Ice Cream Market Report Scope & Overview:

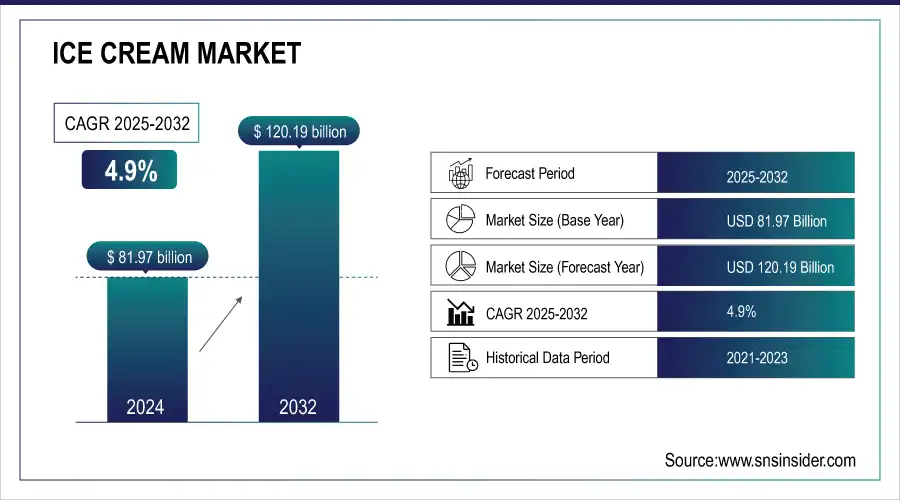

The Ice Cream Market Size was valued at USD 81.97 billion in 2024 and is expected to reach USD 120.19 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2025-2032.

Get PDF Sample Report on Ice Cream Market - Request Sample Report

Ice cream is a combination of milk, cream, industrial sugar, and other ingredients that has been frozen into a soft, creamy treat using unique procedures. It was originally known as iced cream. Stabilizers, such as gluten and plant-based butter, are commonly used to give the mixture a uniform texture. Ice creams also contain milk proteins such as whey and casein, which absorb water and form micelles to improve the product's consistency. Strawberry, vanilla, chocolate, and butterscotch are some of the most popular ice cream flavours. Ice cream is one of the most popular dairy products in India, and it comes in a variety of price levels.

Ice Cream Market Highlights:

-

Ice cream is a sweetened dairy product available in various types including hard, soft, light, and low-fat with diverse flavors driving consumer demand

-

Continuous industry-wide innovation in flavors, nutritional profiles, convenience, automation, and sustainable practices is sustaining strong demand and promoting long-term growth

-

Short shelf life and seasonal demand fluctuations challenge inventory management, cold chain logistics, pricing stability, and operational efficiency

-

Expansion of retail channels including hypermarkets, supermarkets, convenience stores, and online platforms enhances product accessibility, brand visibility, and premium image

-

Retailers’ strategic displays, promotions, and diverse offerings influence consumer purchase decisions, encourage repeat sales, and support overall market growth

-

Increasing focus on eco-friendly packaging and responsible sourcing aligns with consumer preferences, further driving adoption and revenue growth

Ice cream is a sweetened dairy product made with either natural sugar or artificial sweeteners. Companies on the market provide a variety of ice creams, including hard ice cream, soft ice cream, light ice cream, low-fat ice cream, and others. Summer is unquestionably the best time to eat ice cream and other frozen treats. The availability of diverse flavoured ice creams is driving the ice cream industry's expansion. As a result, ice cream buyers pay a higher price for these items, resulting in increased market income.

Ice Cream Market Drivers:

-

Industry-wide innovation is needed to keep product demand high.

Sustaining high product demand requires continuous industry-wide innovation across product development, manufacturing, and marketing processes. Companies must focus on introducing new flavors, improving nutritional profiles, and enhancing convenience to meet evolving consumer preferences. Advanced technologies, such as automation, IoT-enabled production, and data-driven insights, can optimize efficiency and ensure consistent quality. Additionally, sustainable practices, including eco-friendly packaging and responsible sourcing, are increasingly influencing purchase decisions. Collaboration between research teams, suppliers, and retailers is essential to accelerate innovation cycles. By fostering creativity, leveraging technology, and addressing consumer needs, the industry can maintain strong demand, build brand loyalty, and achieve long-term growth.

