Grain Processing Equipment Market Report Scope & Overview:

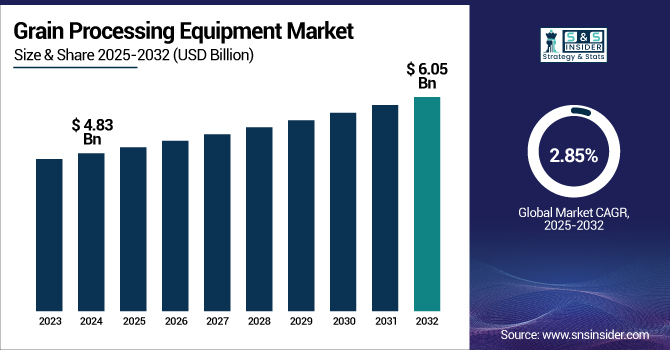

The Grain Processing Equipment Market size was valued at USD 4.83 billion in 2024 and is expected to reach USD 6.05 billion by 2032, growing at a CAGR of 2.85% over the forecast period of 2025-2032.

To Get more information on Grain Processing Equipment Market - Request Free Sample Report

Grain processing equipment market growth is attributed to rising the global food requirement due to increasing population globally. This demand is contributing to a growing dependence of the food and beverage sector on efficient processing technologies to meet this demand. A growing demand for grain-based products and dominant-intensive improvements are further propelling this growth.

Automation and many manufacturers are integrating automation and robotics to streamline various components while reducing labor efforts. Also, the adoption of Internet of Things (IoT) and Industry 4.0 technologies has improved operational efficiency and aligns with the ongoing trend of digitalization in the industry. Additionally, innovation in near-infrared (NIR) spectroscopy is transforming grain sorting, allowing for more accurate assessment of protein content and nitrogen level, which results in higher product quality.

For instance, in October 2024, WinTone Machinery unveiled a cutting-edge 150 tons per day (TPD) corn grits and flour milling plant, marking a significant advancement in grain processing technology. This state-of-the-art facility is designed to meet the growing global demand for high-quality corn-based products.

Grain Processing Equipment Market Size and Forecast

-

Grain Processing Equipment Market Size in 2024: USD 4.83 Billion

-

Grain Processing Equipment Market Size by 2032: USD 6.05 Billion

-

CAGR: 2.85% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Grain Processing Equipment Market Trends

-

Rising global demand for processed grains and cereals is driving the grain processing equipment market.

-

Increasing adoption of automated, energy-efficient, and high-capacity machinery is boosting productivity.

-

Expansion of food processing industries and ready-to-eat product segments is fueling market growth.

-

Growing focus on quality control, hygiene, and contamination prevention is shaping equipment design trends.

-

Integration of IoT and smart monitoring systems is enhancing operational efficiency and predictive maintenance.

-

Rising consumption of grains in emerging economies is expanding market opportunities.

-

Collaborations between equipment manufacturers, food processors, and research institutes are accelerating innovation and technology adoption.

Grain Processing Equipment Market Growth Drivers:

-

Rising Global Population Fuels the Need for Advanced Grain Processing Equipment and Automation

Due to population growth globally, food places an increasing demand, where sufficient and proper grain processing plays an important role. Increasing population age is creating demand for advanced processing equipment to keep the supply of grain-based products stable. Similarly, an expanding population has resulted into a greater demand for processed and ready-to-eat foods, wherein advanced milling, grinding, and packaging technologies would be required. The increasing focus on biofuels from grains is also fuelling demand for high-capacity grain processing machinery. Such a trend is especially prominent in regions where the human population is experiencing rapid growth, which places pressure on agricultural modernization to satisfy food security requirements. With growing input requirements, the processing plants are adopting automation and digital methods to improve operational output and reduce wastage. In conclusion, this is fundamental for global population increase, which is the major reason for innovation and growth in the grain processing equipment market.

In April 2025: The global population is projected to reach 8.09 billion on January 1, 2025, marking an increase of over 71 million people in 2024, according to estimates from the U.S. Census Bureau. India remains the most populous country, with an estimated population of 1.41 billion as of 2024. This growth underscores the ongoing demand for food and agricultural production, highlighting the need for efficient grain processing methods to meet the rising needs of a larger population.

