Chemiluminescence Immunoassay Market Size Analysis:

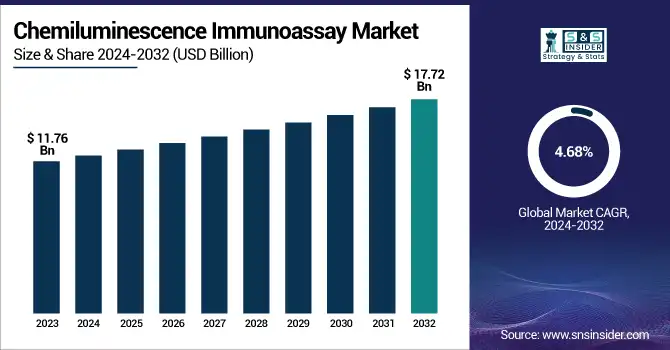

The Chemiluminescence Immunoassay Market Size was valued at USD 11.76 Billion in 2023 and is expected to reach USD 17.72 Billion by 2032 and grow at a CAGR of 4.68% over the forecast period 2024-2032. The increasing number of persons suffering from different types of diseases, mainly infectious diseases, and chronic diseases, is expected to propel the CLIA market over the forecast period. With rigorous regulatory frameworks as well as compliance standards including FDA approvals and quality certifications, CLIA's market dynamics are influenced by concerns such as safety and efficacy. Innovative technologies, featuring more sensitive, faster, and automatic assays, are increasing the power of CLIA. Cost analysis is examined with the adoption of high-quality reagents and diagnostic equipment on pricing trends by balancing affordability and accuracy. CLIA-based diagnostics target huge healthcare spending due to the need for rapid and accurate diagnostic tools in the clinic.

To Get more information on Chemiluminescence Immunoassay Market - Request Free Sample Report

The U.S. chemiluminescence immunoassay (CLIA) market size was USD 3.66 billion in 2023 and is anticipated to grow at a CAGR of 5.88% during the forecast time frame of 2024 to 2032. The growth is attributed to increasing prevalence of chronic diseases, increase in demand for early disease detection, and technological advancements in automated immunoassay systems, which improves diagnostic accuracy and efficiency in clinical laboratories.

Chemiluminescence Immunoassay Market Dynamics

Key Drivers:

-

Rising Chronic Diseases and Technological Advancements Driving the Growth of the Chemiluminescence Immunoassay Market Globally

The emergence of the Chemiluminescence Immunoassay (CLIA) market is fueled by a multitude of factors, among the most notable of which is the growing number of chronic diseases, particularly cancer, cardiovascular disorders, and infectious diseases all of which drive the need for accurate and rapid diagnostic solutions. The growing demand for high-sensitivity and specificity immunoassay techniques has driven the implementation of CLIA as compared to conventional methods based on ELISA. Furthermore, the rising geriatric population, which is more prone to chronic and infectious diseases, is expected to drive the growth of the market. With new technologies like automated analyzers and the use of artificial intelligence (AI), there comes improved efficiency of diagnosis, minimized risk of manpower errors, and decreases in turnaround times, thereby making CLIA a choice of preference among clinical laboratories. In addition, growing attention over personalized medicine and biomarker discovery is further expanding the application scope of CLIA thereby establishing the lucrative growth opportunity.

Restrain:

-

Regulatory Challenges and Technical Complexities Hindering Growth of Chemiluminescence Immunoassay Market Expansion

Some of the major obstacles include the complexity of CLIA systems, which demand the expertise required for operating the technologies. The requirement of assay development, result interpretation, and system calibration at a high level indicates a high burden to be a cause of concern in areas with feedback to trained healthcare professionals. Further, the regulatory environment for the development of immunoassay-based diagnostics is very stringent making it difficult for the market player to operate inside the market. Regulatory approvals from agencies like the FDA and the European Medicines Agency (EMA) may take years and necessitate numerous clinical validations, prolonging both time-to-product and compliance burdens.

Opportunity:

-

Rising Point of Care Testing and Digital Integration Driving Growth Opportunities in CLIA Market

Key Opportunities in the CLIA market are associated with improving all-the-time adoption of point-of-care (POC) testing and home-based diagnostics, primarily in developing economies where the healthcare infrastructure is evolving swiftly. Increased healthcare spending and government measures to enhance diagnostic facilities open up a significant opportunity for growth. Continuous innovations in multiplexing capabilities and novel reagents for assay development should further improve the specificity and performance of CLIA-based diagnostics. Furthermore, increasing implementation of CLIA with digital health platforms and automation of the laboratory is creating new opportunities for market growth.

