Bay Leaf Market Report Scope & Overview:

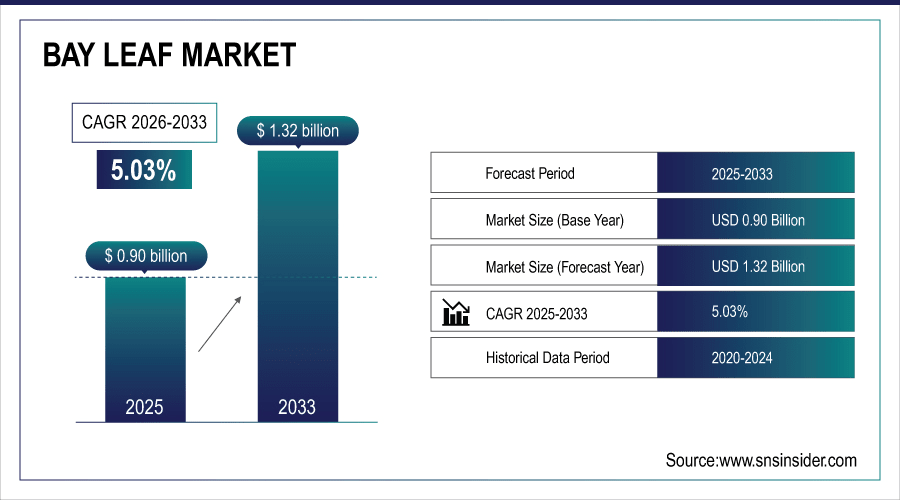

The Bay Leaf Market size was valued at USD 0.90 Billion in 2025E and is projected to reach USD 1.32 Billion by 2033, growing at a CAGR of 5.03% during 2026-2033.

The global market is analyzed through trends, growth drivers, restraints, opportunities, segment performance, and regional analysis. This shows steady growth owing to the rising consumer preference for the natural spices, rising use in curries and medical purposes, and rapidly growing global trade networks. In addition, increasing popularity of organic and bio sustainably produced bay leaves is creating a favorable scenario for market growth across geographies and contributes to increased adoption in food and healthcare sector globally.

Over 60% of households in top-consuming countries use bay leaves regularly in cooking and medicinal preparations.

To Get More Information On Bay Leaf Market - Request Free Sample Report

Bay Leaf Market Trends

-

Rising demand for organic, natural, and chemical-free food products is driving bay leaf consumption globally.

-

Bay leaves are increasingly valued for their flavor and medicinal benefits, encouraging use in cooking and wellness products.

-

Growing awareness of antioxidant and digestive properties of bay leaves is boosting their adoption among health-conscious consumers.

-

Home cooking and gourmet food trends are promoting higher usage of bay leaves in households.

-

Bay leaves are gaining popularity in herbal supplements and functional health products, creating new market avenues.

-

Expansion of premium and value-added organic bay leaf products across North America, Europe, and Asia Pacific offers opportunities for manufacturers.

U.S. Bay Leaf Market Insights

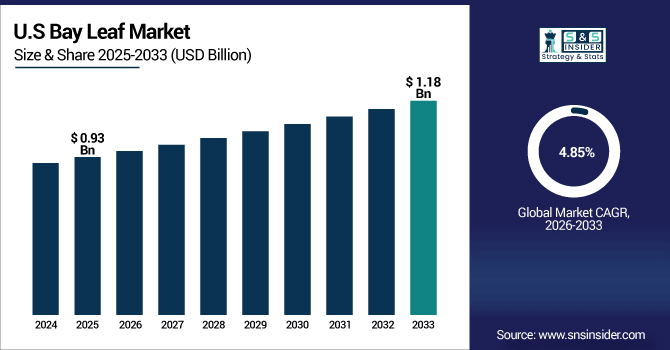

The U.S. Bay Leaf Market size was valued at USD 0.93 Billion in 2025E and is projected to reach USD 1.18 Billion by 2033, growing at a CAGR of 4.85% during 2026-2033.