Grain Processing Equipment Market Restraints:

-

Geopolitical Tensions’ Impact on Global Supply Chains and Grain Processing Equipment Hinders Market Growth

Industries, including grain processing sectors globally, have been severely affected due to global supply chain disruptions fuelled by factors ranging from geopolitics. Global geopolitical tensions, such as the Russia-Ukraine war, have involved across the lines of critical trade routes and decreased the supply of basic materials. Such disruptions have resulted in higher expenses, postponed shipments, and ambiguity in the market, acting as growth restraints for the grain processing equipment industry.

For instance, the current Russia/Ukraine military conflict has heightened geopolitical tensions and disrupted wheat, sunflower oil, and barley, among other key commodities in the region. The result has been determined by creating more shipping and thus longer delivery timelines, changing trading patterns, and stretched resilience in corporate supply chains. In the same manner, the Israel-Hamas conflict has impacted items travelling through key waterways, influencing supply chains globally. The development disrupted maritime shipping routes causing various delays and rising costs for businesses. These geopolitical tensions have reaffirmed the susceptibility of global supply chains.

In April 2025, the Black Sea region, responsible for approximately 30% of global wheat exports, is facing potential supply challenges extending into 2026. Both Russia and Ukraine are anticipated to see reduced harvests, with Ukraine's wheat crop projected to reach its lowest level in 13 years. These factors may result in a tighter global wheat supply soon.

Grain Processing Equipment Market Segment Analysis

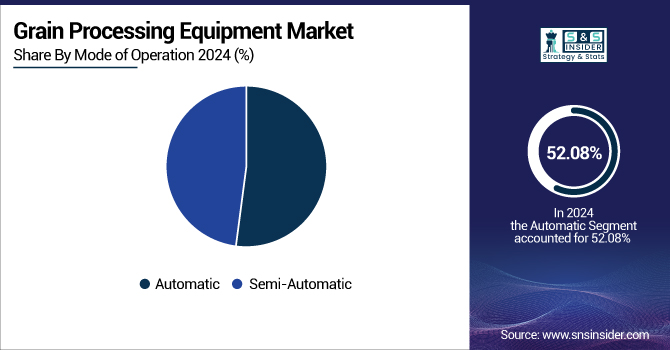

By Mode of Operation, automatic segment dominates the Grain Processing Equipment Market. The semi-automatic segment is the fastest-growing.

In 2024, the automatic mode of operation dominated the grain processing equipment market with a 52.08% share. The demand for enhanced efficiency, accuracy, and less human participation in grain processing is what drives the segment’s growth. By processing continuously and faster, automated systems improve reliability, reduce errors, and provide the ability to operate on a large scale. Additionally, they offer enhanced quality control and economy, making them suitable for commercial production. With the continuous modernization of food and agriculture sectors, automation is essential for meeting the rising productivity demands, which is ultimately driving the growth of the market for automatic systems in grain processing.

The fastest-growing segment in the grain processing equipment market is expected to be semi-automatic systems. Despite the popularity of the automatic and ready-made systems, semi-automatic systems are an attractive, low-cost, versatile alternative, which is gaining traction. They provide an ideal compromise between robot-free and fully automatic systems, making them the solution of choice for many companies looking for ways to optimise processes without incurring the soaring costs associated with automation.

By Machine, pre-processing segment dominates the market. The processing segment is the fastest-growing.

The pre-processing segment is poised to dominate the grain processing equipment market, capturing a substantial 54% share in 2024. It includes cleaning, drying and grading of grains before moving to the next processing stage. These steps are the most basic ones as a system is ensured that the grains are purified from impurities, dried and separated according to quality, which is the first step for efficient and effective processing. The dominance of the segment is attributed to the ability of pre-processing equipment to improve the quality of raw grains and also stop the contamination or spoilage.

The processing segment of the grain processing equipment market, though second in terms of market share, is the fastest-growing segment. This segment is expected to grow at the highest CAGR in the coming years, due to rise in demand for flour, pasta, and ready-to-eat processed grain-based products. Moreover, the demand for processed grains is also increasing due to the fast-growing demand for convenience foods and the urbanization and population growth.