Ice Cream Market Restraints:

-

Performance is hampered by short shelf life and seasonality.

Product performance in the market is often constrained by short shelf life and seasonal demand fluctuations. Perishable goods require careful inventory management, cold chain logistics, and rapid distribution to minimize spoilage and financial losses. Seasonal trends can lead to periods of oversupply or scarcity, affecting pricing, revenue stability, and operational efficiency. Companies must adopt demand forecasting, flexible production scheduling, and innovative preservation techniques to address these challenges. Additionally, marketing strategies that promote off-season consumption and diversification of product lines can help stabilize demand. By mitigating the impacts of perishability and seasonality, businesses can enhance profitability and maintain consistent market presence.

Ice Cream Market Opportunities:

-

Hypermarkets, supermarkets, convenience shops, discounters, forecourt merchants, and grocery stores are examples of retail channels that serve as worldwide marketing tools to help develop an attractive premium image and improve brand exposure for a wide range of ice cream goods. The expansion of these retail channels helps to boost the size of the ice cream market.

Various retail channels, including hypermarkets, supermarkets, convenience stores, discounters, forecourt merchants, and grocery stores, play a crucial role in expanding product reach and enhancing brand visibility. These outlets serve as strategic marketing platforms, helping companies develop a premium brand image and connect with a wide consumer base. By offering attractive displays, promotions, and easy accessibility, retailers influence purchase decisions and encourage repeat sales. The growing presence and diversification of these channels not only increase consumer convenience but also drive product awareness and adoption. As a result, the expansion of retail networks significantly contributes to the overall growth and size of the ice cream market

Ice Cream Market Segment Analysis:

By Product Type

In 2024, the ice cream market is led by Impulse Ice Cream, driven by convenience, affordability, and widespread availability at retail outlets and foodservice locations. Take Home Ice Cream is the fastest-growing segment, fueled by larger pack sizes, at-home consumption trends, and premium offerings.

By Flavor:

Vanilla remains dominant globally due to its universal appeal, while Chocolate and Fruit are the fastest-growing flavors as consumers seek variety and indulgence. Among distribution channels

By Distribution channel:

Supermarkets and Hypermarkets continue to dominate with high footfall and extensive shelf space, whereas Online Sales Channels grow fastest, supported by e-commerce expansion and home delivery services in 2024.

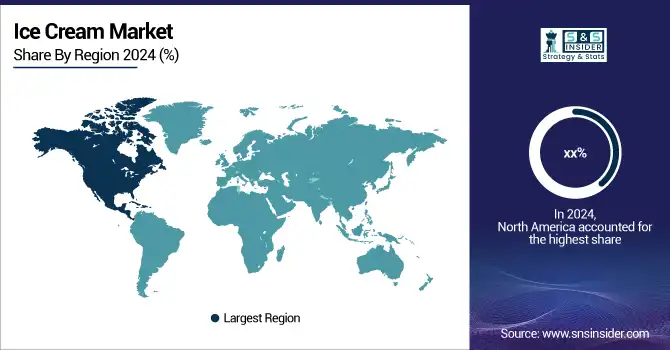

Ice Cream Market Regional Analysis:

North America Ice Cream Market Trends:

North America dominates the ice cream market due to high disposable income, advanced cold chain infrastructure, and widespread retail presence. Strong demand for premium, impulse, and take-home ice cream products drives growth. Consumers increasingly prefer innovative flavors, healthier options, and convenience. Established brands leverage marketing, promotions, and retail partnerships to maintain leadership and expand market share.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia-Pacific Ice Cream Market Trends:

Asia-Pacific is the fastest-growing ice cream market, fueled by rising population, urbanization, and expanding middle-class income. Increased demand for flavored, premium, and artisanal ice cream products is driving growth. Retail channel expansion, including supermarkets, convenience stores, and e-commerce platforms, supports accessibility. Innovation in product variety, seasonal offerings, and localized flavors strengthens consumer adoption and market penetration across the region.

