Battery Contract Manufacturing Market Report Scope & Overview:

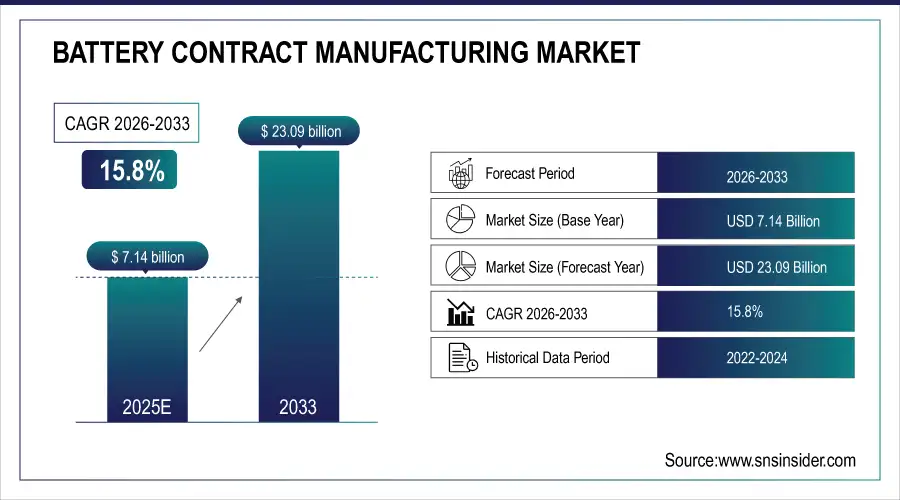

The Battery Contract Manufacturing Market size was valued at USD 7.14 billion in 2025E and is expected to grow to USD 23.09 billion by 2033 with an emerging CAGR of 15.8% over the forecast period of 2026-2033.

Battery contract manufacturing has a number of benefits, including reduced prices, quicker production times, and access to specialised knowledge. Companies may concentrate on their core strengths and leave the manufacturing process to the pros by outsourcing the production of batteries. These causes were responsible for the expansion of the battery contract manufacturing market in the United States during the projected period.

The market is anticipated to increase as a result of growing electric car sales and the sector's expansion in renewable energy. It is anticipated that technological developments to lighten batteries and boost their power output would support industry growth. Additionally, effective distribution channels are probably going to be a key strategy for gaining a competitive edge. With a revenue share of 37.81%, lithium-ion accounted for the bulk of the worldwide battery contract manufacturing market in 2022.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 7.14 Billion

-

Market Size by 2033 USD 23.09 Billion

-

CAGR of 15.8% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

To Get More Information on Battery Contract Manufacturing Market - Request Sample Report

Battery Contract Manufacturing Market Trends:

-

Increasing outsourcing of battery pack assembly and cell manufacturing to specialized contract manufacturers.

-

Rising adoption of automation and advanced robotics to improve production speed and consistency.

-

Expansion of gigafactories and regional manufacturing hubs to meet EV and energy-storage demand.

-

Growing shift toward high-density lithium-ion and solid-state battery technologies.

-

Stronger collaboration between OEMs, battery developers, and contract manufacturers to accelerate innovation and reduce production costs.

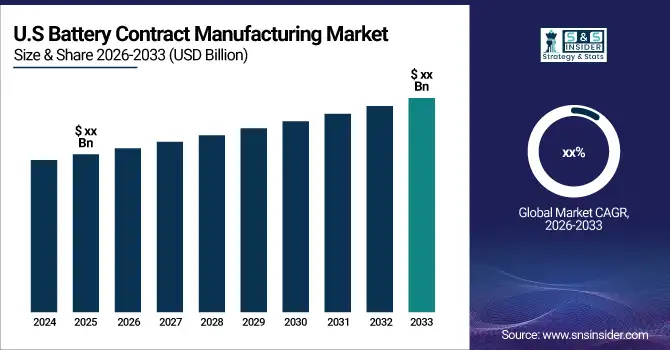

The U.S. Battery Contract Manufacturing market size was valued at an estimated USD 2.65 billion in 2025 and is projected to reach USD 8.75 billion by 2033, growing at a CAGR of 15.6% over the forecast period 2026–2033. Market growth is driven by the rapidly increasing demand for electric vehicles, energy storage systems, and consumer electronics, along with OEMs’ growing preference to outsource battery production to reduce capital expenditure and accelerate time-to-market. Expanding investments in lithium-ion battery technologies, advancements in solid-state and next-generation batteries, and strong government support for domestic battery manufacturing and supply chain localization further propel the U.S. market. The presence of leading automotive and energy companies, coupled with scaling of gigafactories and contract manufacturing partnerships, is expected to sustain robust market growth over the forecast period.