Challenges:

-

Standardization Issues and Competition from Advanced Diagnostics Pose Challenges for CLIA Market Growth

Test standardization is also a crucial challenge, as the same test can yield different results due to assay inter-/intra-assay variability and cross-reactivity. One of the major challenges for healthcare providers is the lack of standardization and reproducibility in different labs. Additionally, notwithstanding these advantages, CLIA remains challenged by other diagnostic opportunities, for instance, PCR and next-generation sequencing (NGS), which provide high specificity for specific applications. The use of CLIA automation solutions integrated with platforms requires large infrastructures and an investment, which causes some difficulties in smaller diagnostic centers and laboratories.

Chemiluminescence Immunoassay Market Segmentation Analysis

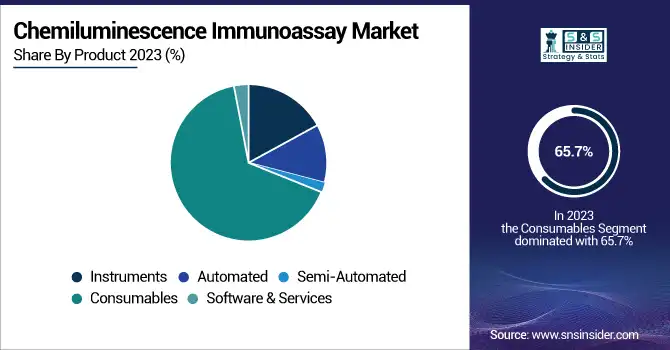

By Product

The consumables segment dominated the Chemiluminescence Immunoassay (CLIA) market with a share of 65.7% in 2023 and it is expected to grow the fastest segment over the forecast period 2024 to 2032. The reason behind this increase can be correlated to the high demand for frequent usage (recurrent utilization) of assay kits, reagents, and diverse consumables used in diagnostics. This, in turn, contributes to growth in the number of tests performed owing to the increasing burden of chronic and infectious diseases, which, in turn, will boost demand for CLIA consumables. In addition, the launch of newer reagent formulations and increases in assay sensitivity are also facilitating market growth. The rising adoption of automated CLIA analyzers in laboratories and hospitals augments Consumables due to the frequent refilling of kits and reagents in these systems. In addition, the rising preference for personalized medicine and biomarker-based diagnostics is also propelling the high-performance consumables market demand.

By Sample Type

Blood sample type led the market in 2023, owing to the high prevalence of blood samples used in the diagnosis of diseases, testing of disease-specific molecules known as biomarkers, and check-up tests conducted routinely. Blood tests have emerged as the gold standard for chronic and infectious disease detection, including cancer, cardiovascular disease, and autoimmune disease because of their high accuracy, sensitivity, and reliability. This has helped strengthen its market lead and improvements in automated CLIA analyzers have bolstered the efficiency of blood-based testing even more.

A urine sample is expected to be the fastest growing segment in terms of CAGR during the forecast period 2024-2032, owing to its non-invasive properties as well as the expanding application of urine tests in disease screening. A lot of commercial demand is also given for urine-based diagnostics for infection, kidney diseases, as well as hormonal imbalances. Further, improvement in the urine assays based on CLIA is enhancing the detection efficiency which will further support the market growth.

By Application

The infectious disease segment held the largest market share globally in 2023, due to the rising prevalence of bacterial, viral, and fungal infections worldwide. Due to their high sensitivity and specificity and short turnaround time, the demand for CLIA-based diagnostics has seen a surge owing to the rising occurrences of HIV, hepatitis, tuberculosis, and COVID-19. In addition, government programs and international health programs aimed at controlling and monitoring communicable diseases have further stimulated the demand for CLIA in clinical laboratories and healthcare settings.

The oncology segment is expected to hold the largest CAGR during the forecast period 2024 to 2032, due to the growing emphasis on early cancer diagnosis and personalized medicine. The rising burden of cancer cases globally and the increasing development of biomarker-based CLIA assays are contributing significantly to the growth of the market. Also, further work on tumor markers and precision diagnostics growing the applications of CLIA in oncology.

By End-Use

The hospitals segment accounted for the largest share in 2023 of the global chemiluminescence immunoassay (CLIA) market owing to the high diagnostic test volume performed in hospital laboratories. Commercially available CLIA-based diagnostics are routinely used by hospitals to detect diseases quickly and accurately to ensure good patient management. Their growing occurrence in infectious diseases, cancer, and chronic conditions has led to the relentless seeker advanced immunoassay technologies in hospitals. Moreover, their incorporation of CLIA automated analyzers in hospitals streamlines the workflow in clinical laboratories leading to short diagnostic turnaround time.

From 2024 to 2032, the pharmaceutical and biotechnology companies category is anticipated to experience the fastest growth, due to the growing emphasis on drug discovery, biomarker research, and clinical trials. Demand is further fueled by the rising utilization of CLIA for companion diagnostics and personalized medicine. Immunoassay technology has also been developed at a rapid pace and its future applications across drug development and therapeutic monitoring areas are also expanding.

