Transthyretin Amyloidosis Treatment Market Report Scope & Overview:

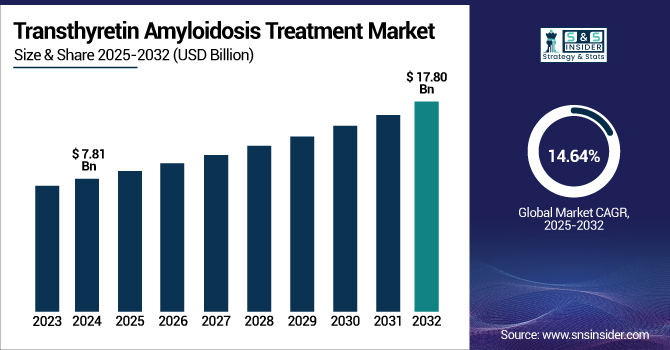

The Transthyretin Amyloidosis Treatment Market size was valued at USD 7.81 billion in 2024 and is expected to reach USD 17.80 billion by 2032, growing at a CAGR of 14.64% over the forecast period of 2025-2032.

To Get more information on Transthyretin Amyloidosis Treatment Market - Request Free Sample Report

The transthyretin amyloidosis treatment market is experiencing strong growth as a result of increasing rates of diagnosis, the development of targeted therapies, and heightened awareness of hereditary and wild-type ATTR. Innovative treatments, such as RNA interference drugs and TTR stabilizers, are transforming therapy. Increased research efforts, approval of drugs by regulatory bodies, and favorable healthcare policies also continue to fuel growth in the market. For Instance, in November 2024, the FDA approved Alnylam Pharmaceuticals' subcutaneous RNA interference therapy, vutrisiran, marketed as Amvuttra, to treat cardiomyopathy with wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM). The therapy is indicated for administration in adult patients. The evolution towards earlier diagnosis and treatment via a customized approach will fuel the expansion in the upcoming forecast period.

The U.S. transthyretin amyloidosis treatment market size was valued at USD 3.11 billion in 2024 and is expected to reach USD 6.92 billion by 2032, growing at a CAGR of 14.27% over the forecast period of 2025-2032.

The U.S. dominates the North American transthyretin amyloidosis treatment market. This dominance is fueled by the developed healthcare infrastructure, early uptake of novel therapies, and the strong presence of major pharmaceutical players with expertise in genetic and orphan diseases.

Market Dynamics:

Drivers:

-

Advancements in Treatment Options are Driving the Transthyretin Amyloidosis Treatment Market

The approval of new therapies, especially gene-silencing therapies, such as patisiran and vutrisiran, has transformed the transthyretin amyloidosis treatment market growth. These treatments operate by lowering the production of transthyretin protein, which causes amyloid deposits in organs, such as the heart and nerves. With these innovative treatments, patients now have access to more effective and targeted treatments. In contrast to conventional therapies, these treatments promise to stop or even reverse the disease process and bringing dramatic improvements in patient outcomes. The availability of such technologies has driven the market, as these therapies bring hope to patients who were once left with few choices.

-

For instance, according to NCBI, recent developments in nuclear cardiac imaging by technetium pyrophosphate scans have made it possible to diagnose ATTR-CM without requiring a cardiac biopsy. Consequently, more and more patients are now being screened and diagnosed with ATTR-CM. Thus, increasing numbers of patients are being screened and diagnosed with ATTR-CM. In parallel, survival has also increased, boosting its prevalence. Consequently, 5,000 to 7,000 new cases are diagnosed every year in the U.S.

-

Increasing Incidence of ATTR is Propelling the Transthyretin Amyloidosis Treatment Market

With the aging population globally, the incidence of wild-type transthyretin amyloidosis (ATTR), especially among elderly individuals, has been rising. Wild-type ATTR is distinguished by amyloid deposits in the nervous system and heart, causing serious conditions, such as peripheral neuropathy and heart failure. This increase in the number of cases, along with greater awareness and improved diagnostic techniques, has driven demand for therapies. Hereditary ATTR, which can be transmitted genetically and affect people at a younger age, is also driving the increased demand for therapies. As the identification of ATTR cases widens, patients are being diagnosed and treated earlier, propelling additional growth in the ATTR amyloidosis treatment market trends.

-

For instance, according to Orphanet, the global frequency of wild-type ATTR amyloidosis (ATTRwt amyloidosis) has been estimated to be around 1 in 5,800 individuals. Autopsy findings have shown fibrillar transthyretin deposits in the hearts of approximately 25% of older adults. Recent evidence has also studied the prevalence of this condition in heart failure and preserved ejection fraction patients, where the prevalence rate can be as high as 13%. Wild-type ATTR amyloidosis is also more frequently seen in males.

Restraints:

-

Regulatory Challenges are Restraining the Transthyretin Amyloidosis Treatment Market Analysis

The process of getting regulatory approval for new therapies in orphan diseases, such as transthyretin amyloidosis (ATTR) may be quite intricate and lengthy. As the disease is rare, there might not be many patients available for conducting clinical trials, which may result in insufficient data to fulfill the requirements of regulatory bodies. Consequently, firms can find it difficult to demonstrate the safety and efficacy of their treatments to regulatory bodies, such as the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA).

