Handheld Chemical and Metal Detector Market Report Scope & Overview:

To get more information on Handheld Chemical and Metal Detector Market - Request Free Sample Report

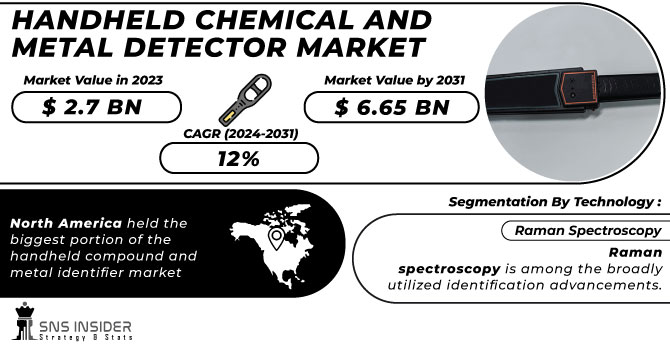

The Handheld Chemical and Metal Detector Market Size was valued at USD 3.29 billion in 2023 and is expected to reach USD 10.03 billion by 2032 and grow at a CAGR of 13.19% over the forecast period 2024-2032. This report offers unique insights into the adoption trends of handheld chemical and metal detectors across different regions, highlighting shifts in demand. It covers the latest technological advancements, including AI integration and sensor improvements, which enhance detection accuracy and usability. The evolving regulatory landscape and compliance requirements are also examined, providing an overview of safety and security standards. Additionally, the report explores export/import data, shedding light on global trade patterns and their influence on the market. Emerging trends such as IoT-connected detectors and user-friendly designs are also featured.

MARKET DYNAMICS

Drivers

-

Growing global security threats have intensified the demand for handheld chemical and metal detectors across law enforcement, military, and border security applications.

Rising global security threats, including terrorism, smuggling, and illegal trafficking, have significantly increased the demand for handheld chemical and metal detectors across various security sectors. There is ever-increasing pressure on governments and law enforcement agencies to make airports, borders, public events, and critical infrastructure sites even more secure. This tool quickly identifies explosives narcotics, and dangerous chemicals, allowing the security detail to take immediate action. They are also used by military forces for guarantees of battlefield safety and counter-terrorist operations. Border security agencies also use them to stop the illegal transport of weapons, drugs, and contraband. At the same time, the sophistication of criminal activities has also increased, leading to the demand for more advanced, reliable, and user-friendly handheld detection technologies. As geopolitical tensions increase and urban security challenges compound, the uptake of these detectors is likely to accelerate, providing improved safety and threat mitigation in high-risk settings.

Restraint

-

The high cost of advanced handheld chemical and metal detectors limits adoption in budget-constrained industries and law enforcement, especially in developing regions.

The high cost of advanced handheld chemical and metal detectors poses a significant barrier to widespread adoption, particularly for small-scale industries and law enforcement agencies in developing regions. These advanced devices utilize state-of-the-art technologies, including ion mobility spectrometry, Raman Spectroscopy and X-ray fluorescence, improving detection accuracy and increasing production costs. Also, the basic price before AI and wireless has made most of these machines inaccessible for budget-sensitive firms. Many smaller security forces and industrial customers find it hard to justify the investment, particularly when alternative detection methods at lower cost may be available, albeit with lesser accuracy. What makes it even worse is that the high initial purchase price only goes up with maintenance, calibration, and battery replacement costs long-term ownership is an expensive affair. Consequently, market expansion in cost-sensitive tiers may stall until manufacturers offer low-cost models or governments offer funding and subsidies for adoption in safety and industrial applications.

Opportunities

-

The development of lightweight, ergonomic, and intuitive handheld detectors enhances portability and ease of use, driving wider adoption across security and industrial sectors.

The development of lightweight and user-friendly handheld chemical and metal detectors is crucial for enhancing usability and efficiency across various industries. Ongoing miniaturization and ergonomic improvements have led to more portable, comfortable-to-use, and accessible devices for first responders, security teams, and industrial workers. This reduced weight and improved grip benefit the detectors they hold, enabling its users to operate the detectors for longer before experiencing fatigue and therefore improve effectiveness in field applications. Intuitive interfaces, touchscreen controls, and wireless connectivity also make operation and data sharing much easier reducing training requirements. AI-driven automation takes this a step further, significantly improving detection accuracy, and allowing for faster threat identification with little to no human intervention. In high-stakes environments like border security, hazardous material detection, and industrial safety, these advancements are particularly valuable as they enable faster and more reliable threat assessment. To encourage widespread adoption of their products, manufacturers are increasingly focusing on user-centric design as demand increases for quick and trustworthy security solutions.