By Application, cleaning segment dominates the market. The dryer segment is experiencing the fastest growth.

The cleaning segment dominated with the largest grain processing equipment market share of over 32% in 2024 due to its crucial role in ensuring grain quality and safety. Grains are regularly contaminated with different impurities of dust, husk, or other waste, which need to be eliminated further in the processing stage. Air classifiers, screen cleaners, and separators are great examples of cleaning equipment that are used in both large-scale and small-scale grain systems. This first step of processing is crucial to avoid contamination from surrounding circumstances and to ensure that the quality of the product meets the standards of the industry. As cleaning machines are required throughout the grain processing industry, this segment leads the market due to their significant necessity.

The dryer segment is experiencing rapid growth, primarily due to the rising demand for moisture control in grains. Maintaining appropriate moisture levels in crops that have been harvested is especially important as climate change is affecting growing conditions. As one of the ways to meet increased quality and shelf-life requirements, grain dryers are becoming a needed piece of equipment within the agriculture sector. With their goal of minimising post-harvest losses and maintaining grain quality in storage, and farmers and processors are on the lookout for feasible solutions. The segment is growing due to moisture resistance, increasing demand for control of moisture, and also due to an increase in the technology of dryers for grains to protect consumable and tradable grains. Therefore, the dryers’ section is taking hold of one of the key growing sectors of agricultural and processing departments.

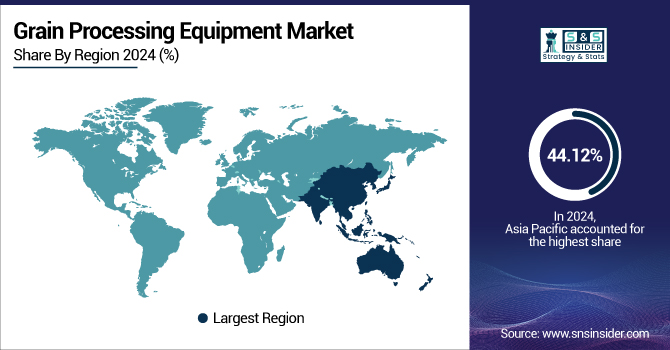

Grain Processing Equipment Market Regional Analysis

Asia Pacific Grain Processing Equipment Market Insights

Asia Pacific is projected to dominate and be the fastest-growing region in the grain processing equipment market, capturing 44.12% of the total share in 2024. The growth is attributed to the fast-growing agriculture sector, increasing population, and surging demand for processed grain products, including flour, rice, and snacks. The growth is propelled by rapid technological advancements across the processing equipment, along with support from government authorities and agencies to enhance food security and minimize post-harvest losses among developing countries, such as China, India, and Japan. The large consumer base and rising demand for shelf-stable and processed food products are the main drivers behind the region's leading position.

China's grain processing equipment market is poised to lead the Asia Pacific region, capturing the largest revenue share in 2024. This growth is primarily fueled by the country’s large population, which generates a significant demand for food security and efficient production solutions. The government's focus on modernizing agriculture through technological innovations like automation and digital farming has been pivotal in driving market expansion.

North America Grain Processing Equipment Market Insights

North America holds a significant share of the market for grain processing equipment due to its advanced agricultural practices and well-established food processing industry. The U.S. and Canada are leading markets, driven by their robust economies, high demand for processed food products, and significant investments in agricultural technology. The region benefits from a strong focus on automation, precision agriculture, and efficient food production methods, which fuel the demand for state-of-the-art grain processing equipment. Additionally, North America has a highly developed distribution network and a solid presence of key market players that continually introduce innovative solutions, ensuring the market remains strong.

The U.S. market is valued at USD 0.92 billion in 2024 and is projected to reach USD 1.16 billion by 2032, growing at a CAGR of 2.99% during the forecast period. This expansion is attributed to increasing demand for high processing technologies, population growth, and new technologies in food processing. The U.S. agricultural production growth will also support market expansion as the production of food and feed is enhanced through modern equipment that improves processing efficiency both in terms of speed and capacity.

