Bending Machines Market Report Scope & Overview:

To get more information on Bending Machines Market - Request Sample Report

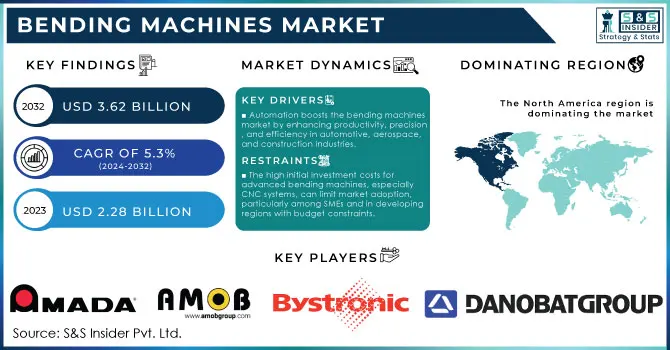

The Bending Machines Market Size was valued at USD 2.28 Billion in 2023 and is now anticipated to grow to USD 3.62 Billion by 2032, displaying a compound annual growth rate (CAGR) of 5.3% during the forecast Period 2024-2032.

The Bending Machines Market has been experiencing significant growth, driven by the increasing demand for efficient metal forming and bending solutions across various industries such as automotive, aerospace, construction, and shipbuilding. Bending machines, used for shaping metal sheets, bars, and tubes, have become essential for manufacturing processes that require precision, speed, and minimal wastage. The market is expanding due to advancements in automation, which enable manufacturers to produce high-quality bent components while reducing labor costs and enhancing productivity.

The rising trend of automation in manufacturing processes is a key growth driver for the market. Automated bending machines, integrated with robotics and smart technologies, have transformed the industry by offering higher efficiency, repeatability, and precision. These machines reduce manual intervention and are particularly popular in industries with large-scale production requirements. Moreover, the adoption of Industry 4.0 and the integration of IoT (Internet of Things) in bending machines have revolutionized machine monitoring, maintenance, and optimization, further fueling market expansion.

MARKET DYNAMICS

DRIVERS

- The growing demand for automation in manufacturing is driving the bending machines market by improving productivity, precision, and operational efficiency across industries like automotive, aerospace, and construction.

The growing demand for automation in manufacturing is a key driver for the bending machines market, as industries such as automotive, aerospace, and construction increasingly rely on automated solutions to boost productivity and efficiency. Automated bending machines streamline production by reducing the need for manual labor, which not only cuts operational costs but also minimizes the risk of human error. This precision is especially important in industries where complex designs and high accuracy are essential, such as in the production of automotive frames, aircraft components, and intricate construction structures.

Automation allows companies to meet the rising demand for high-quality products while maintaining faster production rates. By incorporating advanced technologies like CNC (Computer Numerical Control), bending machines can produce highly precise and repeatable bends, enabling manufacturers to work with a variety of materials and meet custom specifications. Moreover, automated machines optimize material usage and reduce waste, further enhancing cost efficiency. As businesses increasingly focus on improving operational performance and maintaining competitiveness, the adoption of automated bending systems is becoming widespread. These machines not only improve the speed and accuracy of production but also support scalability, allowing manufacturers to handle larger volumes without compromising quality. Consequently, automation is becoming a critical component in modern manufacturing processes, driving growth in the bending machines market as companies look for innovative solutions to keep pace with industrial advancements and market demands.

- The increasing demand for customized metal structures in construction, driven by urbanization and expanding infrastructure projects, is significantly boosting the need for advanced bending machines capable of creating complex components.

The construction sector is experiencing a notable surge in the demand for customized and pre-fabricated metal structures, which plays a crucial role in modern architectural designs. This rising trend is largely driven by rapid urbanization and an increase in infrastructure projects worldwide, prompting builders to seek innovative solutions that meet the evolving needs of construction. Bending machines are essential in this process, as they are responsible for shaping various metal components, including beams, pipes, and other structural elements required for building projects. The ability to produce intricate and precise bends in metal materials is vital for ensuring structural integrity and aesthetic appeal, especially in contemporary designs that often incorporate complex geometric shapes. As a result, the demand for efficient bending machines that can handle a diverse range of shapes and sizes is growing. Manufacturers of bending equipment are continuously innovating, developing machines that offer enhanced capabilities, including improved speed, precision, and versatility to accommodate different materials and thicknesses. Additionally, the push for sustainable construction practices further amplifies the need for advanced bending technology, as builders look to optimize resource use and reduce waste. In summary, the rising use of metal and sheet bending in construction is a driving force behind the increased demand for advanced bending machines, reflecting broader trends in urban development and the ongoing evolution of architectural design. This demand not only fuels the growth of the bending machines market but also enhances the efficiency and quality of construction projects globally.

RESTRAIN

- The high initial investment costs for advanced bending machines, especially CNC systems, can limit market adoption, particularly among SMEs and in developing regions with budget constraints.

The very high upfront investment required for the purchase and installation of sophisticated bending machines, especially CNC and fully automatic systems can often become a huge hurdle for several businesses, notably small to medium scale enterprises (SMEs). As modern machine is pretty expensive, many small scale companies with less start-up have facing the problem of financial to maintain them which used as great machines but also very efficient and provide high precision. This can hamper SMEs from embracing these technologies thereby restricting them to be more competitive against the larger players having high capital expenditure for the same. That is a lot of money to spend on getting an easy bend and it ends up limiting the adoption of bending machines across less developed areas, or in industries that have not been topic to enough investment. The businesses in these regions will have no choice but to rely on older or more cumbersome machines, effectively slowing down productivity and innovation locally. Additionally, the high initial costs also make the industry unattractive to new firms, diminishing market expansion and resulting in an overall slower growth of the industry as a whole. This barrier to entry is a considerable constraint for businesses in areas of low industrial development with little access to capital, inhibiting them from the ability to update manufacturing facilities and utilize the technological advantages presented by modern bending machinery.