Europe Ice Cream Market Trends:

Europe shows steady ice cream market growth, supported by high consumption of artisanal, premium, and low-fat ice cream products. Established brands drive innovation in flavors, packaging, and product formats. Strong retail networks, including supermarkets and specialty stores, ensure product availability. Health-conscious trends and seasonal promotions influence purchasing decisions, sustaining demand while maintaining a competitive landscape among key players.

Latin America Ice Cream Market Trends:

Latin America exhibits moderate ice cream market growth due to increasing urbanization, expanding modern retail channels, and rising disposable income. Consumers are showing growing interest in premium and flavored ice creams. Seasonal demand peaks in summer drive sales, while marketing campaigns and promotions help boost brand visibility. Local manufacturers and multinational companies compete to capture emerging market opportunities across the region.

Middle East & Africa Ice Cream Market Trends:

Middle East and Africa are emerging ice cream markets with growth supported by rising urban population, increasing retail modernization, and seasonal demand. Consumer interest in premium, artisanal, and indulgent ice cream products is increasing. Expansion of supermarkets, convenience stores, and e-commerce platforms improves accessibility. International brands and local players leverage marketing and flavor innovation to strengthen market presence and adoption.

Ice Cream Market Key Players:

-

Unilever Group

-

Nestle S.A.

-

Mars

-

Blue Bell Creameries

-

Lotte Confectionery

-

Wells Dairy Inc.

-

Turkey Hill

-

Mihan Dairy Inc.

-

Meiji Holdings Co. Ltd.

-

Danone S.A.

-

FrieslandCampina N.V.

-

Arla Foods amba

-

Fonterra Co-operative Group Limited

-

Saputo Inc.

-

Yili Group

-

Amul (Gujarat Cooperative Milk Marketing Federation)

-

Kraft Heinz Company

-

Mondelez International

-

Bongrain (Savencia Fromage & Dairy)

Ice Cream Market Competitive Landscape:

Blue Bell Creameries is a Texas-based ice cream manufacturer founded in 1907, renowned for its high-quality, handcrafted ice creams. The company produces a wide range of flavors, including seasonal and premium offerings, and focuses on traditional recipes, innovation, and distribution through retail outlets, foodservice, and limited-time promotions.

- In September 2025, Blue Bell Creameries has launched Classic Pecan Pie Ice Cream, a brown sugar ice cream with roasted pecans, pie crust pieces, and pecan pie filling, now available in select stores and via free drone delivery in Dallas-Fort Worth for a limited time.

Unilever Established in 1929 is a global consumer goods company headquartered in London and Rotterdam, specializing in food, beverages, personal care, and home care products. The company owns iconic ice cream brands such as Magnum, Ben & Jerry’s, and Wall’s. Unilever focuses on product innovation, sustainability, and expanding premium and bite-sized ice cream formats to meet evolving consumer preferences worldwide.

- October 4, 2024 Unilever’s New Bite-Sized Ice Creams Tap Magnum has launched its first-ever bite-sized Bon Bons in three popular flavors, targeting Gen Z and snack enthusiasts across Europe and Australia, offering shareable, snackable portions that complement traditional ice cream formats and drive higher consumer spending.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 81.97 Billion |

| Market Size by 2032 | USD 120.19 Billion |

| CAGR | CAGR 4.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Impulse Ice Cream, Take Home Ice Cream, Artisanal Ice Cream) • by Flavor (Vanilla, Chocolate, Fruit, Others) • by Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Sales Channel) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Unilever Group, Nestlé S.A., General Mills, Inc., Mars, Incorporated, Blue Bell Creameries, Lotte Confectionery, Wells Dairy Inc., Turkey Hill, Mihan Dairy Inc., Meiji Holdings Co., Ltd., Danone S.A., FrieslandCampina N.V., Arla Foods amba, Fonterra Co-operative Group Limited, Saputo Inc., Yili Group, Amul (Gujarat Cooperative Milk Marketing Federation), Kraft Heinz Company, Mondelez International, Bongrain (Savencia Fromage & Dairy) |