The U.S. market is due to demand for ready-to-cook and packaged spices in household along with growing ethnic cuisines and the expansion of the foodservice sector. The growth of retail and e-commerce channels, along with consumer preference for natural and organic culinary ingredients are expected to further contribute to increasing sales of bay leaf products. All of the aforementioned factors combined are arterial reasons for the proliferation of the bay leaf market in the U.S.

Bay Leaf Market Growth Drivers:

-

Rising Demand for Natural and Organic Spices Among Global Consumers Driving Bay Leaf Consumption Growth

Growing demand for organic, natural and chemical-free food products has a positive impact on the growth of bay leaf market. Bay leaves are known for their flavor and medicinal advantages, and consumers worldwide are looking for healthier substitutes in cooking, increasing the consumption of bay leaves. Growing awareness of the sufficiency of antioxidants and digestive benefits of bay leaves is escalating this trend. In addition, rising trend of home cooking of gourmet food spurs usage of bay leaves which sustains demand and enables market growth in many regions.

Over 50% of chefs and culinary professionals incorporate bay leaves in gourmet recipes to enhance aroma and taste.

Bay Leaf Market Restraints:

-

Fluctuating Raw Material Prices and Climatic Factors Limit Market Expansion Globally

Bay leaves are subject to enormous fluctuations in raw material costs owing to seasonality and climatic changes which poses the risk of how stable bay leaf supply would be in the years to come. Drought or surplus rainfall during the growing season alters the quality and yield of the leaf, preventing sustained production. Interruptions in supply can cause price increases and ostensible affordability in products for both manufacturers and end-users soon after. Moreover, it brings vulnerability to dependence on just a few key producing countries for the supply of raw material. Such factors limit their large-scale expansion and thus, can slow down the adoption, challenging the fast-growing bay leaf market.

Bay Leaf Market Opportunities:

-

Rising Popularity of Organic and Functional Food Products Creates Growth Opportunities for Bay Leaf Market

High consumer preferences for organic, functional and health oriented food products offer significant growth opportunities for bay leaf manufacturers. Widely touted for their antioxidant, anti-inflammatory and digestive benefits, bay leaves are proving popular in herbal supplements and health products. Bay leaf products can also be traded as premium or value-added products over organic food sections in North America, Europe and Asia Pacific which would result in new application avenues. Trends such as these should push manufacturers to come out with certified organic and nutraceutical focused variants in order to remain relevant to changing consumer preferences and ensure a step ahead in the market front.

Over 60% of consumers globally prefer organic and chemical-free spices, increasing the adoption of bay leaves in cooking.

Bay Leaf Market Segment Analysis

-

By Product Type, California Bay Leaf led the Bay Leaf Market with a 38.90% share in 2025E, while Indian Bay Leaf is the fastest-growing segment with a CAGR of 5.50%.

-

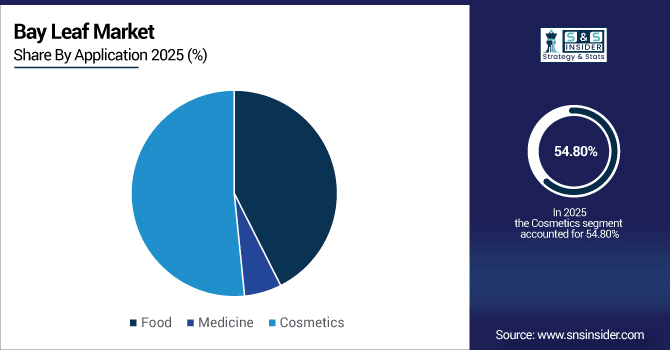

By Application, the Food sector dominated the market with 45.20% share in 2025E, whereas the Medicine segment is expected to grow fastest with a CAGR of 6.20%.

-

By Usage Industry, Food and Beverage led the market with 50.20% share in 2025E, while Healthcare is registering the fastest growth with a CAGR of 5.80%.

-

By Form, Whole Leaf held 55.10% share in 2025E, while Extracts/Essential Oils is growing the fastest with a CAGR of 6%.

By Application, Food Dominate While Medicine Shows Rapid Growth

Food segment was estimated to be the largest revenue generator with an approximate 45.20% of the total market share in 2025E owing to its high application in food preparations and in packaged spice products. For instance, the medicine segment is anticipated to be the fastest growing with a CAGR of around 6.20%, by 2026-2033 due to the increasing awareness of bay leaves beneficial effect on health, rising application in herbal supplements, and growing preference in alternative medicine practices. And one notable company here is, in fact, Frontier Natural Products Co-op, which is actually using the medicinal application of bay leaves to add to its product line.