Challenges

-

Limited awareness and insufficient training on handheld detectors can lead to improper use, impacting their effectiveness and adoption.

The effective use of handheld chemical and metal detectors is highly dependent on proper training and awareness among end users. Such devices, especially those used in mission-critical applications such as security screening or industrial safety, require users to grasp their functionality, calibration, and maintenance for effective detection. Not enough training could bring misuse misinterpretation of results, false alarms, or missed detections, which may have big consequences. Moreover, limited knowledge of these detectors' capabilities or benefits could potentially limit their usage in a few industrial sectors or areas. It may take a while for these technologies to be adopted as many prospective users including small businesses and employees working in remote locations do not see the utility of investing in sophisticated technologies, delaying its ubiquitous application. Therefore, bridging the knowledge gaps and raising awareness is essential to ensure the maximum effectiveness of the handheld chemical and metal detectors market.

SEGMENTATION ANALYSIS

By Technology

The Ion Mobility Spectrometers (IMS) segment dominated with a market share of over 42% in 2023, as they offer quicker and better detection of trace chemicals, explosives, and illegal substances. IMS technology does this by ionizing all the molecules of a gas stream before they pass through an electric field as a time of flight, allowing for very accurate results even from small samples. The quick response times that the Theoretical AI provides, combined with its small size and portability, means it is perfect for use in security, military, and Law Enforcement applications. The technology’s reliability and sensitivity to a wide class of chemical compounds at very low levels make it even more appealing. These features have propelled IMS as the detector of choice for handheld detectors, especially during critical moments when effort detection of chemicals in the field is needed quickly and effectively.

By Application

The Chemical Detection segment dominated with a market share of over 38% in 2023, owing to their importance in security, military, and industrial applications. The growing demand for safety in environments exposed to chemical threats around the world has led to an increase in the number of these devices. They are key to detecting dangerous chemical compounds, including chemical warfare agents, toxic industrial chemicals, and illicit chemicals. Therefore, it is applied in military and defense fields, wherein chemical detection devices are used to stop attacks made by hazardous substances, and in industrial areas, they are used to monitor chemical exposure and ensure safety regulatory compliance. The adoption of this wide range of sensor technology has been influenced by increasing security concerns and industrial safety standards and should continue to deliver substantial growth to this segment.

By End-User

The Customs & Borders segment dominated with a market share of over 32% in 2023, due to the pivotal role these devices play in averting threats at border and customs checkpoints. Handheld detectors are widely used by customs and border security agencies to rapidly screen people, luggage, goods, and vehicles for illegal substances, explosives, and contraband materials. By using these portable and easy-to-use detectors, officers can carry out comprehensive inspections in different environments, whether it be airports, ports, or land borders. The end-user segment of the global smart surveillance market is majorly driven by the increasing need for more making better security solutions across the world so that security can be improved is considered to be the major factor fueling the demand for this market due to which the segment is dominating the market.

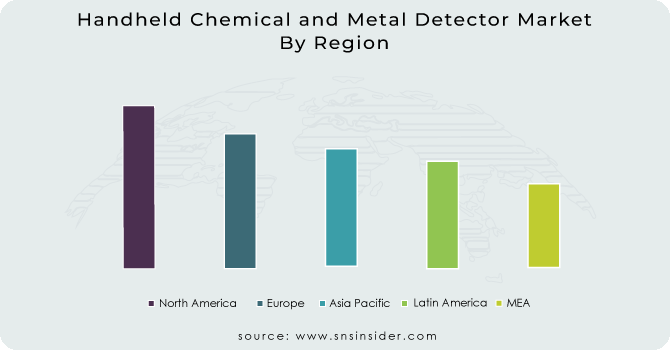

KEY REGIONAL ANALYSIS

North America region dominated with a market share of over 38% in 2023, due to its well-established technological backbone and well-industrialized landscape. This has resulted in many efficient handheld detectors spread across several sectors in the region where security technologies have advanced significantly. These devices are utilized primarily in law enforcement and defense due to the growing need for improved security systems in the public and private sectors. Furthermore, handheld detectors play a crucial role in sectors involving hazardous materials, including chemical plants and manufacturing facilities, where safety and regulatory adherence are paramount. Moreover, with the presence of prominent players and continuous developments in detection technologies including the incorporation of AI and IoT conveniences North America to emerge as a market leader. Advanced detection devices are also in great demand due to government investments in security and defense technologies, thus further increasing the region's dominance in this market.

