Computer Numerical Control Machines (CNC) Market Scope & Overview:

Get More Information on Computer Numerical Control Machines (CNC) Market - Request Sample Report

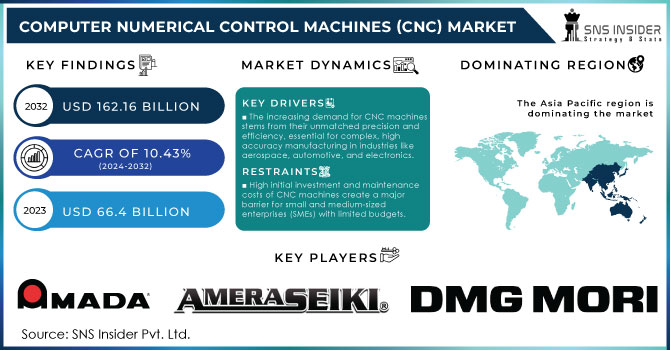

The Computer Numerical Control Machines (CNC) Market size was estimated at USD 66.4 Billion in 2023 and is expected to reach USD 162.16 Billion by 2032 at a CAGR of 10.43% during the forecast period of 2024-2032.

The Computer Numerical Control (CNC) Machines Market is experiencing significant growth, fueled by an increasing demand for precision and automation in manufacturing processes across diverse industries. CNC machines automate machine tools through computer control, enabling high precision in tasks such as drilling, milling, and cutting. This technology is widely adopted in sectors like aerospace, automotive, electronics, and metalworking, where precision and efficiency are critical. The market is also witnessing a shift towards advanced technologies, including integrated CNC systems and IoT-enabled machines, which enhance monitoring and data analysis capabilities, leading to improved operational efficiency. This robust growth is attributed to the rising adoption of automated manufacturing processes, significant investments in the automotive and aerospace sectors, and an increasing emphasis on reducing production costs while enhancing productivity. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in CNC technology is transforming the landscape, making operations smarter and more efficient.

Production costs for CNC machines can vary widely based on the type and complexity of the machine. Typically, the manufacturing costs for CNC machines range from USD 30,000 to USD 500,000 per unit, influenced by factors such as size, capabilities, and technological features. High-end CNC machines, particularly those with advanced technologies like multi-axis systems and automated tooling, generally incur higher production costs. Nonetheless, the investment in CNC machines is often justified by substantial long-term savings in labor costs and increased output, positioning them as a strategic addition for manufacturers seeking a competitive edge in a rapidly evolving market.

MARKET DYNAMICS

DRIVERS

- The increasing demand for CNC machines stems from their unmatched precision and efficiency, essential for complex, high-accuracy manufacturing in industries like aerospace, automotive, and electronics.

The growing demand for precision and efficiency in manufacturing is a key driver of the Computer Numerical Control (CNC) machines market. CNC machines are renowned for their ability to deliver unparalleled precision, consistency, and efficiency, which are essential in industries such as aerospace, automotive, and electronics. These industries require highly accurate and complex parts, and CNC machines are capable of producing components with minute tolerances that would be difficult or impossible to achieve with manual processes. As manufacturing processes evolve and become more intricate, the need for high accuracy and minimal human intervention is increasingly vital. CNC machines automate various manufacturing tasks, drastically reducing the risk of human error. This results in not only improved product quality but also enhanced production speed. By automating repetitive and complex tasks, CNC machines ensure that parts can be manufactured in bulk with identical precision.

Moreover, CNC technology enables manufacturers to achieve mass production with minimal setup time, optimizing the use of raw materials and labor. This efficiency is especially crucial in sectors like automotive and electronics, where large quantities of parts are required with tight deadlines. The precision and automation provided by CNC machines also contribute to reducing production costs and waste, further improving their value proposition in modern industrial applications.

- Innovations in CNC technology, such as multi-axis machines and hybrid systems, are enhancing machine performance and versatility, enabling their application in specialized, high-precision industries like medical devices and precision engineering.

Advances in CNC technology is significantly enhancing the performance, flexibility, and versatility of CNC machines. One key development is the rise of multi-axis machines, which enable more complex and precise machining operations by allowing movement in multiple directions simultaneously. This innovation is particularly useful in industries like aerospace and automotive, where intricate and detailed parts are required. Additionally, hybrid CNC systems, which combine both additive and subtractive manufacturing techniques, are transforming production by integrating 3D printing with traditional CNC machining. This allows manufacturers to achieve more complex geometries while optimizing material usage and production efficiency.