By Product Type, California Bay Leaf Leads Market While Indian Bay Leaf Registers Fastest Growth

The California Bay Leaf segment dominated the Bay Leaf Market with a revenue share of about 38.90% in 2025E, due to its high aroma and flavour consistency and broad culinary application across the globe. Indian Bay Leaf segment will grow at the highest CAGR of nearly 5.50% CAGR between 2026 and 2033, owing to boosts in its recognition of healing features, higher demand in herbal products, and growing acceptance in global cuisine. Amongst players such as McCormick & Company, Inc. Which is also one of the prominent producers contributing to this growth of Indian Bay Leaf.

By Usage Industry, Food and Beverage Lead While Healthcare Registers Fastest Growth

The Food & Beverage segment accounted for the highest share of revenues in the Bay Leaf Market at 50.20% in the year 2025E owing to the high usage in restaurants, hotels, and packaged food industry. Due to increasing applications in herbal treatments, natural illuminatives, and preventive healthcare products, healthcare segment is expected to achieve the fastest CAGR of approximately 5.80% during the predicted period from 2026-2033. And Badia Spices, one of the leading suppliers in the market bay leaves for healthcare and wellness applications.

By Form, Whole Leaf Lead While Extracts/Essential Oils Grow Fastest

Whole Leaf segment accounted for the largest share of the Bay Leaf Market at around 55.10% in 2025E due to its long shelf life, convenience to use in cooking, and high consumer preference. Extracts/Essential Oils segment will have the highest CAGR of nearly 6% during 2026–2033, as extraction and use in cosmetics, pharmaceuticals, and functional food applications are increasing rapidly. In response to increasing demand, Alpina Organic Bay Leaf Company is in production of extract based bay leaf products.

Bay Leaf Market Regional Analysis:

North America Bay Leaf Market Insights

North America Bay Leaf Market is anticipated to remain steady on the back of increasing consumer inclination towards natural and organic spices. The growing application of bay leaves in culinary preparations, instant food, and herbal products is expected to support the demand. Growing foodservice industry, coupled with increasing retail and e-commerce channels are allowing high-quality bay leaves to be readily available for the consumers and driving market growth in the U.S. and Canada region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Bay Leaf Market Insights

The North American bay leaves market is dominated by the U.S., due to the ready availability of bay leaf whether natural or organic due to high consumer demand levels, and established retail and e-commerce channels for the distribution of bay leaf products.

Asia-Pacific Bay Leaf Market Insights

Asia Pacific region reached approximately 42.70% of total Bay Leaf Market revenue in 2025E, owing to the presence of major production centers in India, Indonesia, and Southeast Asia, together with high local consumption. Asia Pacific segment is anticipated to grow at the fastest CAGR of approximately 5.20% during the period 2026-2033 as a result of increasing export demand, rise in disposable income, growing culinary and medicinal applications.

China Bay Leaf Market Insights

China is expected to dominate by production volume, aided by the presence of organized and well-developed supply chains, rising domestic consumption owing to the culinary and medicinal applications of bay leaf, and subsequent exports by China to several international markets by virtue of an increasing number of end-users choosing organic bay leaf and value-added bay leaf products.

Europe Bay Leaf Market Insights

The Europe Bay Leaf market is growing gradually in the market due to the rising demand for natural and organic spices—used for cooking as well as wellness purposes. Increasing popularity of Mediterranean and gourmet foods which uses Bay Leaves, boom in use of bay leaves in herbal supplements is driving market growth. Access via growing consumer-wide retail chains and commerce channels reinforces market acceptance and the availability of quality, responsibly sourced bay leaf products.

Germany Bay Leaf Market Insights

The market in Germany continues to lead the European bay leaf market through greater import volumes, well-adapted retail dynamics and higher consumption of bay leaves for culinary and medicinal applications. Germany remains a leader in Europe, all helped by a strong contribution from Italy and Spain.