Asia-Pacific is witnessing the fastest growth in the Handheld Chemical and Metal Detector Market due to several factors. The growing industrial activities in the region, especially in China, India, and Japan, are driving a significant demand for advanced detection technologies. As these sectors have grown, so have effective safety measures for preventing accidents, hazards, and theft. Increasing security concerns associated with threats such as terrorism, industrial hazards, and environmental protection contribute to the growth of handheld detectors. With public safety and security becoming a top concern for the governments and organizations in the region, a boost in security infrastructure investments is seeing new heights. The rising emphasis on countering threats such as illegal smuggling, environmental pollution, and workplace hazards is also fueling the market for these detection systems.

Need any customization research on Handheld Chemical and Metal Detector Market - Enquiry Now

Some of the major key players in the Handheld Chemical and Metal Detector Market

-

OSI Systems, Inc (Rapiscan Systems - Handheld Chemical Detectors, Handheld X-ray Systems)

-

Teledyne Technologies Incorporated (Teledyne FLIR - Handheld Metal Detectors, Chemical Detectors)

-

Smiths Group plc (Smiths Detection - Handheld Chemical and Explosive Detectors, Handheld Metal Detectors)

-

Thermo Fisher Scientific Inc (Thermo Scientific - Handheld Chemical Analyzers, Portable Metal Detectors)

-

Agilent Technologies, Inc. (Agilent - Handheld Chemical Analysis Instruments)

-

Bruker Corporation,(Bruker - Handheld X-ray Fluorescence Analyzers)

-

Leidos (Leidos - Portable Chemical and Metal Detection Systems)

-

Garrett Metal Detectors (Garrett - Handheld Metal Detectors)

-

908 Devices Inc. (908 Devices - MX908 Handheld Chemical Detector)

-

Nuctech Company Limited (Nuctech - Handheld X-ray and Chemical Detectors)

-

B&W Tek, Inc. (B&W Tek - Handheld Raman Spectrometers for Chemical Detection)

-

FLIR Systems (FLIR - FLIR T-Series Handheld Chemical and Metal Detectors)

-

Horiba, Ltd. (Horiba - Handheld Chemical and Environmental Detectors)

-

Chemring Group (Chemring - Handheld Chemical Detectors and Explosive Detection Systems)

-

Riken Keiki Co., Ltd. (Riken Keiki - Portable Chemical and Gas Detectors)

-

Kidde-Fenwal, Inc. (Kidde - Handheld Fire and Gas Detectors)

-

Gimac (Gimac - Handheld Chemical Detection Systems)

-

Scintrex (Scintrex - Handheld Radiation and Chemical Detection Instruments)

-

Radiation Detection Company (RDC - Handheld Radiation Detectors and Chemical Analyzers)

-

Unisensor (Unisensor - Handheld Gas and Chemical Detectors)

Suppliers for (high-performance handheld detectors for detecting chemicals, explosives, and metals, commonly used by first responders, security agencies, and defense organizations) on Handheld Chemical and Metal Detector Market

-

Thermo Fisher Scientific Inc. (U.S.)

-

Smith’s Detection (U.K.)

-

Fluke Corporation (U.S.)

-

Horiba Ltd. (Japan)

-

Georgetown Instruments (U.S.)

-

Kroll Associates Inc. (U.S.)

-

DetectaChem (U.S.)

-

Shimadzu Corporation (Japan)

-

Rapiscan Systems (U.S.)

-

Chase Research Ltd. (U.K.)

Teledyne Technologies Incorporated-Company Financial Analysis

RECENT DEVELOPMENT

In May 2023: The security division of OSI Systems, Inc. secured an order worth approximately USD 10 million to supply several units of the Eagle M60 mobile high-energy cargo and vehicle inspection system, as well as the Z Backscatter Van cargo and vehicle inspection system. These systems are intended for international security applications.

In March 2023: OSI Systems, Inc.'s security division received an order valued at around USD 20 million from ANA Aeroportos de Portugal to deliver multiple units of the RTT 110 (Real Time Tomography) explosive detection system. These units are being deployed at airports across Portugal for passenger screening.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.29 Billion |

| Market Size by 2032 | USD 10.03 Billion |

| CAGR | CAGR of 13.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Ion Mobility Spectrometers, Raman Spectroscopy, Metal Identification, Others) • By Application (Chemical Detection, Explosive Detection, Narcotics Detection, Metal Detection) • By End User (Airports, Customs & Borders, Law Enforcement Agencies & Forensic Departments, Military & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | OSI Systems, Inc., Teledyne Technologies Incorporated, Smiths Group plc, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bruker Corporation, Leidos, Garrett Metal Detectors, 908 Devices Inc., Nuctech Company Limited, B&W Tek, Inc., FLIR Systems, Horiba, Ltd., Chemring Group, Riken Keiki Co., Ltd., Kidde-Fenwal, Inc., Gimac, Scintrex, Radiation Detection Company, Unisensor |