Segmentation Analysis:

By Therapy

In 2024, the targeted therapy segment dominated the transthyretin amyloidosis treatment market share with 87.14% due to the pervasive use of approved therapies including Pfizer's Vyndaqel (tafamidis), Alnylam's Onpattro (patisiran), and Amvuttra (vutrisiran). The therapies target the root cause of the disease by stabilizing or silencing the transthyretin protein, which improves patient outcomes and retards disease progression. The effectiveness and proven clinical advantages of these treatments have established them as the first choice among medical practitioners, thus enabling the segment to dominate the market.

The pipeline therapy market is anticipated to experience the fastest growth over the forecast period. This growth is supported by the ongoing drug development and clinical research, with new therapies, such as BridgeBio's acoramidis and Ionis Pharmaceuticals' eplontersen, launched during the period. These investigational drugs have been designed to provide enhanced efficacy while limiting side effects, further meeting the hereditary and wild-type transthyretin amyloidosis unmet medical needs. With growing investment in novel therapies and hopes for better patient outcomes in the future, the pipeline therapy segment growth in the future is expected to be stimulated by these factors.

By Type

In 2024, the ATTR with polyneuropathy (ATTR-PN) segment dominated the transthyretin amyloidosis treatment market with 78.25% market share. The growth is driven by the high incidence of hereditary transthyretin amyloidosis with polyneuropathy symptoms, which has resulted in earlier diagnosis and treatment. The presence of approved treatments, such as patisiran (Onpattro), vutrisiran (Amvuttra), and eplontersen (Wainua), has further established this segment as the market leader. These treatments have been effective in managing neurological symptoms, thereby improving patients' quality of life and encouraging their use on a large scale.

The ATTR with cardiomyopathy (ATTR-CM) segment is predicted to experience the fastest growth during the forecast period. Growth is driven by increasing awareness of the cardiac manifestation of transthyretin amyloidosis and improved diagnostic techniques, which lead to earlier diagnosis. The introduction of new therapies, such as acoramidis (Attruby) and the broadened indication of vutrisiran in ATTR-CM, creates an opportunity for the treatments. These trends, combined with an increasingly aging population at risk of cardiac diseases, are set to drive the rapid growth of the ATTR-CM segment during the forecast period.

By Disease

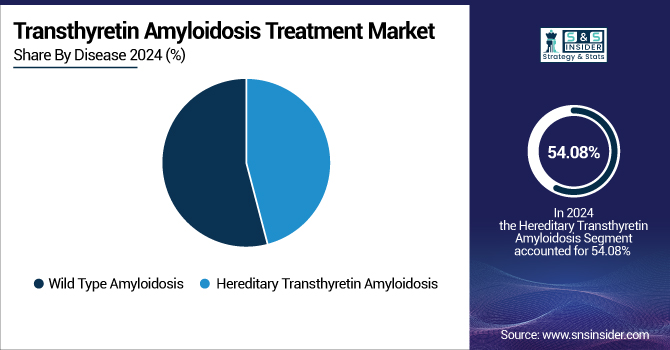

In 2024, the wild-type amyloidosis segment dominated the transthyretin amyloidosis treatment market with 54.08% share, as it is more prevalent among the aging population. This type of amyloidosis, previously underdiagnosed in many instances, has been more recognized due to improved diagnostic methods and greater awareness among medical professionals. The population trend of an aging population has further added to the increasing incidence of wild-type amyloidosis globally, thus fueling the need for effective treatments, resulting in the growth of wild-type ATTR amyloidosis treatment.

The hereditary transthyretin amyloidosis (hATTR) segment is anticipated to witness the fastest growth during the forecast period with a CAGR of 14.73%. This growth is driven by greater genetic testing, resulting in earlier and more precise diagnoses of familial cases. The approval and development of novel therapies, including gene-silencing drugs, such as patisiran and vutrisiran, have broadened the treatment paradigm for hATTR. Also, growing promotion programs and government initiatives toward the commercialization of orphan drugs has stimulated investment and research in the sector, thus fueling the growth of the segment.

By Distribution Channel

The hospital pharmacies segment led the transthyretin amyloidosis treatment market in 2024, with a revenue share of approximately 52.31% as transthyretin amyloidosis therapies are complex and may need to be administered intravenously while closely monitored. These complex therapies are best suited to hospital pharmacies for proper storage, preparation, and administration. They also perform an essential function in patient education and support for adherence, allowing for the smooth integration of treatments into overall care plans.

The online pharmacies segment is expected to register the fastest growth rate over the forecast period, with an approximate compound annual growth rate (CAGR) of 14.76%. The reason behind the growth is enhanced patient preference toward home delivery convenience and remote accessibility to medications. Online pharmacies provide competitive prices and an increased treatment scope, including coverage for underserved or rural populations. Issues with ensuring genuine medication and handling regulatory environments remain on top priority for growth of this segment.