Software advancements are another major driver of CNC technology improvements. The incorporation of advanced controls, IoT (Internet of Things) connectivity, and artificial intelligence (AI) is making CNC machines smarter and more automated. These features allow for real-time monitoring, predictive maintenance, and enhanced accuracy, further minimizing human error and reducing downtime. As a result, CNC machines are now being deployed in more specialized and high-value industries, such as medical device manufacturing and precision engineering, where the production of intricate and highly accurate components is crucial. These ongoing innovations are expanding the capabilities of CNC machines beyond traditional applications, driving their adoption in advanced manufacturing sectors and positioning them as indispensable tools for modern production processes.

RESTRAIN

- High initial investment and maintenance costs of CNC machines create a major barrier for small and medium-sized enterprises (SMEs) with limited budgets.

The high initial investment and maintenance costs associated with CNC machines present a significant barrier, particularly for small and medium-sized enterprises (SMEs). While CNC machines offer considerable long-term benefits, such as increased precision, productivity, and reduced human error, the upfront expense of purchasing and installing these machines is substantial. The capital investment required for CNC machines includes not only the cost of the equipment itself but also the necessary infrastructure modifications, such as electrical upgrades and workspace adjustments. For SMEs with limited financial resources, this initial cost can be prohibitive, preventing them from adopting this advanced technology.

In addition to the initial investment, CNC machines come with ongoing maintenance costs that further strain company budgets. Regular upkeep, software updates, and machine calibration are necessary to ensure optimal performance and minimize downtime. These maintenance tasks often require specialized technicians or skilled labor, which adds to the operational expenses. Furthermore, any machine downtime due to technical issues can lead to costly production delays, making the overall cost of ownership even higher. For SMEs, which often operate on tighter margins, these ongoing costs can deter them from fully leveraging CNC technology, even if it could improve their long-term competitiveness. As a result, many smaller businesses may hesitate to adopt CNC machines, despite the clear advantages in efficiency and precision that these machines offer, hindering their ability to compete with larger, more well-capitalized enterprises.

KEY MARKET SEGMENTS

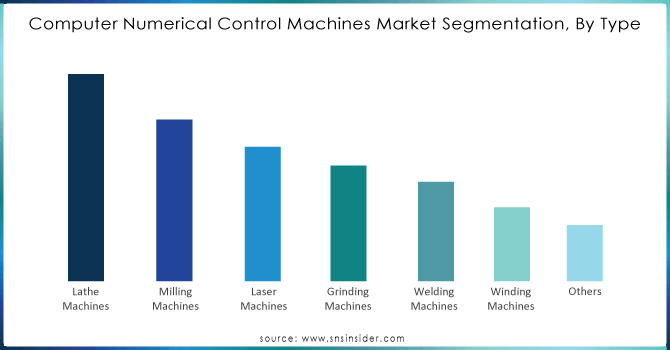

By Type

The Lathe machines segment accounted for largest market share of over 29.06% in 2023. The automotive sector is expected to remain the major contributor of the segment as lathe machines are capable of performing tasks quickly. This demand is attributed to the requirement of producing personalized components such as cylinder heads, gearboxes, starter motors, and for prototyping purposes. The segment is also likely to gain from continued technological strides in CNC lathe systems already out there. The introduction of the new features to suiting various applications will further boost segment growth.

Need any customization research on Computer Numerical Control Machines Market - Inquiry Now

By End-use

The industrial segment accounted for largest market share of approximately 28.09% in 2023. Industries have turned to adopting CNC machines as it the easiest and fastest way to all forms of automation with better operating efficiencies. These are the machines that do complex manufacturing take place with minimal human intervention, which in turn result in more output and less production time. Additionally, the industrial sector differs in its inclusion of multiple manufacturing industries (packaging, electronics, medical and others).

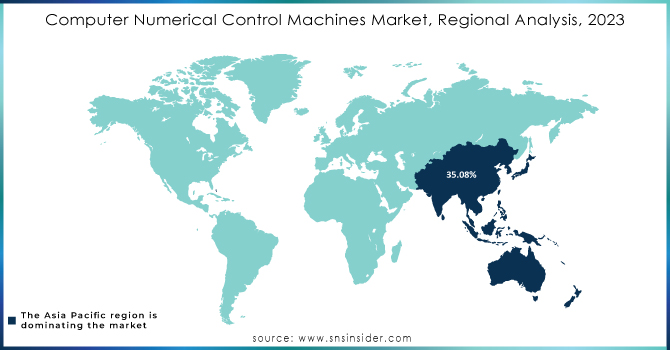

REGIONAL ANALYSIS

The Asia Pacific region is currently dominating the market, valued at approximately 35.08% in 2023. This dominance is primarily due to significant technological advancements, a surge in manufacturing outsourcing services, and rapid industrialization within the region. The availability of low-cost raw materials and operational costs has further fueled the demand for CNC machines, resulting in increased sales and market penetration.