KEY SEGMENTATION ANALYSIS

By Technology

The hydraulic segment dominated the market share over 36.02% in 2023. Hydraulic machines are preferred because they are extremely strong, solid, and have the capacity to carry out heavy-duty tasks; qualities suitable for industries such as automotive, construction and shipbuilding. These machines are very powerful and accurate, making them far more popular for larger scale metal bending processes.

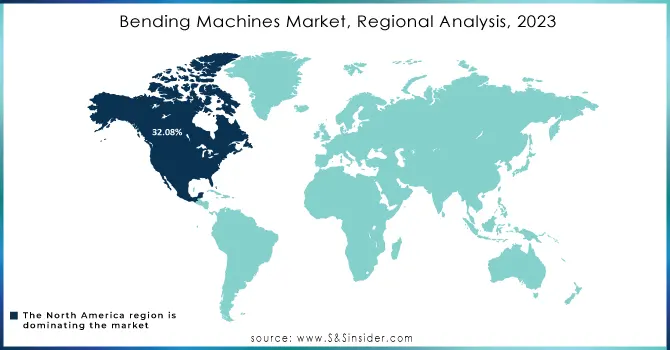

REGIONAL ANALYSIS

North America is dominated market share over 32.08% in 2023, Due to its strong manufacturing industry, advancements in technology, and growing need for accuracy and productivity in metalwork processes. The area is known for its established infrastructure and various companies that utilize bending machines for a variety of reasons.

The Asia-Pacific region is expected to grow at the fastest CAGR from 2024 to 2032. The Asia Pacific region shows potential for automated bending machine sales due to an increase in small and medium-sized businesses and an expanding economy. Additionally, the Chinese market for bending machines had the greatest market share, while the market for bending machines in India experienced the most rapid growth in the Asia-Pacific region.

Need any customization research on Bending Machines Market - Enquiry Now

KEY PLAYERS

Some of the major key players of Bending Machines Market

- AMADA Co. Ltd.: (AMADA HFE-M2 Series Press Brakes)

- AMOB Group: (MAM 3 Hydraulic Tube Bender)

- BLM S.P.A.: (Elect-M Tube Bending Machines)

- Bystronic Laser AG: (Xpert Pro Press Brake)

- DANOBAT GROUP S. Coop.: (IRIS Tube Bending Machine)

- Hochstrate Maschinenbau, Umformtechnologien GmbH: (HRB Tube Bending Machines)

- EUROMAC Spa: (MTX Plus CNC Bending Machine)

- Haco NV: (Haco ERM Hydraulic Press Brakes)

- HAEUSLER AG Duggingen: (VRM Profile Bending Machine)

- Inductaflex Ltd.: (AFM Aluminum Bending Machine)

- LVD Co.: (PPEB Press Brake)

- Murata Machinery Ltd.: (BB II Series CNC Bending Machines)

- Numalliance: (FX15 Tube Bending Machine)

- Promau S.r.l.: (DAVI) (MCB 4-Roll Plate Bending Machine)

- SafanDarley BV: (E-Brake Ultra)

- Schnell Spa: (FORMA Rebar Bending Machine)

- Schwarze Robitec GmbH: (CNC 220 HD Tube Bending Machine)

- Stierli Bieger AG: (220 CNC-W Horizontal Bending Machine)

- transfluid Maschinenbau GmbH:(Tube Bending Machine)

- TRUMPF SE Co. KG :(TruBend Series 5000)

RECENT DEVELOPMENTS

In April 2023: Metalix updated their software-controlled robots for the bending process. The updated version of the software can complete the robotic bending procedure in only a few minutes.

In June 2023: Bradbury launched the Biegemaster XBend machine, which can bend material in two directions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.28 Billion |

| Market Size by 2032 | USD 3.62 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Automotive, General machinery, Transport machinery, Precision engineering, Building and construction) • By Technology (Hydraulic, Mechanical, Electric, Pneumatic) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AMADA Co. Ltd., AMOB Group, BLM S.P.A., Bystronic Laser AG, DANOBAT GROUP S. Coop., Hochstrate Maschinenbau, Umformtechnologien GmbH, EUROMAC Spa, Haco NV, HAEUSLER AG Duggingen, Inductaflex Ltd., LVD Co. nv, Murata Machinery Ltd., Numalliance, Promau S.r.l., SafanDarley BV, Schnell Spa, Schwarze Robitec GmbH, Stierli Bieger AG, transfluid Maschinenbau GmbH, TRUMPF SE Co. KG |

| Key Drivers | • The growing demand for automation in manufacturing is driving the bending machines market by improving productivity, precision, and operational efficiency across industries like automotive, aerospace, and construction. • The increasing demand for customized metal structures in construction, driven by urbanization and expanding infrastructure projects, is significantly boosting the need for advanced bending machines capable of creating complex components. |

| RESTRAINTS | • The high initial investment costs for advanced bending machines, especially CNC systems, can limit market adoption, particularly among SMEs and in developing regions with budget constraints. |