Battery Contract Manufacturing Market Growth Drivers:

-

Growing automotive sector

-

Increasing demand for batteries

The market is anticipated to be driven by rising demand for lithium-ion batteries in smartphones due to their longer shelf life and increased efficiency. Additionally, rising consumer interest in electric cars as a result of increased consumer concern about lowering global carbon emissions is anticipated to boost market expansion.

Battery Contract Manufacturing Market Restraints:

The Battery Contract Manufacturing Market faces restraints from declining prices of custom lithium-ion batteries, which can reduce profit margins for manufacturers. Additionally, supply chain vulnerabilities, including raw material shortages, logistical challenges, and geopolitical uncertainties, pose risks to consistent production and timely delivery, limiting market growth and investment in new manufacturing capacities.

Battery Contract Manufacturing Market Opportunities:

Advancements in battery storage technologies and supportive government policies present significant opportunities in the Battery Contract Manufacturing Market. Improved energy density, longer lifespan, and safer battery chemistries drive demand, while incentives, subsidies, and regulatory support encourage investment in local manufacturing, boosting production capacity and accelerating market growth globally.

Battery Contract Manufacturing Market Segment Analysis:

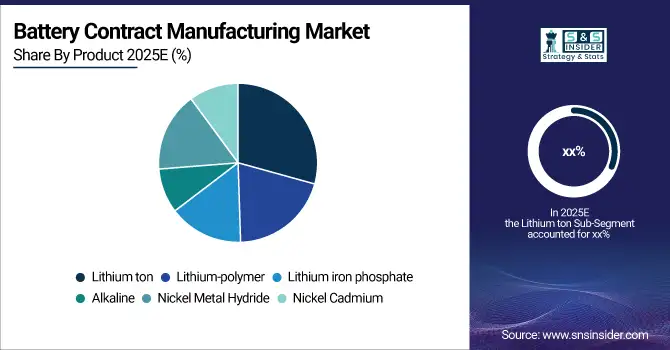

By Product

The Battery Contract Manufacturing Market encompasses diverse battery products, including Lithium-ion, Lithium-polymer, Lithium iron phosphate, Alkaline, Nickel Metal Hydride, and Nickel Cadmium batteries. Lithium-based chemistries dominate due to high energy density, long life, and widespread use in EVs, smartphones, and energy storage. Other chemistries support niche applications, industrial use, and cost-sensitive markets, ensuring a broad and versatile product portfolio.

By Application

The Battery Contract Manufacturing Market serves diverse applications, including Electric Vehicles, Consumer Electronics, Defense/Military, Telecom Towers, Energy Storage Systems, Mining, Space, Marine and Submarines, and other industrial uses. Growing EV adoption, expanding portable electronics, and increasing renewable energy storage needs drive demand, while specialized sectors like defense and space require high-performance, reliable battery solutions.

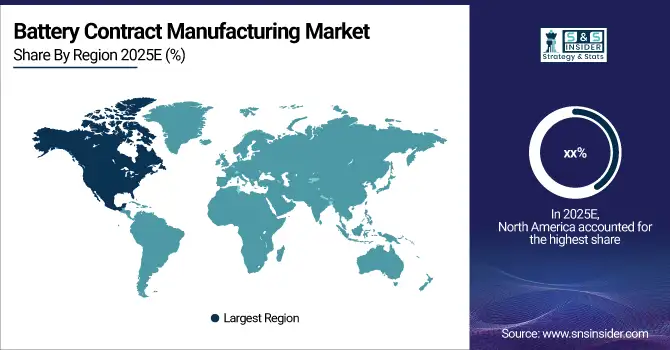

Battery Contract Manufacturing Market Regional Analysis:

North America Battery Contract Manufacturing Market Insights

North America leads the Battery Contract Manufacturing Market with strong demand from electric vehicles, consumer electronics, and energy storage sectors. Established automotive and electronics industries, coupled with government incentives for clean energy and EV adoption, drive market growth. Advanced manufacturing infrastructure, technological expertise, and collaborations between OEMs and contract manufacturers strengthen production capabilities. However, high labor and operational costs may influence investment decisions and regional expansion strategies.