Key players

Some of the major players in the Computer Numerical Control Machines Market:

-

AMADA MACHINERY CO., LTD.: (CNC Laser Cutting Machines, CNC Punch Presses)

-

Amera Seiki: (CNC Turning Centers, CNC Vertical Machining Centers (VMC)

-

DMG MORI CO., LTD.: (CNC Lathes, CNC Milling Machines, CNC Universal Machines (DMU Series)

-

General Technology Group: (CNC Horizontal Machining Centers, CNC Boring and Milling Machines)

-

Dalian Machine Tool Corporation: (CNC Lathes, CNC Drilling Machines)

-

DATRON AG: (High-Speed CNC Milling Machines (DATRON M8Cube)

-

FANUC CORPORATION: (CNC Controls, CNC Robodrill (High Precision CNC Machining Center)

-

Haas Automation, Inc.: (CNC Vertical Machining Centers (VF Series), CNC Turning Centers (ST Series)

-

Hurco Companies, Inc.: (CNC Machine Tools (VM Series Machining Centers, TM Series CNC Lathes)

-

OKUMA Corporation: (CNC Multitasking Machines, CNC Lathes (LU Series)

-

Shenyang Machine Tool Part Co., Ltd.: (CNC Milling Machines, CNC Machining Centers)

-

YAMAZAKI MAZAK CORPORATION: (CNC Multi-tasking Machines (INTEGREX Series), CNC Lathes (QUICK TURN Series)

-

Makino Milling Machine Co., Ltd.: (CNC Vertical and Horizontal Machining Centers (PS Series)

-

Schuler AG: (CNC Press Brakes, CNC Punching Machines)

-

Siemens AG: (CNC Controllers (Sinumerik Series), CNC Automation Systems)

-

GF Machining Solutions: (CNC Milling Machines, CNC Electrical Discharge Machining (EDM) Machines)

-

Doosan Machine Tools: (CNC Turning Centers, CNC Boring Mills)

-

Mitsubishi Electric Corporation: (CNC Controls, CNC EDM Machines (MV Series)

-

Brother Industries, Ltd.: (CNC Tapping Centers (Brother SPEEDIO Series)

-

KOMATSU NTC Ltd.: (CNC Grinding Machines, CNC Transfer Machines)

RECENT TRENDS

In April 2023: Mitsubishi Electric India CNC partnered with SolidCAM, a Computer Aided Manufacturing (CAM) software provider. Through the partnership, SolidCAM deliver a range of machining solutions which involves high-speed roughing as well as finishing for several industries, such as Medical, Die & Mold, Auto & Aerospace parts, Machine Element parts, among others.

In August 2023: OKUMA Corporation launched a next-generation machine control - Okuma OSP-P500. The product is equipped with dual-core computer processors that deliver improved levels of machine processing power. It is also equipped with Digital Twin Technology, which allows high-precision machining simulations to be produced on a computer.

In September 2023: DMG MORI CO., LTD. announced the acquisition of KURAKI, a CNC machine manufacturer. Through the acquisition former company aims to expand the demand for CNC horizontal boring as well as milling machines by incorporating digitalization and automation technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 66.4 Billion |

| Market Size by 2032 | USD 162.16 Billion |

| CAGR | CAGR of 10.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lathe Machines, Milling Machines, Laser Machines, Grinding Machines, Welding Machines, Winding Machines, Others) • By End-use (Automotive, Aerospace & Defense, Construction Equipment, Power & Energy, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AMADA MACHINERY CO., LTD., Amera Seiki, DMG MORI CO., LTD., General Technology Group, Dalian Machine Tool Corporation, DATRON AG, FANUC CORPORATION, Haas Automation, Inc, Hurco Companies, Inc., OKUMA Corporation, Shenyang Machine Tool Part Co., Ltd., YAMAZAKI MAZAK CORPORATION, Makino Milling Machine Co., Ltd, Schuler AG, Siemens AG, GF Machining Solutions, Doosan Machine Tools, Mitsubishi Electric Corporation, Brother Industries, Ltd, KOMATSU NTC Ltd |

| Key Drivers | • The increasing demand for CNC machines stems from their unmatched precision and efficiency, essential for complex, high-accuracy manufacturing in industries like aerospace, automotive, and electronics. • Innovations in CNC technology, such as multi-axis machines and hybrid systems, are enhancing machine performance and versatility, enabling their application in specialized, high-precision industries like medical devices and precision engineering. |

| RESTRAINTS | • High initial investment and maintenance costs of CNC machines create a major barrier for small and medium-sized enterprises (SMEs) with limited budgets. |