dual-function probe solutions that can handle both electrical and optical testing simultaneously. This approach enhances test efficiency, ensures known good die (KDG) yield before packaging, and minimizes costly post-packaging failures. As a result, demand is rising for advanced wafer-level test systems that can address precision alignment, thermal control, and automated probing within production environments—positioning photonic integrated circuit (PIC) testing as a critical growth segment in the evolving semiconductor manufacturing ecosystem.

Teradyne and ficonTEC unveil the first double-sided silicon photonics wafer probe test cell, enabling high-throughput electro-optical testing of bonded wafers.

Restraints:

-

Rapid Advancements in Semiconductor Design Lead to Reduced Probe Card Lifecycle

The increasing complexity of semiconductor packaging due to new trends such as chiplets, 2.5D/3D IC packages, and heterogeneous integration, is sharply reducing the effective life span of probe cards. And now new devices, newer generations are driving the test requirements for further finer pitches, more number of pins, and different kind of electrical-optical interfaces need the probe cards to be redesigned/redesigned. This constant need for innovation imposes a heavy burden on manufacturers in terms of R&D investment, lead times, and cost. Additionally, legacy probe card setups often become obsolete faster than expected, creating inefficiencies and driving up operational costs. This trend challenges scalability and makes long-term planning difficult for test providers, especially as device development cycles continue to accelerate across applications like AI, automotive, and 5G.

Opportunities:

-

Rising Semiconductor Complexity Drives Demand for Advanced Probe Card Handling Solutions

The probe cards market is witnessing emerging opportunities include the rising demand for safer, efficient, and sustainable handling solutions in the semiconductor testing applications. As the wafer designs become more complex, and with the increased investment in advanced packaging, the market’s demand for reliable logistics and protection of the highly sensitive probe cards began to soar. It opens up possibilities for new, clever ways to transport, store, and provide ESD protection while supporting in-fab and global distribution flows. What’s more, the drive to use green materials dovetails with the industry’s overall sustainability objectives, opening the door for companies to distinguish themselves with green innovations, all while maintaining high-reliability and characterization in high-precision semiconductor test.

Technoprobe introduces a high-performance, ESD-safe, environmentally friendly carrier to improve the safety of handling and shipping probe cards.

Challenges:

-

Intensifying Cost Pressures from Foundries and OSATs Challenge Probe Card Innovation

The growing demand from semiconductor foundries and outsourced semiconductor assembly and test (OSAT) providers for lower cost-of-test per die is placing significant strain on probe card manufacturers. These users are being pressured to maximize their yields and minimize costs, forcing probe card suppliers to provide solutions that feature high accuracy, long-life durability, and cost effectiveness. This trade-off has also been growing more challenging as device geometries continue to scale down while testing needs become more advanced. Manufacturers need to not only develop R&D and new materials, but also manage margins. The struggle is to innovate without adding too much cost for cost engineering also becomes a factor in the competitive landscape of the test world.

Probe Card Market Segmentation Analysis:

By Type

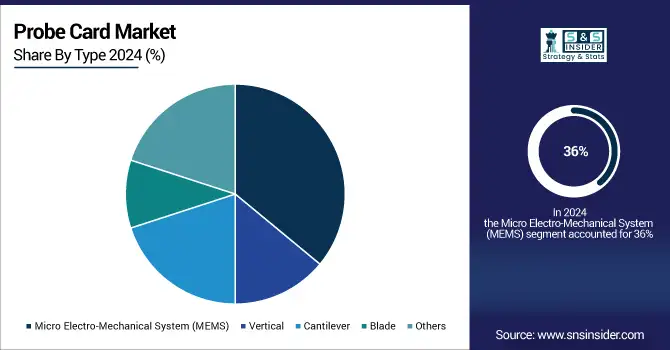

The Micro Electro-Mechanical System (MEMS) segment held a dominant Probe Card Market share of around 36% in 2024 and experience the fastest growth in the Probe Card Market over 2025-2032 with a CAGR of 9.17%, as this technology provides better precision, scaling and are ideal for advanced semiconductor testing. With advancements in chip architecture moving towards increasing density and smaller nodes, MEMS probe cards provide improved signal integrity and reliability. Being suitable for high frequency applications and now playing more important roles in logic/DRAM/RF testing, there is currently no doubt that MEMS serves as a main factor for the innovation of next-generation semiconductor test.