Regional Insights

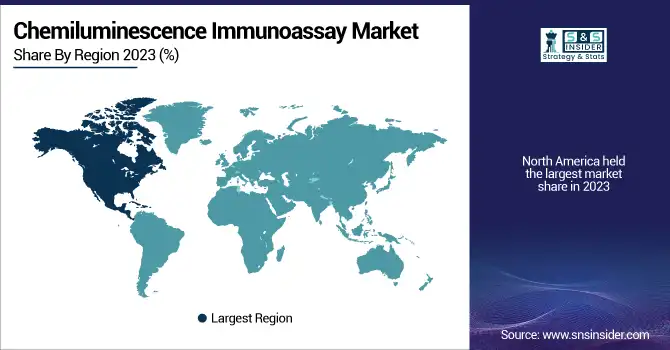

In 2023, North America accounted for the largest share of the Chemiluminescence Immunoassay (CLIA) market due to well-developed healthcare infrastructure, high utilization of automated diagnostic solutions, and growing incidence of chronic and infectious diseases. Moreover, the high prevalence of leading market leaders like Abbott, Roche Diagnostics, and Siemens Healthineers have, in turn, bolstered the regional dominance. In addition, government initiatives for early detection of diseases and rising research in biomarker-based diagnostics are serving as a tailwind for the growth of the market. In other cases, U.S.-based organizations like the U.S. Centers for Disease Control and Prevention (CDC), which is promoting immunoassay-based testing for infectious diseases, continue to drive demand for CLIA-based diagnostics. In addition, leading hospitals and diagnostic laboratories in the region, including Mayo Clinic and Quest Diagnostics, use CLIA systems for high-throughput and accurate testing.

Asia Pacific is projected to expand at the fastest CAGR over the forecast period from 2024 to 2032, due to the rising healthcare investments and increasing patient population in the region coupled with a rise in awareness regarding early disease detection. Growing healthcare programs and the increasing biotechnology sector are driving high demand for advanced diagnostic technologies, in developing countries such as China, India, and Japan. As an example, the National Health Commission in China has been a strong promoter of the application of advanced immunodiagnostic techniques, and Indian companies such as Transasia Bio-Medicals Ltd., have been focusing on the expansion of the CLIA product portfolio. Moreover, ventures among global manufacturers and professional diagnostic firms to improve the adoption of CLIA in emerging economies will boost market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Chemiluminescence Immunoassay Market Key players

Some of the major players in the Chemiluminescence Immunoassay Market are:

-

F. Hoffmann-La Roche AG (Elecsys CLIA Analyzers)

-

Danaher Corporation (Beckman Coulter Access Immunoassay Systems)

-

Siemens Healthineers (ADVIA Centaur Immunoassay Systems)

-

Abbott Laboratories (ARCHITECT i1000SR Immunoassay Analyzer)

-

DiaSorin S.p.A. (LIAISON XL Analyzer)

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (CL-900i CLIA Analyzer)

-

Ortho Clinical Diagnostics (VITROS Immunodiagnostic Products)

-

Tosoh Corporation (AIA-CL Series Analyzers)

-

Sysmex Corporation (HISCL Series Immunoassay Analyzers)

-

Randox Laboratories Ltd. (Evidence Investigator Analyzer)

-

bioMérieux (VIDAS Immunoassay Systems)

-

Inova Diagnostics, Inc. (QUANTA Flash CLIA Assays)

-

Maccura Biotechnology Co., Ltd. (iMagic CLIA Analyzer)

-

Immunodiagnostic Systems (IDS-iSYS Multi-Discipline Automated System)

-

Shenzhen New Industries Biomedical Engineering Co., Ltd. (MAGLUMI CLIA Analyzers)

Recent Trends

-

In July 2024, Danaher Corporation announced two new Centers of Innovation in Diagnostics to accelerate precision medicine development. These centers, located in the UK and U.S., will integrate advanced diagnostic capabilities to streamline the discovery-to-approval process.

-

In January 2025, bioMérieux acquired the Norwegian immunoassay start-up SpinChip Diagnostics for EURO 138 million to strengthen its point-of-care diagnostics portfolio. The acquisition integrates SpinChip’s rapid immunoassay platform, with the first product launch expected in 2026.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.76 Billion |

| Market Size by 2032 | USD 17.72 Billion |

| CAGR | CAGR of 4.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Instruments, Automated, Semi-automated, Consumables, Software & Services) • By Sample Type (Blood, Urine, Saliva, Other Sample Types) • By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease, Autoimmune Disease, Other Applications) • By End Use (Hospitals, Clinical Laboratories, Pharmaceutical & Biotechnology Companies, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche AG, Danaher Corporation, Siemens Healthineers, Abbott Laboratories, DiaSorin S.p.A., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Ortho Clinical Diagnostics, Tosoh Corporation, Sysmex Corporation, Randox Laboratories Ltd., bioMérieux, Inova Diagnostics, Inc., Maccura Biotechnology Co., Ltd., Immunodiagnostic Systems, Shenzhen New Industries Biomedical Engineering Co., Ltd. |