Canada’s market for grain processing equipment was valued at USD 0.16 billion in 2024, is projected to reach USD 0.23 billion by 2032, growing at a CAGR of 4.00% during the projected period. The strong agricultural sector of Canada, the continuously mounting demand for advanced processing technologies, and the requirement for improved grain production mainly drive this growth. Canada’s focus on innovation in agriculture, sustainable practices, and the export of high-quality grains continues to contribute to growth in the market at a rate that outpaces that of the U.S., helping to drive demand for new grain processing equipment.

Europe Grain Processing Equipment Market Insights

Europe holds a significant position in the Grain Processing Equipment Market, driven by advanced agricultural practices, adoption of modern milling technologies, and government support for food processing infrastructure. The region’s emphasis on high-quality grain products, coupled with investments in automation and precision equipment, is boosting efficiency and productivity. Strong presence of key manufacturers and continuous R&D initiatives further enhance the deployment of innovative grain processing solutions across Europe.

Middle East & Africa and Latin America Grain Processing Equipment Market Insights

The Grain Processing Equipment Market in the Middle East & Africa and Latin America is expanding steadily, supported by growing investments in agriculture and food processing infrastructure. Rising demand for high-quality grain products, modernization of milling facilities, and adoption of automated and energy-efficient equipment are driving market growth. Government initiatives and collaborations with global technology providers are further accelerating the deployment of advanced grain processing solutions in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Grain Processing Equipment Market Competitive Landscape:

Satake Corporation Overview:

Satake Corporation specializes in comprehensive grain processing, storage, and handling solutions for the agricultural sector. The company provides milling, sorting, and drying equipment along with silo and storage technologies, focusing on operational efficiency, food safety, and process automation. Satake actively expands through acquisitions, partnerships, and technological innovation to strengthen its market presence and offer integrated solutions for modern agricultural processing needs globally.

-

2024 – Acquired DE Engineers’ Silo Division to enhance grain storage and handling solutions in Australia, integrating silo technologies into its agricultural processing offering.

Bühler Group Overview

Bühler Group is a global leader in grain processing and food technology, providing advanced solutions for milling, sorting, cleaning, and feed production. The company emphasizes innovation, sustainability, and digitalization to optimize production efficiency and food safety. Bühler invests heavily in research, technology centers, and local support to empower producers worldwide, enhancing process reliability, product quality, and overall operational performance across both developed and emerging markets.

-

2025 – Bühler broke ground on a new manufacturing facility in Torreón, Mexico, scheduled to begin operations in Q2 2026, strengthening its Grains & Food business.

-

2024 – Opened its new Grain Innovation Center (GIC) in Uzwil, Switzerland: a 2,000 m² high-tech facility with over 70 advanced machines for testing, training, and process innovation in milling & grain/fodder.

-

2024 – Announced the Grain Processing Innovation Center (GPIC) in Kano, Nigeria to support local producers for safe, affordable food from crops such as sorghum, millet, maize, and beans.

Key Players

Grain Processing Equipment Market Key players are:

-

Forsberg Agritech (India) Pvt. Ltd.

-

Golfetto Sangati S.r.l.

-

Lewis M. Carter Manufacturing, LLC

-

WESTRUP A/S

-

Osaw Agro Industries Private Limited

-

Lianyungang Huantai Machinery Co., Ltd.

-

Satake USA, Inc.

-

Bühler Group

-

Alvan Blanch Development Company Limited

-

GEA Group AG

-

AGI (Ag Growth International)

-

Cimbria A/S

-

Bühler Sortex

-

Van Aarsen International

-

Famsun Group

-

Satake Corporation (Japan)

-

Ocrim S.p.A.

-

Alltech Inc.

-

Westrup A/S

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.83 Billion |

| Market Size by 2032 | USD 6.05 Billion |

| CAGR | CAGR of 2.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mode of Operation (Automatic, Semi-automatic) • By Machine (Pre-processing, Processing) • By Application (Cleaning, Grading, Handling, Coaters, Dryers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | PETKUS Technologie GmbH, Forsberg Agritech (India) Pvt. Ltd., Golfetto Sangati S.r.l., Lewis M. Carter Manufacturing, LLC, WESTRUP A/S, Osaw Agro Industries Private Limited, Lianyungang Huantai Machinery Co., Ltd., Satake USA, Inc., Bühler Group, Alvan Blanch Development Company Limited |