Do You Need any Customization Research on Battery Contract Manufacturing Market - Enquire Now

Asia Pacific Battery Contract Manufacturing Market Insights

Asia Pacific dominates the global Battery Contract Manufacturing Market, driven by major battery and EV manufacturers in China, Japan, and South Korea. Rapid industrialization, government support for renewable energy, and increasing consumer electronics demand accelerate market growth. Availability of raw materials and lower production costs attract global OEMs. Investments in gigafactories, technological innovations, and strategic partnerships enhance manufacturing capacity, making the region a hub for battery contract manufacturing globally.

Europe Battery Contract Manufacturing Market Insights

Europe’s Battery Contract Manufacturing Market is expanding due to increasing EV production, renewable energy integration, and supportive EU regulations. Strong automotive and electronics sectors, combined with investments in advanced battery technologies, drive regional growth. Government incentives for clean energy and sustainable manufacturing further encourage investment. Collaboration between European OEMs, battery developers, and contract manufacturers enhances production efficiency, while a focus on safety, quality, and low-carbon technologies positions the region for long-term market growth.

Latin America (LATAM) & Middle East & Africa (MEA) Battery Contract Manufacturing Market Insights

LATAM and MEA are emerging markets for Battery Contract Manufacturing, driven by renewable energy projects, mining activities, and growing EV adoption. Abundant natural resources, such as lithium in LATAM, support raw material supply. Government initiatives and foreign investments encourage local manufacturing expansion. While infrastructure and technology gaps exist, increasing energy demand, off-grid solutions, and industrial electrification create opportunities. Strategic partnerships with global OEMs accelerate technology transfer and market development in these regions.

Competitive Landscape for Battery Contract Manufacturing Market:

Ttek Assemblies Inc. is a U.S.-based contract manufacturer specializing in custom battery packs and electronic assemblies. The company offers a wide range of battery chemistries, including lithium-ion, lithium-polymer, nickel-metal hydride, nickel-cadmium, and alkaline, serving applications in medical, industrial, military, and consumer electronics. Ttek focuses on precision manufacturing, quality control, and scalable production solutions to meet diverse OEM requirements.

-

In 2024, Ttek Assemblies secured about US$ 1,726,000 in new commercial financing to support expansion of its battery manufacturing and custom‑battery pack services.

Johnson Controls is a global leader in building technologies, automation, HVAC, security, fire‑safety, and energy‑management systems. With a legacy dating back to 1885, the company delivers smart building solutions via its “OpenBlue” platform across more than 150 countries. It serves commercial, industrial, institutional and data‑center clients, focusing on energy efficiency, sustainability, and integrated building services.

-

In August 2025, Johnson Controls completed the sale of its Residential and Light Commercial HVAC business to Bosch Group a major strategic move that refocuses the company on building solutions and smart infrastructure.

KEY PLAYERS

The Major Plauyers are Rose Batteries, Ttek Assemblies Inc., PH2, Johnson Controls, Valmet Automotive, Tiger Electronics, inc., Coulometrics, LLC, Enersys, Exide Industries Limited and other players are listed in a final report.

| Report Attributes | Details |

| Market Size in 2025E | USD 7.14 Billion |

| Market Size by 2033 | USD 23.09 Billion |

| CAGR | CAGR of 15.8% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Lithium ton, Lithium-polymer, Lithium iron phosphate, Alkaline, Nickel Metal Hydride, Nickel Cadmium) • By Application (Electric vehicles, Consumer Electronics, Defense / Military, Telecom Towers, Energy Storage System, Mining, Space, Marine and sub-marines, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Rose Batteries, Ttek Assemblies Inc., PH2, Johnson Controls, Valmet Automotive, Tiger Electronics, inc., Coulometrics, LLC, Enersys, Exide Industries Limited |