By Application

The Foundry & logic segment held a dominant Probe Card Market share of around 35% in 2024, growing need for AI, 5G, and HPC applications leading to increased wafer volumes and challenging testing requirements. This is driving demand for high-accuracy, hard probe cards matched to logic device geometries and will make the segment a key driver of long-term market growth and product evolution.

The DRAM segment is expected to experience the fastest growth in the Probe Card Market over 2025-2032 with a CAGR of 10.99%, due to growing demand for high-speed memory in data centers, AI workloads, and mobile devices. Increasingly complex and dense DRAM architectures are driving the need for advanced probe cards to help maintain testing accuracy and yield, positioning this part of the market as a key growth driver out to 2032.

Probe Card Market Regional Outlook:

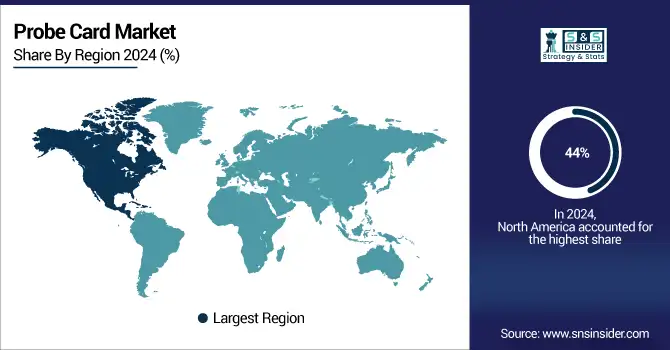

In 2024, North America dominated the Probe Card market and accounted for 44% of revenue share, driven by the presence of major semiconductor manufacturers, strong investments in R&D, and early adoption of advanced testing technologies. The region’s leadership in AI, 5G, and automotive electronics further accelerated demand for high-precision probe solutions, solidifying its dominant market position.

The U.S. probe card market is expanding steadily, due to factors such as growing R & D of semiconductors, increasing demand for advanced IC testing, rising investment in AI, 5G, and domestic chip manufacturing programs among others.

The U.S. has launched a Section 301 investigation into China’s legacy semiconductor industry, citing unfair trade practices. The probe could lead to import restrictions, impacting key sectors like defense and automotive.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to witness the fastest growth in the Probe Card Market from 2025 to 2032, with a projected CAGR of 9.56%, driven by expanding semiconductor manufacturing hubs in countries like Taiwan, South Korea, and China. Growing investments in foundries, rising demand for consumer electronics, and regional government support for domestic chip production are fueling the need for high-performance probe cards, making Asia-Pacific a key growth engine through 2032.

China has launched an antitrust probe into Google following the U.S. imposition of a 10% tariff on Chinese imports, intensifying ongoing trade tensions between the two powers.

In 2024, Europe emerged as a promising region in the Probe Card Market, with the increasing investments being made in the semiconductor R&D, rising trend of localized chip manufacturing, and initiatives such as the EU Chips Act. Innovation Focus in the region is also impacting the demand for sophisticated test solutions and the potential of the market because of the well-developed automotive and industrial electronics market.

LATAM and MEA is experiencing steady growth in the Probe Card market, driven by gradual expansion of semiconductor assembly and testing activities, rising adoption of consumer electronics, and increasing investments in digital infrastructure. Government initiatives to attract tech manufacturing, coupled with partnerships with global semiconductor firms, are enhancing regional capabilities. As local demand for advanced electronic components grows, so does the need for efficient and cost-effective probe testing solutions.

Key Players:

The Probe Card Companies are Form Factor, Teradyne, ficonTEC, Technoprobe, Nidec Advance Technology, Micronics Japan Co. Ltd. (MJC), MPI Corporation, Korea Instrument Co. Ltd., SV Probe, and TSE Co. Ltd and Others.

Recent Developments:

-

In December 2024, Nidec Advance Technology launched a semiconductor temperature measurement probe using thermocouple technology and a chamber head type probe card for high-voltage applications to enhance power semiconductor testing accuracy and durability.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.73 Billion |

| Market Size by 2032 | USD 5.18 Billion |

| CAGR | CAGR of 8.33% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Micro Electro-Mechanical System (MEMS), Vertical, Cantilever, Blade, Others) • By Application(DRAM, Flash, Foundry & logic, Parametric, Others (RF / MMW / Radar Calibration Tools)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Probe Card market companies are Form Factor, Teradyne, ficonTEC, Technoprobe, Nidec Advance Technology, Micronics Japan Co. Ltd. (MJC), MPI Corporation, Korea Instrument Co. Ltd., SV Probe, and TSE Co. Ltd and Others. |