Latin America (LATAM) and Middle East & Africa (MEA) Bay Leaf Market Insights

UAE is the leading region for Middle East & Africa bay leaf market owing to high imports, strong retail networks and growing demand for natural and herbal spices followed by Saudi Arabia and Qatar. Strong culinary usage, adoption of packaged products and healthful consumption are dominant themes within the region, with Brazil at the forefront.

Bay Leaf Market Competitive Landscape:

McCormick, a worldwide leader in seasoning services and solutions. They are well known for their quality bay leaf products which find application in culinary uses around the world. McCormick® Bay Leaves (0.12 oz), with a tea-like flavor and minty aroma, they add complexity in slow-cooked dishes of French, Mediterranean and Indian cuisines when used to season meat and vegetable dishes, soups and sauces. These hand-selected, certified organic Turkish bay leaves have a full-bodied fragrance and are perfect in soups, braises, and sauces; McCormick® Gourmet Organic Turkish Bay Leaves (0.18 oz)

-

In January 2024, McCormick announced its 2024 Flavor of the Year: Tamarind, featured in their new Tamarind & Pasilla Chile Seasoning. While this product doesn't directly involve bay leaves, it reflects McCormick's ongoing innovation in flavor offerings.

Alpina Organic Co. deals in organic herbs and spices, bay leaves included, launching into the world of sustainable farming with the booming demand for organic spices as its base for a global export business. Nature's All Foods' Organic Bay Leaves are hand-picked and sun-dried to retain natural aroma and taste for many types of dishes, and Bay Leaf Granules finely milled from premium quality bay leaves to provide a seasoning alternative for consistent flavor in recipes.

-

In August 2025, Alpina Organic Co. continues to focus on producing organic bay leaves, catering to the growing consumer demand for natural and chemical-free food products. Their offerings include whole and milled bay leaves, sourced from certified organic farms.

Spice World Inc., one of the top suppliers of fresh and convenient garlic, ginger, and seasoning products, provides bay leaves in whole and ground forms. Whole Bay Leaves are best for long-cooked recipes, where they infuse flavor gradually to enhance the taste of soups, stews, and sauces; Ground Bay Leaves offer an immediate release of flavor to sauces, marinades, and other quick-cooking recipes.

-

In October 2024, Spice World introduced new products such as Refrigerated Fresh Diced Garlic, Refrigerated Peeled Ginger, and a Garlic & Ginger Seasoning Blend. These innovations align with their strategy to expand their product line and meet evolving consumer preferences.

Bay Leaf Market Key Players:

Some of the Bay Leaf Market Companies are:

-

McCormick & Company, Inc.

-

Spice World USA

-

Alpina Organic Bay Leaf Company

-

Badia Spices

-

Anatoli Spices

-

Frontier Natural Products Co-op

-

Pacific Spice Company, Inc.

-

Gourmet Foods Inc.

-

Sultar Ltd

-

Mars, Incorporated

-

Zizira

-

Tea Haven

-

Darsil

-

Just a Little Spice

-

Laurus

-

Hoby Agriculture and Forest Product Co. Ltd

-

G2m

-

Mountain Rose Herbs

-

ALDERA

-

Alpina

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 0.90 Billion |

| Market Size by 2033 | USD 1.32 Billion |

| CAGR | CAGR of 5.03% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (California Bay Leaf, Bay Laurel, Indonesian Bay Leaf, Indian Bay Leaf, Indonesian Laurel, West Indian Bay Leaf and Mexican Bay Leaf) • By Application (Food, Medicine and Cosmetics) • By Usage Industry (Healthcare, Food and Beverage and Consumer Goods) • By Form (Whole Leaf, Powder, Extracts/Essential Oils) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | McCormick & Company, Inc., Spice World USA, Alpina Organic Bay Leaf Company, Badia Spices, Anatoli Spices, Frontier Natural Products Co-op, Pacific Spice Company, Inc., Gourmet Foods Inc., Sultar Ltd, Mars, Incorporated, Zizira, Tea Haven, Darsil, Just a Little Spice, Laurus, Hoby Agriculture and Forest Product Co. Ltd, G2m, Mountain Rose Herbs, ALDERA, and Alpina. |