Regional Analysis:

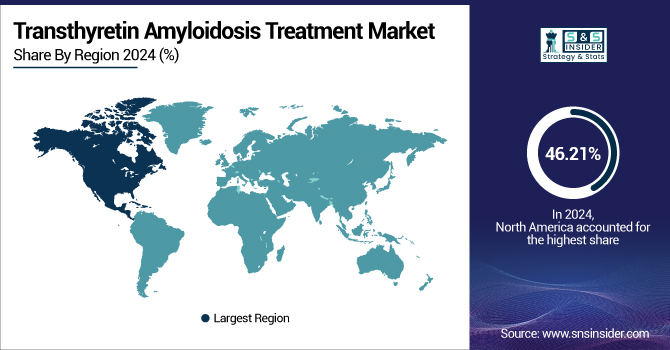

North America dominated the transthyretin amyloidosis treatment market with 46.21% market share in 2024, owing to its established healthcare infrastructure, greater awareness of the disease, and the presence of dominant pharmaceutical and biotechnology firms. Early availability of cutting-edge therapeutics and favorable regulatory backing by agencies, such as the FDA, and heavy investments in research related to rare diseases, further enhance the leadership of the region. Furthermore, high diagnosis rates, along with higher levels of clinical trial activity and reimbursement support for new therapies, are continuing to drive regional market growth.

Asia Pacific is the fastest-growing region in the transthyretin amyloidosis treatment market analysis, with 15.68% CAGR over the forecast period. This increasing growth is driven by improving healthcare infrastructure, growing healthcare spending, increasing awareness regarding rare genetic disorders, and a growing patient population. China, Japan, and India are witnessing increasing clinical trial participation and quicker regulatory approval of innovative treatments, and the region is highly promising for pharmaceutical companies willing to extend their presence globally.

Europe has a high market share in the transthyretin amyloidosis treatment market because of increased awareness, early diagnosis initiatives, and the availability of well-developed healthcare infrastructure. Germany, the UK, and France are at the forefront in terms of treatment adoption. Germany leads in the European transthyretin amyloidosis treatment market due to the presence of a strong healthcare infrastructure, early embrace of new therapies, and dominance of the region by major pharmaceutical firms. The nation's enthusiasm for development, coupled with favorable regulatory policies, has supported the distribution and adoption of sophisticated treatments for transthyretin amyloidosis. Germany's focus on early diagnosis and all-encompassing patient care further helps it reign supreme in this niche market segment.

Latin America and the Middle East & Africa (MEA) are witnessing slow growth in the transthyretin amyloidosis treatment market. In Latin America, delayed diagnosis, lack of easy access to specialty treatment centers, and the expensive nature of emerging therapies such as RNA interference drugs are the drivers for the slow market growth. Similarly, in the MEA region, tight regulatory procedures and the lack of availability of advanced diagnostic equipment impede fast growth. Nevertheless, continuous efforts to develop healthcare infrastructure and raise disease awareness are likely to underpin incremental market growth in these markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Transthyretin Amyloidosis Treatment Market Players:

Alnylam Pharmaceuticals, Pfizer Inc., Ionis Pharmaceuticals, BridgeBio Pharma, Prothena Corporation plc, Akcea Therapeutics, Eidos Therapeutics, SOM Biotech, AstraZeneca plc, Alexion Pharmaceuticals, and other players are the major players competing in the market.

Recent Developments:

-

March 2025 – Alnylam Pharmaceuticals announced that the U.S. Food and Drug Administration (FDA) has approved AMVUTTRA (vutrisiran), the first RNA interference (RNAi) therapy demonstrated to lower cardiovascular death, hospitalizations, and urgent heart failure visits in adults with the diagnosis of ATTR amyloidosis with cardiomyopathy (ATTR-CM).

-

February 2024 – BridgeBio Pharma, Inc., a commercial-stage biopharmaceutical company with a focus on genetic diseases and cancers, reported that the U.S. Food and Drug Administration (FDA) has accepted for review the New Drug Application (NDA) filed by the company for acoramidis, an investigational medicine under development to treat ATTR cardiomyopathy (ATTR-CM).

Transthyretin Amyloidosis Treatment Market Report Scope:

Report Attributes Details Market Size in 2024 USD 7.81 Billion Market Size by 2032 USD 17.80 Billion CAGR CAGR of 14.64% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Therapy (Targeted Therapy, Supportive Therapy, Pipeline Therapy)

• By Type (ATTR with Polyneuropathy (ATTR-PN), ATTR with Cardiomyopathy (ATTR-CM))

• By Disease (Hereditary Transthyretin Amyloidosis, Wild Type Amyloidosis)

• By Distribution Channel (Hospital Pharmacies, Specialty Pharmacies, Retail Pharmacies, Online Pharmacies)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Alnylam Pharmaceuticals, Pfizer Inc., Ionis Pharmaceuticals, BridgeBio Pharma, Prothena Corporation plc, Akcea Therapeutics, Eidos Therapeutics, SOM Biotech, AstraZeneca plc, Alexion Pharmaceuticals, and other players.